Topic Background

芜湖大司马

Binance

1d ago

A Twitter user asked if it's worthwhile for Mr. Ma to invest 10,000 or 20,000 yuan in cryptocurrency.

Some small business owners, especially those who frequently get bogged down in trivial matters in life, might consider this:

Divide 10,000 or 20,000 yuan into ten portions, open a cryptocurrency marketplace, and invest in various cryptocurrencies such as Meme, public chains, Prep, platform coins, metaverse, prediction markets, and privacy coins. You could even add some scam KOLs' schemes.

Then you'll find that all you think about every day is the rise and fall of these cryptocurrency prices. You'll spend your days watching Binance's two leading cryptocurrencies and the Nikkei, your afternoons watching European markets, and your evenings watching Wall Street's market manipulation.

Compared to the 10-point fluctuations in cryptocurrency prices and these indices, the things that cause you stress, anxiety, and headaches are insignificant.

You'll feel no emotional impact, and might even find it amusing.

You'll only see the foolishness in the boss's promises, the male colleagues' gifts of oil, the female colleagues' tea, and the celebrity gossip.

From then on, life was peaceful and smooth sailing; the journey was long and arduous, and the treatment cost was only a few tens of thousands!

#BNB #BTC

Jason Chen Jian

Crypto Newbie

02-02 13:32

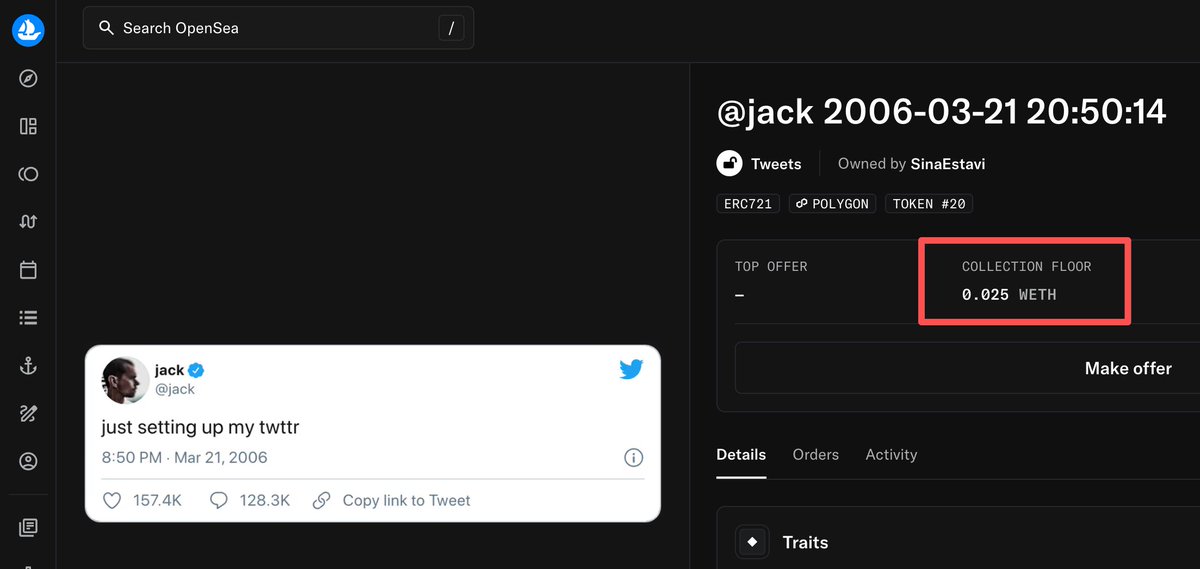

Twitter founder Jack Dorsey (@jack) minted Twitter's first genesis tweet into an NFT and auctioned it off. How much do you think it should be worth?

0.025 ETH, now worth $50 USD, but back then, @SinaEstavi bought it for a whopping 1630 ETH, equivalent to $2.9 million USD. Looking back now, $50 USD seems like a lot, less valuable than a toilet paper roll. But at the time, it was during the frenzy of the metaverse and everything being on-chain, and this NFT was hailed as the Hebrew creation bible of the digital world.

The best stories involve the most people.

Web3Caff Research

媒体

02-02 12:38

In December 2024, two events occurred almost simultaneously: Nike announced the closure of its virtual sneaker studio, RTFKT, in January 2025; Adidas officially launched its ALTS digital avatar series, three years in the making. The two largest global sportswear brands made drastically different choices at the same time.

Similar divergences have spread throughout the industry. Over the past four years, almost all leading consumer brands have experimented with Web3: Starbucks launched the NFT membership program Odyssey, which closed after approximately 22 months; Louis Vuitton released the €39,000 digital collectible VIA Treasure Trunk, which continues to operate and expand its product line; Gucci opened a virtual store at Roblox; H&M experimented with a metaverse showroom; and LVMH even used a metaverse approach to present content at its 2023 shareholders' meeting.

Both are leading brands, both have made significant investments, and both claim to be optimistic about the long-term value of Web3—why such drastically different outcomes?

Before discussing specific cases, it's necessary to return to a fundamental question: Why are traditional brands venturing into Web3?

During the 2021 boom, many brands entered the field citing reasons like "everyone else is doing it" or "it seems innovative." This lack of clear objectives inherently creates uncertainty—when brands haven't clearly defined the specific problems they want to solve, such technological attempts often resemble a high-cost demonstration rather than building long-term capabilities.

The above content is excerpted from Web3Caff Research's "Traditional Brands' Web3 Practice: A 10,000-Word Research Report: Exploring Long-Term Value Differentiation in Web3—A Road to Hell or a Discovery of Opportunities? A Panoramic Analysis of its Development Background, Typical Cases, Business Models, Compliance Paths, and Future Prospects"

Click to view the full version 👇

vitalik.eth

Ethereum

02-01 23:23

How I View Creator Tokens

Over the past decade, we've seen people experimenting with content incentives in the cryptocurrency space, from early platforms like Bihu and Steemit, to BitClout in 2021, Zora, and tipping features on decentralized social platforms. So far, I don't think we've achieved much success, which I believe is because the problem itself is very complex.

First, I want to talk about my perspective on the problem. A key difference between incentivizing creators in the 2000s and now is that the main problem in the 2000s was a lack of content. In the 2020s, content is abundant; AI can generate a complete metaverse for just $10. The problem is content quality. Therefore, your goal isn't *incentivizing content creation*, but *promoting high-quality content*.

Personally, I think the most successful example of creator incentives we've seen so far is Substack. To understand why, look at the top ten authors:

Now, you might disagree with many of these authors. But I have no doubt that:

1. They are generally of high quality and make positive contributions to the discussion.

2. Without Substack's platform, most of them probably wouldn't have achieved such high visibility.

Therefore, Substack is truly discovering high-quality and diverse content.

Now, we can compare it to creator token projects. I don't want to criticize any single project because I think there's a certain failure pattern in the entire category.

For example:

Zora Top Creator Token:

BitClout:

Basically, the top ten authors already have high social status; they tend to be impressive, but the main reason isn't their content.

Substack's core is a simple subscription service: you pay N dollars per month to read an author's articles. But the key to Substack's success is that they didn't just build this mechanism and leave it at that. Their launch process was very pragmatic, deliberately bringing in high-quality content creators to the platform. This was based on their unique vision of cultivating a high-quality knowledge environment, including providing income guarantees for specific members.

Now, let's look at an idea I think is viable (of course, coming up with new ideas is inherently more speculative and prone to error than criticizing existing ones).

Create a non-tokenized decentralized autonomous organization (DAO). It could be inspired by Protocol Guild: It has N members who can (anonymously) vote on the addition and removal of new members. If N exceeds approximately 200, consider automatic splitting.

Importantly, don't try to make the DAO universal, or even try to cover the entire industry. Instead, embrace strong viewpoints. Embrace a dominant content type (long-form writing, music, short videos, long videos, novels, educational content, etc.) and a dominant style (e.g., country or region of origin, political viewpoint, or, in the cryptocurrency space, which projects you most support, etc.). Carefully select initial members to maximize their alignment with the intended style.

The goal is to build a community larger than a single creator, capable of building a public brand and collectively negotiating revenue opportunities, yet small enough for manageable internal governance.

Now, tokens come in handy. In summary, my assumption for the next decade is that most effective governance mechanisms will take the form of "a large number of people and bots participating in prediction markets, while the output oracles are composed of a diverse group of optimized individuals capable of aligning with objectives and resisting information snatching." In this scenario, our approach is as follows: anyone can become a creator and create creator tokens. Then, if they are accepted into a creator DAO, a portion of their earnings from the DAO will be used to burn their creator tokens.

This way, token speculators are not participating in a recursive speculative attention game that relies solely on themselves. Instead, they are actually predicting which new creators a high-value creator DAO will be willing to accept. Simultaneously, they provide a valuable service to the creator DAO: they help the DAO discover potential creators for it to choose from.

Therefore, ultimately, it is not speculators who rise and fall, but high-value content creators (we assume that excellent creators also possess good quality judgment) who determine who rises and falls.

Crypto Monkey Brother 🐒

Crypto Newbie

01-31 20:48

It's time to put aside the grudges and rivalries among the various exchanges.

The entire industry is facing a problem:

Where will new users come from? How will existing users survive?

Currently, it seems that apart from operating a casino, no other narrative is viable.

No matter where users gamble, the probability of being scammed is increasing.

Frankly speaking, the last bull market really filled me with hope for the future.

New things like DeFi, NFTs, blockchain games, metaverse, public chains, and storage emerged.

This round has completely dashed those hopes; it seems the industry still has something, yet it also seems like it has nothing.

Continuing to argue will only lead to more people being disappointed and leaving the market.

KK.aWSB

Crypto Newbie

01-29 11:32

Despite Meta's ambitious plans to expand from the metaverse to large-scale AI models repeatedly failing,

Mark Zuckerberg stated that 3.58 billion people use their products daily.

It is estimated that there are currently about 8.3 billion people on Earth. This means that approximately 43.1% of the world's population uses Meta's products daily.

The company remains at the heart of the human attention network.

Crypto梦醒时分

Crypto Newbie

01-29 10:50

By 2026, the Web3 industry has shifted from a technology race to value realization. Vanar, with its "AI-native infrastructure stack," has achieved a leapfrog upgrade from the traditional Layer 1, becoming a key hub connecting 3 billion users. Its core breakthrough lies in the reconstruction of its underlying architecture: a unique five-layer system integration of the Neutron semantic compression layer and the Kayon on-chain inference engine, enabling unstructured data such as legal documents and financial certificates to be directly uploaded to the blockchain and transformed into an AI-readable format, completely eliminating reliance on third-party storage and perfectly adapting to core practical scenarios such as RWA and PayFi.

Its strong technical capabilities directly address industry pain points: a 3-second block speed, a 30 million gas limit, and a fixed-fee model denominated in USD, eradicating the problems of "cardboard speeds" and "high costs." The EVM and WASM dual-compatible architecture further lowers the barrier to entry for developers. Vanar's ecosystem is flourishing across multiple fronts. Its strategic partnership with NVIDIA injects top-tier computing power, empowering innovation in the metaverse and AI applications. The Virtua metaverse and VGN gaming network have attracted over 100 million users, with more than 100 DApps covering diverse scenarios, and user activity increasing by 70% annually. It has also established deposit channels in 146 countries and native RWA support, building a seamless bridge between Web2 and Web3.

With a fixed supply of 2.4 billion tokens, a 20-year release period, and 83% allocated to ecosystem incentives, Vanar forms a sustainable value loop. In the current L1 public chain landscape, which is shifting towards "real-world applications + regulatory compliance," Vanar, with its technological scarcity, ecosystem inclusivity, and commercial viability, breaks down barriers and becomes a core engine for the popularization of Web3.

#Vanar $VANRY @Vanar

The mining lamb

Crypto Newbie

01-28 21:09

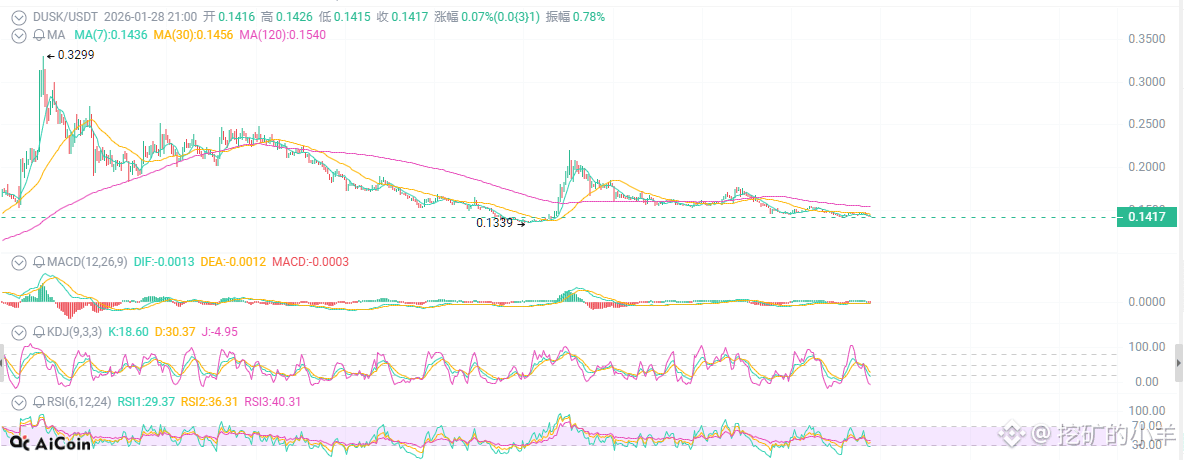

Is DUSK, this compliant coin, the next 100x opportunity?

I looked at the data today and want to be honest.

Large investors are indeed buying, pouring in 75.7 million coins, $13.1 million in real money. But the price is still falling, from $0.18 to $0.14, a drop of almost 20%.

DUSK's compliance with RWA sounds impressive, with partnerships with NPEX and QuantumZ payments—all reputable institutions. But the question is, how long will it take for these institutions to adopt it? Two years? Three years?

Can the market wait? Can your money wait?

DUSK's technical analysis is even more straightforward. The EMA5 to 120 are all in a bearish alignment, the MACD has a death cross, and the KDJ is diverging downwards. These indicators don't lie; they tell you one thing: there are more sellers than buyers, and significantly more.

What's most disheartening? Trading volume is still declining, a 25% drop. Even retail investors are unwilling to buy.

But why are large investors still buying? $13.1 million is not a small sum; institutional investors don't act impulsively. They may see things we can't.

Compliant RWA is indeed a trend, but trend and timing are two different things. Like the blockchain concept in 2017 and the metaverse in 2021, these were good trends, but if the timing was wrong, losses still occurred.

DUSK is currently priced at 0.14, with technical support at 0.13. If it can't hold this level, then we really need to look at 0.1.

DUSK is currently in this state: fundamentals are telling the story of the future, while the price reflects the current reality. Which do you choose to believe?

@Dusk_Foundation #dusk #Dusk

JRNY Crypto

Crypto Newbie

01-28 13:13

🚀 The JRNY CLUB Unified Series airdrop event has ended.

All eligible NFTs have been distributed to the wallet addresses recorded at the time of the snapshot.

Next:

• NFTs are now available in the Unified Series and have been distributed to the same wallet addresses with identical token IDs.

• A new reveal process replaces the burn mechanism, eliminating gas fees, and all NFTs offer identical functionality.

• The contract upgrade is complete, unlocking the next phase of staking, metaverse features, and the progress system.

• Dashboards and characters are now refreshable as we fully transition to the new series.

• With the unification of the series, our focus will shift to preparations for the issuance of the $JRNY token.

Official marketplace and link below 👇

𝐓𝐡𝐞 𝐀𝐫𝐭 𝐨𝐟 𝐏𝐮𝐫𝐩𝐨𝐬𝐞 🇺🇸

Crypto Newbie

01-28 08:08

The multiverse is not a scientific theory.

It's something you're forced to accept when evidence points to a place you've already decided you don't want to go.

20th-century physics terrified materialists. Here's why they invented infinite universes to cope: 👇