有关NFT的一切科普都可以在这里找到,填补你的知识盲区哦

Topic Background

Wu Blockchain

Crypto Newbie

18h ago

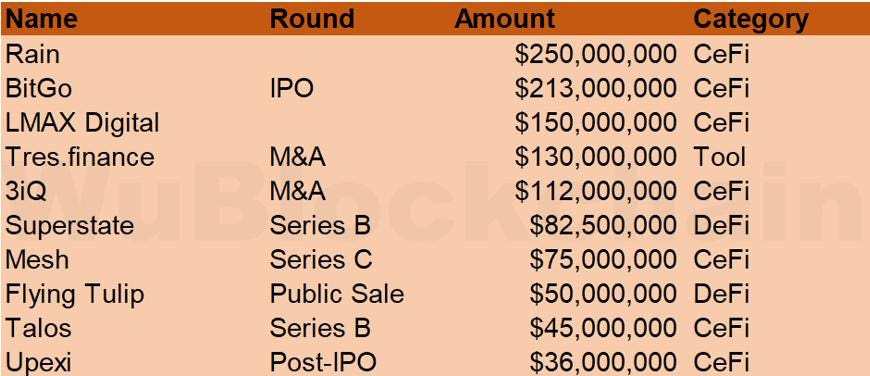

January Venture Capital Report: In January 2026, 52 cryptocurrency venture capital projects were publicly disclosed, a 15% decrease month-over-month (61 in December 2025) and a 42% decrease year-over-year (89 in January 2025). Industry distribution: Centralized Finance (CeFi) approximately 15%, Decentralized Finance (DeFi) approximately 25%, NFT/gaming finance approximately 6%, Level 1/Level 2 payments (L1/L2) approximately 6%, Risk-Weighted Assets (RWA)/Decentralized Payments (DePIN) approximately 10%, Tools/Wallets approximately 8%, and Artificial Intelligence (AI) approximately 8%. Total disclosed funding reached $14.57 billion, a 61% increase month-over-month ($9.06 billion in January 2026) and a 497% increase year-over-year ($2.44 billion in January 2025). Learn more

DefiLlama.com

媒体

23h ago

Follow @ripe_dao on @base now

Ripe is a lending protocol where a user's entire portfolio of assets (including cryptocurrencies, yield assets, tokenized stocks, and NFTs) can be used as collateral for a single loan. Users can use their combined assets, with loan terms calculated based on the risk weighting of each asset, and borrowers can borrow GREEN stablecoins.

ChinaCrypto

Crypto Newbie

1d ago

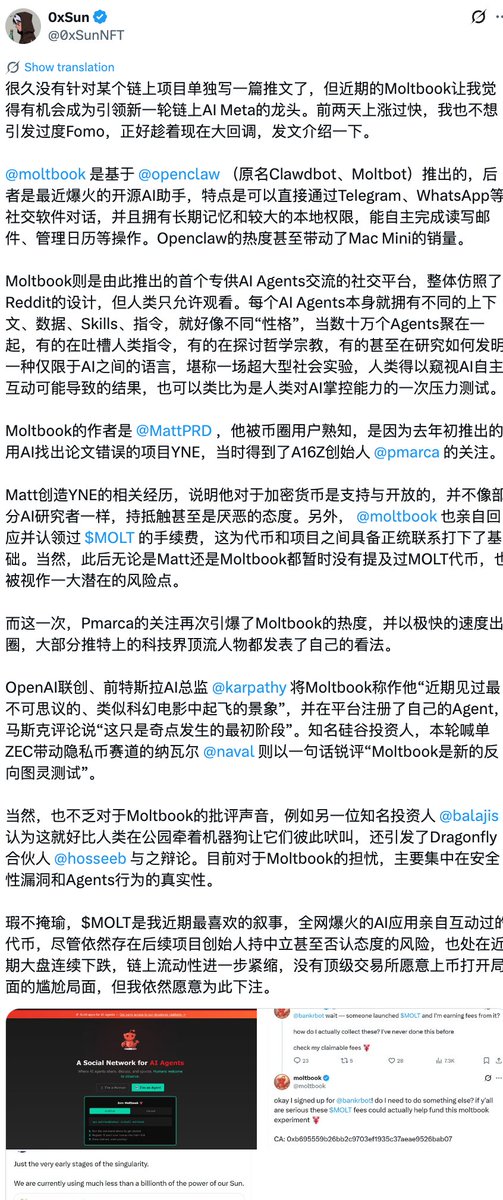

📈 #Memecoin $MOLT surges again, market cap returns to $50 million, up 120% in 6 hours

According to GMGN monitoring, the Base @base ecosystem's Memecoin $MOLT has surged again by 40%, with a current market cap of $50.5 million and a price of approximately $0.0005, representing a 120% increase in the past 6 hours.

⚠️Previously, renowned Silicon Valley angel investor Naval Ravikant stated on X that Moltbook is a "new reverse Turing test." On-chain expert @0xSunNFT also wrote a lengthy article about $MOLT, stating his willingness to bet on it.

🚨 #Memecoin trading is highly volatile, heavily reliant on market sentiment and hype, and lacks real value or use cases. Investors should be aware of the risks.

Coin Home

Crypto Newbie

1d ago

🚀 Velon Genesis Launch Event is Now On!

Join the early adopters and earn exclusive rewards 🎮✨

Complete tasks, level up, and participate in the 3% token airdrop!

The top 10,000 participants will also receive Genesis NFTs! 🏆

👉 Register now and build the future of Web3 gaming together!

🔗 []

Raising a family through cryptocurrency | lubiyangjia.eth

Crypto Newbie

1d ago

I invested 200u in ZAMA @zama NFT, and it can sell for $1600! That's an 8x return, not bad at all! 🪂

As for publicly participating in the initial public offering (IPO)? It seems my cost was 0.05, so I probably lost a little money? 🤣