有关比特币的一切你都可以在这里发现,比特币视频解说,文字解说,比特币相关价格、技术、底层原理、未来发展统统覆盖到✌

Topic Background

Sanma Ge

Crypto Newbie

34m ago

I woke up to find my position gone! Turns out, it was because I accurately predicted the 73888 point level yesterday!

We posted the 73888 level in our analysis chart before going to sleep, and we mentioned this point multiple times during the live stream, even giving investors a "pre-market tip." #BTC 👉🏻[Pre-market Tip Log](https://app.binance.com/uni-qr/cpos/35960408375409?r=SDR9QGU2&l=zh-CN&uco=YlhI6nVWAwXtxF1K2b4Utg&uc=app_square_share_link&us=copylink) Also, after hitting 2208 on Ethereum, it rose to 2346, a gain of over 100 points. #ETH

Also, after hitting 2208 on Ethereum, it rose to 2346, a gain of over 100 points. #ETH](http://img.528btc.com.cn/pro/2026-02-04/img/177017839637197h91h7699j877x5cjh1b0xb907hc9ax.png)

good god

Crypto Newbie

35m ago

In previous bull and bear market cycles, the maximum drop exceeded 70%.

The 2025 bull market saw BTC reach a high of $126,000.

A 30% drop occurred, reaching $8,200 (already broken).

A 40% drop occurred, reaching $75,600 (already broken).

A 50% drop occurred, reaching $63,000 (not reached).

A 60% drop occurred, reaching $50,400 (not reached).

A drop below 70% occurred, reaching $37,800 (not reached).

If the historical cycle continues, a 60% drop is very possible.

At that point, it would already be at $50,000.

If the cycle continues, even after a 60% drop, a rebound could occur, breaking through $100,000 again.

A $200,000 drop is also a very real possibility.

余烬Ember

Crypto Newbie

41m ago

A whale who lost $230 million on Hyperliquid after his long ETH position was liquidated three days ago is now cutting his losses on leveraged ETH holdings: he sold 50,000 ETH ($112.8 million) to reduce leverage.

Just a week ago (January 27th), he leveraged his position to go long on 148,000 ETH ($426 million) at $2,883, after which ETH plummeted to $2.2K.

This not only liquidated his Hyperliquid ETH long position, but also brought his leveraged ETH long position close to the liquidation threshold. In the last two days, he sold 50,000 ETH, lowering the liquidation price to around $1,600.

Address: 0xca08371f6e9204dd6927dcc2db5504ea062b2998

He currently holds 33,000 BTC ($2.52 billion) and 748,000 ETH ($1.693 billion) on the blockchain, worth $4.213 billion.

Running Finance - FinaceRun

Crypto Newbie

43m ago

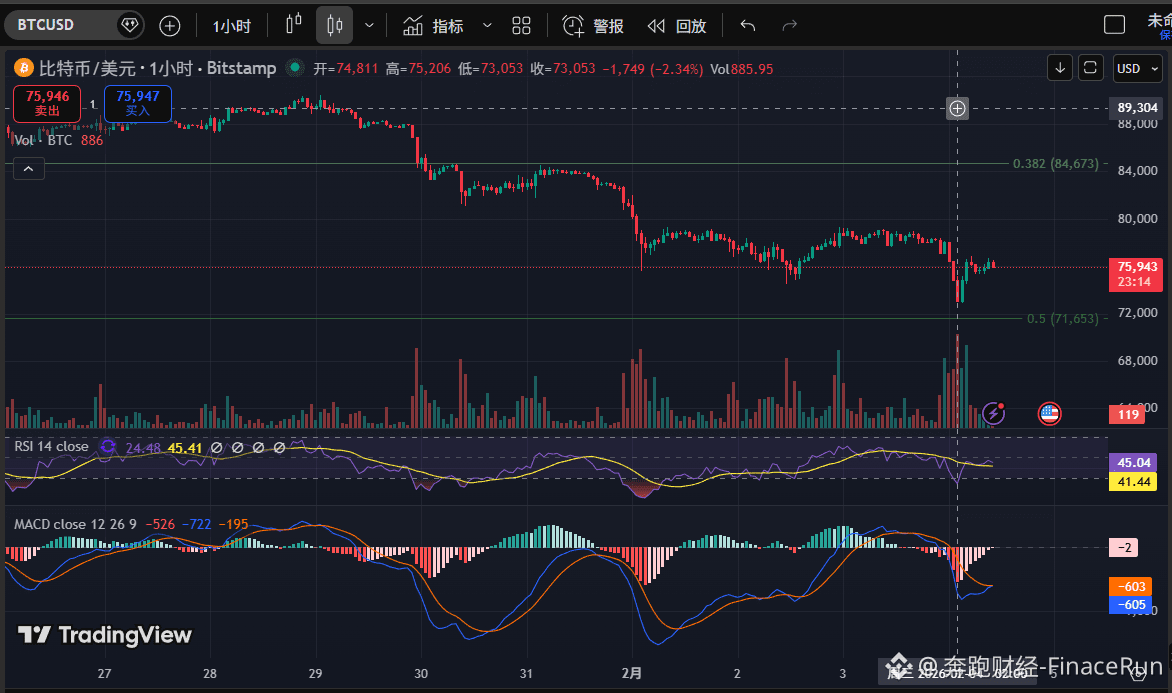

Iran's pursuit of bilateral nuclear talks with the US caused Bitcoin to briefly fall below $75,000

As market sentiment remained weak, the cryptocurrency market experienced another widespread decline. Bitcoin prices suffered another sharp drop in the early hours of the morning, breaking below the key support level of $75,000 and briefly dipping to $73,000.

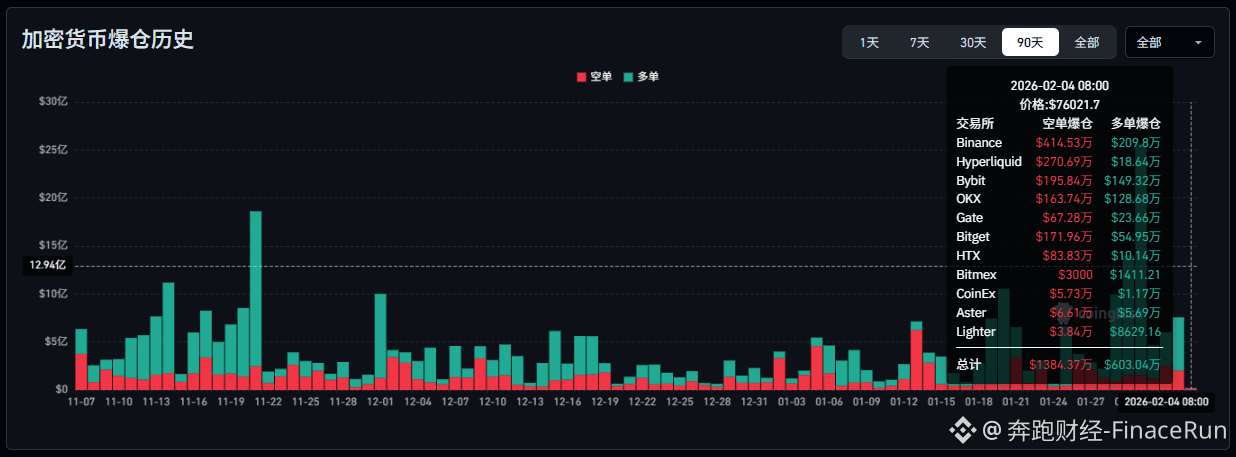

It is reported that BTC fell from approximately $78,000 to below $73,000 in the past few hours. This rapid decline resulted in the liquidation of approximately $20 million in derivatives positions across major exchanges, with short positions accounting for the vast majority.

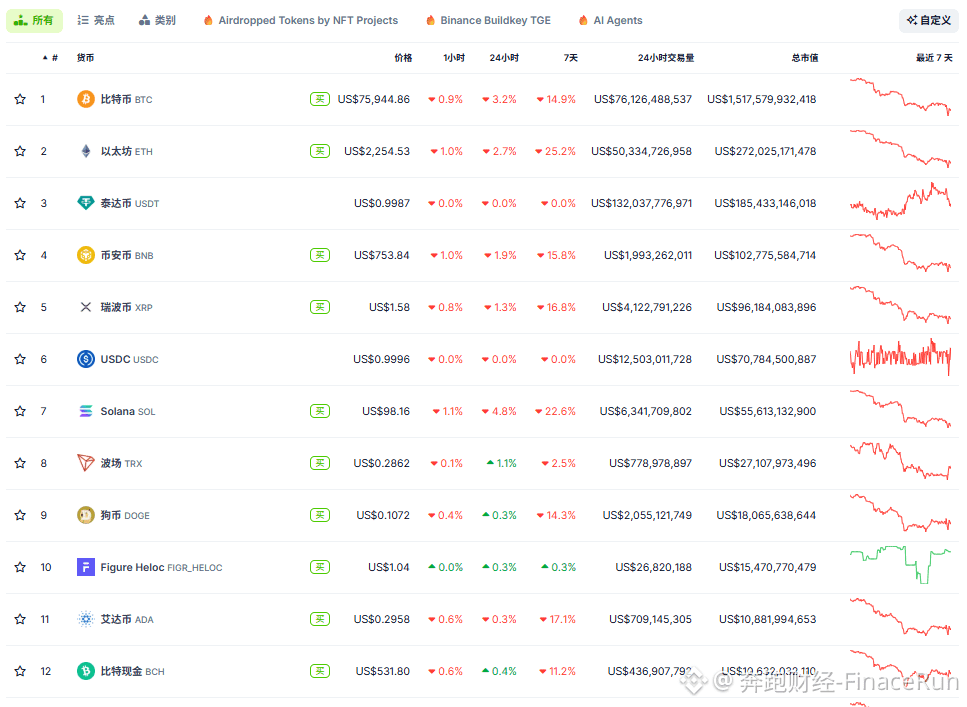

According to Coingecko data, in the past 24 hours, BTC fell by 3.2%, ETH by 2.7%, XRP by 1.3%, SOL by 4.8%, and ADA by 0.3%, with the overall market showing a downward trend.

Analysts believe that the direct trigger for this market volatility was the sudden change in the geopolitical situation in the Middle East. Reports indicate that Iran's proposal to change the format of its nuclear talks with the United States has directly led to a stalemate in the talks scheduled for this Friday in Istanbul.

Previously, Egypt, Qatar, Saudi Arabia, and Oman had strongly advocated for these talks, but Iran's preference for bilateral meetings has been seen as a potential undermining of diplomatic efforts.

Meanwhile, the US troop buildup in the Gulf region has further increased the risk of regional military conflict.

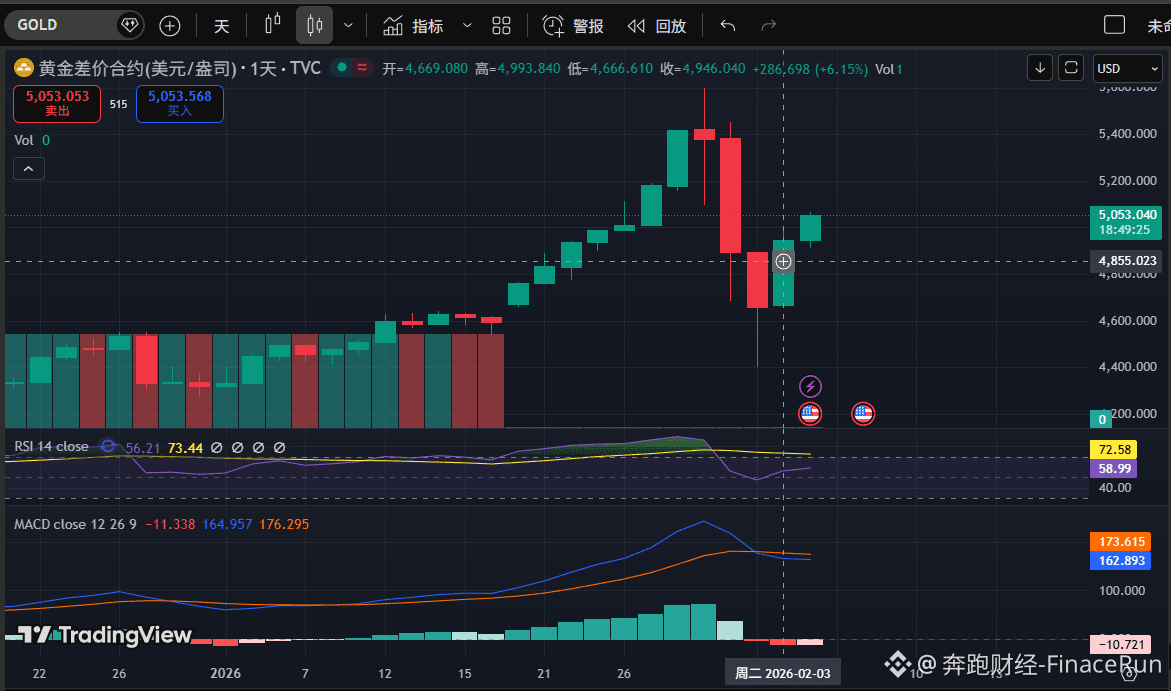

Faced with this sudden geopolitical development, traditional safe-haven assets and cryptocurrencies have exhibited drastically different trends. Gold, as a traditional safe haven, has risen approximately 6.15% in the past 24 hours; conversely, Bitcoin has fallen nearly 3.2% during the same period.

This stark contrast between rising safe-haven assets and falling risk assets clearly illustrates the increasingly evident flow of funds driven by risk aversion in the current market. Under these circumstances, a substantial recovery in the crypto market is unlikely, and weak fluctuations may become the norm.

#GeopoliticalRisks #IranNuclearTalks

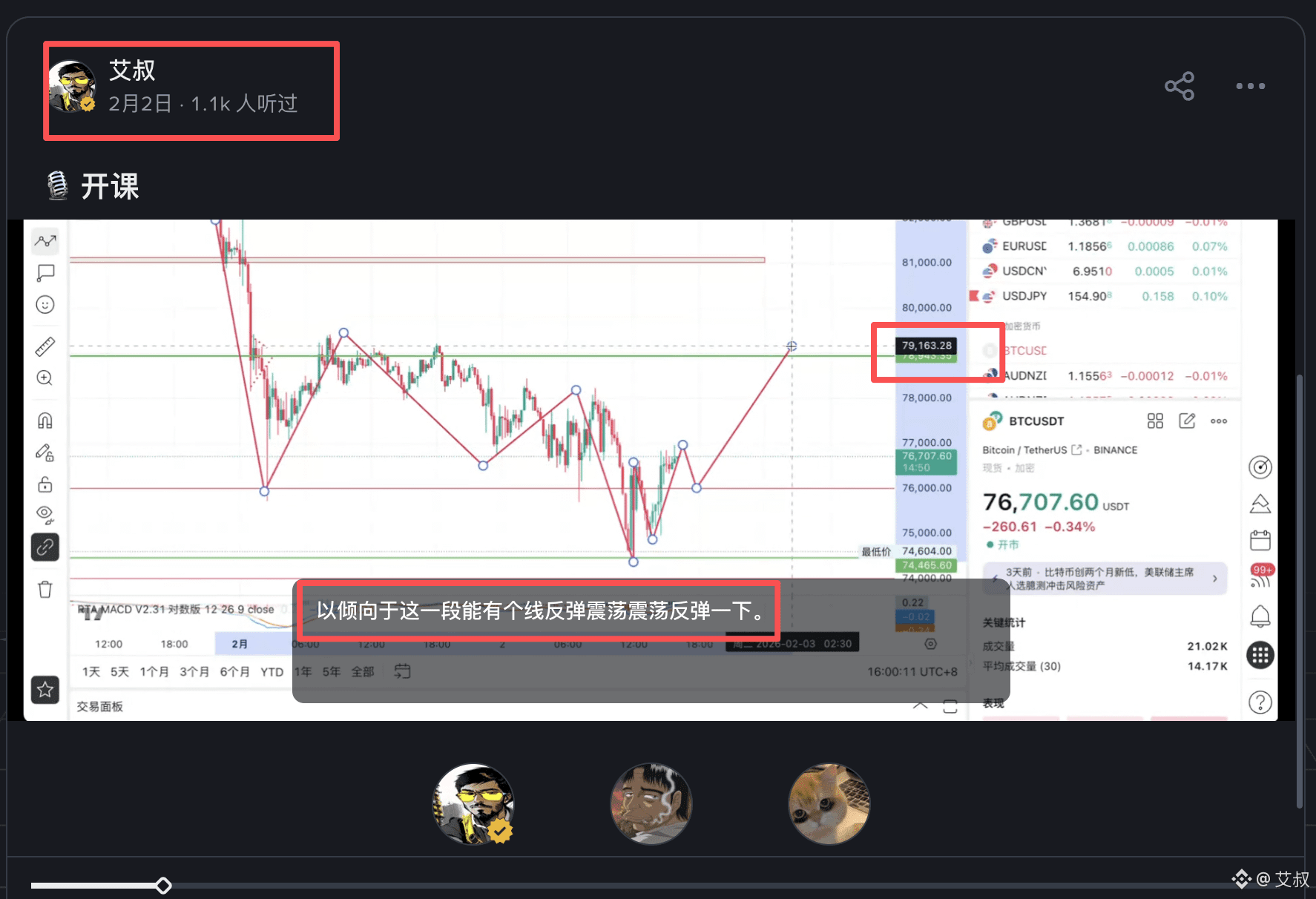

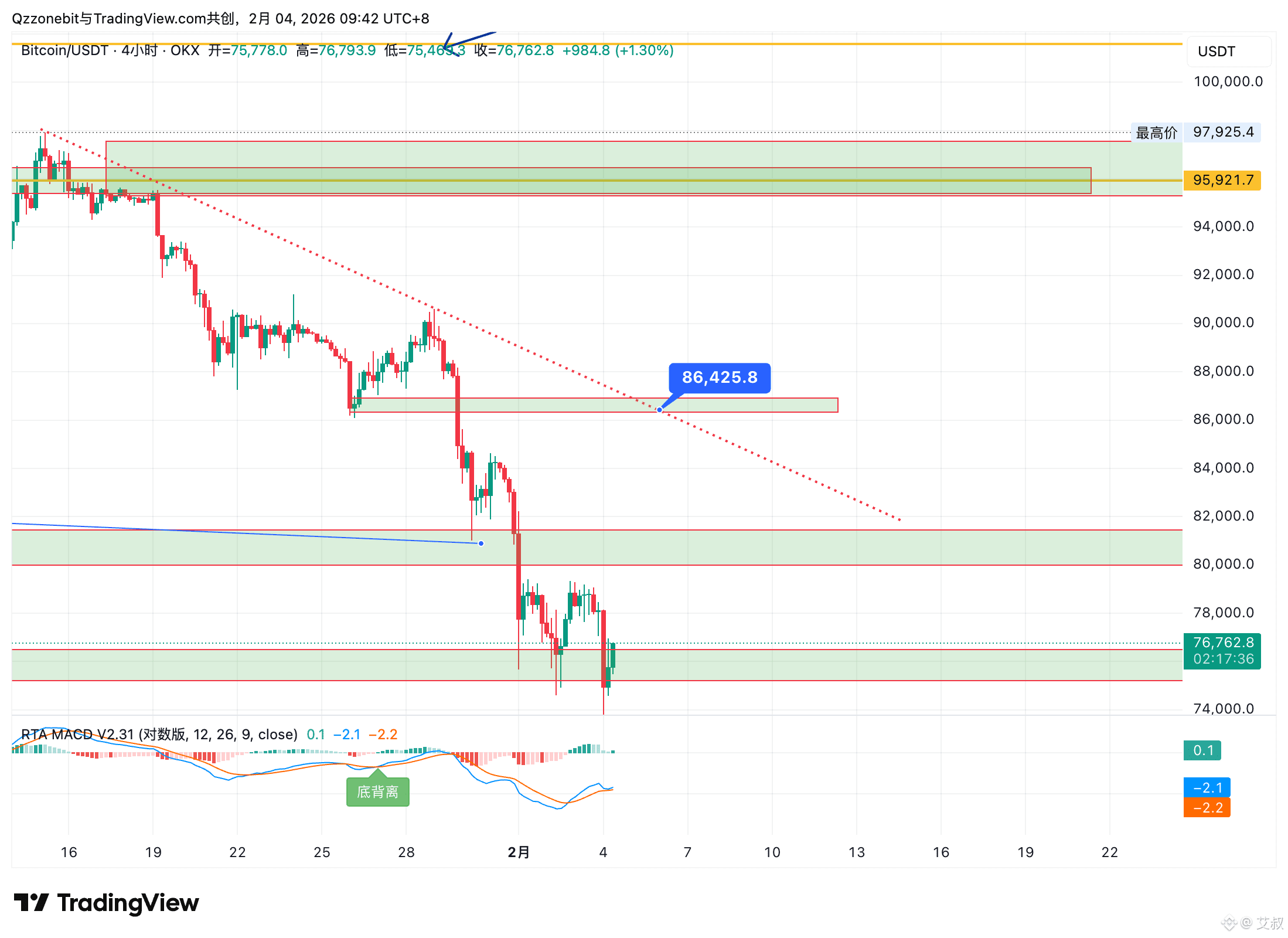

艾叔

Crypto Newbie

1h ago

$BTC

If you don't understand, watch the live stream replays.

Like Bitcoin, on the 2nd we talked about a rebound, targeting around 89, and also suggesting a pullback.

Ethereum shorting positions are around 3025-3050.

We need to know where the positions are, and also why they are there.

Currently, the market has repeatedly tested new lows.

If it can consolidate and move out of 82 before the 15th, or if it can remain above 7.8 this week,

we can start looking for a bottoming structure.

Otherwise, without triggering these conditions, it's all left-side behavior.

{future}(BTCUSDT)