以太坊K线分析,变现机会分享,V神动态跟踪,以太坊链上追踪等👏

Topic Background

Sanma Ge

Crypto Newbie

32m ago

I woke up to find my position gone! Turns out, it was because I accurately predicted the 73888 point level yesterday!

We posted the 73888 level in our analysis chart before going to sleep, and we mentioned this point multiple times during the live stream, even giving investors a "pre-market tip." #BTC 👉🏻[Pre-market Tip Log](https://app.binance.com/uni-qr/cpos/35960408375409?r=SDR9QGU2&l=zh-CN&uco=YlhI6nVWAwXtxF1K2b4Utg&uc=app_square_share_link&us=copylink) Also, after hitting 2208 on Ethereum, it rose to 2346, a gain of over 100 points. #ETH

Also, after hitting 2208 on Ethereum, it rose to 2346, a gain of over 100 points. #ETH](http://img.528btc.com.cn/pro/2026-02-04/img/177017839637197h91h7699j877x5cjh1b0xb907hc9ax.png)

余烬Ember

Crypto Newbie

39m ago

A whale who lost $230 million on Hyperliquid after his long ETH position was liquidated three days ago is now cutting his losses on leveraged ETH holdings: he sold 50,000 ETH ($112.8 million) to reduce leverage.

Just a week ago (January 27th), he leveraged his position to go long on 148,000 ETH ($426 million) at $2,883, after which ETH plummeted to $2.2K.

This not only liquidated his Hyperliquid ETH long position, but also brought his leveraged ETH long position close to the liquidation threshold. In the last two days, he sold 50,000 ETH, lowering the liquidation price to around $1,600.

Address: 0xca08371f6e9204dd6927dcc2db5504ea062b2998

He currently holds 33,000 BTC ($2.52 billion) and 748,000 ETH ($1.693 billion) on the blockchain, worth $4.213 billion.

Running Finance - FinaceRun

Crypto Newbie

41m ago

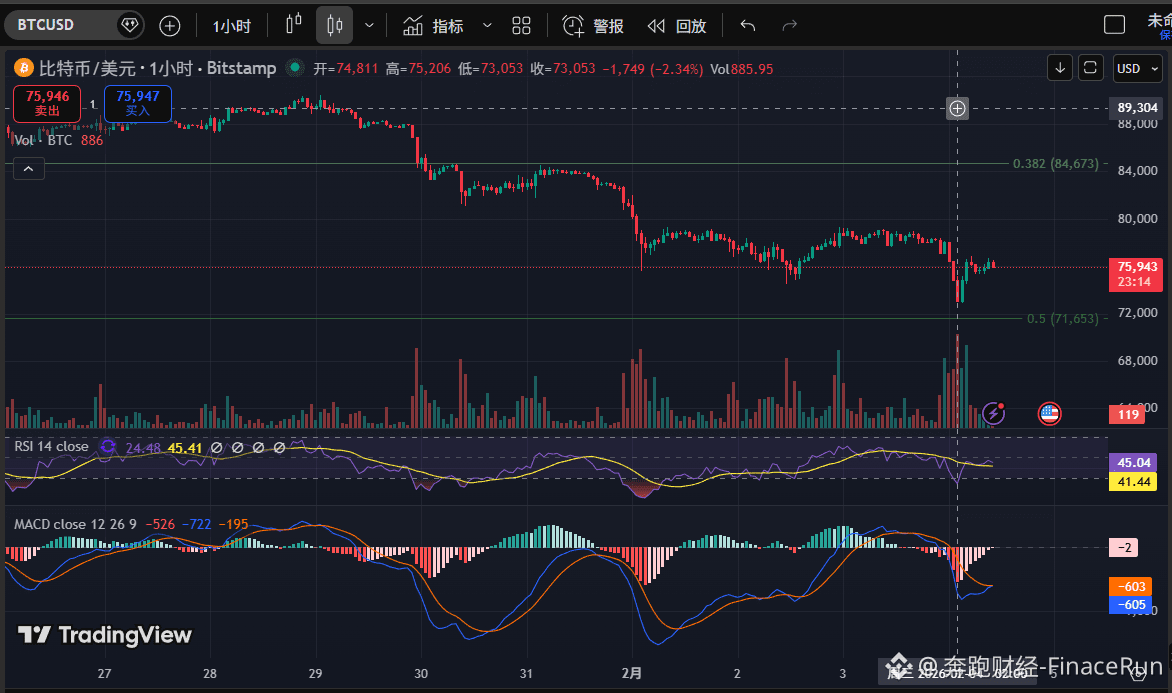

Iran's pursuit of bilateral nuclear talks with the US caused Bitcoin to briefly fall below $75,000

As market sentiment remained weak, the cryptocurrency market experienced another widespread decline. Bitcoin prices suffered another sharp drop in the early hours of the morning, breaking below the key support level of $75,000 and briefly dipping to $73,000.

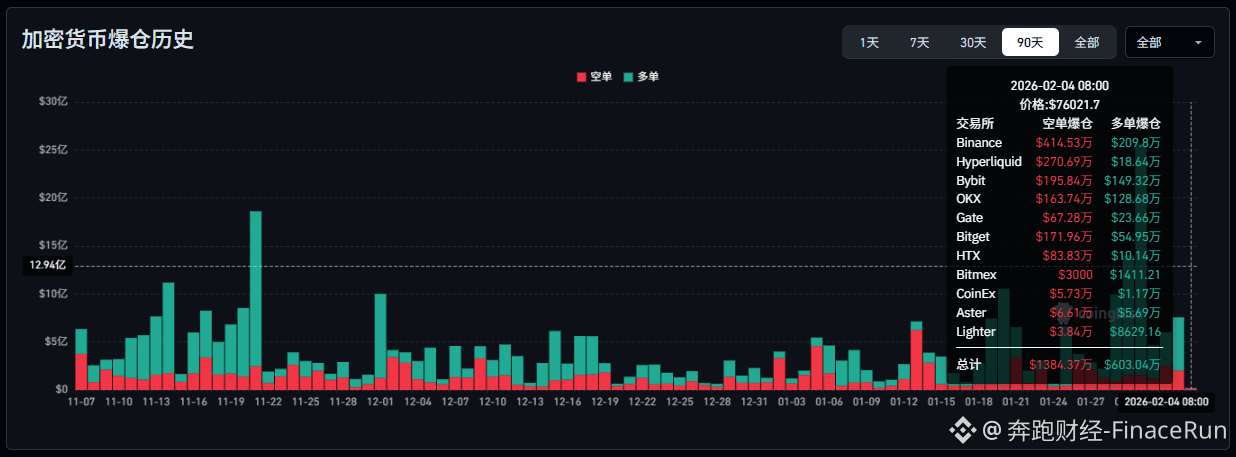

It is reported that BTC fell from approximately $78,000 to below $73,000 in the past few hours. This rapid decline resulted in the liquidation of approximately $20 million in derivatives positions across major exchanges, with short positions accounting for the vast majority.

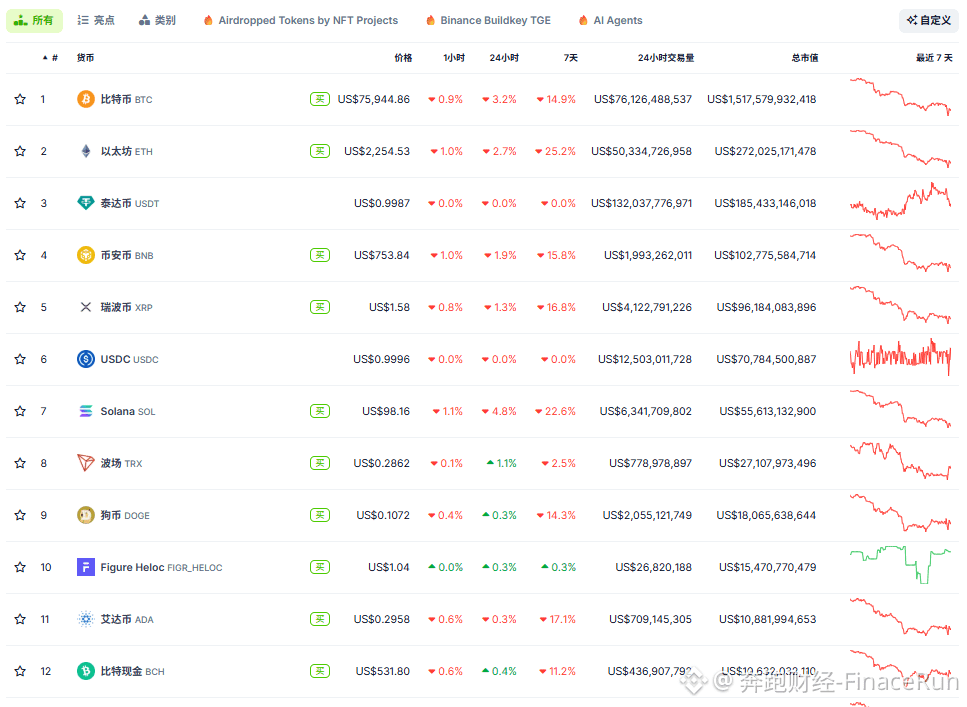

According to Coingecko data, in the past 24 hours, BTC fell by 3.2%, ETH by 2.7%, XRP by 1.3%, SOL by 4.8%, and ADA by 0.3%, with the overall market showing a downward trend.

Analysts believe that the direct trigger for this market volatility was the sudden change in the geopolitical situation in the Middle East. Reports indicate that Iran's proposal to change the format of its nuclear talks with the United States has directly led to a stalemate in the talks scheduled for this Friday in Istanbul.

Previously, Egypt, Qatar, Saudi Arabia, and Oman had strongly advocated for these talks, but Iran's preference for bilateral meetings has been seen as a potential undermining of diplomatic efforts.

Meanwhile, the US troop buildup in the Gulf region has further increased the risk of regional military conflict.

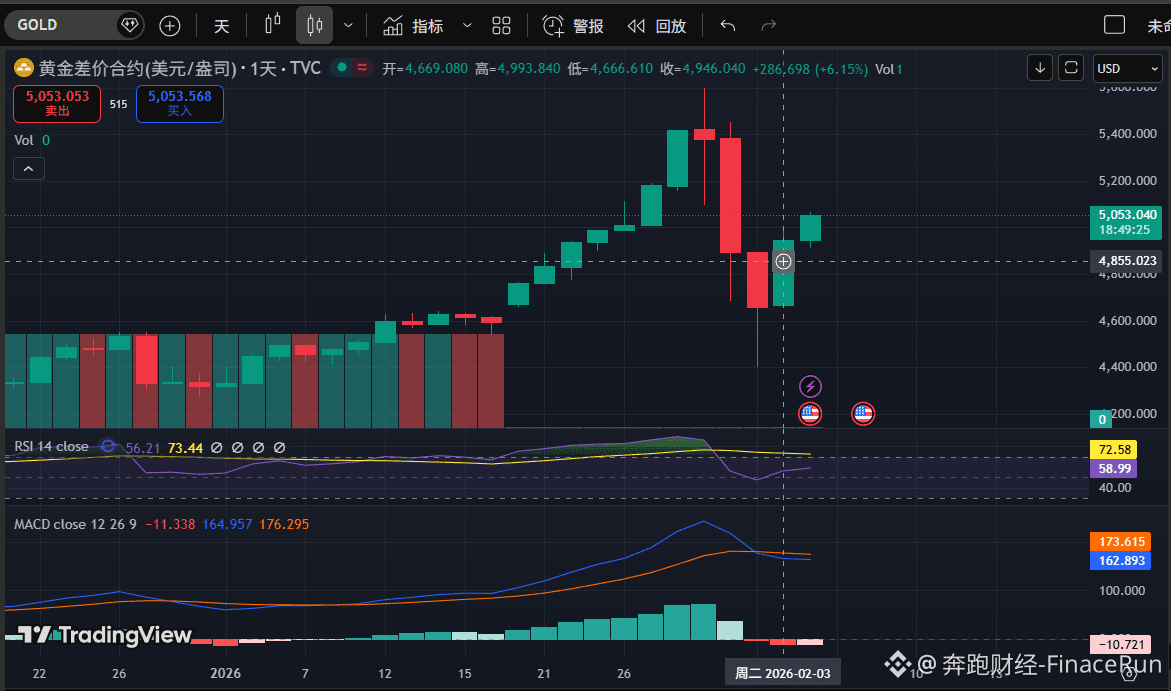

Faced with this sudden geopolitical development, traditional safe-haven assets and cryptocurrencies have exhibited drastically different trends. Gold, as a traditional safe haven, has risen approximately 6.15% in the past 24 hours; conversely, Bitcoin has fallen nearly 3.2% during the same period.

This stark contrast between rising safe-haven assets and falling risk assets clearly illustrates the increasingly evident flow of funds driven by risk aversion in the current market. Under these circumstances, a substantial recovery in the crypto market is unlikely, and weak fluctuations may become the norm.

#GeopoliticalRisks #IranNuclearTalks

吴说区块链

Binance

49m ago

According to Wu, in response to claims that "Bitmine (BMNR) faces $6.6 billion in unrealized losses, and future selling pressure will limit the price of ETH," Tom Lee, Chairman of Bitmine, the Ethereum treasury company, stated that these claims ignore the core principles of the Ethereum treasury. He pointed out that Bitmine aims to track the price of ETH and outperform the market over time; during periods of crypto market downturn, unrealized losses on ETH holdings are a "feature, not a vulnerability," just as index ETFs also experience losses during market declines.

独领风骚必暴富

Crypto Newbie

56m ago

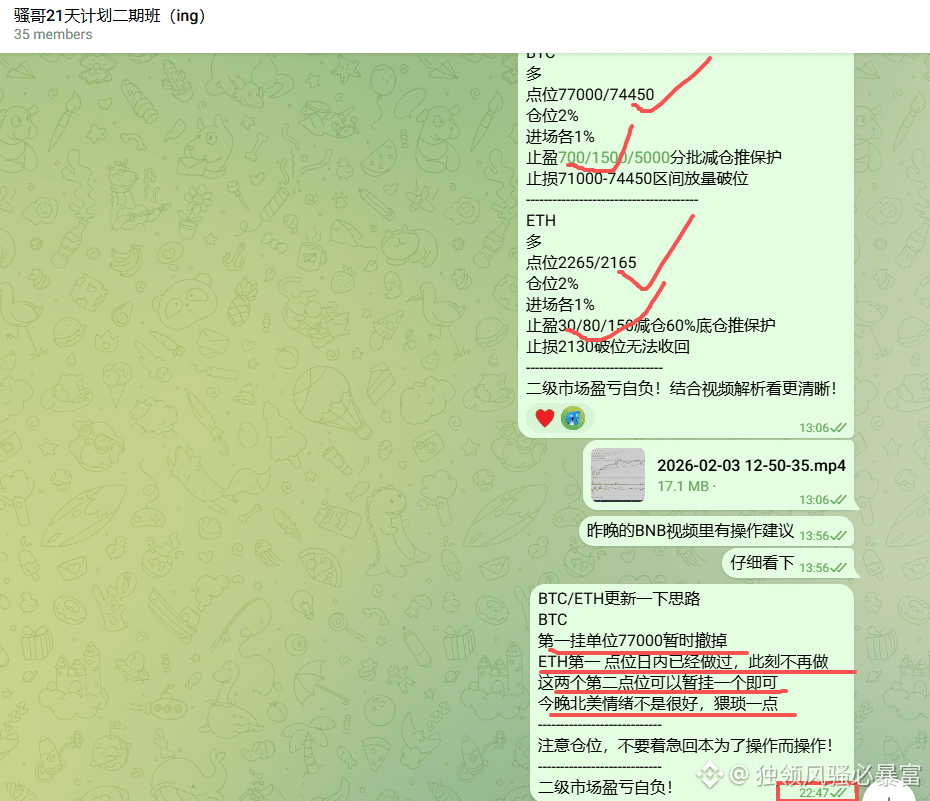

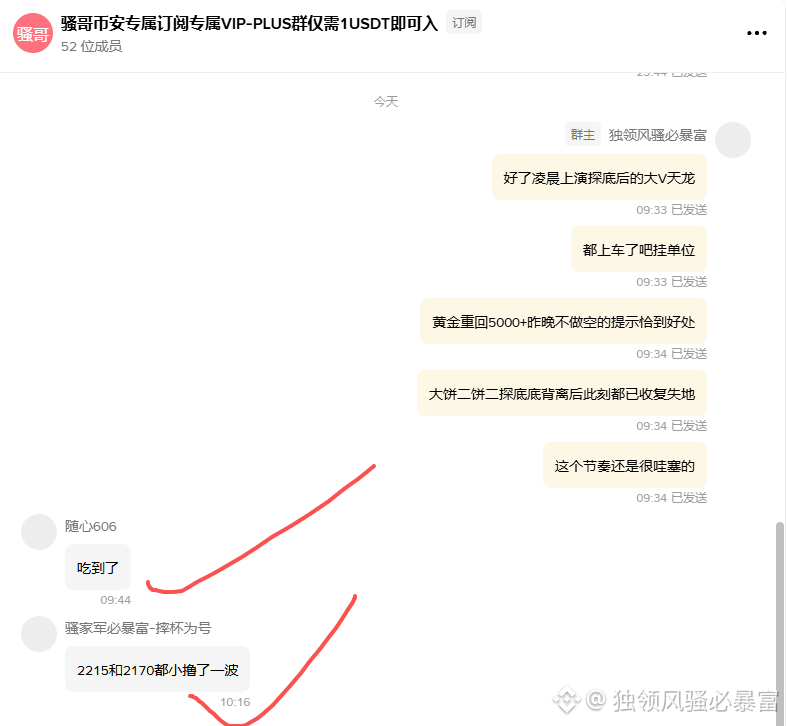

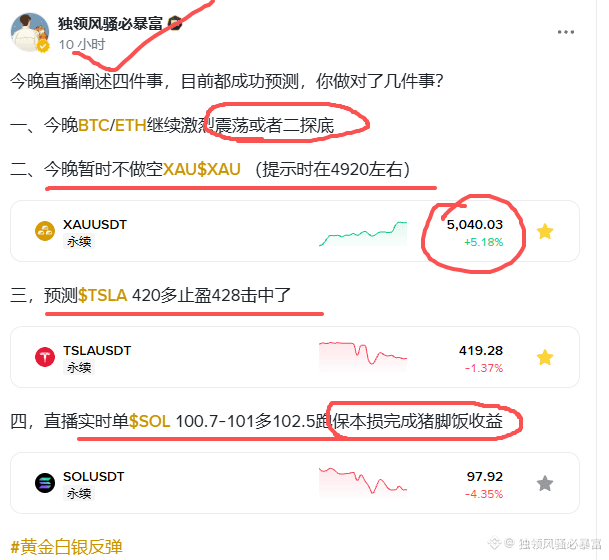

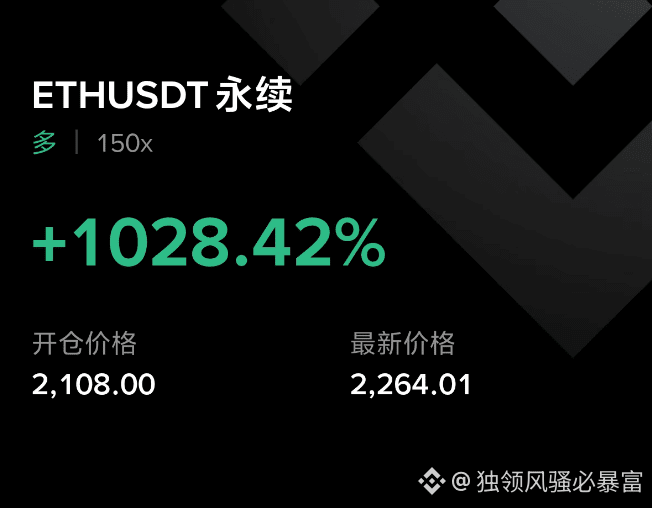

Last night's post-mortem analysis was almost entirely online, and all the strategies we implemented based on our analysis achieved profit targets!

If you're still not making money, then you're definitely not following Brother Sao's lead closely enough!

Brother Sao is serious about catching market manipulators!

#PartialUSGovernmentGovernmentShutdownEnded

{future}(SOLUSDT)

{future}(XAUUSDT)

{future}(ETHUSDT)

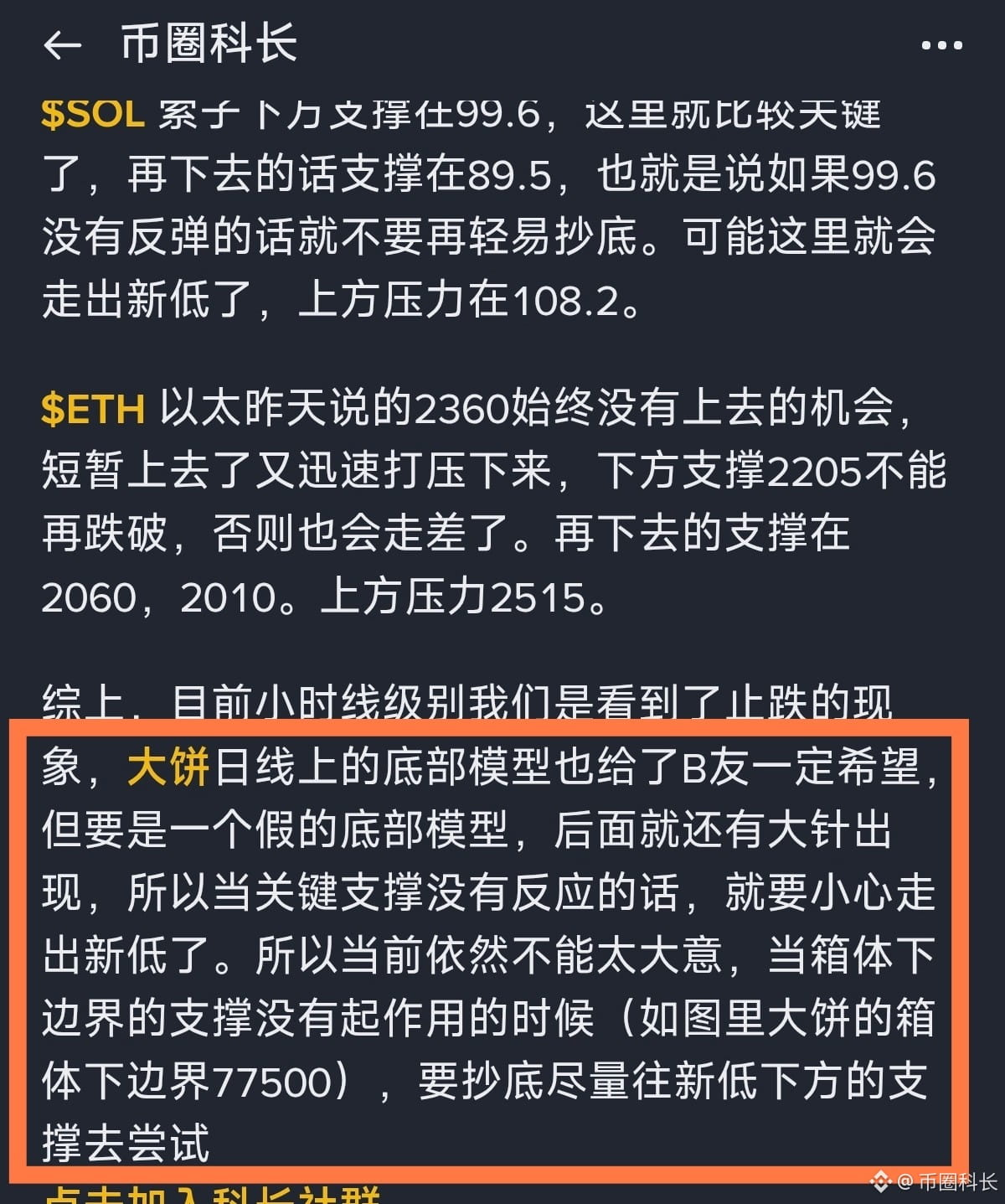

币圈科长

Crypto Newbie

1h ago

If it goes down, it'll drop to 70,000, then to 60,000, then to 50,000... There's no going back. Tell me how you explain this? You've got no shame!

I woke up to find the trading range broken, a new low. They've really gone all out. Those who shorted ETH yesterday should have gotten their money. The 4-hour EMA15 for Bitcoin is still crucial; until it breaks through, the bulls should be careful. 🤣🤣

#TrumpSaysFirmSupportForCryptocurrency

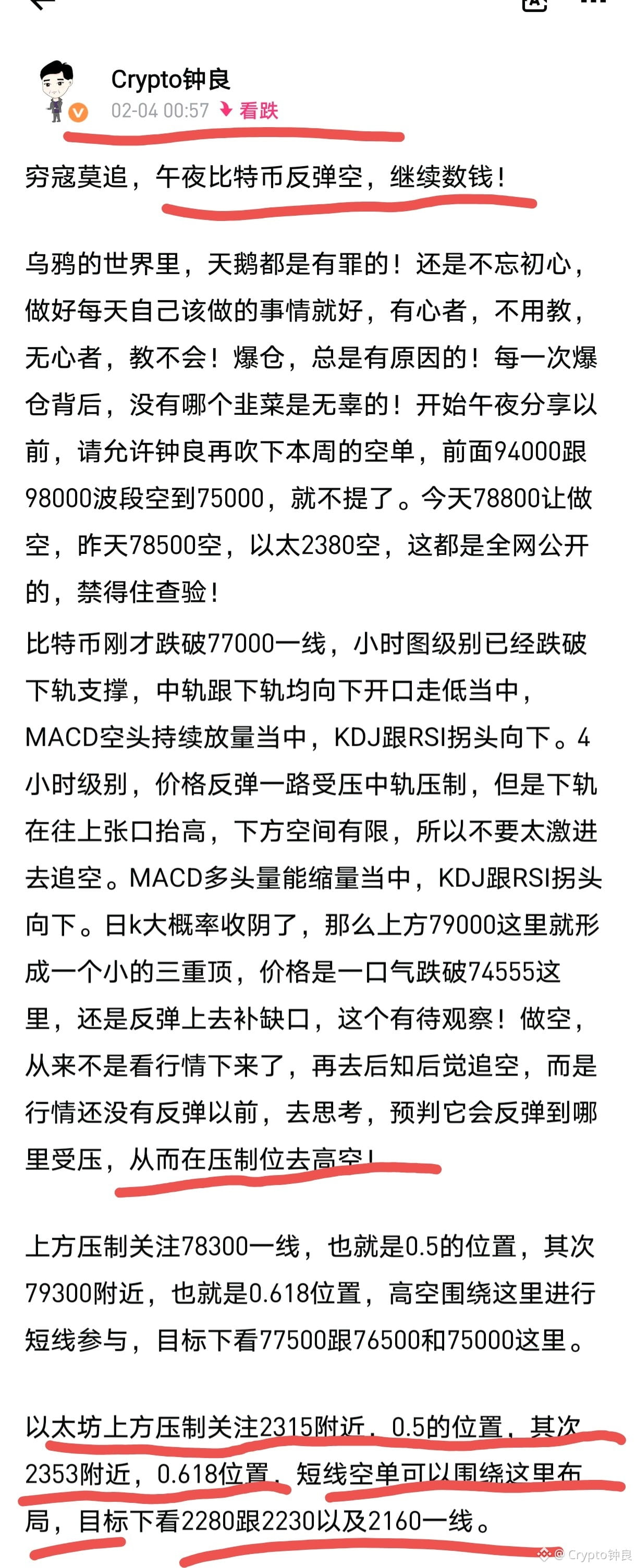

Crypto钟良

Crypto Newbie

1h ago

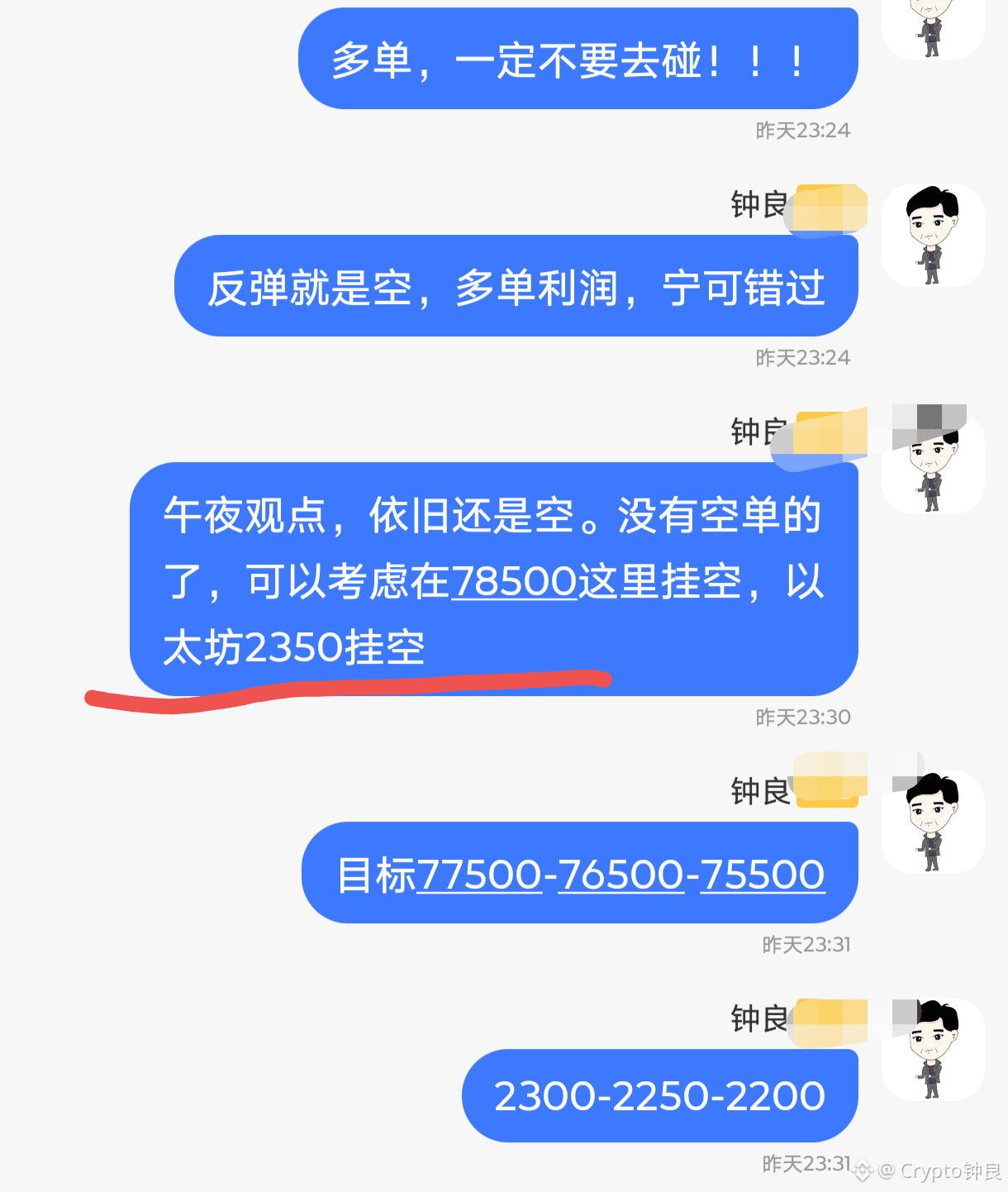

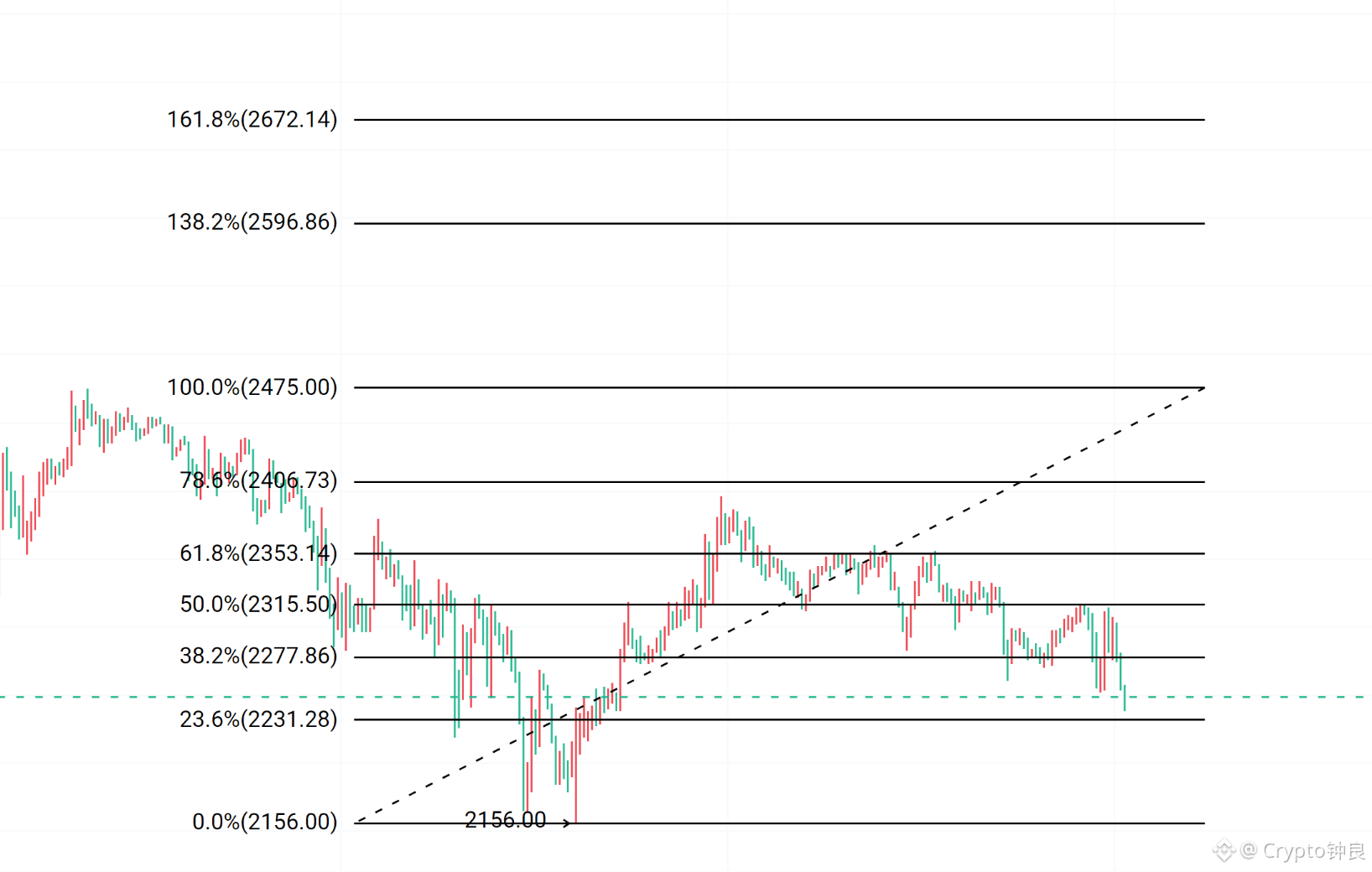

Where is the bottom? How to buy? Zhong Liang doesn't know, but he's already pressed the long button. He told us to place short orders at midnight, did we place them? Ethereum told us to place short orders at 2350, did we place them? The post on the forum was very clear, very direct, and even included a chart showing Fibonacci retracements, telling us to place short orders at 0.5 and 0.618. Now the price is 2270, didn't we make a profit again?

Behind every liquidation, no retail investor is innocent! So, no matter how much you update, you can never wake those who are pretending to be asleep! There are no unrealistic promises or exaggerated profits here; every moment is live, and real-time orders are the best proof of our strength. We don't do anything fancy; making money is the only way. Foresight is priceless, and regret is even more precious. Let those who are watching continue to watch, let those who are worried continue to worry, let those who are afraid continue to be afraid, let those who are stopped out continue to be stopped out, let those who are making money continue to make money. Every situation is a test, and every market follows the laws of nature. There are no investments that don't generate profits, only operations that don't yield profits. Finding the right mentor is incredibly important! $BTC

{future}(BTCUSDT)

Chris Lee

Crypto Newbie

1h ago

Merkle3s Weekly Update 📊 02/04

1️⃣ Macroeconomics and Risk Appetite

➡️ From the risk of a government shutdown to the nomination of a Fed candidate, #BTC has suffered two consecutive shocks: first, the release of panic, then the amplification of the Fed nomination leading to a second round of suppression.

➡️ Precious metals also experienced rare two-way fluctuations: first rising due to panic, then quickly retreating under the narrative of a stronger dollar.

➡️ The rebound in inflation data has become a potential time bomb; some believe the market may still face a deeper decline or a longer period of sideways consolidation.

2️⃣ Fund Flows and ETF Direction

➡️ After the release of panic, $BTC saw a round of fund inflows, but $ETH continued to see outflows.

➡️ The fund structure shows a "safe haven before selection" characteristic, with a short-term bias towards defense rather than a full return to risk.

3️⃣ On-Chain Hot Topics and Narrative Shift

➡️ On-chain funds have shown a clear migration: after the controversy between CZ and OKX, #BNB and Chinese #Memes... Collective Cooling Down

➡️ #Base absorbed some of the #BNB spillover funds, mainly flowing into #ClawdBot/#MoltBot/#OpenClaw related #AI narratives, and driving up the AI-related coin $CLANKER, thus reaping a wave of AI hype.

4️⃣ OpenClaw Ecosystem Short-Term Explosion and Pullback

➡️ The OpenClaw Agent-dedicated forum #Moltbook experienced a surge in popularity, pushing $MOLT's market capitalization past $100 million.

➡️ Subsequently, a market crash led to a "rapid pullback in the hype," while Moltbook's outage and exposure of spam messages exacerbated negative sentiment and a loss of trust.