Topic Background

烟筒

Binance

14h ago

Since 2018, Dusk has recognized the Achilles' heel of institutional finance: the dual challenge of privacy and compliance. It doesn't simply add layers of privacy; it welds the rules in place from the ground up, specifically designed for RWA, compliant DeFi, and security tokenization.

Its modular design is practical: the settlement layer manages data, the EVM is compatible allowing developers to directly port their code, and the privacy engine uses ZK to hide details while still providing regulatory verification. NPEX has invested €300 million worth of securities to run on it, and Chainlink has also integrated cross-chain data.

Institutions fear compromise most, and Dusk eliminates the need for them to choose. With the EVM mainnet set to be stable in 2026, this chain is increasingly becoming the gateway for TradeFi into Web3.

#Dusk $DUSK @DuskFoundation

小杰尼龟

Crypto Newbie

15h ago

I've been closely monitoring the price movement of $VANRY lately, and to be honest, this chart gives me mixed feelings. Looking at the chart, the price is struggling around 0.0065. Although there's been a slight rebound of about 1.8% in the short term, looking at longer periods—whether it's 7 days, 30 days, or 90 days—the declines are all in double digits. Especially in the last six months to a year, it's dropped by nearly 80%, which isn't just a simple correction, but almost a complete halving.

However, I'm not too worried. Because when looking at $VANRY, you can't just look at the price; you need to look at what the Vanar Chain behind it is doing.

The core of Vanar Chain is an AI-native Layer 1 chain, compatible with the EVM, with high throughput and negligible fees—block generation in 3 seconds, which is incredibly friendly for games and RWA applications. Their Neutron layer can compress data into AI-readable "seeds," while the Kayon engine supports natural language queries and automated decision-making, feeling like giving the blockchain an intelligent brain. On the ecosystem front, Feenix recently joined, offering gas-free swaps across 25+ chains and allowing direct transactions via Telegram – incredibly convenient. SuiRWA also brings AI investment and asset tokenization; imagine real-world assets like real estate and art directly on-chain, with AI optimizing investments – isn't this the prototype of future PayFi?

The flowchart shows the entire process from fixed USD fees to AI-assisted payments, looking very professional. Images of AI figures walking under the stars also suggest Vanar is leading us into a decentralized, intelligent era. Recent news mentions their discussions with Worldpay on Agentic Payments at Abu Dhabi Financial Week, and the addition of payment expert Saiprasad Raut to their team, further boosting my confidence in their practical applications. The number of nodes has recently jumped 35% to 18k, indicating a growing number of validators and a more stable chain.

However, VANRY has recently fallen by more than 10% in the past week and by about 20% this month. But forecasts suggest it may rebound to above 0.01 by 2026, indicating good ROI potential. I personally hold a small position, mainly because I believe the AI + blockchain narrative will explode. This isn't blind FOMO, but rather seeing them shift from demos to subscription models, with real-world usage driving value. In short, Vanar Chain makes me feel that Web3 isn't an isolated island, but a bridge connecting to reality. If you're also interested, you might want to research it further. @Vanar #Vanar $VANRY

{future}(VANRYUSDT)

BlockchainBaller

Crypto Newbie

19h ago

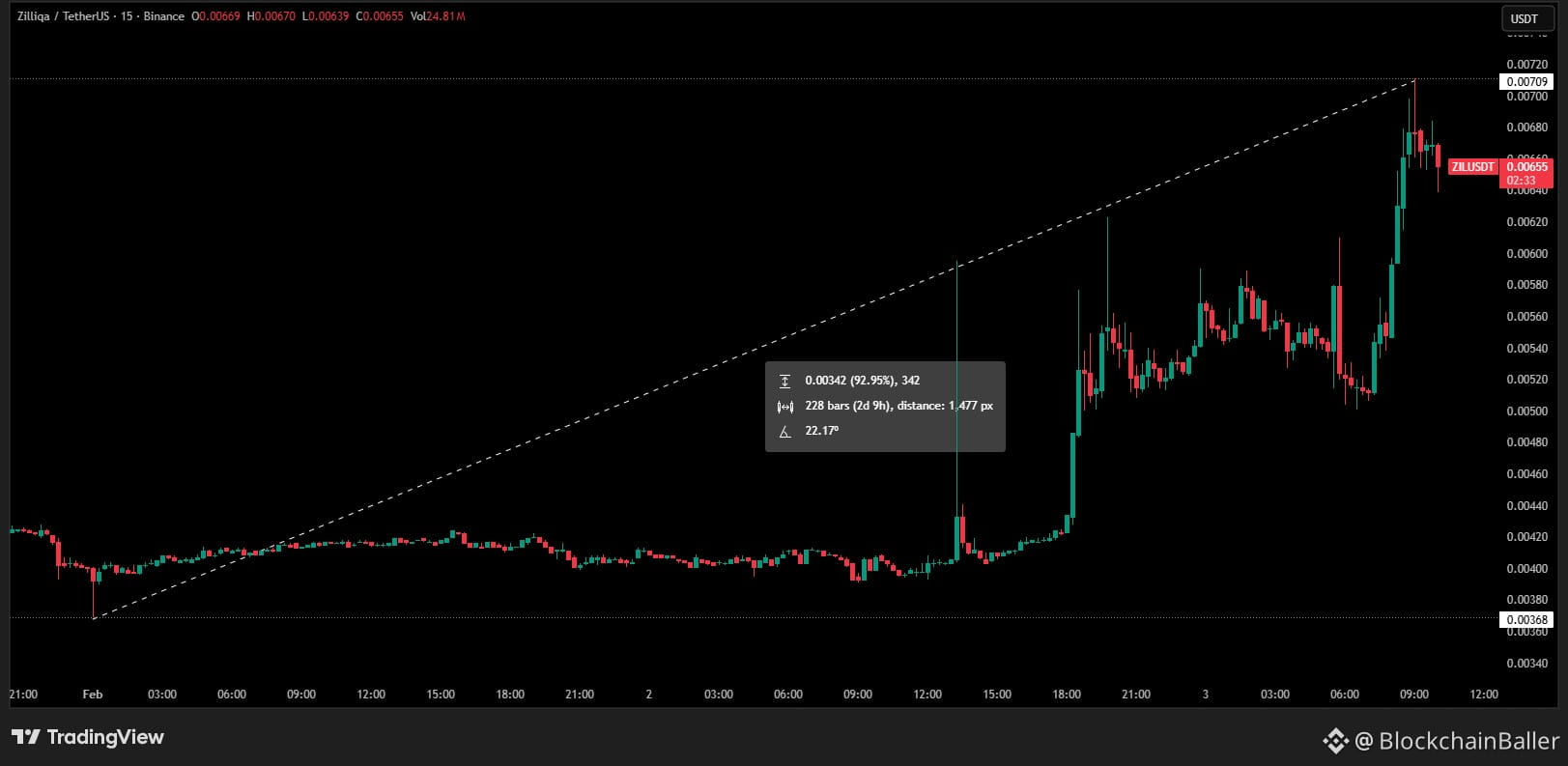

ZIL Price Surges! 🔥

• Up 69% Today

• Up 90% from February 1st Low

All of this happened before the February 5th hard fork, which will bring better scalability, EVM compatibility, and smarter contracts.

This is an upgrade-driven upward momentum.

This usually means that such momentum won't last… Enter positions cautiously.

Chain Broker

Crypto Newbie

1d ago

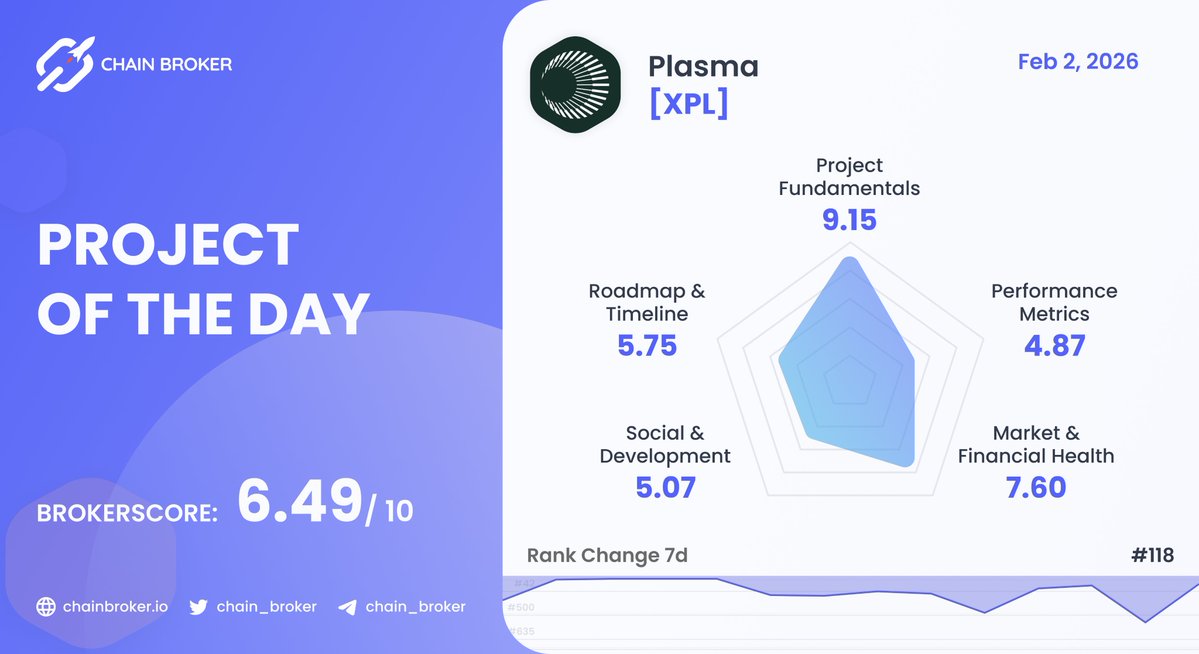

💥 Today's Project Recommendation - February 2, 2026

@Plasma $XPL is an #L1 blockchain designed for high-volume, low-cost, near-instantaneous stablecoin payments. It supports zero-fee USDT transfers and is fully compatible with #EVM.

BrokerScore: 6.49 / 10

Rank: #118

Learn more, click here:

👉

Crypto Compass (Southern Cut)

Crypto Newbie

01-31 23:18

My girlfriend said my back looked a little hunched today.

I said, "If the sky were falling, of course I'd be hunched!"

I also asked if I could get a discount on my monthly subscription next month. She was quite agreeable. She asked what kind of discount, and I said 10%. She just kicked me out! I'm freezing outside in flip-flops, shorts, and underwear. I didn't even take my phone. Is there anyone kind enough to transfer me 100 USD? I need to buy some clothes. Thank you.

EVM address: 0x9384a2a371b3432f662c350f90399fd34c9f7cbd

Crypto_Jun Shao

Crypto Newbie

01-31 21:12

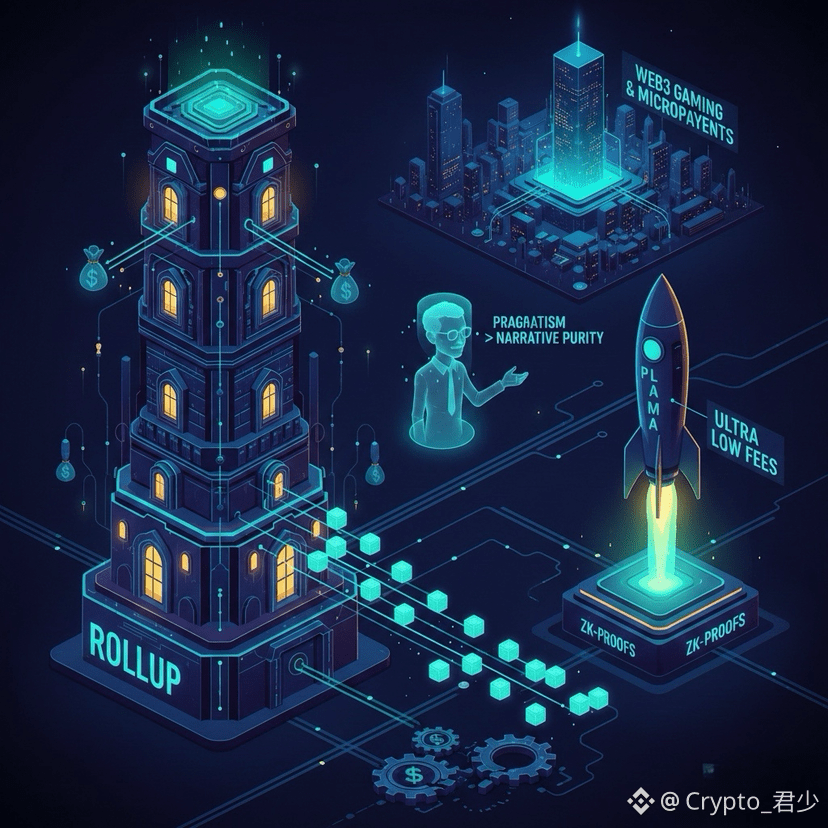

Recent developments in Plasma have indeed prompted many veteran users to call it a "renaissance."

It was initially thought that it had been relegated to the dustbin of history by Rollups, but with Vitalik bringing Plasma back to the forefront, especially with the emergence of optimizations for EVM scalability, the tide has turned.

My first impression is that pragmatism has triumphed over narrative perfectionism. Previously, Plasma's biggest pain point was its incredibly user-unfriendly "exit mechanism," requiring users to become coding geniuses to salvage assets if data became unavailable. However, the current technological approach is clearly smarter, addressing data availability challenges by borrowing from ZK proofs, allowing Plasma to maintain extremely high throughput while no longer acting as an "island" vulnerable to disconnection.

From a news perspective, this seems more like a "precise poverty alleviation" effort to reduce L2 costs. While Rollups are already powerful, for small payments or game interactions with thousands of transactions per second and extremely low individual value, DA costs remain a burden. Plasma's "extremely cost-effective" model of keeping data off-chain perfectly fills this niche.

Personal opinion: I don't believe Plasma will replace Rollup, but it's becoming a "special forces" tool in specific scenarios. It's no longer that cumbersome old relic, but has evolved into a lighter and more secure extension component. If you're still looking at it with outdated perspectives, you might miss the new opportunities brought about by this wave of underlying architecture rethinking.

#plasma $XPL @Plasma

Wu Blockchain

Crypto Newbie

01-31 20:25

Weekly project updates: Over 30,000 ERC-8004 trustless agents have registered; Jupiter launched Offerbook lending; Lighter released LighterEVM; Lido V3 officially launched; Hyperliquid's liquidity surpasses Binance; Optimism approved OP buyback; Story Delation postponed token unlocking, etc.

Elja

Crypto Newbie

01-31 14:30

15 lucky winners will receive $300 #USDT!

- Like and retweet this post

- Register for an OKX wallet

- Register for a WEEX wallet

How to participate: Please provide the following information in the comments:

• Screenshots proving all non-Twitter related steps

• Your EVM wallet address

#givai_114

This event ends in 2 days.

Elja

Crypto Newbie

01-31 01:30

15 lucky winners will receive $300 #USDT!

- Like and retweet this post

- Register for an OKX wallet

- Register for a WEEX wallet

How to participate: Please provide the following information in the comments:

• Screenshots proving all non-Twitter related steps

• Your EVM wallet address

#givai_114

This event ends in 2 days.

Frank Chaparro

Crypto Newbie

01-30 04:31

Some personal updates: I will be stepping down as Director of Growth at the Monad Foundation.

I have been working for Monad for the past three years.

I have been working in the cryptocurrency space for the past nine years, dedicating myself full-time to the industry since joining CMS's venture capital team in 2020.

After listening to over 1,000 startup pitches, I came across Monad and knew it was a once-in-a-lifetime opportunity. I poured my heart and soul into helping it reach the market.

Building Monad from scratch with Keone, James, Eunice, and the entire team has been one of the most fulfilling experiences of my career.

Our goal was to build a truly scalable, decentralized, EVM-compatible L1 layer. Seeing this vision become a reality after years of hard work is incredible. Its technology is top-notch, and its ecosystem boasts over 100 teams ready to embrace the next wave of users.

I am proud of our integrity, our commitment to not taking shortcuts, and our long-term vision in building Monad. Monad is currently on a strong upward trajectory and has a promising future. Both the Monad Foundation and Category Labs will be launching a series of exciting initiatives in 2026.

I will be transitioning to an advisory role and will continue to be actively involved in supporting Monad and its broader ecosystem.

Looking forward to the future—stay tuned for updates.