New York in 1929,

was experiencing the most frenzied period of the American stock market.

Joseph Kennedy, the father of the future President John F. Kennedy.

He was not only a politician but also a top Wall Street trader.

One morning, he went to a corner of Wall Street to have his shoes shined.

A teenage boy was shining his shoes.

The boy chatted excitedly as he diligently polished the shoes.

But he didn't talk about the weather or baseball,

he started talking about stocks.

The boy's eyes lit up as he told Kennedy:

"Sir, you should buy oil stocks!"

"I have insider information, this stock is about to take off!"

He even gave a few seemingly professional analyses of the market trends.

After listening, Kennedy smiled and gave the boy a generous tip.

He didn't buy oil stocks.

Instead, as soon as he returned to his office, he gave his broker instructions:

"Sell all the stocks I hold."

"Not a single one left, liquidate everything."

The broker was stunned and asked him why. Kennedy coldly replied:

"When even a shoeshine boy is recommending stocks to me,"

"It means everyone who wants to buy stocks has already bought them."

"There's no new money left to buy."

A few days later.

The Great Crash of 1929 erupted.

Countless people lost everything, while Kennedy emerged unscathed.

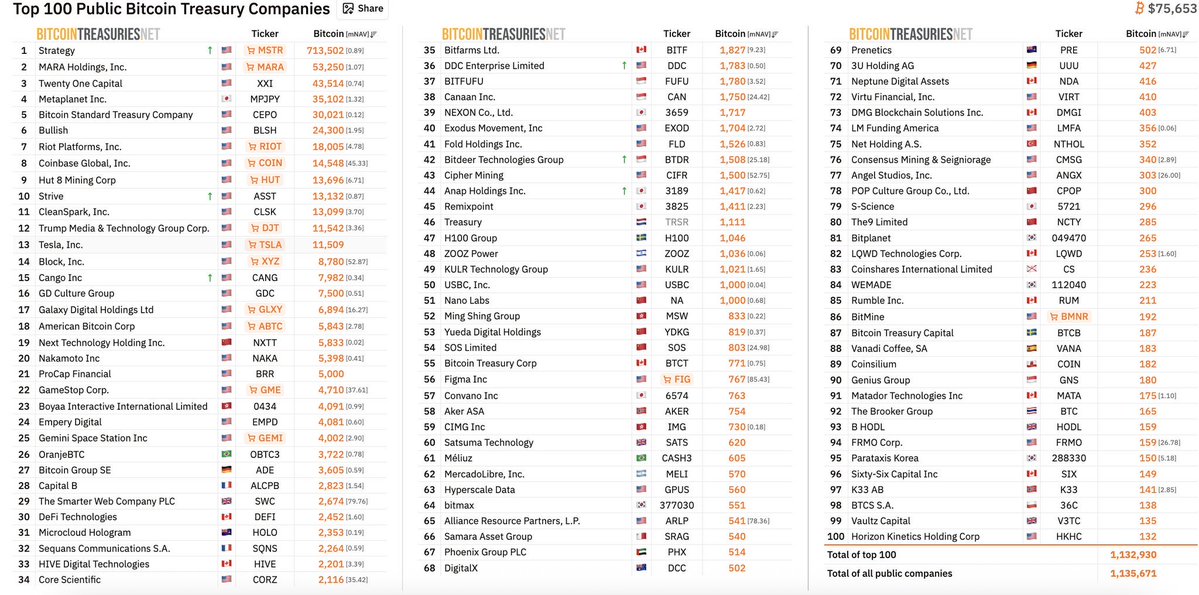

🖊️This is the famous "Shoeshine Boy Theory."

At the end of a bull market, extreme frenzy often accompanies it.

When market aunties, taxi drivers, and even those without risk tolerance are talking about getting rich quick,

this is usually not an opportunity, but a death knell.

Investment Practice:

At the peak of Meme coin or a bull market,

when you see everyone on social media posting their profits and recommending trades,

remember Kennedy's shoes.

The most rational course of action at this time is to avoid FOMO.

This is the perfect time to find an exit point.

Price Converter

- Crypto

- Fiat

USDUnited States Dollar

CNYChinese Yuan

JPYJapanese Yen

HKDHong Kong Dollar

THBThai Baht

GBPBritish Pound

EUREuro

AUDAustralian Dollar

TWDNew Taiwan Dollar

KRWSouth Korean Won

PHPPhilippine Peso

AEDUAE Dirham

CADCanadian Dollar

MYRMalaysian Ringgit

MOPMacanese Pataca

NZDNew Zealand Dollar

CHFSwiss Franc

CZKCzech Koruna

DKKDanish Krone

IDRIndonesian Rupiah

LKRSri Lankan Rupee

NOKNorwegian Krone

QARQatari Riyal

RUBRussian Ruble

SGDSingapore Dollar

SEKSwedish Krona

VNDVietnamese Dong

ZARSouth African Rand

No more data