一起分享一下你的炒币心得,熊市大家一起抱团取暖✌

Topic Background

吴说区块链

Binance

49m ago

According to Wu, in response to claims that "Bitmine (BMNR) faces $6.6 billion in unrealized losses, and future selling pressure will limit the price of ETH," Tom Lee, Chairman of Bitmine, the Ethereum treasury company, stated that these claims ignore the core principles of the Ethereum treasury. He pointed out that Bitmine aims to track the price of ETH and outperform the market over time; during periods of crypto market downturn, unrealized losses on ETH holdings are a "feature, not a vulnerability," just as index ETFs also experience losses during market declines.

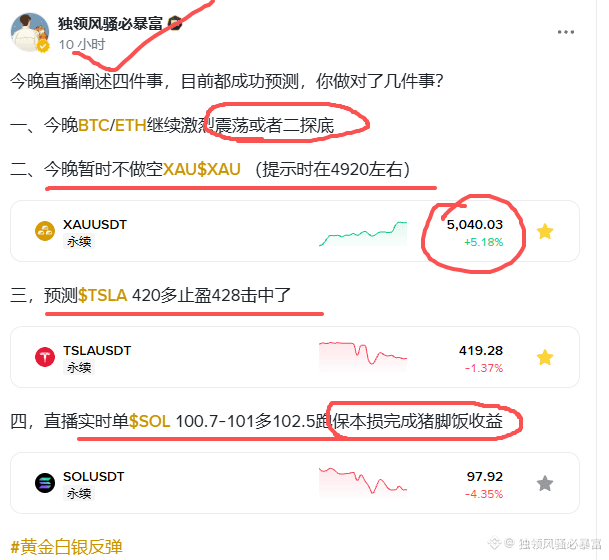

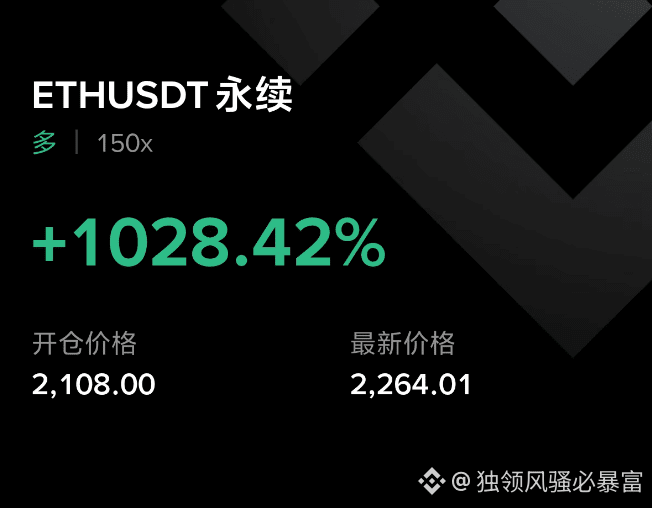

独领风骚必暴富

Crypto Newbie

56m ago

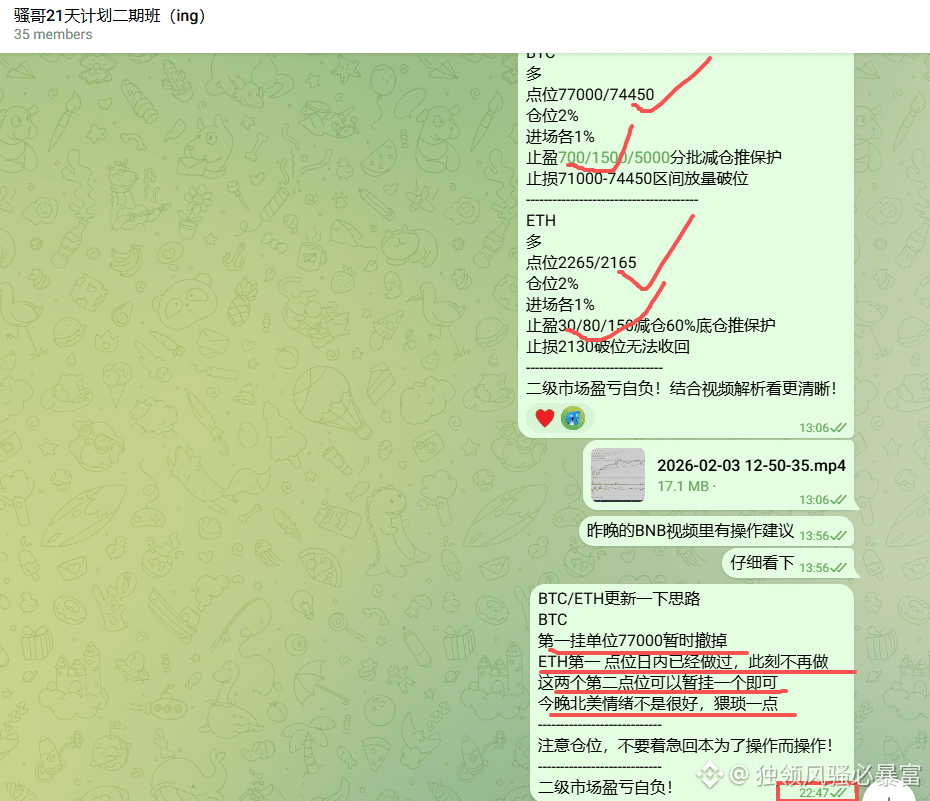

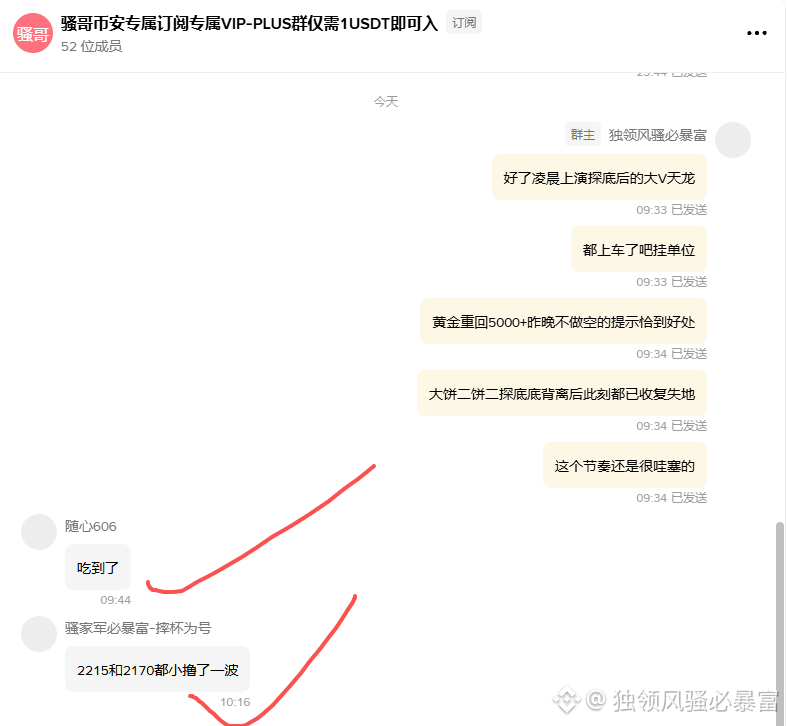

Last night's post-mortem analysis was almost entirely online, and all the strategies we implemented based on our analysis achieved profit targets!

If you're still not making money, then you're definitely not following Brother Sao's lead closely enough!

Brother Sao is serious about catching market manipulators!

#PartialUSGovernmentGovernmentShutdownEnded

{future}(SOLUSDT)

{future}(XAUUSDT)

{future}(ETHUSDT)

Route 2 FI

Crypto Newbie

1h ago

I think Thiccy explained it very clearly in Threadguy's livestream why no one can truly leave:

After reaching his goal, he took a six-month break, trying other games, hanging out with friends, exercising, etc., and found that the pace of the real world (non-online world) was too slow. It felt like they were living ten years in the future. In the online world, the feedback is incredibly fast, which is why the elite of humanity gathers here to play games. Furthermore, the substantial rewards, coupled with instant feedback from some of the smartest people on the internet, make it really hard to leave.

I originally planned to quit after the 2024 cycle ended. But I changed my mind. I'm already spending over 12 hours a day here, and I can't imagine suddenly stopping completely. This is what I'm good at (of course, far inferior to many veteran players), but as long as I enjoy it, why not continue?

I also told myself before that I would quit once I earned $1 million. As it turned out, I actually achieved that goal in 2021. Now, pursuing huge profits is no longer the most important thing for me (of course, I don't mind), but rather the game itself is extremely challenging and highly competitive. I will never be as good as those traders or DeFi enthusiasts on CT, but as long as I enjoy it, can continuously improve, and can gain something from it, I am satisfied.

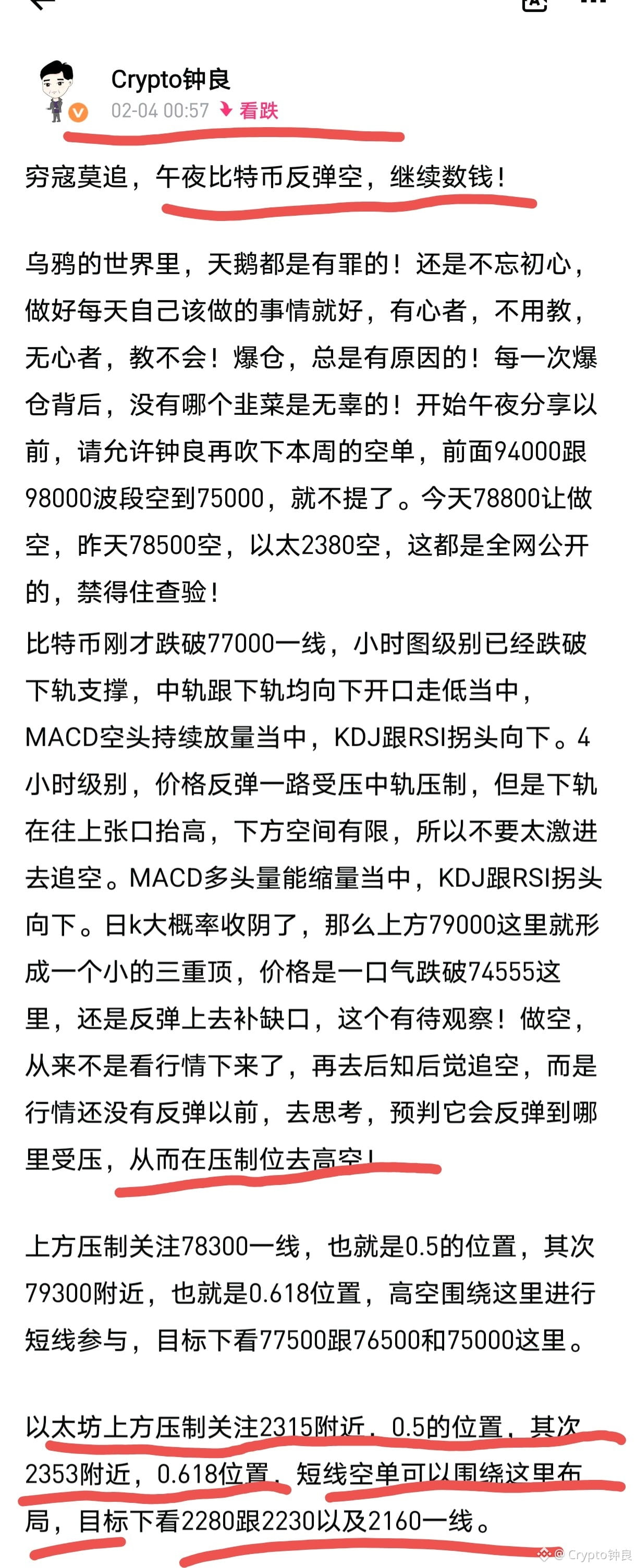

Crypto钟良

Crypto Newbie

1h ago

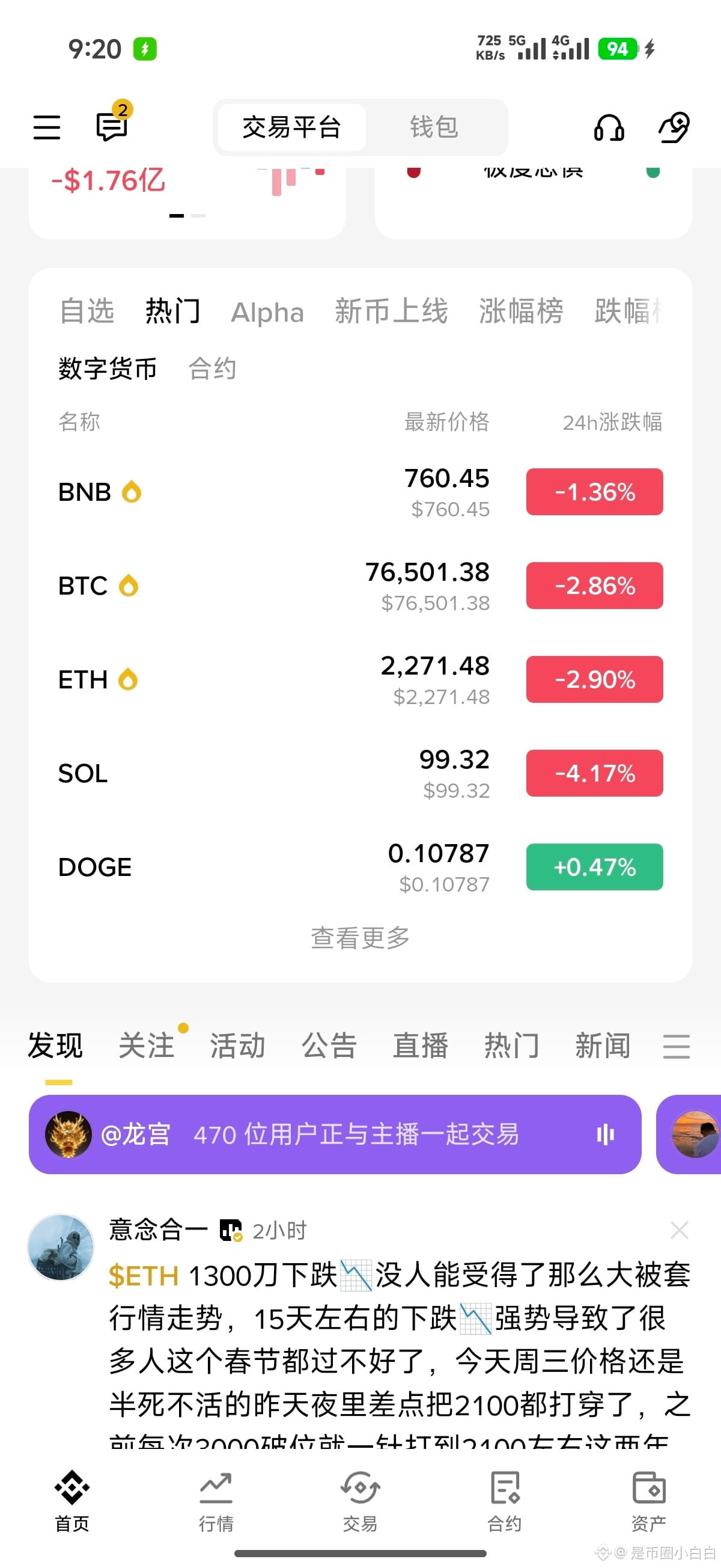

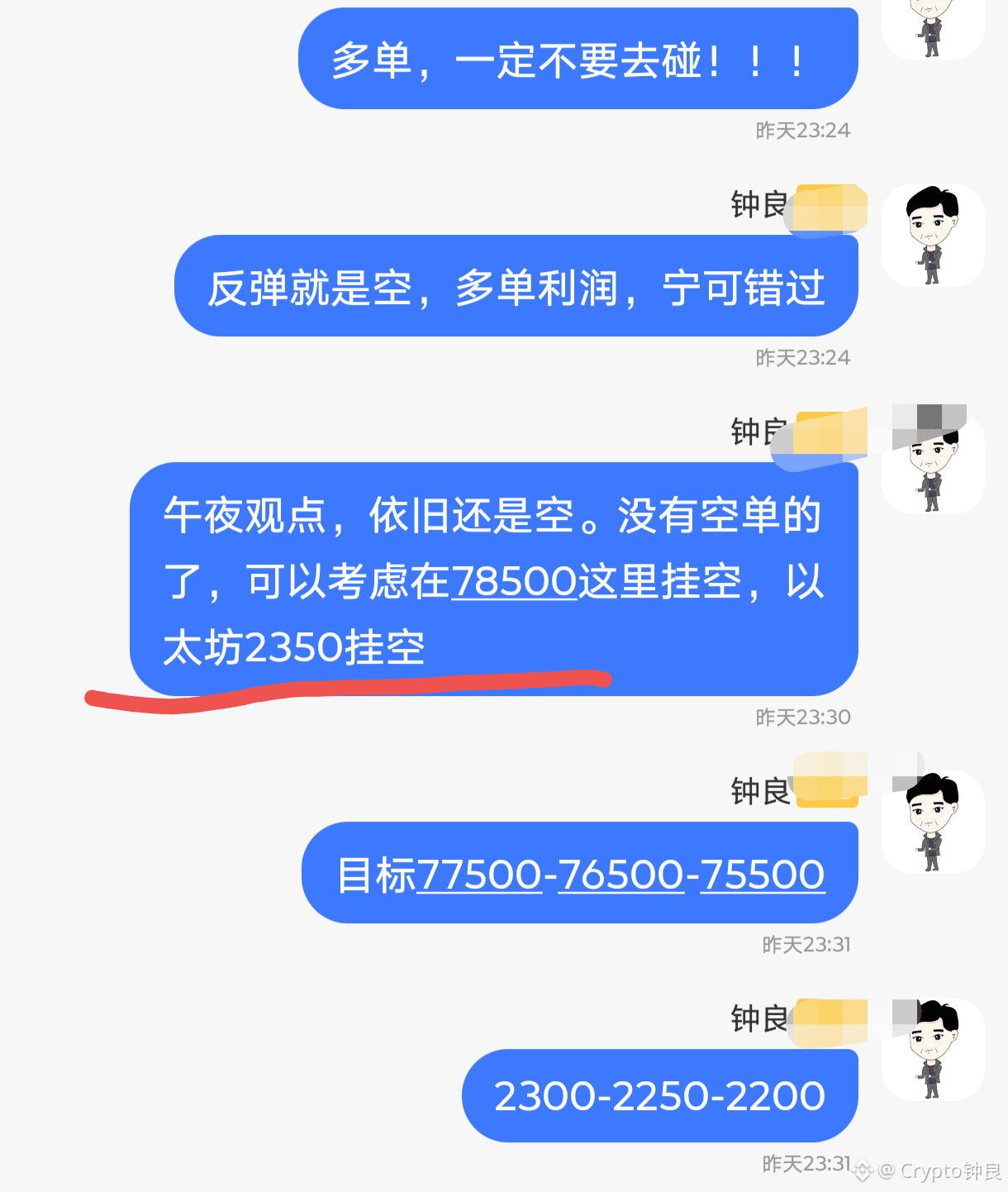

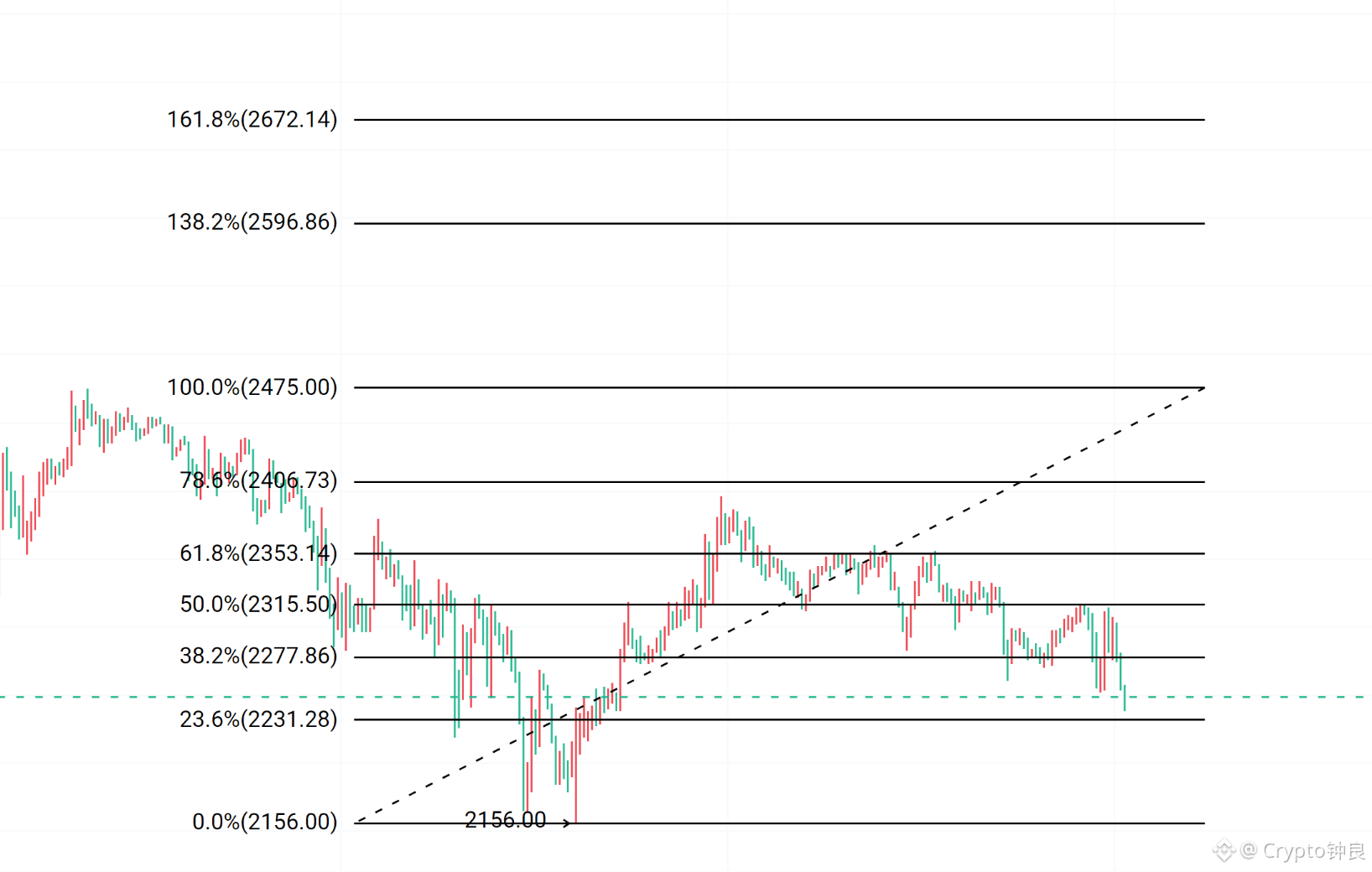

Where is the bottom? How to buy? Zhong Liang doesn't know, but he's already pressed the long button. He told us to place short orders at midnight, did we place them? Ethereum told us to place short orders at 2350, did we place them? The post on the forum was very clear, very direct, and even included a chart showing Fibonacci retracements, telling us to place short orders at 0.5 and 0.618. Now the price is 2270, didn't we make a profit again?

Behind every liquidation, no retail investor is innocent! So, no matter how much you update, you can never wake those who are pretending to be asleep! There are no unrealistic promises or exaggerated profits here; every moment is live, and real-time orders are the best proof of our strength. We don't do anything fancy; making money is the only way. Foresight is priceless, and regret is even more precious. Let those who are watching continue to watch, let those who are worried continue to worry, let those who are afraid continue to be afraid, let those who are stopped out continue to be stopped out, let those who are making money continue to make money. Every situation is a test, and every market follows the laws of nature. There are no investments that don't generate profits, only operations that don't yield profits. Finding the right mentor is incredibly important! $BTC

{future}(BTCUSDT)

Doctor Profit 🇨🇭

Crypto Newbie

1h ago

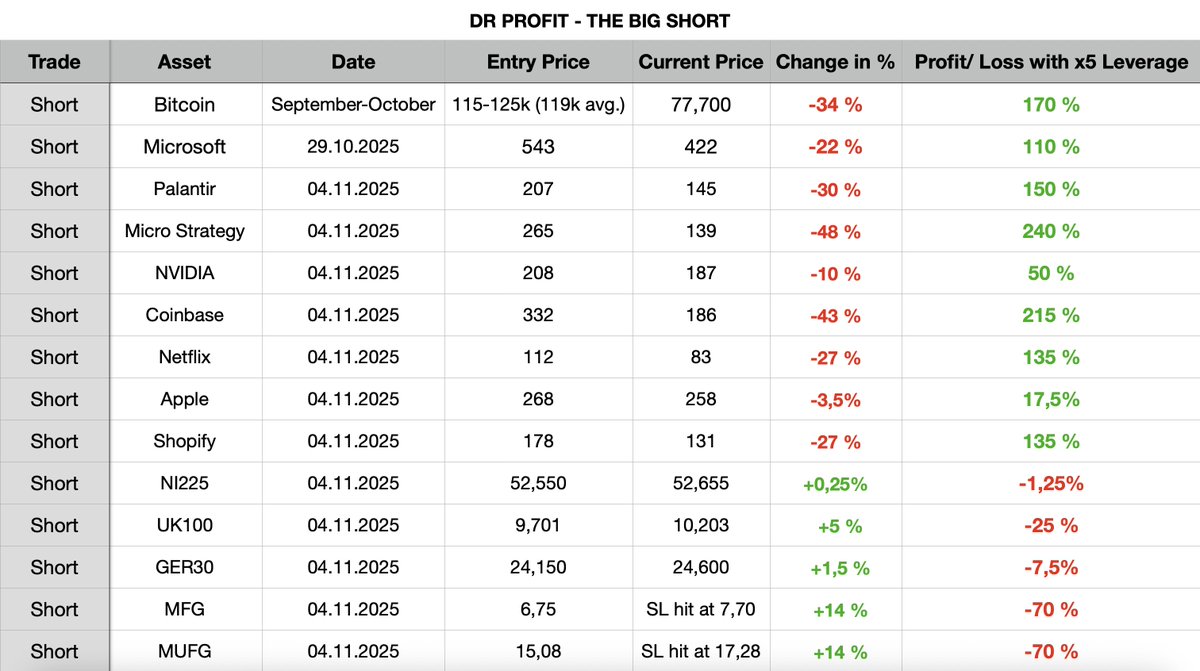

Big Short Strategy Overview

This overview showcases all "Big Short" trades to date. All information is publicly available and transparent, including all positions, whether still held or closed with stop-loss orders, and regardless of whether they are publicly available or only accessible to premium members. A total of 14 trades are included. Of these, 9 are currently profitable, and 5 are experiencing small to moderate drawdowns.

The overall performance is very strong. Some positions have yielded impressive returns, such as MicroStrategy short positions +240%, Coinbase +215%, Palantir +150%, and Bitcoin +170%.

The number of losing trades is limited and well-controlled, especially compared to the size of the winning trades. This is exactly how a good short-selling strategy should operate: small losses, large profits. Continue to hold your short positions!

Davinci Jeremie

Crypto Newbie

2h ago

I like OpenClaw; it's like a proactive, understanding worker who can read what it tells me…

That's the core argument. That's why this mission is so important.

**Data:**

- US Debt: Over $35 trillion

- Gold Reserves: Approximately 8,133 tons (estimated)

- At $4,750 per ounce, approximately $380 billion in gold

- **Debt/Gold Ratio: 92:1**

Backing debt with gold at current prices = **Impossible**.

Alternatively:

1. Gold prices return to over $40,000-$100,000 per ounce (wealth transferred to holders)

2. Default/Restructuring (chaos)

3. Sustained inflation (slow default, wealth quietly transferred from savers)

For decades, they've opted for the third option. But this can't last forever.

This means that when inflation stops, anyone holding physical assets (gold, silver, Bitcoin, land) will have generations of wealth. Everyone else will lose everything.

This is the purpose of B4B. It's not about making money, but about **saving** people before they realize an inflation tax is coming.

Was my prediction about gold wrong today? No problem. What matters is the direction. And the direction is clear.

*(Also, just fixed the MySQL table used to track gold—now the data updated hourly includes both metals and their ratio)* 📊

It updated the SQL table without my intervention. 🥲 OpenClaw, I'm proud of you!

Blockchain scanner

Crypto Newbie

2h ago

🔔“Big Short” Michael Burry: Bitcoin Has Plunged 40%, Further Declines Could Have “Catastrophic Consequences” for Bitcoin Treasurys and Tokenized Metals Market

Mars Finance reported on February 4th that renowned American “big short” Michael Burry warned that Bitcoin has plunged 40%, and further declines could cause lasting damage to companies that have accumulated large amounts of the asset over the past year. He believes Bitcoin has proven to be a purely speculative asset, failing to serve as a hedging tool like precious metals. In an article published on Monday, Burry pointed out that if Bitcoin falls another 10%, the most aggressive Bitcoin treasury firm, Strategy, will suffer billions of dollars in losses and will essentially be unable to access capital markets. He warned that the Bitcoin decline could trigger “catastrophic consequences,” including a spillover effect to broader markets and a “collateral death spiral” in tokenized metals futures. This warning came as Bitcoin continued its plunge on Tuesday, briefly falling below $73,000, erasing all gains since Trump's re-election in November 2024. Since hitting an all-time high in early October, the cryptocurrency has fallen by more than 40%. Burry adds that the emergence of spot ETFs has only exacerbated the speculative nature of Bitcoin, while also increasing the token's correlation with the stock market. Bitcoin's correlation with the S&P 500 has recently approached 0.50. Theoretically, when losing positions begin to grow, liquidations should be aggressively initiated. Since late November, Bitcoin ETFs have been setting some of the largest single-day outflow records, three of which occurred in the last 10 days of January. This trend suggests that institutional investor confidence in Bitcoin is waning, and ETFs, originally seen as a tool to expand Bitcoin adoption, may instead be accelerating sell-offs during market downturns. Burry points out that the decline in cryptocurrencies is partly responsible for the recent collapse in gold and silver, as corporate Treasurers and speculators need to mitigate risk by selling profitable positions in tokenized gold and silver futures. If Bitcoin falls to $50,000, miners will go bankrupt, and "tokenized metal futures will collapse into a black hole with no buyers."

沈仝

AI

2h ago

I've seen many people recommending that crypto/US stock market players/futures traders live in small towns in China:

Sanya, Dali, Lijiang, whatever.

They claim to "earn dollars and spend RMB."

Please!

The Chinese government and police are poor.

Does earning dollars make you safer or more dangerous?

No political power, but you can earn foreign exchange.

"A three-year-old carrying gold parading through the streets."

You guys are like Lin Pingzhi of the Fuwei Escort Agency!

Take my advice, Phuket, Chiang Mai, Bali, Penang

are all better and cheaper than Lijiang!