Topic Background

BTCdayu

Crypto Newbie

47m ago

The first sign of the AI bubble bursting has appeared.

The AI boom was marked by:

1. Nvidia's commitment to invest $100 billion in OpenAI.

2. OpenAI's commitment to buy computing power from Oracle.

3. Oracle buying graphics cards from Nvidia to significantly expand its data centers, then selling the computing power to OpenAI.

Now, Nvidia's CEO, Jensen Huang, is saying: "Who said I was definitely going to invest? He invited us to invest, and I haven't even decided whether to invest or not!"

So OpenAI is saying: "Let's just make our own chips, damn it."

Oracle: "What the hell? I've raised so much money to buy cards and build data centers, what are you two doing? I'm doomed, I'll have to lay off employees, this is going to collapse."

Why did Huang change his tune? Because Huang could see that Chatgpt's subscriptions were getting slower and slower, resulting in $5 billion in annual losses. The money earned from selling graphics cards couldn't be spent like that anymore—this was wise. During a bull market, we make money quickly, but recklessly spent investments are basically never recovered.

Oracle's stock has already crashed as a warning. They've spent $50 billion building data centers; if OpenAI runs out of money, they won't find customers, and the data centers will become obsolete.

So, this game of money laundering in Silicon Valley has encountered its first "yellow swan."

AI is certainly great, but the bubble is even bigger.

The exception is Google, which is making a lot of money, and GEMINI is becoming increasingly powerful, its prices are decreasing, and its user base is growing.

The following scenarios might be:

Scenario 1: OpenAI goes public, raises funds, surges, then crashes repeatedly, triggering the AI bubble burst.

Then those who see this post go all in on $150 of Google and make a fortune.

Scenario 2: It doesn't even go public; it crashes on the spot.

Scenario 3: It goes public, holds up, the crash lasts a bit longer, but it eventually collapses.

CryptoChan

Crypto Newbie

55m ago

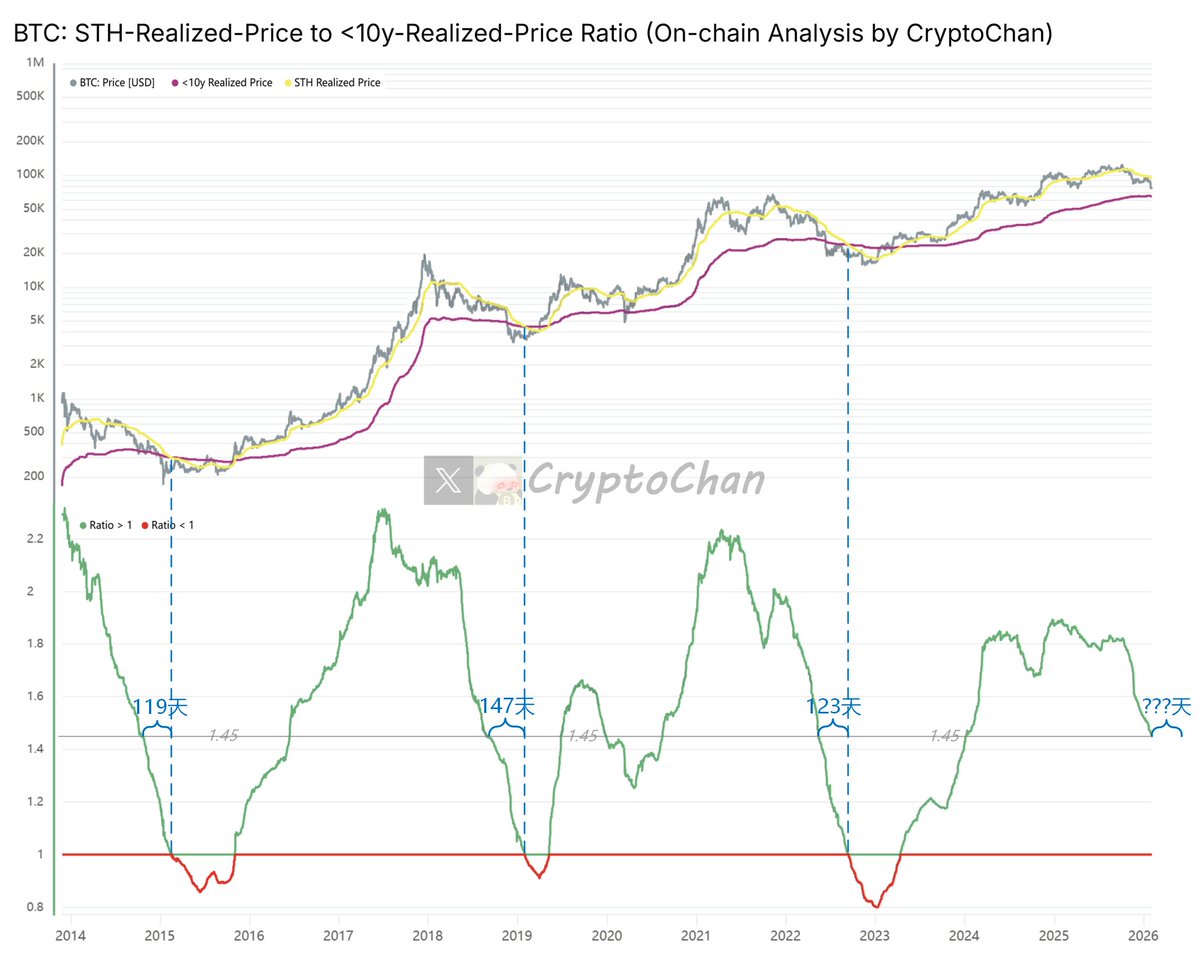

The indicator in the current chart has fallen to 1.45.

In 2014, it took 119 days for this indicator to drop from 1.45 to 1.

In 2018, it took 147 days.

In 2022, it took 123 days.

Note: An indicator reaching 1 generally indicates a bear market bottom.

The gray line at the top of the chart represents the #BTC price; the yellow line represents the average cost price for short-term BTC holders; the magenta line represents the average cost price for long-term BTC holders (excluding those held for more than 10 years).

The indicator at the bottom of the chart is the ratio of the "average cost price for short-term BTC holders" to the "average cost price for long-term BTC holders (excluding those held for more than 10 years)" (i.e., yellow line / magenta line).

The average cost price for short-term BTC holders is defined as investors or entities that have held Bitcoin for less than 155 days. This indicator reflects the cost basis of recent market entrants, who tend to be more sensitive to price fluctuations and more likely to sell their positions during market volatility or downturns. It is often seen as a barometer of short-term market sentiment and momentum: in a bull market, prices are typically above this average cost; in a bear market, prices falling below this level can trigger further selling pressure.

The BTC Long-Term Holder Average Cost is defined as the cost basis of investors or entities that have held Bitcoin for more than 155 days. This indicator excludes holdings held for more than 10 years (lost or extremely long-term immobile assets, such as Satoshi's coins) to focus on a more "active" group of long-term holders. These extremely long-term holdings have extremely low costs and are unlikely to move, thus excluding them provides a more realistic LTH cost basis, reflecting the average holding price of long-term investors who are likely to actually participate in buying and selling throughout market cycles. This indicator is often seen as a reference for market fundamental support levels: in a bear market, it may serve as a potential price bottom.

The ratio (average cost of BTC short-term holders / average cost of BTC long-term holders) reflects the stage of the Bitcoin market cycle and the dynamics of participant behavior:

Ratio > 1: Indicates that the average cost of short-term holders is higher than that of adjusted long-term holders. This typically occurs in bull markets, where recent entrants buy at higher prices, while long-term holders have a lower cost basis (even excluding extremely long-term holdings). This suggests optimistic market sentiment and strong new capital inflows, but may also foreshadow overheated speculation or a potential pullback.

Ratio < 1: Indicates that the average cost of short-term holders is lower than that of adjusted long-term holders. This is common in bear markets or market bottoms, where recent entrants buy at lower prices, while long-term holders have a higher cost basis (reflecting their holdings across the cycle). This is often a signal of surrender, suggesting that weak hands have been cleared out and the market may be heading towards recovery or the start of a bull market.

General meaning: An upward trend in the ratio indicates that the cost of short-term holders is increasing relative to long-term holders, marking a "numerical rise" phase or the continuation of a bull market; a downward trend indicates that the cost of long-term holders is increasing relative to short-term holders, marking a bear market or distribution phase. Excluding holdings >10 years brings LTH's cost closer to active market participants, avoiding the distortion of the ratio by low-cost lost coins, thus more accurately capturing cyclical turning points (such as the transition from a bear market to a bull market). Historically, when the ratio falls below 1, it often presents a long-term buying opportunity.

Raccoon Chan Little Raccoon

Crypto Newbie

1h ago

Some observations from offline meetings:

At the end of the bull market,

the focus is mainly on showing off sports cars, designer jewelry, and watches;

quiet luxury remains the norm.

Loro Piana I can't tell either.

In the early stages of a bear market, everyone has a flawless, radiant complexion. Chest muscles, abs, and defined waistlines are visible. Perfume scents have richer top, middle, and base notes. Vitality fills the nostrils. Even the hairlines that fade with age seem to be receding.

In the middle stages of a bear market, I don't know if it's because the growth hormones like Smegrazine, Minoxidil, and other drugs are no longer effective, or if the side effects outweigh the benefits, or if insomnia is causing a rise in cortisol, or if it's because we can't afford to renew our gym and beauty salon memberships, but all we have left are faded logos hanging precariously on our thick, loose bellies, and even our clothes smell secondhand. Fitness trackers are useless except for tracking steps.

Is this what beauty looks like during an economic downturn?

Titan of Crypto

Crypto Newbie

3h ago

#Bitcoin and ISM PMI

Many people have asked me this question in comments and private messages, so I'll explain briefly here.

First, calling the ISM PMI a "business cycle" is absurd.

In economics, selectively taking a macroeconomic indicator out of context and treating it as a cycle is called abusing proxy indicators.

That being said, let's look at the charts.

In 2013, 2016, and 2020, when the PMI rose above 50, Bitcoin showed hidden bullish divergences.

Each time, a bull market followed.

And today?

The PMI has just broken 50 again, but this time it shows a typical bearish divergence.

The same indicator, different structure, can lead to different results.

KK.aWSB

Crypto Newbie

4h ago

New York in 1929,

was experiencing the most frenzied period of the American stock market.

Joseph Kennedy, the father of the future President John F. Kennedy.

He was not only a politician but also a top Wall Street trader.

One morning, he went to a corner of Wall Street to have his shoes shined.

A teenage boy was shining his shoes.

The boy chatted excitedly as he diligently polished the shoes.

But he didn't talk about the weather or baseball,

he started talking about stocks.

The boy's eyes lit up as he told Kennedy:

"Sir, you should buy oil stocks!"

"I have insider information, this stock is about to take off!"

He even gave a few seemingly professional analyses of the market trends.

After listening, Kennedy smiled and gave the boy a generous tip.

He didn't buy oil stocks.

Instead, as soon as he returned to his office, he gave his broker instructions:

"Sell all the stocks I hold."

"Not a single one left, liquidate everything."

The broker was stunned and asked him why. Kennedy coldly replied:

"When even a shoeshine boy is recommending stocks to me,"

"It means everyone who wants to buy stocks has already bought them."

"There's no new money left to buy."

A few days later.

The Great Crash of 1929 erupted.

Countless people lost everything, while Kennedy emerged unscathed.

🖊️This is the famous "Shoeshine Boy Theory."

At the end of a bull market, extreme frenzy often accompanies it.

When market aunties, taxi drivers, and even those without risk tolerance are talking about getting rich quick,

this is usually not an opportunity, but a death knell.

Investment Practice:

At the peak of Meme coin or a bull market,

when you see everyone on social media posting their profits and recommending trades,

remember Kennedy's shoes.

The most rational course of action at this time is to avoid FOMO.

This is the perfect time to find an exit point.

good god

Crypto Newbie

4h ago

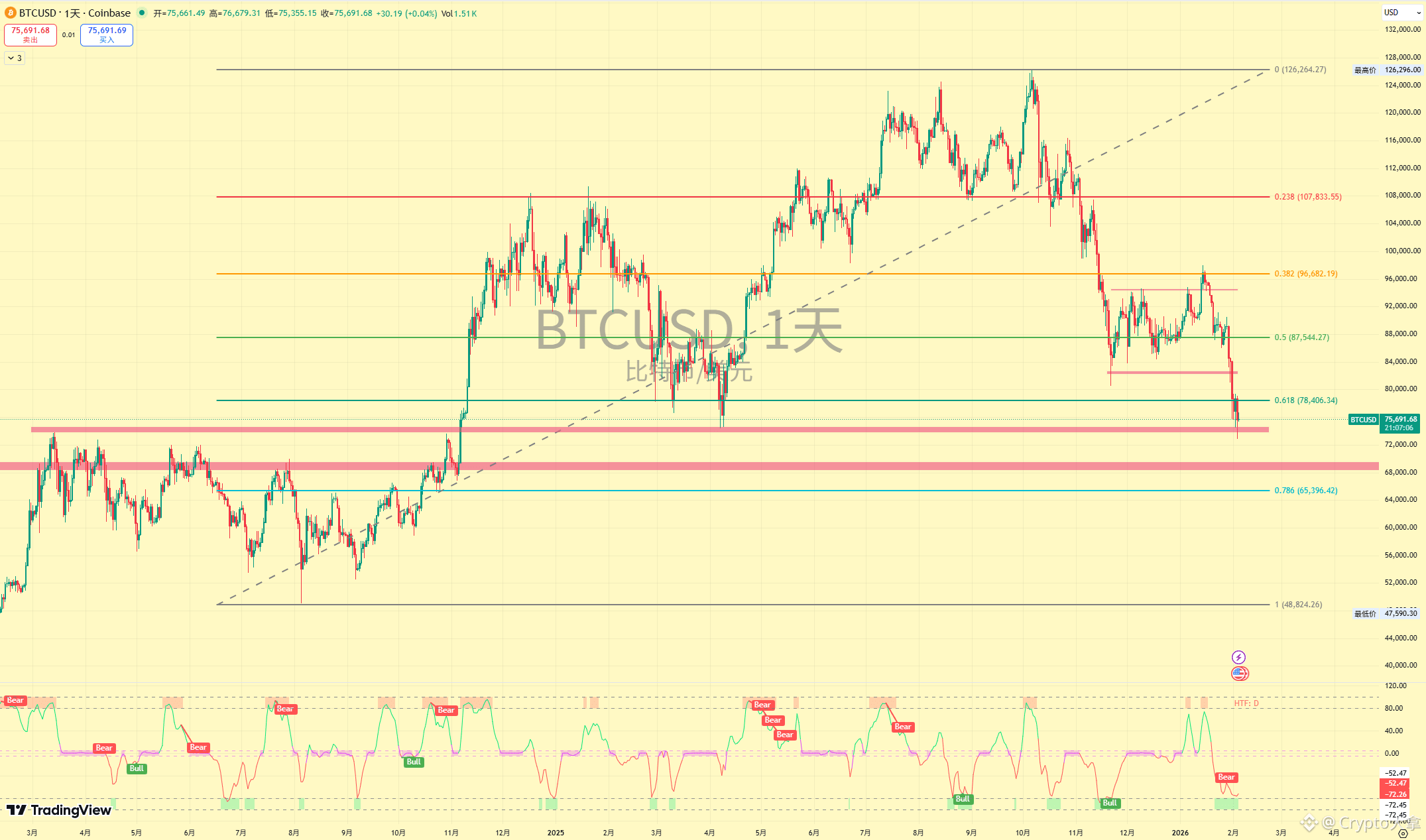

In previous bull and bear market cycles, the maximum drop exceeded 70%.

The 2025 bull market saw BTC reach a high of $126,000.

A 30% drop occurred, reaching $8,200 (already broken).

A 40% drop occurred, reaching $75,600 (already broken).

A 50% drop occurred, reaching $63,000 (not reached).

A 60% drop occurred, reaching $50,400 (not reached).

A drop below 70% occurred, reaching $37,800 (not reached).

If the historical cycle continues, a 60% drop is very possible.

At that point, it would already be at $50,000.

If the cycle continues, even after a 60% drop, a rebound could occur, breaking through $100,000 again.

A $200,000 drop is also a very real possibility.

Crypto大拿

Crypto Newbie

5h ago

#BTC Bitcoin is still falling. The 74k support level failed to hold, and the short-term low is around 72k. I don't know if this is really the bottom!

The only remaining support levels are the previous high of 69k and the 0.786 Fibonacci retracement level of 65k. Will it continue to fall? Are there any brothers still believing in the bull market?