Topic Background

KK.aWSB

Crypto Newbie

2h ago

New York in 1929,

was experiencing the most frenzied period of the American stock market.

Joseph Kennedy, the father of the future President John F. Kennedy.

He was not only a politician but also a top Wall Street trader.

One morning, he went to a corner of Wall Street to have his shoes shined.

A teenage boy was shining his shoes.

The boy chatted excitedly as he diligently polished the shoes.

But he didn't talk about the weather or baseball,

he started talking about stocks.

The boy's eyes lit up as he told Kennedy:

"Sir, you should buy oil stocks!"

"I have insider information, this stock is about to take off!"

He even gave a few seemingly professional analyses of the market trends.

After listening, Kennedy smiled and gave the boy a generous tip.

He didn't buy oil stocks.

Instead, as soon as he returned to his office, he gave his broker instructions:

"Sell all the stocks I hold."

"Not a single one left, liquidate everything."

The broker was stunned and asked him why. Kennedy coldly replied:

"When even a shoeshine boy is recommending stocks to me,"

"It means everyone who wants to buy stocks has already bought them."

"There's no new money left to buy."

A few days later.

The Great Crash of 1929 erupted.

Countless people lost everything, while Kennedy emerged unscathed.

🖊️This is the famous "Shoeshine Boy Theory."

At the end of a bull market, extreme frenzy often accompanies it.

When market aunties, taxi drivers, and even those without risk tolerance are talking about getting rich quick,

this is usually not an opportunity, but a death knell.

Investment Practice:

At the peak of Meme coin or a bull market,

when you see everyone on social media posting their profits and recommending trades,

remember Kennedy's shoes.

The most rational course of action at this time is to avoid FOMO.

This is the perfect time to find an exit point.

Blockchain.com

钱包

5h ago

@onemorepeter just announced on @CoinDesk Live that @OndoFinance is officially expanding its tokenized US stocks and ETFs to the European market.

Over 200 blue-chip assets are now available and can be traded directly through your DeFi wallet.

Self-custodied. Full ownership. No intermediaries. Join us! 🚀

CryptoDiffer - StandWithUkraine

Crypto Newbie

8h ago

Market Review, January 29-30: The Beginning of a Market Correction

From January 29th to 30th, the market experienced one of the fastest declines in recent years, with nearly $10 trillion in global market capitalization evaporating in just two days.

⏪ January 29th – Microsoft Earnings Triggers Risk Aversion

Microsoft's earnings report showed that, against an increasingly competitive backdrop, the returns on artificial intelligence (AI) will take longer to materialize. As a Nasdaq-weighted stock, the sell-off in Microsoft (MSFT) triggered widespread equity deleveraging.

Investors acted swiftly, selling off the most liquid assets, including precious metals, despite their recent strong performance.

⏪ January 30th – Fed Chair Appointment Changes Inflation Expectations

The appointment of Kevin Warsh as the new Federal Reserve Chair eased concerns about uncontrolled money printing.

The market quickly adjusted its expectations for monetary policy, reducing the demand for inflation hedges. Metals and Derivatives Experience Chain Liquidation

🔤 Market Impact

- Stocks: Western markets generally declined

- Precious Metals: One of the largest drops in history

- Cryptocurrencies: Liquidations exceeded $2.5 billion due to macroeconomic pressures

MartyParty

Crypto Newbie

8h ago

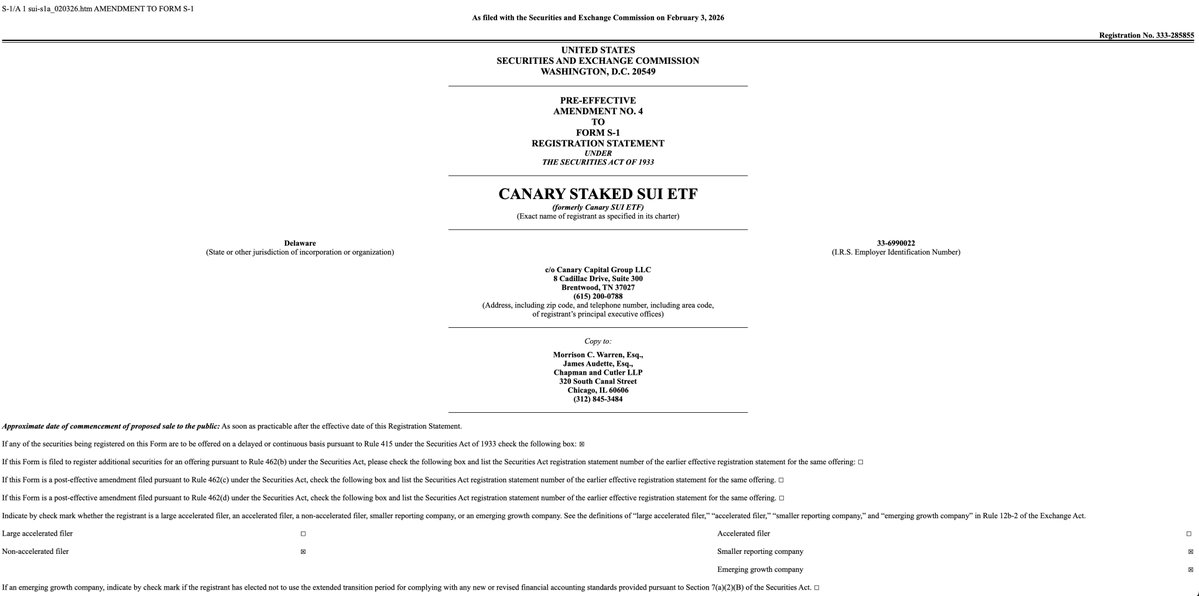

Latest news on the SUI ETF: @CanaryFunds has submitted amendments to its S-1/A filing for the SUI Staking ETF, including the following changes:

- Name changed to Canary Staked SUI ETF

- The ticker symbol remains SUIS, and it will trade on the Nasdaq Stock Exchange.

- Seed round size remains 200,000 shares.

- Underwriter remains Seed Capital Investor.

- Law firm remains Chapman and Cutler LLP.

@SuiNetwork