Topic Background

Running Finance - FinaceRun

Crypto Newbie

40m ago

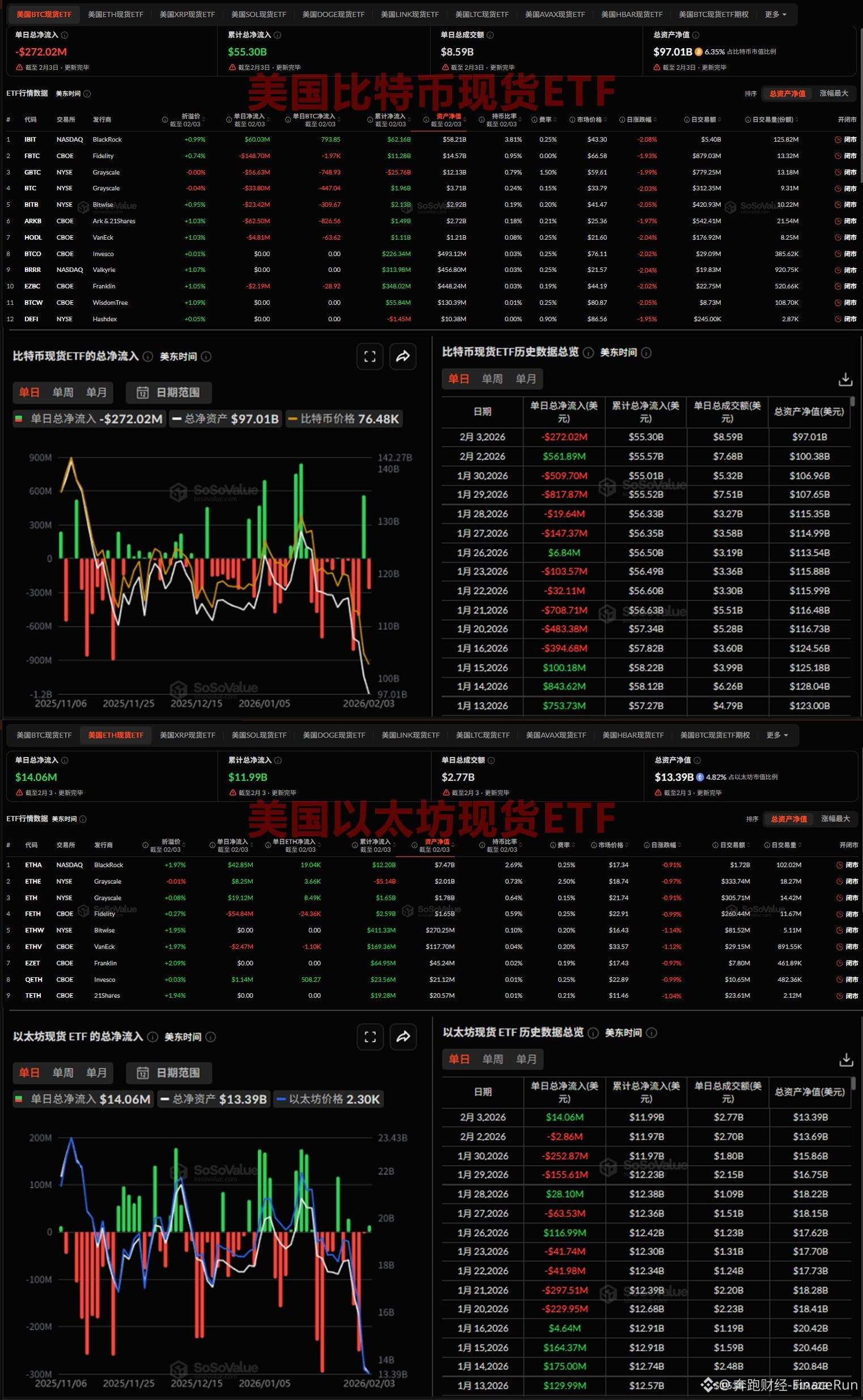

US BTC spot ETFs saw a net outflow of $272 million on Tuesday, while ETH ETFs experienced a net inflow of $14.06 million.

February 4th - According to SoSovalue data, US BTC spot ETFs recorded their first net outflow of funds this week yesterday, totaling nearly $272 million.

Fidelity's FBTC saw the largest net outflow yesterday, at nearly $149 million (approximately 1,970 BTC). FBTC's cumulative net inflow to date is $11.28 billion.

Secondly, Ark & 21Shares ARKB and Grayscale's GBTC and BTC saw net outflows of $62.5 million (826.56 BTC), $56.63 million (748.93 BTC), and $33.8 million (447.04 BTC), respectively.

Bitwise BITB, VanEck HODL, and Franklin EZBC saw net outflows of $23.42 million (309.67 BTC), $4.81 million (63.62 BTC), and $2.19 million (28.92 BTC), respectively.

Notably, BlackRock's IBIT was the only BTC ETF to see a net inflow of $60.03 million (793.85 BTC) yesterday.

Currently, Bitcoin spot ETFs have a total net asset value of $97.01 billion, representing a significant portion of Bitcoin's total market capitalization. The figure was 6.35%, with a cumulative net inflow of $55.3 billion.

On the same day, the US Ethereum spot ETF recorded its first net inflow of funds this week, amounting to $14.06 million.

BlackRock's ETHA topped the list of net inflows yesterday with $42.85 million (approximately 19,040 ETH), bringing its total net inflow to $12.2 billion.

Grayscale's ETH and ETHE, and Invesco's QETH, recorded net inflows of $19.12 million (approximately 8,490 ETH), $8.25 million (approximately 3,660 ETH), and $1.14 million (508.27 ETH), respectively.

Meanwhile, Fidelity's FETH and VanEck's ETHV saw net outflows of $54.84 million (approximately 24,360 ETH) and $2.47 million (approximately 1,100 ETH), respectively.

Currently, Ethereum spot ETFs have a total net asset value of $13.39 billion, representing 4.82% of the total Ethereum market capitalization, with a cumulative net inflow. $11.99 billion.

#BitcoinETF #EthereumETF

Ethereum Daily

Ethereum

1h ago

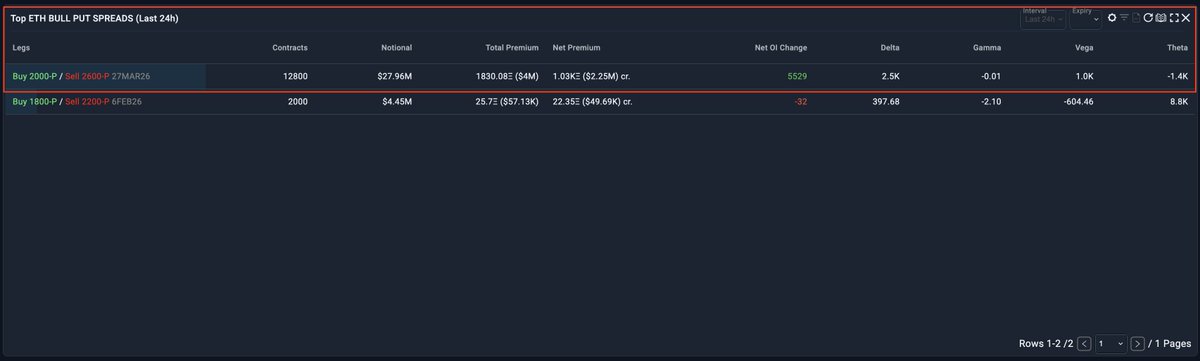

🚨 Big Players Hedging Against Ethereum's Worst-Case Scenario, Still Preparing for the Next Round of Operations

🔹We haven't seen such a clear two-stage structure in Ethereum options trading for a long time.

🔹Total size: Approximately $97 million in notional principal (approximately $69 million on February 27th | approximately $28 million on March 26th).

🔹The goal is not purely one-sided betting, but risk hedging and volatility arbitrage.

1⃣ February 27th Segment – Downside Hedging (1800 → 1500)

- Notional Principal: Approximately $69 million | Net Premium: -$300,000

- Profit: Profits begin when Ethereum price falls below 1800, with maximum profit reached at 1500

→ In the short term, traders are preparing for a decline in Ethereum. If Ethereum (ETH) continues to fall to around $1500, the trade on February 27th will serve as a low-cost hedge against spot risk.

2⃣ March 26th Trade – Theta Mining/Bounce Strategy (2000 → 2600)

- Notional Amount: Approximately $28 million | Net Premium: +$2.25 million

- Profit: Profitable as long as the Ethereum price is above $2000, with maximum profit if the price remains above $2600

→ This trade spans approximately one month, with the strike price and spot price not differing significantly, indicating that the trader, while collecting a premium, also allowed room for a rebound after the sell-off. The $2.25 million premium collected offset the approximately $300,000 hedging costs paid in the February 27th trade.

📊 Summary

Short-term downside hedging + medium-term volatility selling to cover insurance costs – not a one-sided bet on Ethereum.

Rock Sugar Orange Brother YYDS

Crypto Newbie

6h ago

Bitcoin's high was $126,000. If we calculate based on a 45% drop in gold ETFs, the bottom would be around $69,300.

If we calculate based on a maximum retracement of 57% for the Dow Jones and Nasdaq, the bottom would be approximately $54,200 ($126,000 x 0.43).

If we calculate based on a maximum retracement of 60% for Apple, the bottom would be approximately $50,000 ($126,000 x 0.4).

If we calculate based on a maximum retracement of 70% for Tesla and Nvidia, the bottom would be approximately $38,000 ($126,000 x 0.3).

The above data is based on the maximum declines of gold, the Dow Jones, Nasdaq, S&P 500, Tesla, and Nvidia over the past 20 years.

Summary: The most probable bottom for Bitcoin in this round is between $70,000 and $50,000, with an extreme low of $38,000.

Reference: Dollar-cost averaging between $70,000 and $50,000, or all-in bets at $40,000!

吴说区块链

Binance

7h ago

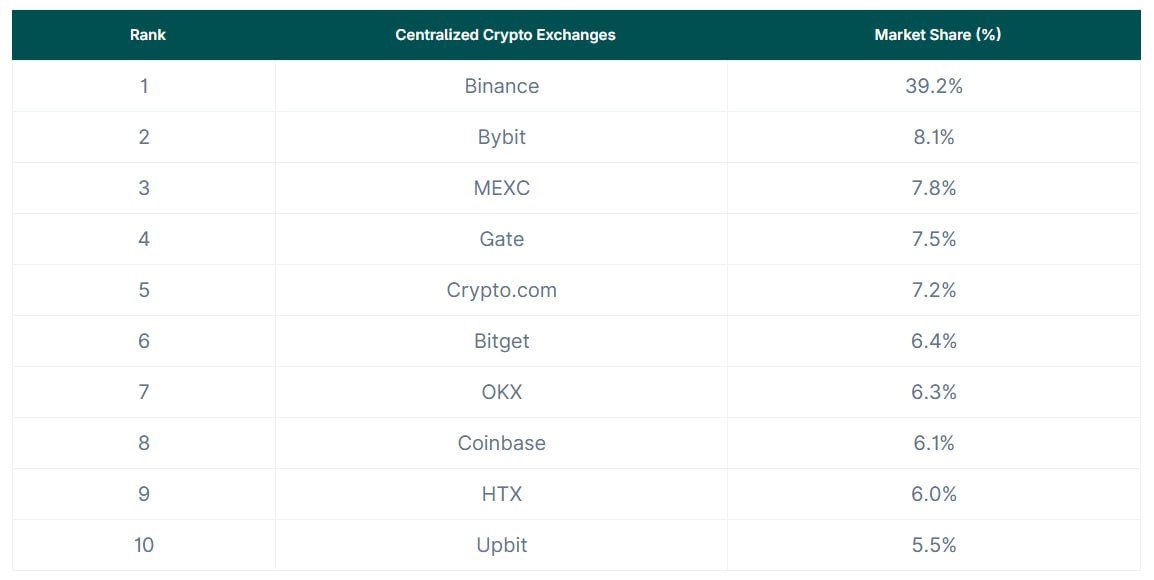

According to CoinGecko data, the total spot trading volume of the top ten centralized exchanges globally reached $18.7 trillion in 2025, a year-on-year increase of 7.6%. Binance maintained its leading position with a 39.2% market share, with a total spot trading volume of approximately $7.3 trillion, a slight year-on-year decrease of 0.5%. Bybit ranked second, with a total trading volume of approximately $1.5 trillion and a market share of 8.1%. MEXC was the fastest-growing exchange in 2025, with a total trading volume of approximately $1.5 trillion, a year-on-year increase of 90.9%, mainly benefiting from its continued implementation of a zero-fee spot trading strategy. In addition, platforms such as Bitget, Gate, and HTX also recorded double-digit growth in trading volume throughout the year, while OKX and Upbit experienced varying degrees of decline.

Mr. Nameless

Crypto Newbie

10h ago

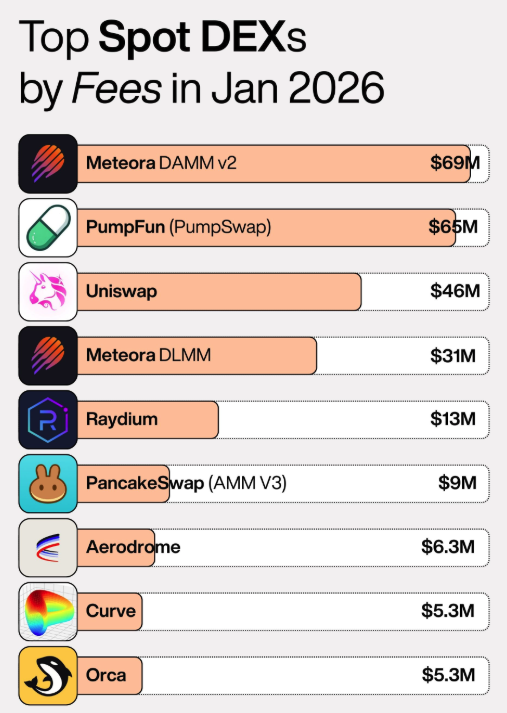

📊 Want to see the real DEX rankings? Forget the narrative, look at the transaction fees.

Below is a ranking of DEX transaction fees for the past 30 days compiled by DefiLlama

(Only $1M+ fees are counted) 👇

1️⃣ @MeteoraAG (DAMM V2) — $69.11M

2️⃣ @Pumpfun (PumpSwap) — $65.67M

3️⃣ @Uniswap — $46.02M

4️⃣ @MeteoraAG (DLMM) — $31.24M

5️⃣ @Raydium — $13.08M

6️⃣ @PancakeSwap (AMM V3) — $9.17M

7️⃣ @AerodromeFi — $6.53M

8️⃣ @CurveFinance — $5.36M

9️⃣ @orca_so — $5.35M

🔟 @HyperliquidX (Spot Order Book) — $2.15M

11️⃣ @THORChain — $2.14M

12️⃣ @PancakeSwap (AMM) — $2.12M

13️⃣ @QuickswapDEX — $2.05M

14️⃣ @prjx_hl — $1.49M

15️⃣ @BlackholeDEX — $1.08M

16️⃣ @PancakeSwap (Infinity) — $1.01M

💡 Conclusion in one sentence: Transaction fees = Real users + Real transactions + Real cash flow.

Who's making money is obvious.

The presence of Solana-based, Base-based, and new AMM/Orderbook platforms is already very clear.

IT Tech

Crypto Newbie

11h ago

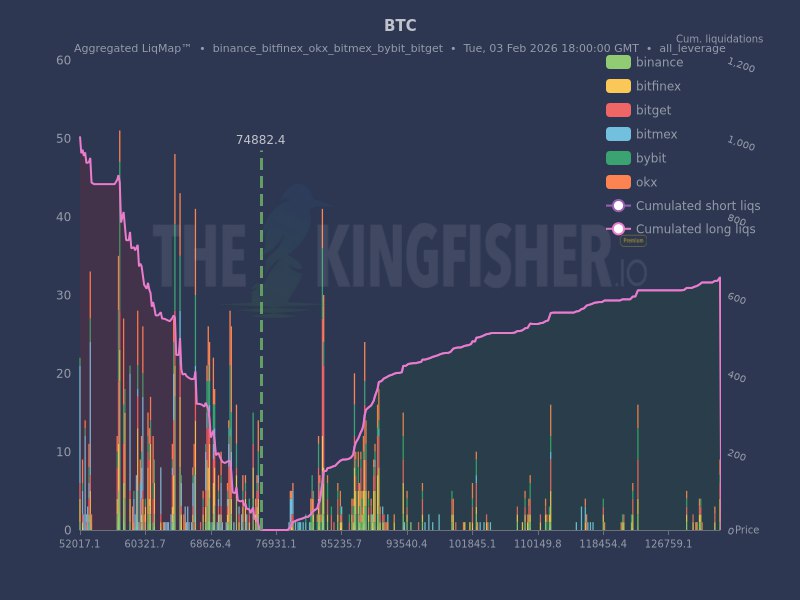

The $BTC liquidation map has loaded. ⚠️

A large number of long liquidations are piling up below spot. The curve is steepening rapidly.

Further price declines could trigger a chain reaction of risks.

Funding rates are rising rapidly.

Let's pray for these newly arriving longs.

Huobi HTX

Crypto Newbie

11h ago

So many new cryptocurrencies have been listed lately! We have to share this with our fellow traders!

🔥 $MOLT, $CLAWNCH, $BIRB New Crypto Trading Extravaganza – A fantastic giveaway!

Share and comment on this post for a chance to win one of 10 $10 grid trading trial funds!

Link in the comments section, see you there!

@moltbook @Clawnch_Bot @moonbirds @zama @ETHGasOfficial @SentientAGI @infinex @EnsoBuild

Trading pairs (spot USDT trading pairs): $MOLT, $CLAWNCH, $ZAMA, $BIRB, $GWEI, $SENT, $INX, $ENSO

📅 Event period: February 3, 2026, 18:00 – February 10, 2026, 18:00 (UTC+8)

🪄 Event link: