🚨 Big Players Hedging Against Ethereum's Worst-Case Scenario, Still Preparing for the Next Round of Operations

🔹We haven't seen such a clear two-stage structure in Ethereum options trading for a long time.

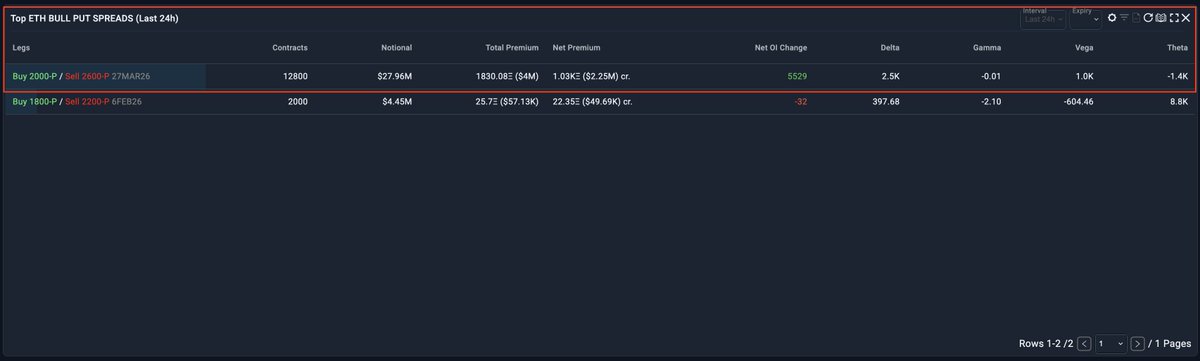

🔹Total size: Approximately $97 million in notional principal (approximately $69 million on February 27th | approximately $28 million on March 26th).

🔹The goal is not purely one-sided betting, but risk hedging and volatility arbitrage.

1⃣ February 27th Segment – Downside Hedging (1800 → 1500)

- Notional Principal: Approximately $69 million | Net Premium: -$300,000

- Profit: Profits begin when Ethereum price falls below 1800, with maximum profit reached at 1500

→ In the short term, traders are preparing for a decline in Ethereum. If Ethereum (ETH) continues to fall to around $1500, the trade on February 27th will serve as a low-cost hedge against spot risk.

2⃣ March 26th Trade – Theta Mining/Bounce Strategy (2000 → 2600)

- Notional Amount: Approximately $28 million | Net Premium: +$2.25 million

- Profit: Profitable as long as the Ethereum price is above $2000, with maximum profit if the price remains above $2600

→ This trade spans approximately one month, with the strike price and spot price not differing significantly, indicating that the trader, while collecting a premium, also allowed room for a rebound after the sell-off. The $2.25 million premium collected offset the approximately $300,000 hedging costs paid in the February 27th trade.

📊 Summary

Short-term downside hedging + medium-term volatility selling to cover insurance costs – not a one-sided bet on Ethereum.