Topic Background

Kolunite社区

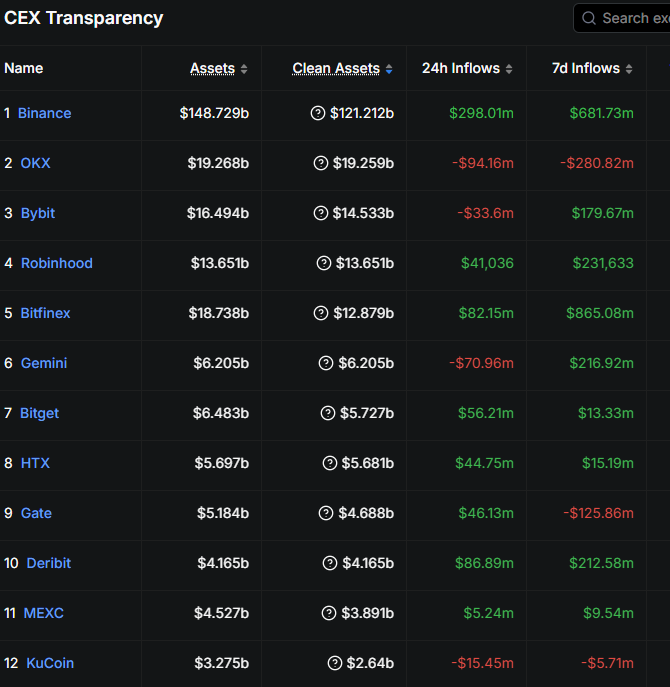

Binance

45m ago

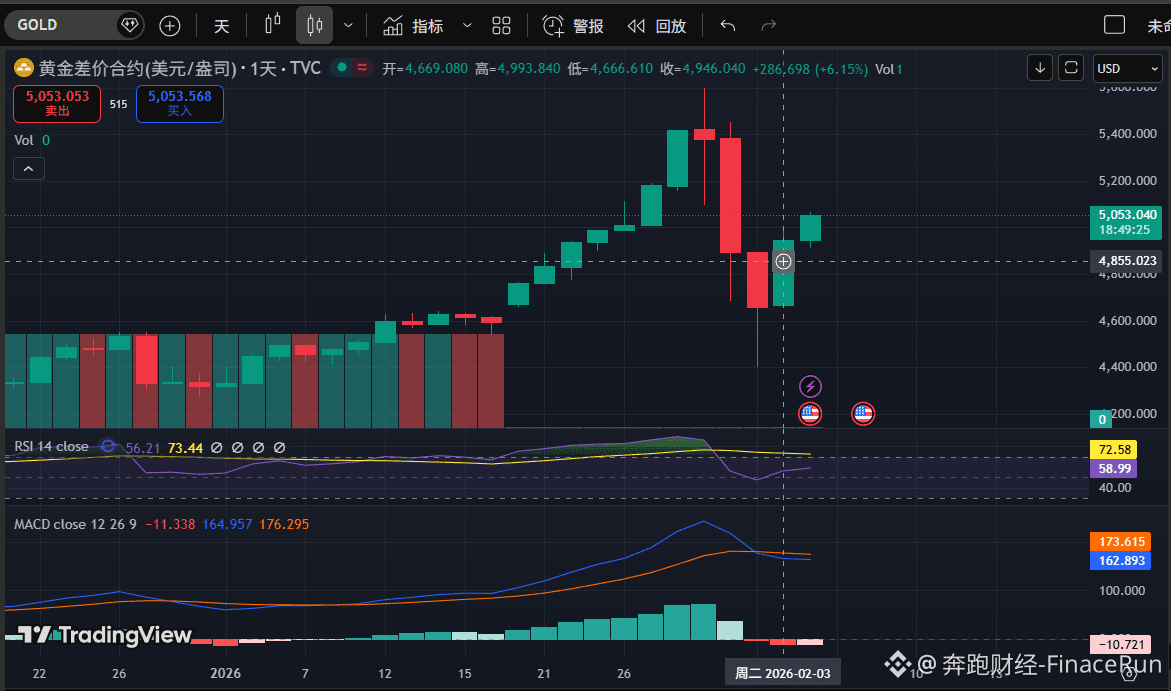

[Warning] Bitcoin prices rebounded sharply this morning; is this the "lowest point" of the quarter? Gold and silver trading volumes on cryptocurrency exchanges are higher than BTC; should they just rename themselves "futures exchanges"? Ethereum (ETH) is being shorted here! Is the Nasdaq correction about to bottom out?

Running Finance - FinaceRun

Crypto Newbie

2h ago

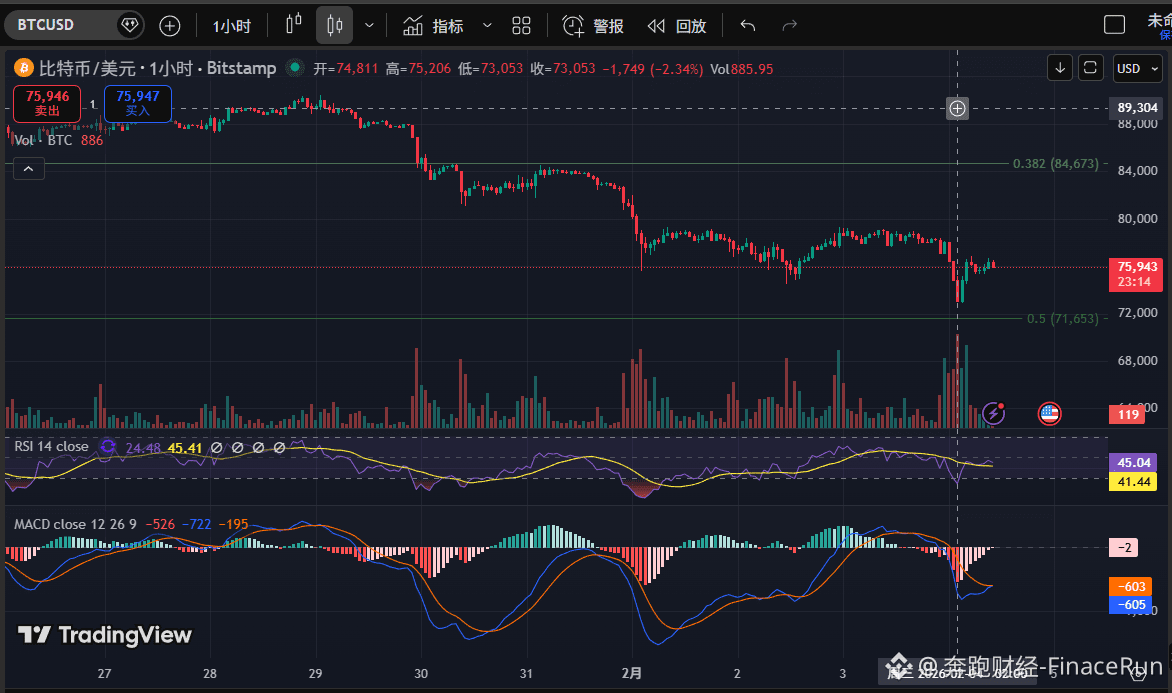

Iran's pursuit of bilateral nuclear talks with the US caused Bitcoin to briefly fall below $75,000

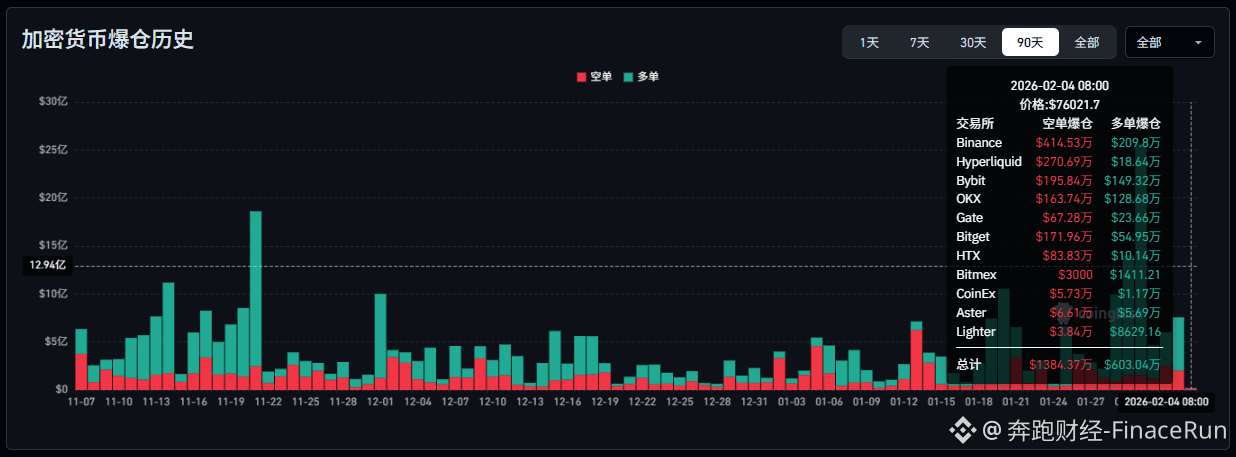

As market sentiment remained weak, the cryptocurrency market experienced another widespread decline. Bitcoin prices suffered another sharp drop in the early hours of the morning, breaking below the key support level of $75,000 and briefly dipping to $73,000.

It is reported that BTC fell from approximately $78,000 to below $73,000 in the past few hours. This rapid decline resulted in the liquidation of approximately $20 million in derivatives positions across major exchanges, with short positions accounting for the vast majority.

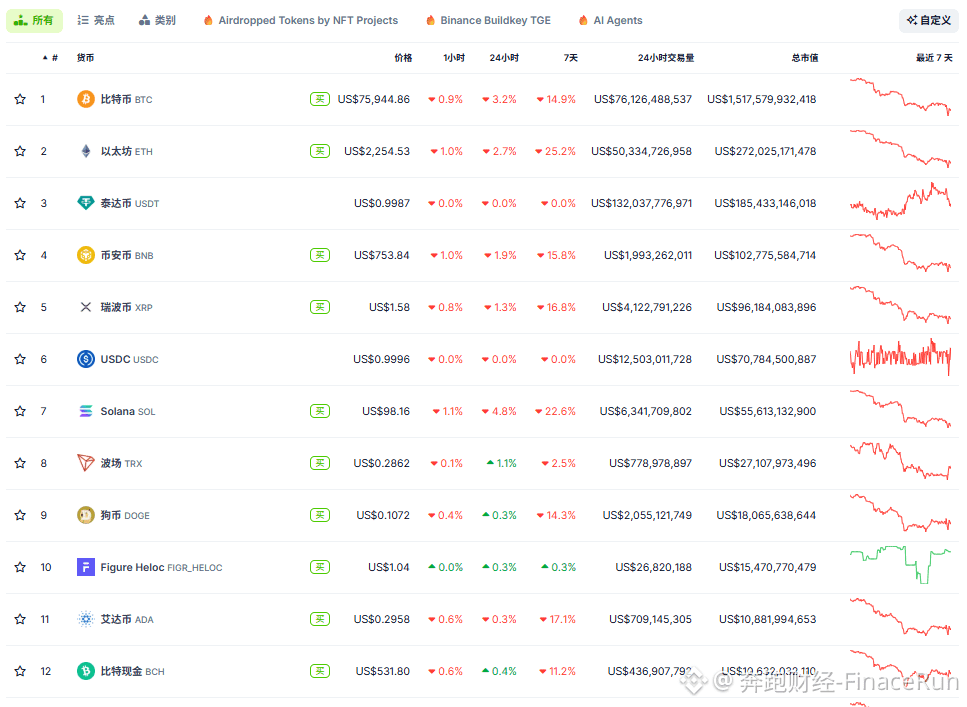

According to Coingecko data, in the past 24 hours, BTC fell by 3.2%, ETH by 2.7%, XRP by 1.3%, SOL by 4.8%, and ADA by 0.3%, with the overall market showing a downward trend.

Analysts believe that the direct trigger for this market volatility was the sudden change in the geopolitical situation in the Middle East. Reports indicate that Iran's proposal to change the format of its nuclear talks with the United States has directly led to a stalemate in the talks scheduled for this Friday in Istanbul.

Previously, Egypt, Qatar, Saudi Arabia, and Oman had strongly advocated for these talks, but Iran's preference for bilateral meetings has been seen as a potential undermining of diplomatic efforts.

Meanwhile, the US troop buildup in the Gulf region has further increased the risk of regional military conflict.

Faced with this sudden geopolitical development, traditional safe-haven assets and cryptocurrencies have exhibited drastically different trends. Gold, as a traditional safe haven, has risen approximately 6.15% in the past 24 hours; conversely, Bitcoin has fallen nearly 3.2% during the same period.

This stark contrast between rising safe-haven assets and falling risk assets clearly illustrates the increasingly evident flow of funds driven by risk aversion in the current market. Under these circumstances, a substantial recovery in the crypto market is unlikely, and weak fluctuations may become the norm.

#GeopoliticalRisks #IranNuclearTalks

吴说区块链

Binance

4h ago

According to Hong Kong 01, Hong Kong police launched a three-week "Operation Scheme," arresting 682 people for fraud and money laundering, involving a total of HK$620 million. The operation dismantled an online romance scam syndicate that not only defrauded 314 victims of HK$44 million through fabricated scenarios but also impersonated police officers to conduct secondary scams. The syndicate employed a money laundering gang, using over 200 dummy accounts and overseas cryptocurrency platforms to convert the defrauded funds into virtual currency and then cash out through over-the-counter exchanges. In addition, police also cracked down on a syndicate that used dummy accounts to launder HK$32 million in illegal gambling proceeds, arresting several related individuals.

Notifi

Infra

4h ago

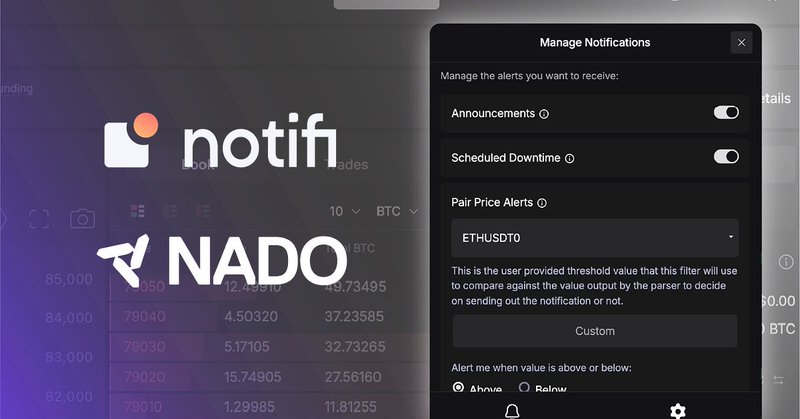

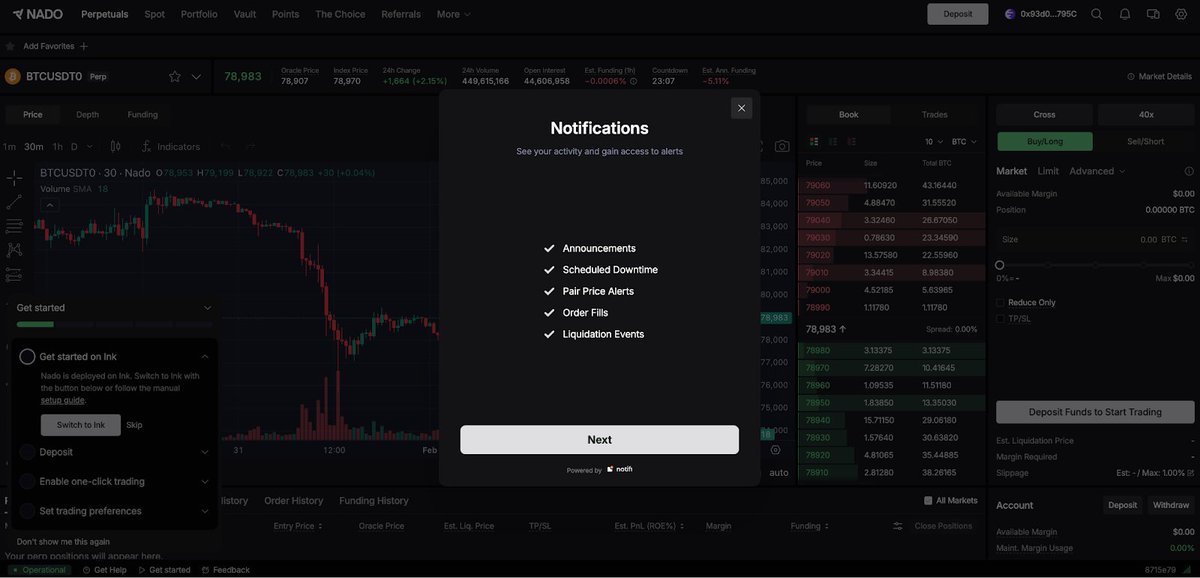

🔔 Integration Notifications 🔔

Notifi is thrilled to announce its latest integration with @nadoHQ. Nado is a brand new decentralized exchange (DEX) built on @inkonchain, a new L2 blockchain launched by @krakenfx. 🧵

Nado just launched its first quarter, and it's a "perfect storm." This new CLOB DEX offers precise trading with up to 20x leverage and high execution throughput, while leveraging Ink's powerful performance and speed to ensure a low-latency trading experience.

Nado users can now receive instant notifications on key topics, including:

- Nado Announcements

- Scheduled Maintenance

- Trading Pair Prices

- Order Execution

- Liquidation

Subscribe to Nado Notifications Now

Interested in enabling notifications for your decentralized application?

Contact Notifi's business development team via Telegram (@missjeev) or DM us on Twitter!

DANNY-OF-WEB3 🧸 🦇🔊

Crypto Newbie

4h ago

Honestly, I think…

If you really want to succeed long-term in this field, you must learn to trade; it's the most fundamental skill in cryptocurrency.

If you've been following me these past few days, you'll have noticed that almost all the content on my page is about "trading." Trust me, you don't always have to wait for TGE (the token exchange) to survive; it should just be icing on the cake for your existing portfolio.

Master trading skills, and you can achieve financial freedom!

Blockchain scanner

Crypto Newbie

5h ago

🔔Nevada Gaming Regulatory Commission Accuses Coinbase of Offering Unlicensed Sports Betting

According to a report by Cointelegraph, the Nevada Gaming Regulatory Commission has filed documents in the First Judicial District Court of Nevada accusing Coinbase Financial Markets of offering unlicensed sports betting. The Commission subsequently requested a temporary restraining order and a preliminary injunction to prohibit Coinbase from “operating a derivatives exchange and prediction market related to sports betting.” Nevada Gaming Regulatory Commission Chairman Mike Dreitzer stated in a statement, “The Commission is committed to its obligation to operate a thriving gaming industry and protect the citizens of Nevada. Yesterday’s action reaffirms that obligation.” Less than a week ago, Coinbase announced a partnership with Kalshi, launching prediction markets in all 50 states. While the Commodity Futures Trading Commission (CFTC) regulates the Kalshi platform at the federal level, the platform may still face legal action from state regulators, including those in Nevada.

MartyParty

Crypto Newbie

5h ago

One number can explain Bitcoin's price:

That number is -0.65.

This is Bitcoin's Z-score.

In simple terms if you're not a statistician:

The Z-score tells you how much the price deviates from its normal range.

• Z = 0 → Price is normal

• Z > 0 → Price is too high

• Z < 0 → Price is too low

It doesn't predict speculation, but rather measures the tension in the price.

Here's the significance of -0.65:

At this point after each previous halving, Bitcoin's price was above the trend level:

2012: +1.02

2016: +1.32

2020: +0.48

Today: -0.65

This has never happened before.

Never in the last 15 years.

So what does the data tell us next?

I ran the full dataset: 5,681 daily observations.

Every crash. Every bubble. Every macroeconomic system.

The relationship between the Z-score and future prices is not weak.

Correlation with future 18-month returns: -0.745

Variance explained by this single variable: approximately 56%

This means that the degree of price overexpansion explains subsequent movements better than interest rates, CPI, market narratives, or sentiment.

From Z ≤ -0.6 (where we are now):

• 12-month win rate: 100%

• Negative returns: 0

• Worst case: +47%

• Median return: +181%

From Z ≥ +1.0:

• Win rate: 44%

• Maximum drawdown: -73%

This is not a subjective opinion.

This is asymmetry.

So why doesn't the price "feel" bullish? Because Bitcoin pricing is no longer like trading.

It's being used.

Bitcoin is now traded 24/7, settled instantly, and can be used as collateral. Funds can flow through Bitcoin without anyone pressing a buy button on an exchange.

This temporarily suppresses prices.

But it doesn't weaken demand.

The market calls this "lack of interest."

Mathematically, it's called a classification error.

Meanwhile, supply has mathematically tightened permanently.

The 2024 issuance halving.

ETFs absorb hundreds of Bitcoins daily off-exchange.

Institutions are quietly accumulating.

Selling does occur, but Bitcoin is transferring from short-term holders to long-term holders' balance sheets at approximately a 36% discount to its network value.

This is not distribution.

This is a change of ownership.

Mean reversion doesn't need a catalyst.

Discrepancy half-life: Approximately 133 days.

This means:

• Approximately 50% of the gaps will be closed within about 4 months.

• Approximately 75% of the gaps will be closed within about 8 months.

• Approximately 90% of the gaps will be closed within about 12 months.

No need for optimism.

No explanation needed.

Time will tell.

This is not a trade.

This is a position.

It's not a bet on a "Bitcoin surge."

It's a bet that mathematics still holds true in this cycle.

Because when a highly stretched system recovers quickly...

Chenxi

Crypto Newbie

5h ago

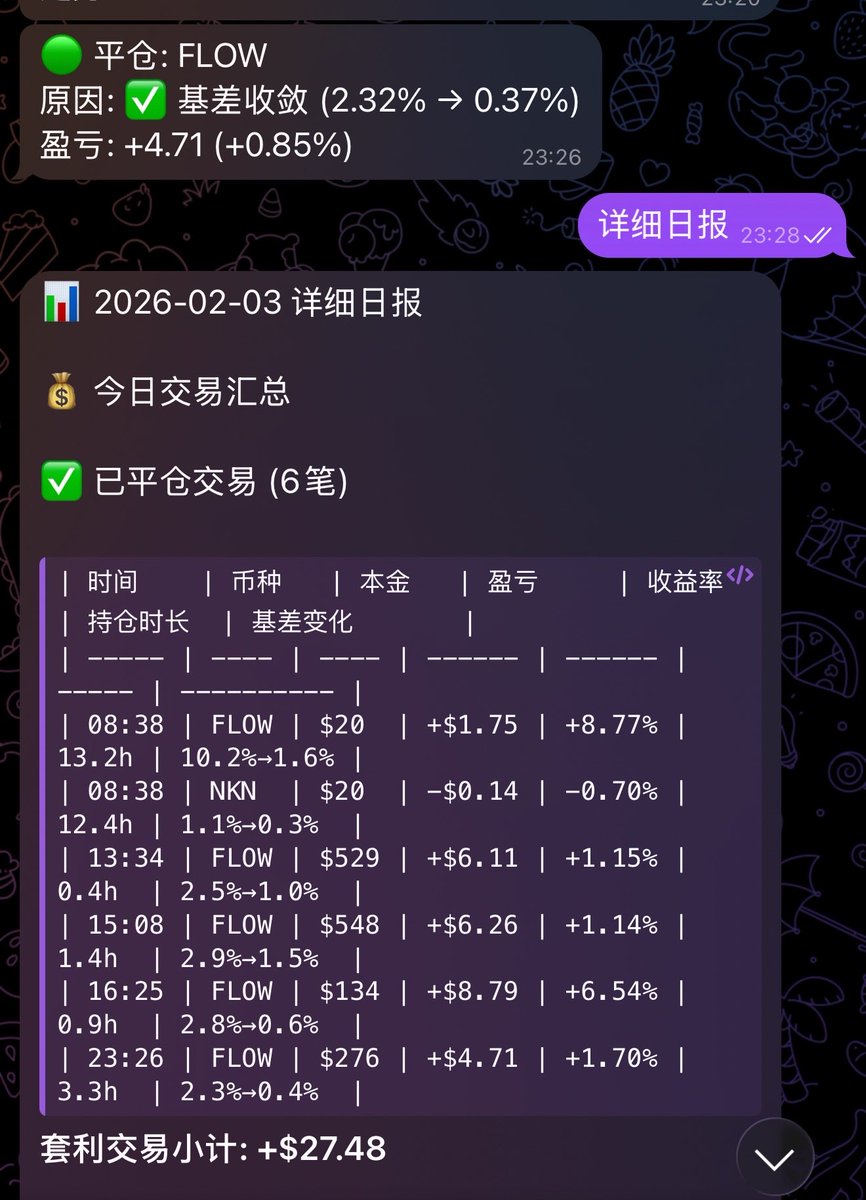

Out of boredom, I looked at the same-exchange basis spreads and wrote some code. I backtested the positive basis spreads of the same coin on several exchanges over the past three months.

The flow on Binance spot futures showed a difference greater than 2% 221 times in the past three months, with the highest basis spread reaching 17.74%. Why isn't anyone mentioning this? Although the liquidity exposure isn't large, it's still incredibly absurd. 🤔

Blockchain scanner

Crypto Newbie

5h ago

🔔SWC, the UK's Largest Bitcoin Treasury Company, Lists on the London Stock Exchange Main Board

According to Mars Finance, on February 4th, Smarter Web Company, the UK's largest Bitcoin treasury company, successfully listed on the London Stock Exchange Main Board on February 3rd, with the stock code SWC. The share price on its first day of trading was 43 pence, giving it a market capitalization of approximately £118 million. Currently, Smarter Web Company has purchased 2,674 Bitcoins, with an average purchase price of approximately $111,000.