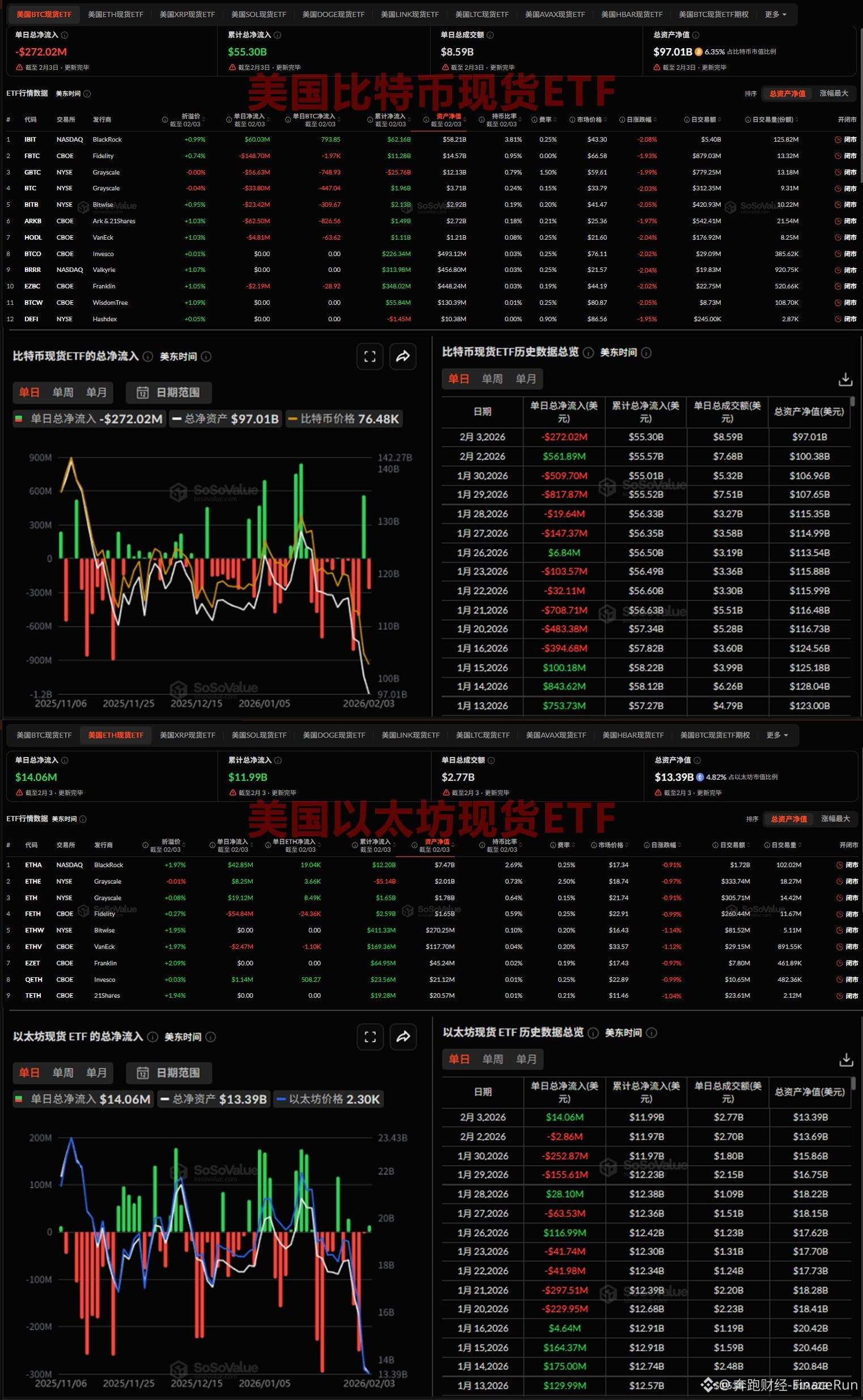

US BTC spot ETFs saw a net outflow of $272 million on Tuesday, while ETH ETFs experienced a net inflow of $14.06 million.

February 4th - According to SoSovalue data, US BTC spot ETFs recorded their first net outflow of funds this week yesterday, totaling nearly $272 million.

Fidelity's FBTC saw the largest net outflow yesterday, at nearly $149 million (approximately 1,970 BTC). FBTC's cumulative net inflow to date is $11.28 billion.

Secondly, Ark & 21Shares ARKB and Grayscale's GBTC and BTC saw net outflows of $62.5 million (826.56 BTC), $56.63 million (748.93 BTC), and $33.8 million (447.04 BTC), respectively.

Bitwise BITB, VanEck HODL, and Franklin EZBC saw net outflows of $23.42 million (309.67 BTC), $4.81 million (63.62 BTC), and $2.19 million (28.92 BTC), respectively.

Notably, BlackRock's IBIT was the only BTC ETF to see a net inflow of $60.03 million (793.85 BTC) yesterday.

Currently, Bitcoin spot ETFs have a total net asset value of $97.01 billion, representing a significant portion of Bitcoin's total market capitalization. The figure was 6.35%, with a cumulative net inflow of $55.3 billion.

On the same day, the US Ethereum spot ETF recorded its first net inflow of funds this week, amounting to $14.06 million.

BlackRock's ETHA topped the list of net inflows yesterday with $42.85 million (approximately 19,040 ETH), bringing its total net inflow to $12.2 billion.

Grayscale's ETH and ETHE, and Invesco's QETH, recorded net inflows of $19.12 million (approximately 8,490 ETH), $8.25 million (approximately 3,660 ETH), and $1.14 million (508.27 ETH), respectively.

Meanwhile, Fidelity's FETH and VanEck's ETHV saw net outflows of $54.84 million (approximately 24,360 ETH) and $2.47 million (approximately 1,100 ETH), respectively.

Currently, Ethereum spot ETFs have a total net asset value of $13.39 billion, representing 4.82% of the total Ethereum market capitalization, with a cumulative net inflow. $11.99 billion.

#BitcoinETF #EthereumETF