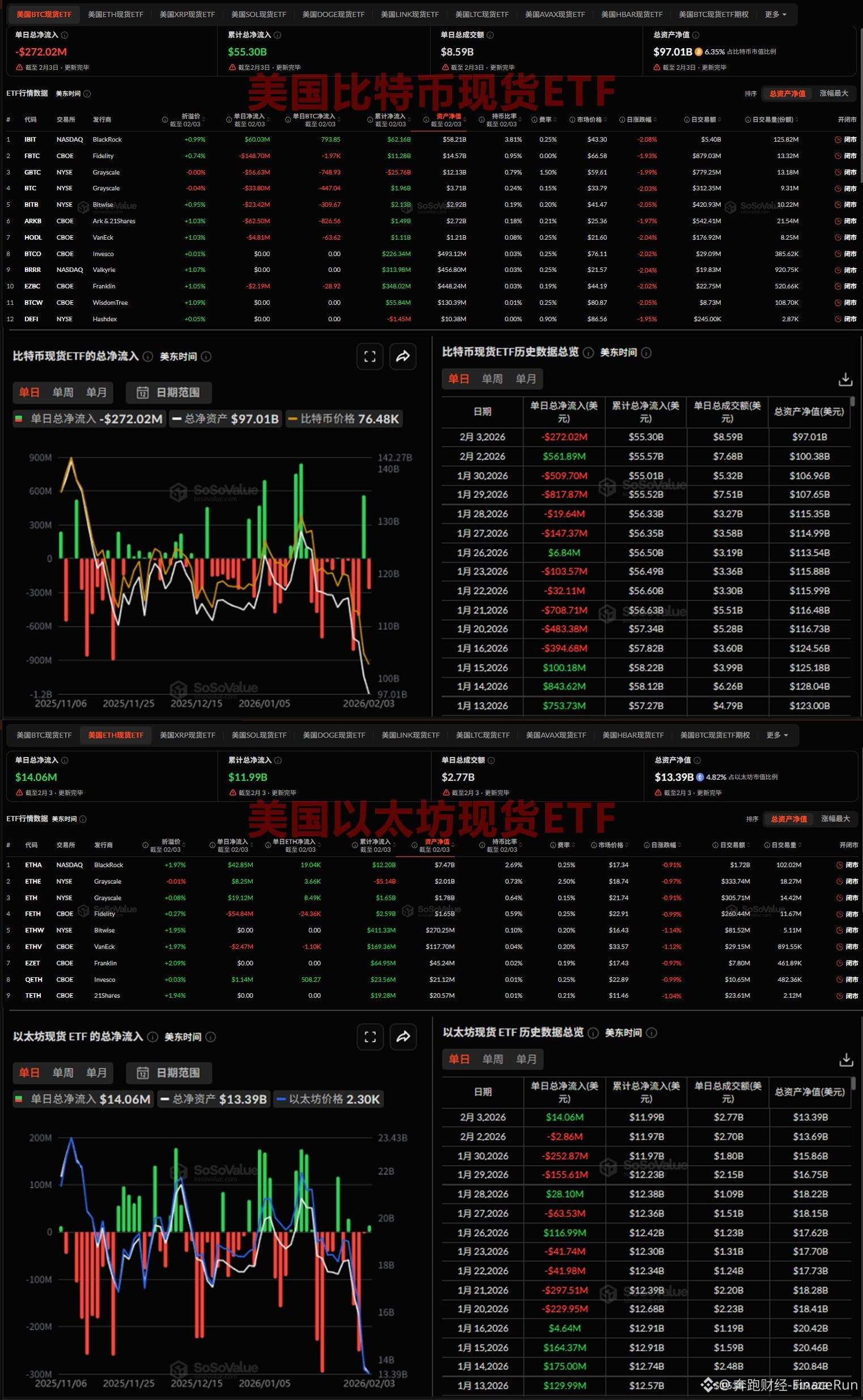

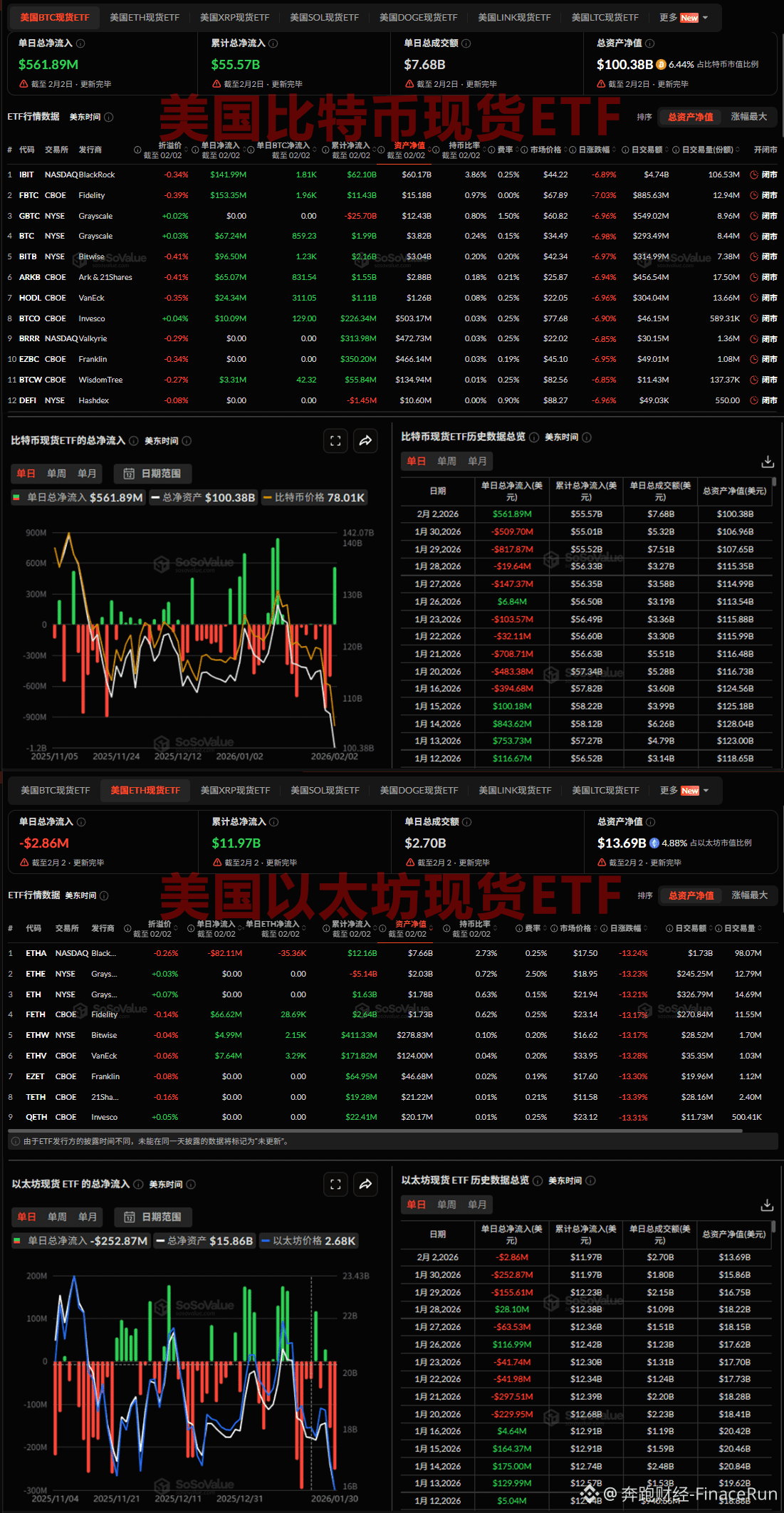

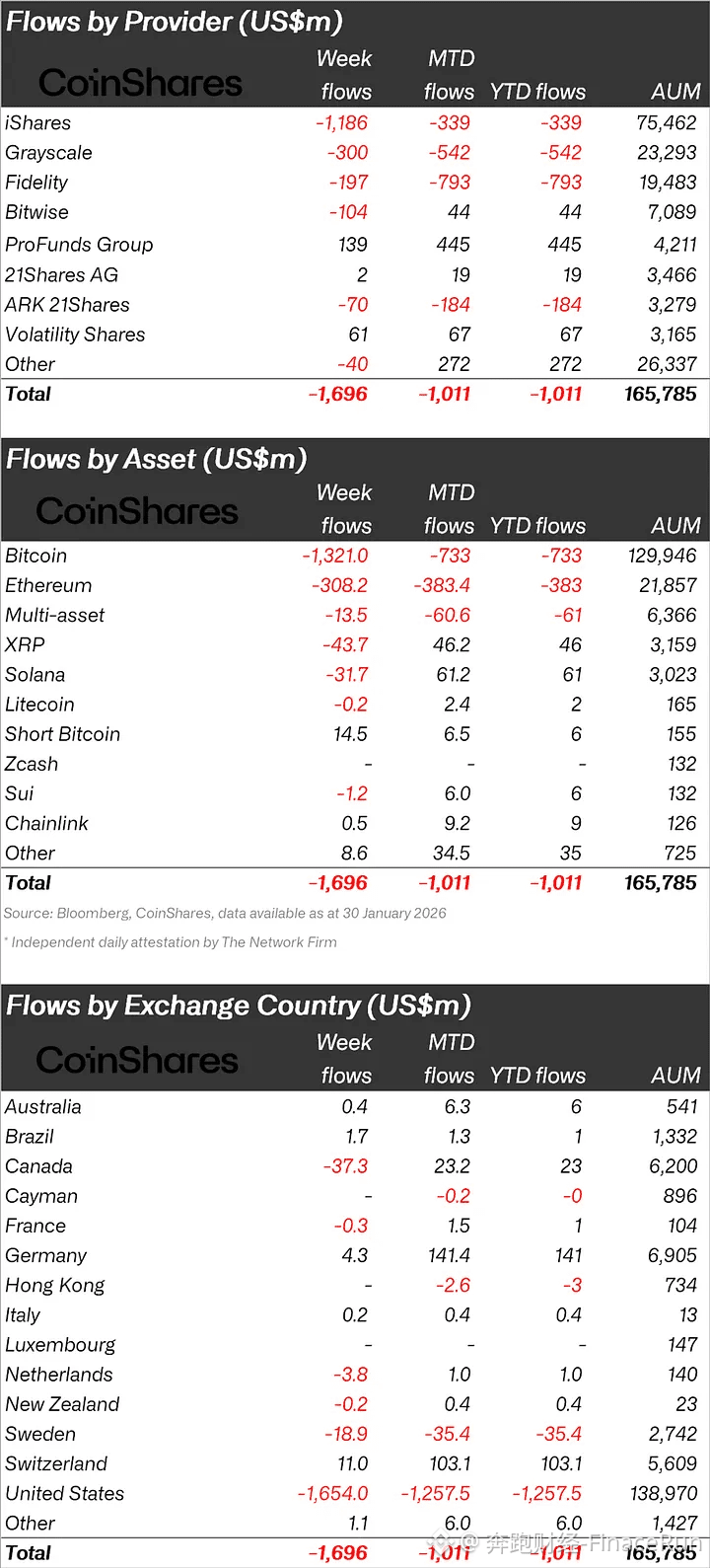

美国 BTC现货 ETF 周二总净流出 2.72 亿美元,ETH ETF 却现 1406 万美元的单日总净流入

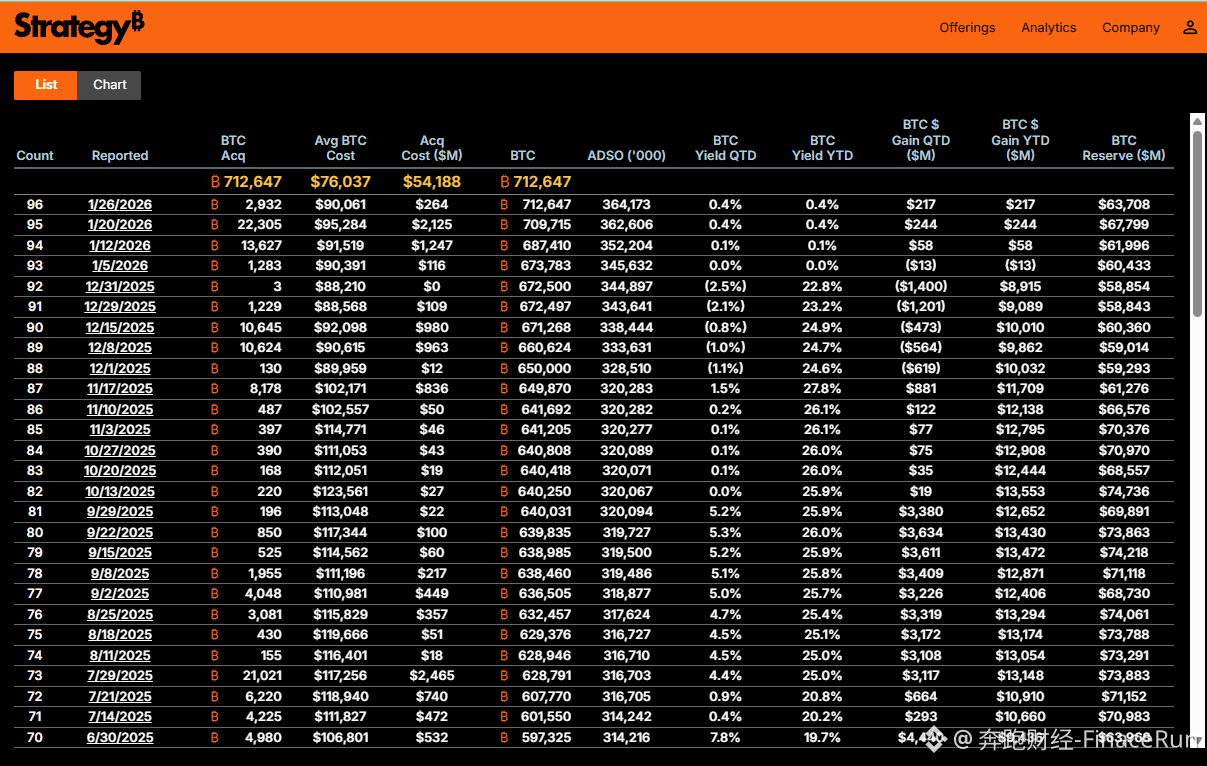

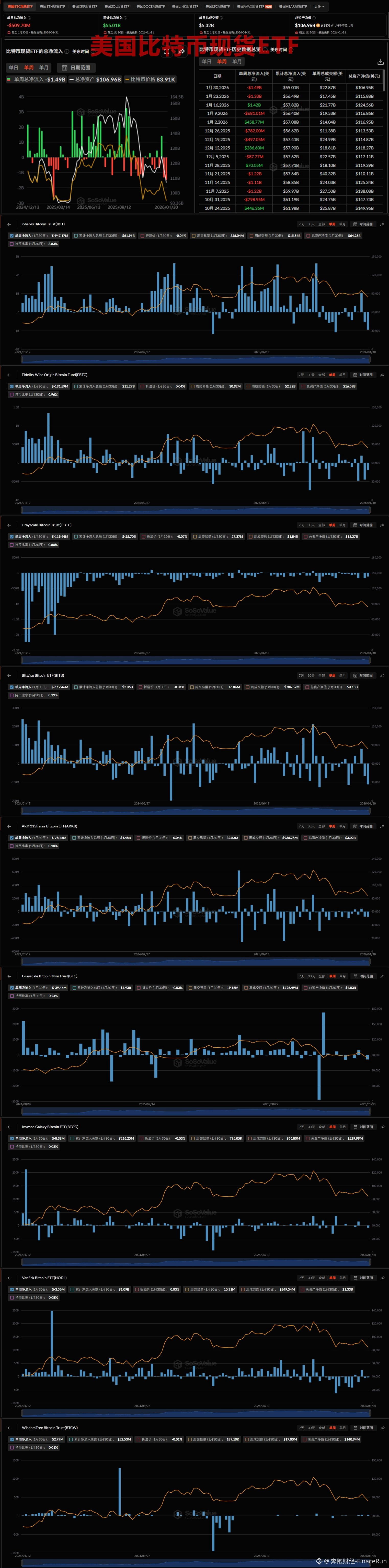

2 月 4 日讯,据 SoSovalue 数据,美国 BTC 现货 ETF昨日以近 2.72 亿美元,录得本周以来的首日资金总净流出;

其中,富达(Fidelity)FBTC 以近 1.49 亿美元(约合1,970枚BTC)居昨日净流出最多,目前 FBTC 累计总净流入 112.8 亿美元。

其次是 Ark&21Shares ARKB 以及灰度(Grayscale)旗下 GBTC 和BTC,分别录得 6250 万美元(826.56枚BTC)以及 5663 万美元(748.93枚BTC)和 3380 万美元(447.04枚BTC)的单日净流出;

而 Bitwise BITB、VanEck HODL 和 Franklin EZBC,分别录得 2342 万美元(309.67枚BTC)、481 万美元(63.62枚BTC)和 219 万美元(28.92枚BTC)的单日净流出;

值得注意的是,贝莱德(BlackRock)IBIT 却以 6003 万美元(793.85枚BTC)成为昨日唯一一支净流入的 BTC ETF;

截止当前,比特币现货 ETF 总资产净值为970.1 亿美元,占比特币总市值比例的 6.35%,累计总净流入 553.0 亿美元。

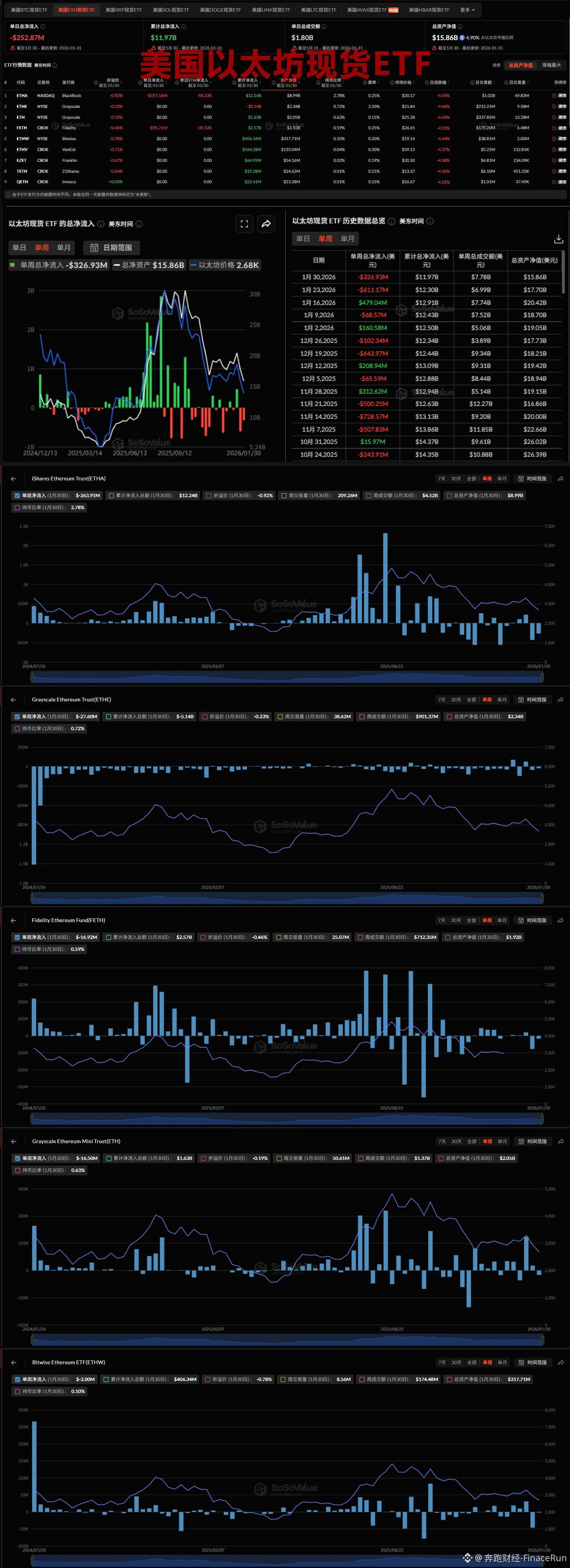

同一天,美国以太坊现货 ETF 却以 1406 万美元,录得本周以来的首日资金总净流入。

其中,贝莱德(BlackRock)ETHA 以 4285 万美元(约合19,040枚ETH)居昨日净流入榜首,目前 ETHA 累计总净流入122.0亿美元;

灰度(Grayscale)旗下 ETH 和 ETHE 以及 Invesco QETH,分别录得1912万美元(约合8,490枚ETH)、825万美元(约合3,660枚ETH)和114万美元(508.27枚ETH)的单日净流入;

而富达(Fidelity)FETH 和 VanEck ETHV,昨日却现 5484 万美元(约合24,360枚ETH)和 247 万美元(约合1,100枚ETH)的单日净流出;

截止当前,以太坊现货 ETF 总资产净值 133.9 亿美元,占以太坊总市值比例的 4.82%,累计总净流入 119.9 亿美元。

#比特币ETF #以太坊ETF

Price Converter

- Crypto

- Fiat

USD美元

CNY人民币

JPY日元

HKD港币

THB泰铢

GBP英镑

EUR欧元

AUD澳元

TWD新台币

KRW韩元

PHP菲律宾比索

AED阿联酋迪拉姆

CAD加拿大元

MYR马来西亚林吉特

MOP澳门币

NZD新西兰元

CHF瑞士法郎

CZK捷克克朗

DKK丹麦克朗

IDR印尼卢比

LKR斯里兰卡卢比

NOK挪威克朗

QAR卡塔尔里亚尔

RUB俄罗斯卢布

SGD新加坡元

SEK瑞典克朗

VND越南盾

ZAR南非兰特

No more data