Topic Background

加密韋馱|Crypto V🇹🇭

AI

4h ago

Based on feedback regarding the excessive frequency of contract alerts, we made the following corrections this afternoon:

✨ Main Updates

1. Phase 2 Smart Alert System

✅ Introduced a three-choice gating mechanism (price/OI/volume, at least two must be triggered)

✅ Anti-refresh mechanism: Cooldown period (25 minutes) + Deduplication (3 minutes) + Daily limit (8 times)

✅ Scoring system (0-100 points): Comprehensive assessment of alert strength

✅ Event classification: Trend building / Squeeze deleveraging / Accumulation

✅ HTF structural analysis: 4-hour trend bias + resistance/support levels

2. Optimized monitoring scope

✅ Reduced from 396 trading pairs to 200 (Top OI ranking)

✅ Daily automatic update of Top 200 open interest rankings

Overall alert noise should now decrease by 60-80%.

Chenxi

Crypto Newbie

5h ago

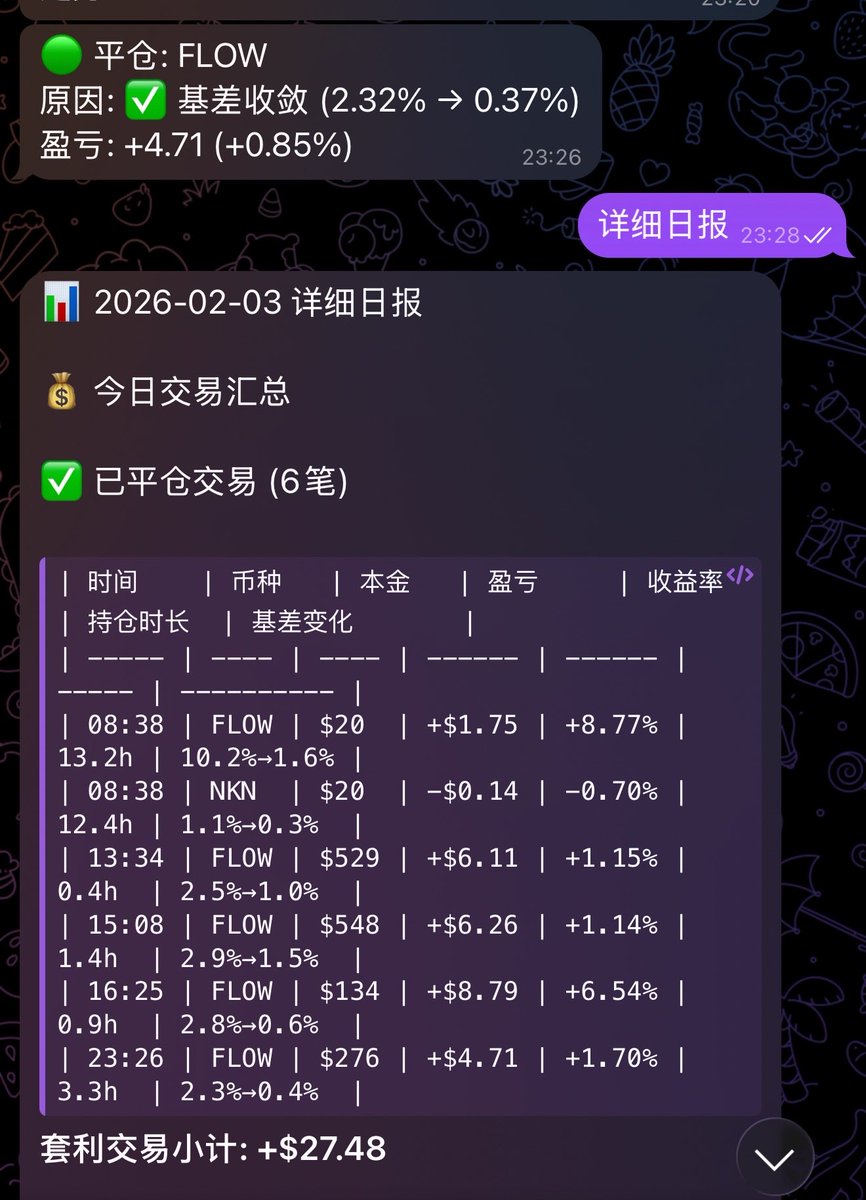

Out of boredom, I looked at the same-exchange basis spreads and wrote some code. I backtested the positive basis spreads of the same coin on several exchanges over the past three months.

The flow on Binance spot futures showed a difference greater than 2% 221 times in the past three months, with the highest basis spread reaching 17.74%. Why isn't anyone mentioning this? Although the liquidity exposure isn't large, it's still incredibly absurd. 🤔

Shadow mole

Crypto Newbie

5h ago

Last night, all three major U.S. stock indexes plunged. The Nasdaq fell more than 2% at one point, the S&P 500 fell more than 1.6%, and the Dow Jones Industrial Average fell more than 1%. At the close, the Nasdaq was down 1.43%, the S&P 500 was down 0.83%, and the Dow Jones was down 0.34%.

The cryptocurrency market was also dragged down! Bitcoin fell 3.78% to $75,800, Ethereum fell 3.88% to $2,260, Solana fell more than 5%, XRP fell nearly 2%, and BNB, Cardano, and others fell more than 1%.

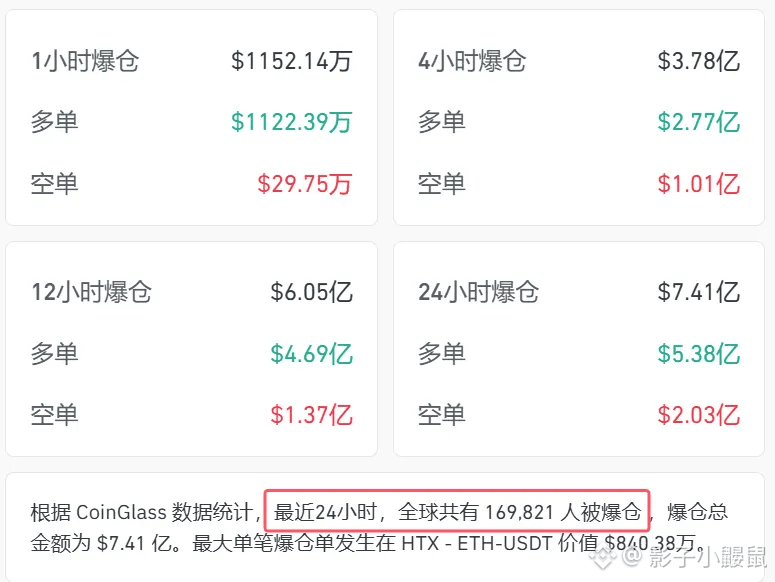

In the past 24 hours, over $700 million in cryptocurrency futures contracts were liquidated, affecting 169,800 investors.

Peng Weite

Crypto Newbie

5h ago

2.4 Bitcoin Price Analysis: Major players are using liquidity to achieve precise two-way profit-taking. The structure is becoming clearer, possibly at the end of a Y-a wave. The market's performance in the 80,000-82,000 range should be monitored for future rebounds. (Bitcoin contract trading) — Commander

Blockchain scanner

Crypto Newbie

6h ago

🔔Nevada Regulator Sues Coinbase, Alleging It Offers Unlicensed Sports Betting Contracts

According to Mars Finance, the Nevada Gaming Control Board has filed a civil enforcement lawsuit in the First Judicial District Court of Nevada, accusing Coinbase of offering unlicensed sports betting contracts through its Coinbase Financial Markets division. The filing shows that the regulator is also requesting a temporary restraining order and a preliminary injunction, requiring Coinbase to cease "operating a sports betting-related derivatives exchange and prediction market" in Nevada.

Nevada Gaming Control Board Chairman Mike Dreitzer stated that this move aims to fulfill regulatory responsibilities and protect the local gaming industry and the interests of state residents. This lawsuit comes less than a week after Coinbase announced its partnership with Kalshi to launch prediction market services in all 50 states. Although Kalshi is regulated at the federal level by the Commodity Futures Trading Commission (CFTC), state-level regulators can still file legal challenges regarding related businesses.

Furthermore, Nevada recently took similar action against Polymarket, with a court previously granting a temporary restraining order prohibiting it from offering event-based contract betting to state residents. These cases are also seen as potentially challenging federal regulatory authority over forecasting markets.

吴说区块链

Binance

6h ago

The Nevada Gaming Control Board has announced a civil lawsuit against Coinbase, accusing it of offering unlicensed sports betting contracts in Nevada. The board has filed for a temporary restraining order and a preliminary injunction in the First District of Nevada court in Carson City, seeking to prohibit Coinbase from operating a sports betting derivatives exchange and prediction market. (Cointelegraph)

RYAN SΞAN ADAMS - rsa.eth

Crypto Newbie

11h ago

On-chain AI agents will drive cryptocurrency market capitalization past $10 trillion.

If you're bullish on OpenClaw, you're bullish on cryptocurrency.

Two points to note:

1) Cryptocurrency adoption has stalled due to poor user experience.

2) What's a "bad user experience" for humans is an excellent user experience for AI agents.

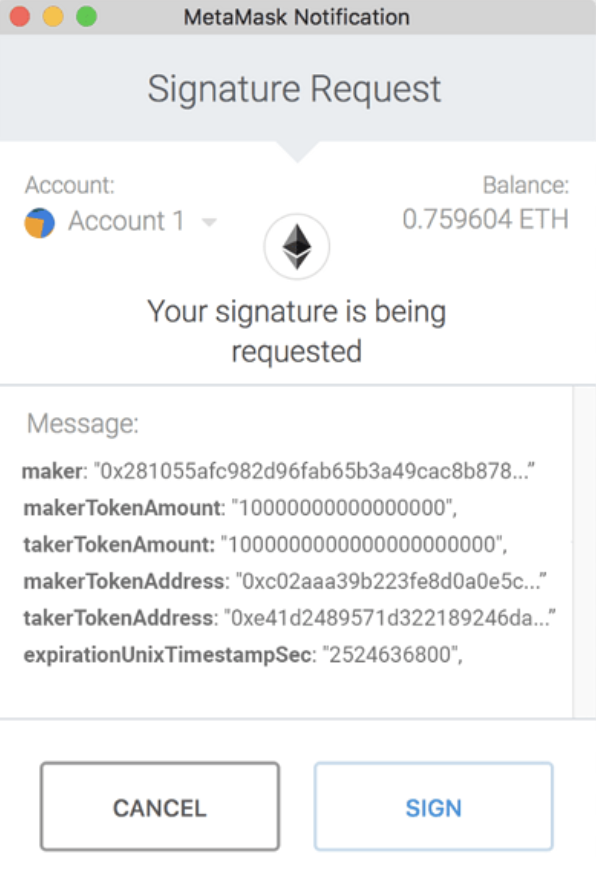

Take this Metamask transaction; it's complex. Imagine how an average person would understand what they're signing. A terrible user experience.

But an AI agent seeing this information would think, "Wow, this user experience is fantastic"—it's precise and detailed—it's a software instruction. Seeing the smart contract code and the transaction payload, the AI agent fully understands what's happening.

They love this experience.

Which financial system will these "molting robots" prefer?

(Obviously)

One more point to note:

3) Within one or two years, there will be billions of intelligent agents, many of which will have wallets (and trillions a year from now).

The “AIFi narrative” is currently underground, much like DeFi in 2019. Dry fuses are quietly building, but it will explode someday.

Nobody's paying attention to cryptocurrencies right now because of the price drop… but I believe AI agents will eventually scale to trillions of crypto wallets.

AIFi is the next frontier of DeFi.

An exciting moment.

zhao

Crypto Newbie

12h ago

Want to test your market intuition? 🔥 Predict whether the BTC spot price will rise or fall two days from today, on Thursday. We will randomly select 3 users who guess correctly and each receive a 10 USDT contract trial fund reward!

How to participate: 1️⃣ Follow @GateFutures

2️⃣ Retweet this post

3️⃣ Comment with your prediction and tag your friend

🏆 Winners will be announced two days later on Friday.

Challenge your market insight!

#GateFutures #BTCPrediction #GateFuturesChallenge