Topic Background

Lianyanshe, Chain Research Society

Crypto Newbie

3h ago

The most important lesson I learned from the last cycle is not to fight the cycle. There are no supercycles, and don't blindly follow the big players; every cycle sees several big players sacrificed.

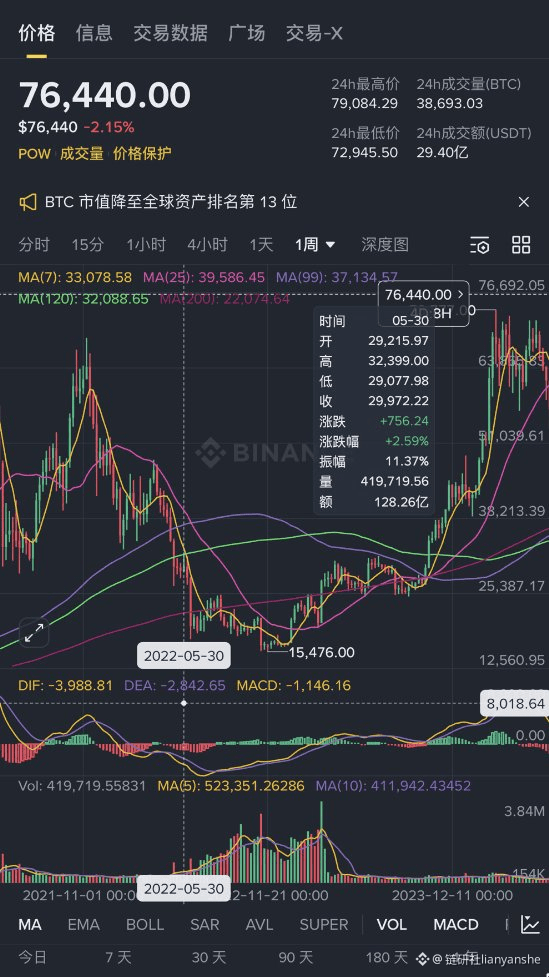

After reviewing the past few days, the current bear market is basically following the same pattern as the last one.

Last Cycle (May 2022): $30,000 was considered a solid bottom for the supercycle at the time because it was the starting point after the May 19, 2021 crash and also the support level of the 120-week moving average. I particularly remember that when it broke below $30,000, the VIX was already below 10, and many bargain hunters believed that the market couldn't fall any further or that a rebound was imminent.

Current Cycle (February 2026): $80,000, which was once a strong support level, has now become a strong resistance level at the 120-week moving average. $80,000 is also the cost price for Bitcoin mining companies. The current $76,000 is like a brief struggle after the price fell below $30,000 in the last cycle. The market may very well have another move to completely shatter confidence, such as touching the top of the last cycle at $69,000.

If it falls below $70,000, it will trigger even larger-scale stop-loss and liquidation orders, which might be necessary to surpass the massive trading volume of November 2025. Without extreme panic, rebounds are often just traps for bulls.

Don't let emotions sway you in a cycle. In extreme trending markets, sentiment indicators can be distorted. A fear index of 10 indicates that retail investors are desperate, but major players may still be using this despair to conduct one last deep dive. Trend lines are more direct than any indicator. As long as the price is below the MA120, all rises are just rebounds, not reversals.

Bitcoin has been breaking new lows these past few days. Looking back at the price action of the last cycle, the expected rebound after a break below with high volume was 20%, from $26,700 to $32,399. Based on the current situation, we can only expect massive trading volume if the price breaks through 70,000. The rebound is anticipated to reach just over $80,000, above the weekly MA120, representing a potential 15% increase.

Furthermore, considering the cyclical nature of Bitcoin, it should bottom out in November or December. What do you think the price will be then? $70,000? $60,000? Or even lower?

Han Paopao

Crypto Newbie

1d ago

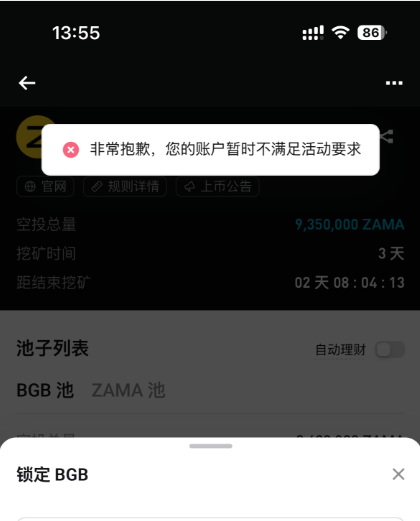

What does this mean? I can't participate in Bitget's ZAMA mining event.

I could participate in previous events, but suddenly I can't participate in this one?

My account is verified.

@Bitget_zh

@Bitget_zh I've also sent you my ID via private message, but the problem isn't solved.

A旺旺

Crypto Newbie

1d ago

A new narrative for cryptocurrencies is quietly emerging.

This new narrative always precedes regulation.

Capture (outcome trading) and predict the future of those with foresight.

This is similar to the boom cycles of past industry narratives like mining, DeFi, blockchain games, and memes.

Wu Blockchain

Crypto Newbie

1d ago

Antpool data shows that, with the current Bitcoin mining difficulty and an electricity cost of $0.08 per kilowatt-hour, the prices of several mining machines, including the Antminer S19 XP+ Hydro, WhatsMiner M60S, and Avalon A1466I, are close to their discontinuation prices. The discontinuation price of the Antminer S21 series is approximately $69,000 to $74,000 per Bitcoin, while high-hashrate models such as the U3S23H and S23 Hydro remain profitable at over $44,000 per Bitcoin.

吴说区块链

Binance

1d ago

According to Antpool data, under the current Bitcoin mining difficulty and an electricity price of $0.08/kWh, models such as the Antminer S19 XP+ Hyd, Whatsminer M60S, and Avalon A1466I are currently close to their shutdown price in Bitcoin; the shutdown price of the Antminer S21 series (S21, S21+, S21 Hyd) is approximately between $69,000 and $74,000. Furthermore, high-hashrate models such as the Antminer U3S23H and S23 Hyd have shutdown prices exceeding $44,000.

snowball 💤🎶

meme玩家

02-02 19:45

The first wave of the creator economy started with content writing, with "Bihu" as its peak representative, and its core keyword being "Bi Dong" (cryptocurrency holder), now known as content mining.

The second wave of the creator economy was NFTs, with "Opensen" as its peak representative. Later, major disputes arose over royalty issues, leading to the emergence of royalty-free platforms like Blur.

The third wave of the creator economy is currently driven by AI. We are currently in the midst of this trend, which has already seen the emergence of concepts like Moltbook, and royalty mechanisms have returned to the forefront.

Previously, every blockchain had to have a DEX and a DOGE token. Now, under the royalty mechanism, every platform must burn "#Snowball" (a cryptocurrency).