Topic Background

Biupa-TZC

Crypto Newbie

01-12 12:12

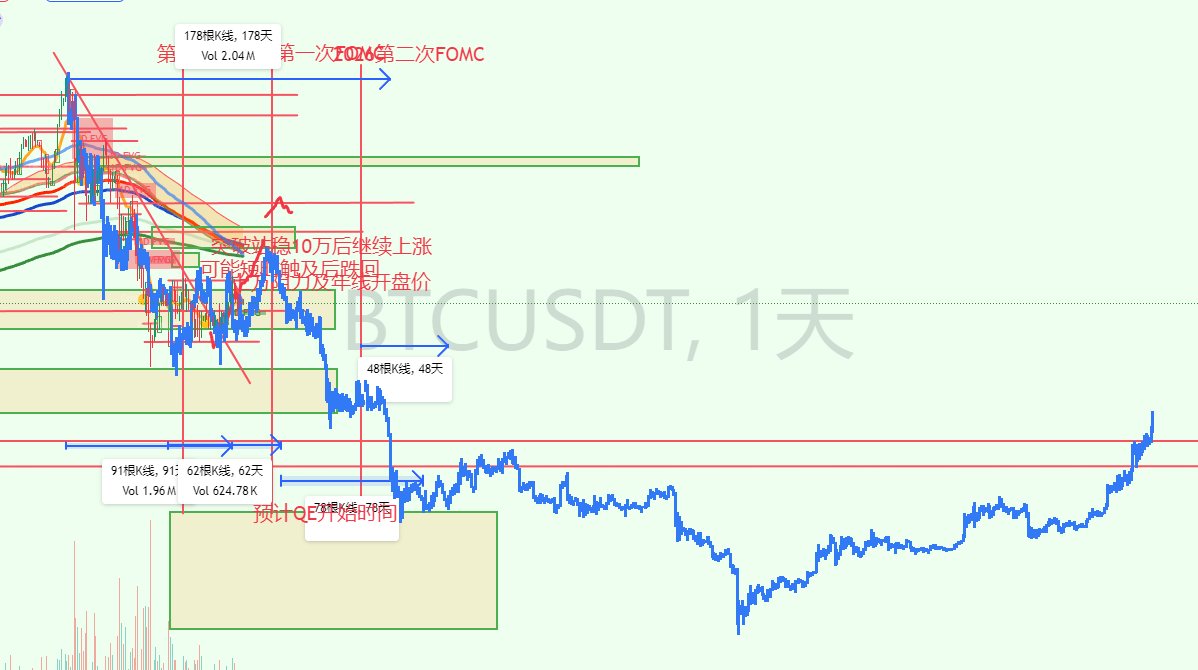

Imagine if late March to early April goes as we expect, and BTC temporarily bottoms out, then rebounds to July or August, just like in 2019 and 2022 (ignoring LUNA 3AC).

Then Q4 brings another black swan event, and the price drops halved from 80,000 to 45,000.

Then a major bull run begins (45,000 - 144,000).

Of course, the predictions from foreign investors were completely disproven by the end of March, making them a laughing stock.

But if another black swan event occurs in Q4, it might catch even the most cautious people off guard.

JL幽灵哥

Crypto Newbie

01-05 14:38

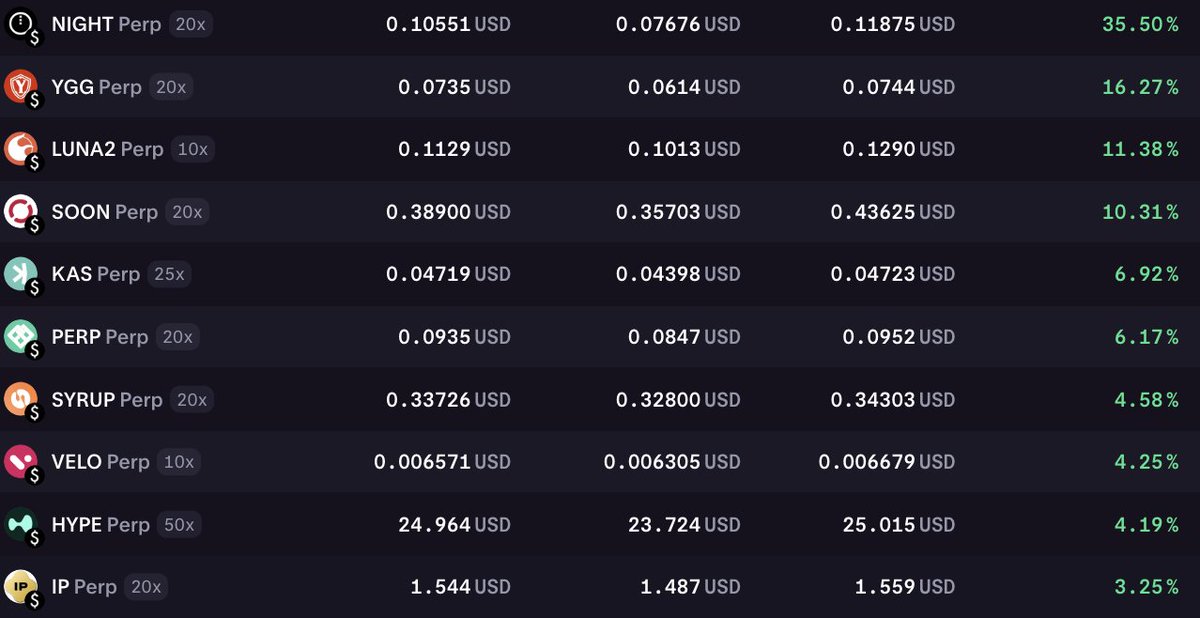

$USTC $LUNA2 bankruptcy series long,

Mainstream copycats have overpriced,

Niche copycats make up for the increase,

USTC looks at 0.0077-0.0089 first!

I unloaded the force twice before,

A 50% increase for the third time is not too much!

Luna can also pay attention,

Needless to say, breaking through 0.1,

Just wait and see when 0.15-0.2 arrives!

{future}(LUNA2USDT)

{future}(USTCUSDT)

BlockchainBaller

Crypto Newbie

01-01 16:16

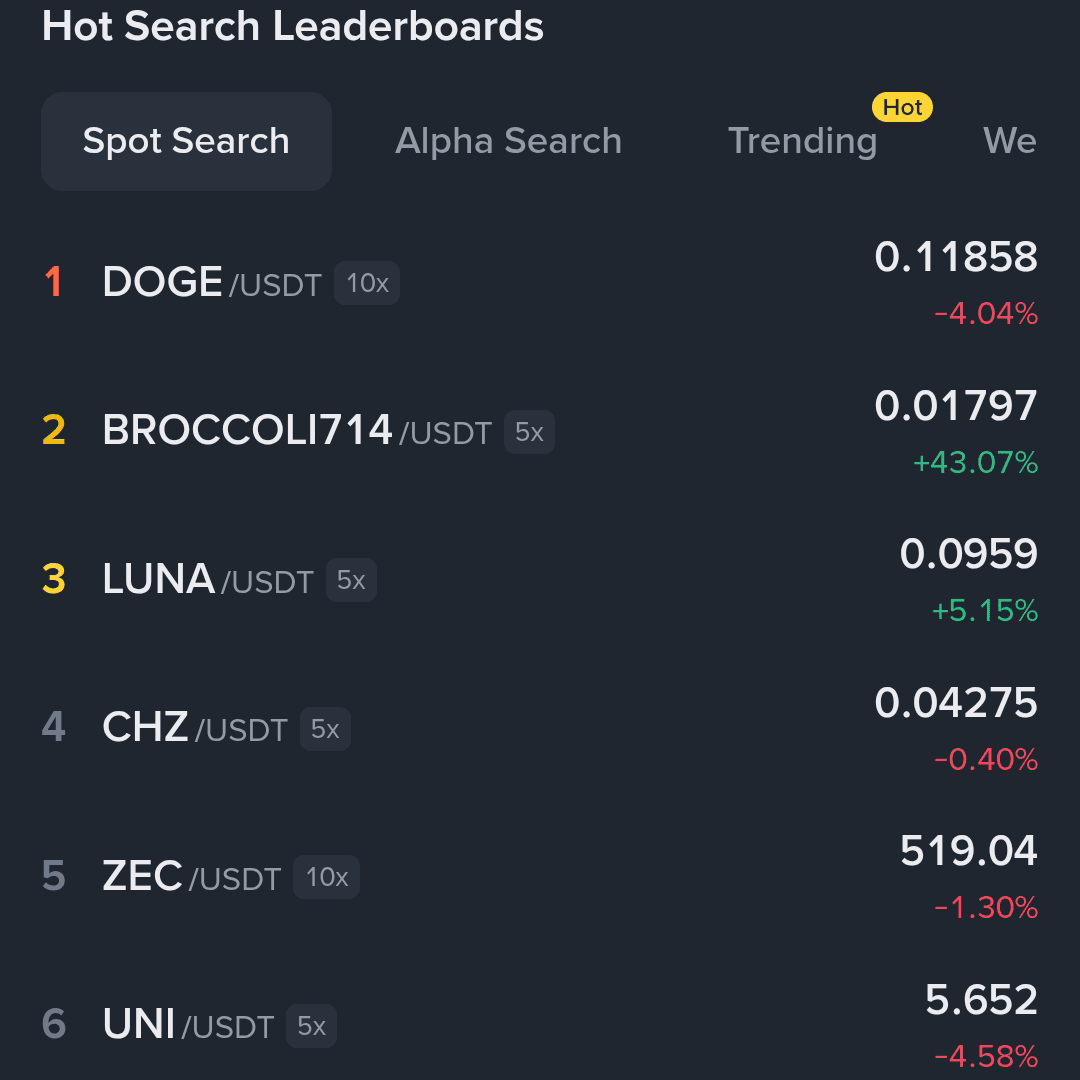

My goodness, this is unbelievable…

Look at $BROCCOLI714, $LUNA, $LUNC!

The search rankings are incredibly hot, volatility is returning, rotation is rapid, and momentum is filtering for hot stocks. Keep your eyes peeled, proceed with caution, opportunities are everywhere.

BlockchainBaller

Crypto Newbie

01-01 01:39

Wait...wait...wait...🔥

$LUNA2 and $LUNC are currently showing strong momentum. If this momentum continues, the next upside targets are #LUNA2 → 0.12 / 0.15 and #LUNC → 0.000050 / 0.000060 respectively. 🚀 This upward trend has only just begun and is not yet over.

JL幽灵哥

Crypto Newbie

2025-12-19 09:30

USTC has fallen enough. Go long at 0.0071. Keep an eye on the $LUNA2 bankruptcy series before the end of the month. With the overall market falling like this, some speculative coins will likely rebound. Target 0.0078-0.0099 first, with a stop-loss around that level. I don't care about anything else; 10% should be enough!

{future}(LUNA2USDT)

{future}(USTCUSDT)