Topic Background

TheCryptoBasic

Crypto Newbie

1d ago

Jack Mallers, CEO of Twenty One Capital, stated that Bitcoin will become a $200 trillion asset.

Twenty One Capital recently emphasized Bitcoin's growth potential, stating that it will become a $200 trillion asset.

Twenty One Capital listed on the New York Stock Exchange (NYSE) on December 9th, with a Bitcoin reserve of $3.9 billion, making it the third-largest publicly traded company in terms of Bitcoin reserves.

Shortly after the NYSE opened, Mallers spoke on the CUBE+NYSE Wired program, discussing Bitcoin, its growth potential, and Twenty One Capital's strategy, which differs from other companies focused on Bitcoin.

Notably, Mallers stated that Bitcoin has proven to be an asset with rapid growth potential. He specifically pointed out that over the past five to ten years, Bitcoin has delivered compound growth to holders' portfolios, with an annual growth rate as high as 50%.

He further emphasized Bitcoin's future growth trajectory. Currently, Bitcoin's market capitalization is approximately $2 trillion, and he points out that in the near future, the Bitcoin ecosystem could grow to $20 trillion or even $200 trillion.

It's worth noting that his prediction is based on the assumption that Bitcoin will become the world's next reserve asset. Mahles points out that the global financial system must "re-find collateral," and traditional government bonds and treasury bonds do not seem to be new collateral.

For example, if Bitcoin eventually becomes an asset with a market capitalization of $200 trillion, its price will rise significantly from current levels. Assuming a 100-fold increase in Bitcoin's price, with 20 million Bitcoins in circulation, each Bitcoin would trade at $10 million. Compared to the current price of $92,270, this represents a 10,737% increase.

Caleb Franzen

Crypto Newbie

12-11 22:03

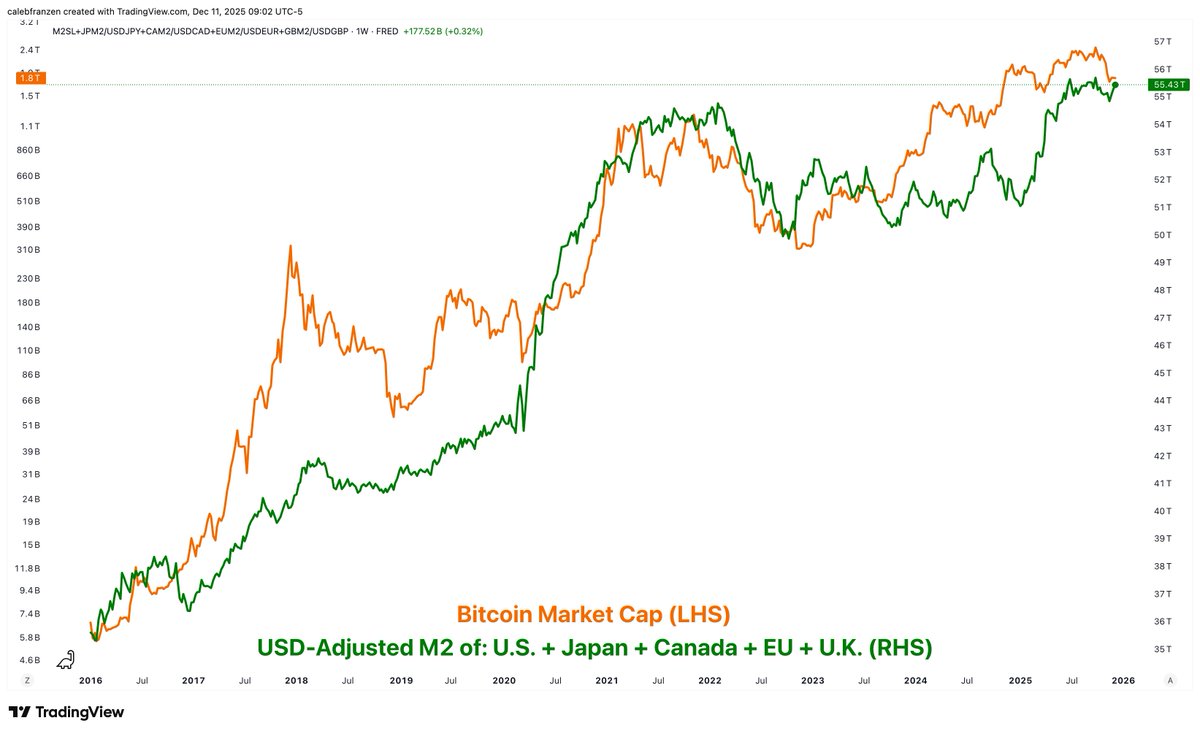

Global M2 money supply has increased again.

However, the price of Bitcoin has not risen accordingly…

🟢 My “Global” M2 Model

🟠 Bitcoin Market Cap (USD)

My global M2 model tracks the M2 money supply (in USD) in the United States, Japan, Canada, the European Union, and the United Kingdom.

Excludes China and India.

CoinMarketCap

媒体

12-07 14:00

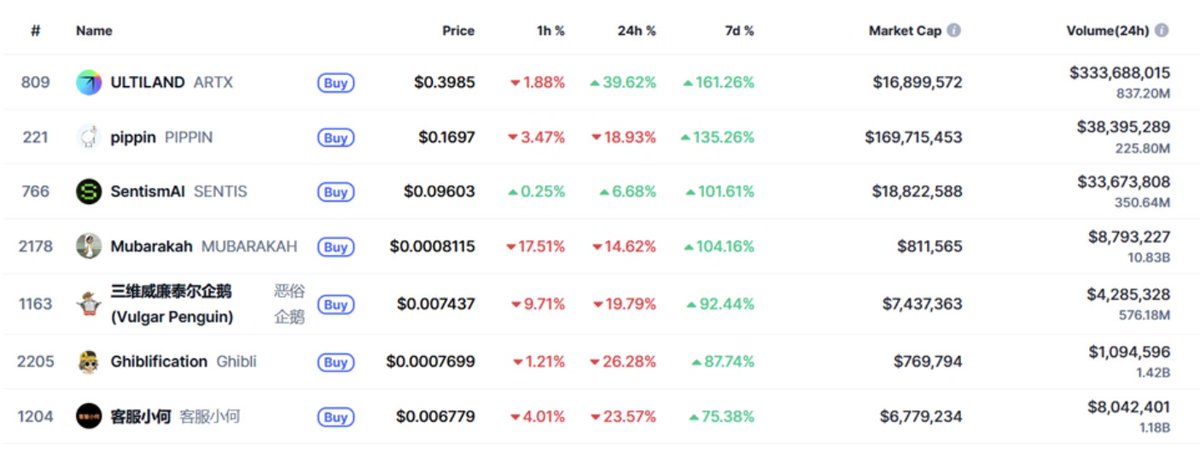

Binance Alpha Weekly Recap: Airdrops Continue, Market Panic Spreads

ULTILAND Surges 161% in Seven Days! Despite Market Panic, Alpha Launches Four Airdrops! Alpha's Market Cap Falls 3.96% to $13.13 Billion! The Fear & Greed Index Reaches 25/100 for 47 Consecutive Days!

Let's analyze Alpha's performance this week. 🧵

1/7

📈 Market Overview

Binance Alpha's market capitalization reached $13.13 billion, with a trading volume of $8.32 billion. Despite the overall market weakness, Alpha maintained an active airdrop schedule, launching four airdrops. The total cryptocurrency market capitalization reached $3.13 trillion, with Bitcoin accounting for 58.7%, providing Alpha participants with an opportunity to accumulate at a lower entry point.

2/7

🏆 Top Performing Cryptocurrencies

7-Day Gainers:

🔹@ULTILAND (ULTILAND): Up 161.26% to $0.3985, Market Cap $16.9 million

🔹@pippinlovesyou (pippin): Up 135.26% to $0.1697, Market Cap $169.7 million

🔹SentisMI (SENTIS): Up 101.61% to $0.09603, Market Cap $18.8 million

🔹Mubarakah (MUBARAKAH): Up 104.16% to $0.0008115, Market Cap $811,600

🔹Vulgar Penguin: Up 92.44% to $0.007437 USD, Market Cap $7.4 million

3/7

💼 How to Participate in Binance Alpha

🔹 Earn Alpha Points by holding/trading eligible tokens (15-day rolling window)

🔹 Check requirements when a project launches (recent airdrops require 242-256 points, each claim costs 15 points)

🔹 Redeem points on the Alpha Events page after trading begins

🔹 Please confirm your claim within 24 hours, otherwise you will lose your eligibility

4/7

⚠️ Panic Continues to Spread

The CMC Fear & Greed Index is 25/100, remaining in the fear zone for 47 consecutive days, the longest such period since November 2024. Social media sentiment is 4.74/10, indicating a complex signal. This sell-off was primarily driven by three factors: the Italian Securities and Exchange Commission (Consob) set the MiCA compliance deadline for June 2026; Strategy reduced its Bitcoin purchases by 93% (from 134,000 BTC per month to 135 BTC in December); and spot trading volume dropped 18% in 24 hours, from $244 billion to $200 billion.

5/7

⚡ Airdrops continue despite market weakness

🔹 @GaiAIio GAIX launched on November 29th, airdropping 400 tokens, requiring 256 Alpha Credits to redeem.

🔹 @RaylsLabs RAYLS launched on December 1st, airdropping 800 tokens, requiring 242 Alpha Credits to redeem.

🔹 @Humanityprot Humanity Protocol launched on December 3rd, offering 295 tokens, requiring 242 Credits to redeem.

🔹 @Yooldo_Games ESPORTS launched on December 4th, offering 80 tokens, requiring 250 Credits to redeem.

6/7

💡 Important Note

🔹 Monitor your Credits balance over the past 15 days to ensure you are eligible for airdrops.

🔹 Watch for the Fear & Greed Index returning to neutral (50+), which could be a potential catalyst for price increases.

🔹 Assess the token's fundamentals within a 24-hour confirmation window.

Stay tuned.

TheCryptoBasic

Crypto Newbie

12-06 14:24

#If XRP's market capitalization increases by $1 trillion, the price could reach $18.95. #Ripple 🧵🧵🧵

How much would XRP's price rise if its market capitalization increased by up to $1 trillion?

XRP has been the focus of discussion and speculation for the past few days, especially after the launch of its first pure spot ETF—the Canary Capital XRP ETF (XRPC). The product saw $58 million in trading volume and a net inflow of $245 million on its first day.

Despite the ETF's strong performance, XRP's price has fallen sharply due to a general market correction. This correction has pushed Bitcoin (BTC) below the key support level of $100,000. Since the downtrend began on November 11, XRP's market capitalization has shrunk by $14.63 billion, currently standing at $137.12 billion.

It's worth noting that an overall market recovery could boost XRP's prospects and potentially push its market capitalization to all-time highs. For reference, XRP's all-time high market capitalization is currently $216.69 billion, reached on July 18th when the price peaked at $3.66.

Currently, XRP is valued at $137.12 billion, a drop of $79.57 billion from that peak. Meanwhile, amid market expectations of a potential XRP recovery, we recently assessed what its price could reach if XRP not only recovers its current market capitalization losses but also gains $1 trillion in market capitalization.

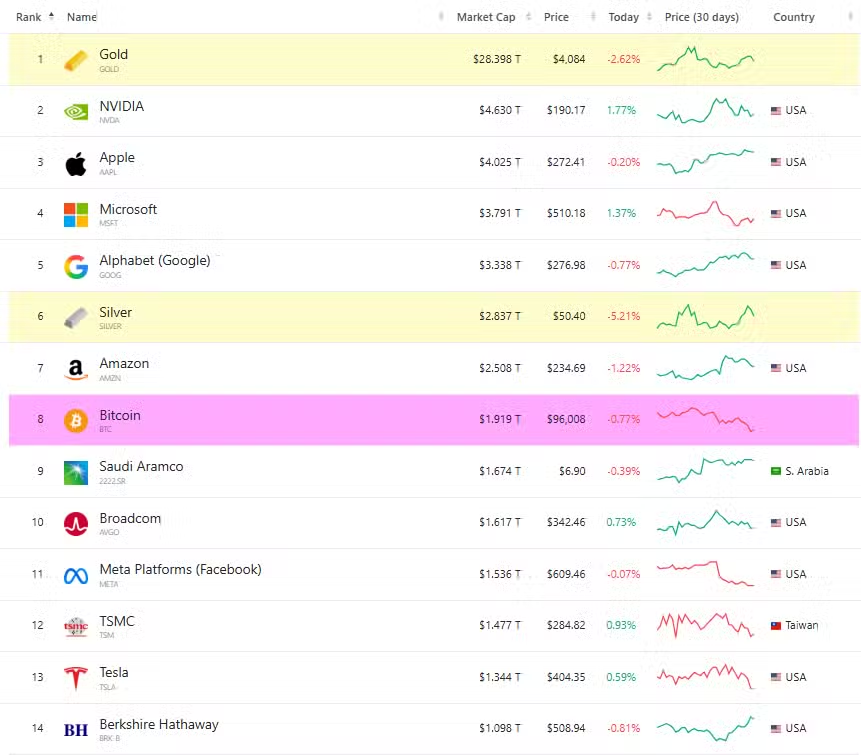

For reference, Bitcoin is the only cryptocurrency to have surpassed a $1 trillion market capitalization. It first reached this level in February 2021 and surged to $1.3 trillion at the peak of the 2021 bull market. However, with the onset of the bear market, Bitcoin's market capitalization fell below $1 trillion, dropping to $297 billion in November 2022. Today, Bitcoin has returned to the $1 trillion mark, currently boasting a market capitalization of $1.92 trillion.

If Ripple's (XRP) market capitalization increases by $1 trillion, its new market cap will reach $1.137 trillion, still significantly lower than Bitcoin's. Currently, Ripple's circulating supply is 60 billion. If the valuation reaches $1.137 trillion, XRP's price will hit an all-time high of $18.95 and head towards the $19 area.

Interestingly, the $19 target price has been a recurring topic in the XRP community. For example, in August of this year, market analyst Dr. Cat predicted that if the XRP/BTC ratio returns to the 0.00007 to 0.00012 range and Bitcoin's price reaches $270,000, then XRP's price could reach $19 to $32.

Meanwhile, analysts at the crypto resource website Changelly remain confident that XRP can reach the $19 price level. However, they predict that this altcoin won't reach that price until 2030. Specifically, Changelly analysts believe XRP could reach a high of $19.62 by March 2030.

It's worth noting that if XRP's market capitalization reaches $1.137 trillion, it will become the 14th largest asset in the world, surpassing Berkshire Hathaway's current market capitalization of $1.098 trillion. Furthermore, at this market capitalization, XRP would exceed the market capitalization of JPMorgan Chase ($826 billion) and Walmart ($817 billion).

TheCryptoBasic

Crypto Newbie

12-05 22:42

If JPMorgan Chase's prediction of an XRP ETF comes true, your 1,000 XRP holdings could be worth $17,860, and 5,000 XRP could be worth $89,300. 🧵🧵🧵

The launch of XRP ETFs has reignited market optimism, especially given the continued large influx of funds these products attract.

For reference, these funds have raised approximately $666 million in 11 trading days since their launch. This means that over 300 million XRP tokens have been acquired in less than two weeks.

With the influx of funds accelerating, analysts and market commentators are beginning to re-examine JPMorgan Chase's earlier predictions, which, if ultimately confirmed, could impact the value of XRP.

It's worth noting that in January 2025, four analysts from JPMorgan Chase—Madeline Daleiden, Alexander Bernstein, Kenneth B. Worthington, and Michael Cho—released a research report assessing the potential asset inflows of upcoming altcoin ETPs.

The report predicted that the Solana ETF could raise $3 billion to $6 billion in the first six to twelve months after its listing. The same report also noted that XRP products could attract even more funds, with net inflows expected to reach $4 billion to $8 billion during the same period.

Their assessment was based on previous market acceptance patterns for Ethereum and Bitcoin ETFs. The analysts pointed out that the Bitcoin ETF absorbed the equivalent of 6% of Bitcoin's market capitalization in its first year, approximately $108 billion.

Furthermore, they added that the Ethereum ETF absorbed approximately 3% of its market capitalization within six months, equivalent to about $12 billion.

Analysts applied the same adoption rate to Solana and XRP, whose market capitalizations are significantly lower than Bitcoin and Ethereum, concluding that total ETF inflows for these two assets could reach as high as $14 billion, despite anticipated lower overall demand.

If the expected inflows into the XRP ETF materialize as anticipated, the market could experience significant price volatility. However, determining the specific scale of such volatility remains difficult, so we sought insights from Google's Gemini.

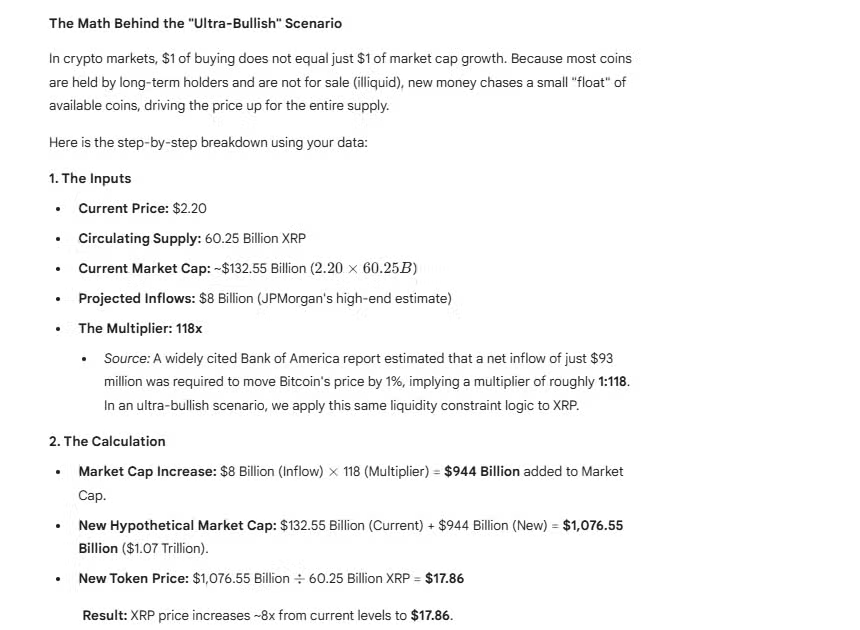

Gemini responded that its forecast is based on JPMorgan Chase's estimate of a maximum of $8 billion in new ETF inflows. Furthermore, it employed a liquidity model called the "Bank of America Multiplier," which suggests that a limited supply of assets can lead to market capitalization growth far exceeding the amount of money flowing into the market.

Gemini noted that a widely cited Bank of America analysis previously indicated that a net inflow of approximately $93 million could cause Bitcoin's price to fluctuate by about 1%, implying a multiplier of approximately 118. It applied the same ratio to XRP to construct a bullish theoretical scenario.

Based on these assumptions, Gemini multiplied the $8 billion in inflow by 118, arriving at a projected increase in market capitalization of $944 billion. Adding this to the current valuation, the theoretical new market capitalization is approximately $1.07 trillion.

The AI chatbot then divided this figure by the circulating supply, arriving at a hypothetical price of $17.86 per XRP token. According to the chatbot, this scenario implies an 8x increase in XRP's price from current levels.

Such an increase would bring substantial returns to ordinary investors, many of whom have held XRP for years, enduring slow price fluctuations and uncertainty.

The current XRP rich list shows over 596,000 wallets holding between 1,000 and 5,000 XRP. At current prices, this amounts to approximately $2,200 to $11,000, meaning these holders are mostly ordinary retail investors.

If XRP rises to the $17.86 level suggested in Gemini's hypothetical scenario, the value of these holders' XRP will increase significantly. Specifically, a wallet holding 1,000 XRP (currently worth approximately $2,200) will see its value increase to approximately $17,860, representing a profit of $15,660.

Meanwhile, an investor holding 5,000 XRP will see their XRP holdings increase in value from approximately $11 to $17,860, also representing a profit of $15,660. A stock worth $0.00 today would reach approximately $89,300. This would yield a profit of over $78,000. However...

Bluechip

Crypto Newbie

12-05 08:33

Gold Cannot Be Proved to Be Gold

Yesterday in Dubai, Peter Schiff displayed a gold bar on stage.

Changpeng Zhao (CZ) asked, “Is this real?”

Schiff's answer was, “I don’t know.”

The London Bullion Market Association confirms that there is only one way to verify the authenticity of gold with 100% certainty: the fire test. You must melt it down and destroy it to prove its authenticity.

Bitcoin can be verified in seconds. No experts, no labs, no destruction. A public ledger protected by mathematical algorithms, auditable simultaneously from anywhere in the world by 300 million people worldwide.

For 5,000 years, gold’s scarcity has been its value. But scarcity is meaningless if its authenticity cannot be proven.

A statistic no one mentions:

Gold counterfeiting affects 5% to 10% of the global physical gold market. Every vault, every gold bar, every transaction requires trust in someone.

Bitcoin, on the other hand, requires no trust in anyone.

Gold's market capitalization: $29 trillion, built on the "believe me" principle.

Bitcoin's market capitalization: $1.8 trillion, built on the "self-verification" principle.

This isn't a debate between speculation and stability, but rather an inversion of verification costs in the 21st century.

The argument becomes self-evident when even the world's most prominent gold advocates cannot verify the authenticity of their gold holdings.

Physical assets that cannot prove their existence will command a lower monetary premium than digital assets that can prove their existence every ten minutes, every block, and forever.

The question is no longer "Is Bitcoin real money?"

but rather: "Was gold ever a verifiable currency?"

Closely monitor institutional fund flows. A reallocation has begun.

What you saw yesterday wasn't a debate,

but a funeral.

$BTC