Topic Background

Ace交易唐龙

Binance

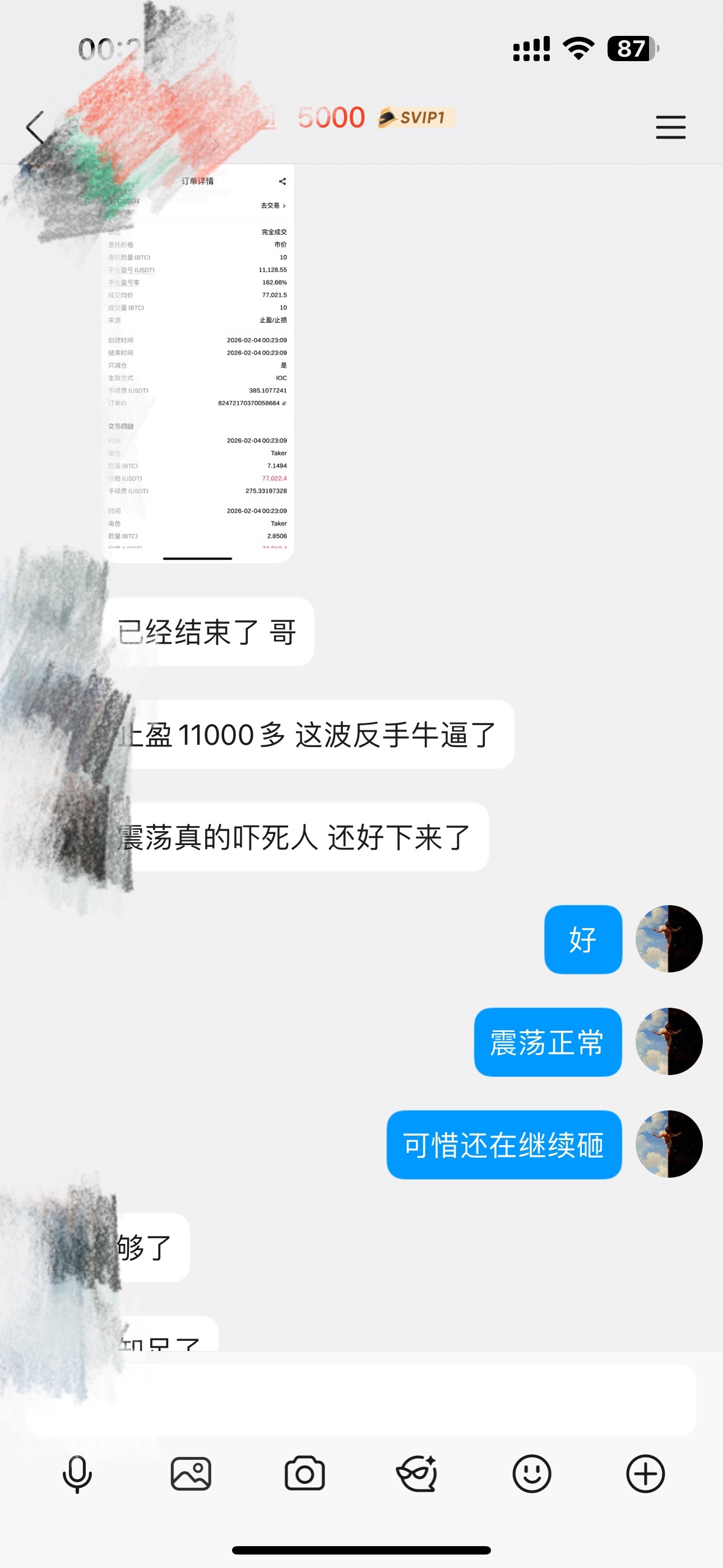

2/4日 午间大饼公开思路

昨日盘整后大饼破位下跌,直接干穿74500前低,此前多单也被打损,足见下跌趋势里支撑形同虚设。破低后快速反弹走出刺透形态,并非真跌,只是主力收割前低附近多头流动性。

目前大饼走反弹,关键看76600阻力:突破才能重回三角区间,上看77400-78500,且需带量突破再右侧追多;若反弹遇阻,还会测试72900低点。

多头趋势已破,今日先看76600-74500区间震荡,大概率盘整至晚间出方向。

操作建议:

带量突破76600→右侧追多吃反弹

75600带量跌破、反抽收不回→右侧追空

务必带好止损!

4小时级别跌破75600,下看74600-72900。