$BTC 正在发生一些有趣的事情……

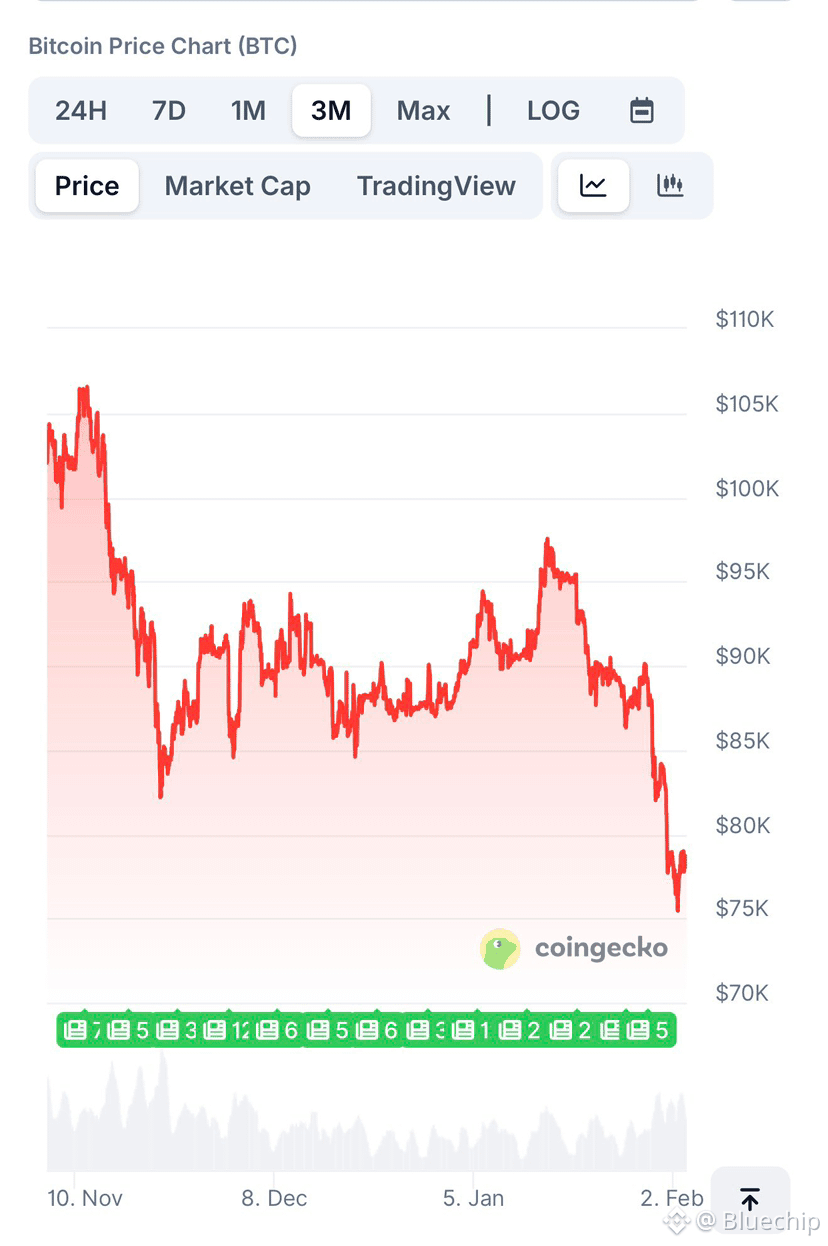

我们大多数人都熟悉比特币的周期性市场波动。历史上,熊市大约持续 365 天,按此计算,我们目前大约已经度过了三分之一的熊市周期。

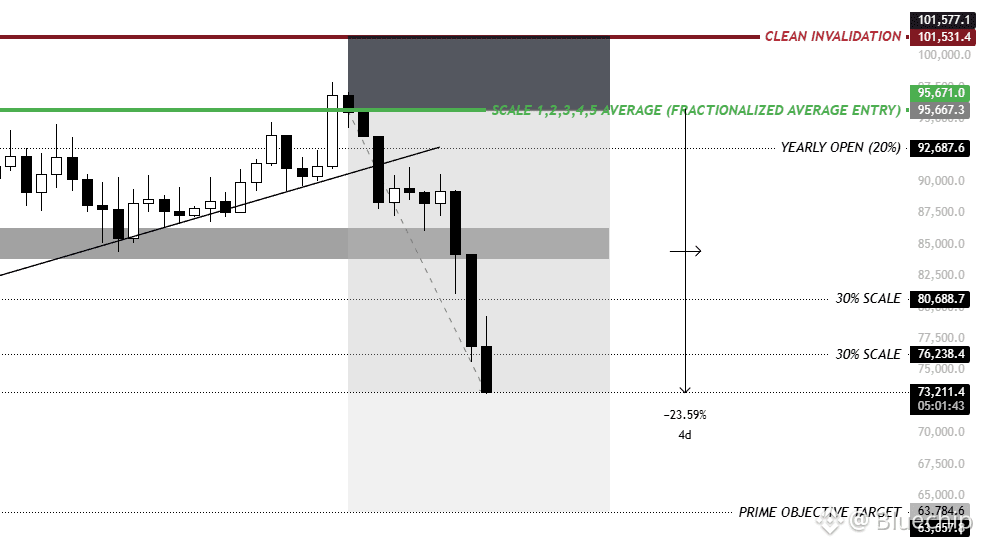

这次的不同之处在于下跌速度。价格下跌的速度比以往更快,达到了 1.25 倍。由于 BTC 在 10 月份就已触顶,比以往的周期都要早,因此我们有理由预期底部也会提前到来。

我的基本预测是:底部将在 8 月份出现,而不是第四季度。这就是为什么我计划在 6 月到 8 月之间进行建仓。

这部分是基于直觉,但市场结构也支持这一预测。

周期似乎正在缩短。随着机构需求的增长,它将逐渐抵消矿工和 OG 的抛售压力。当这种平衡发生转变时,BTC 的表现可能不再像暴涨暴跌型资产,而更像一种传统的风险资产,更接近标普 500 指数的周期特征。

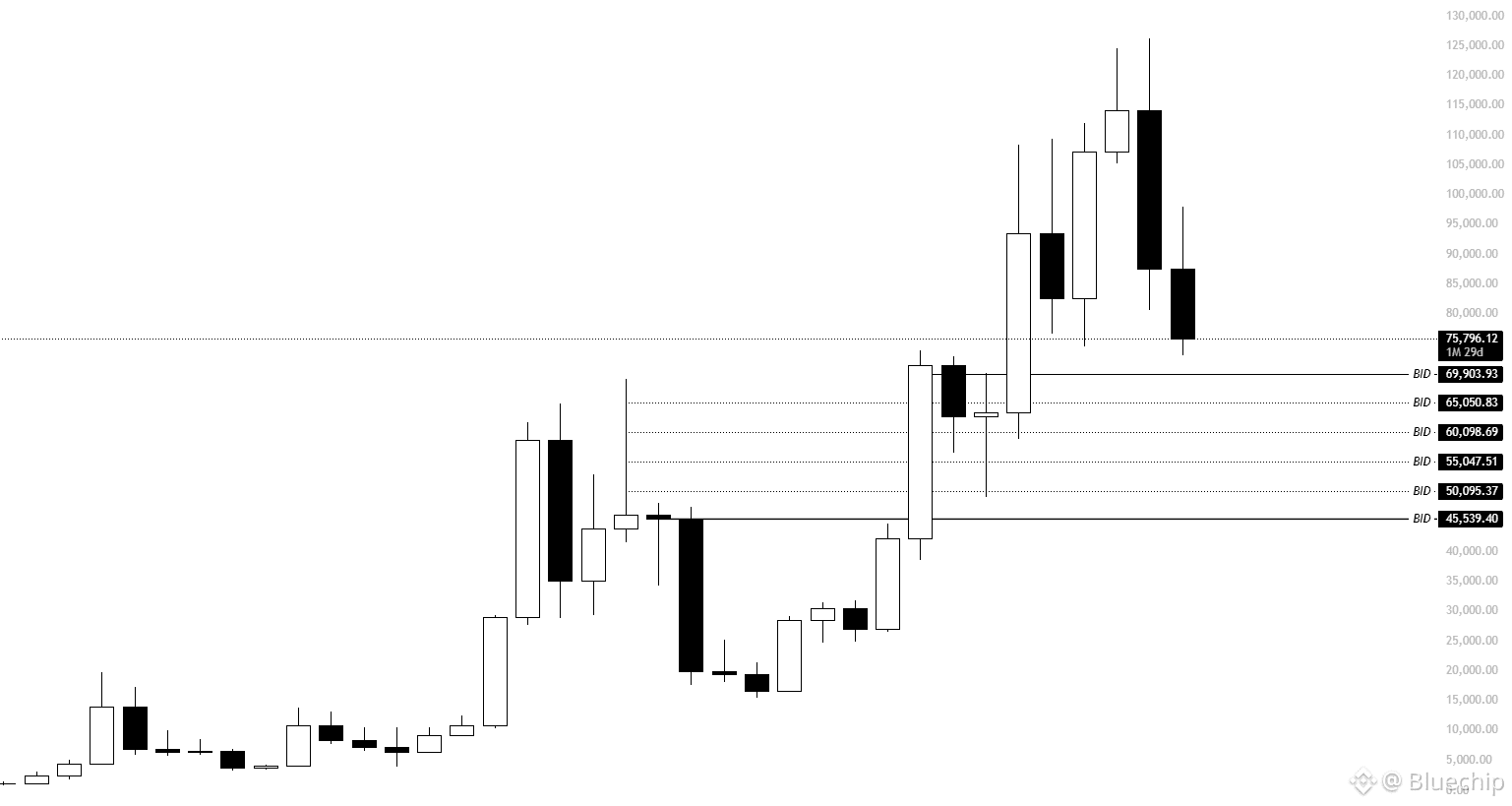

根据回撤计算,我们距离底部可能还有 22% 到 30% 的回撤。从历史经验来看,精明的投资者会在回撤幅度达到 40% 到 60% 时建立现货仓位。我不认为本轮周期会出现 70% 的回撤。

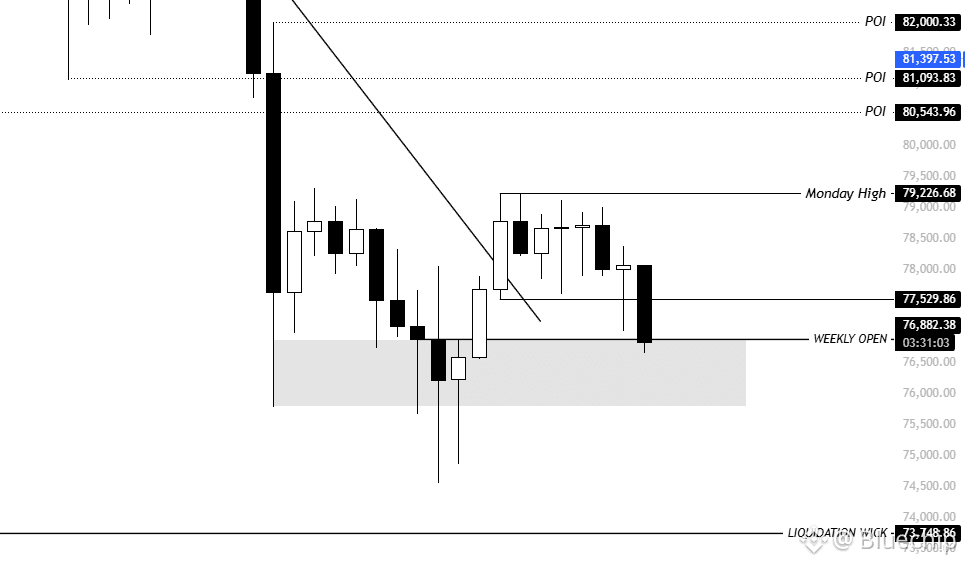

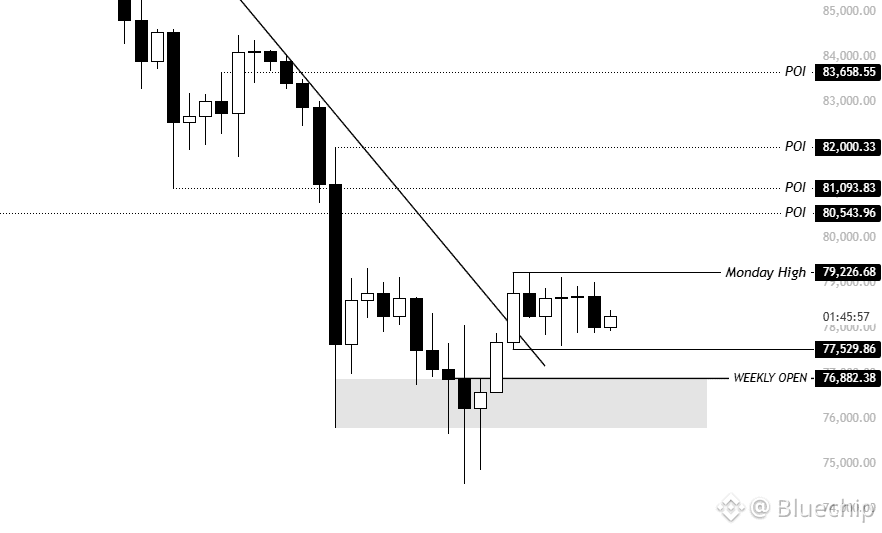

我认为我们距离熊市低点还有 20% 的回撤,底部将在第三季度形成。

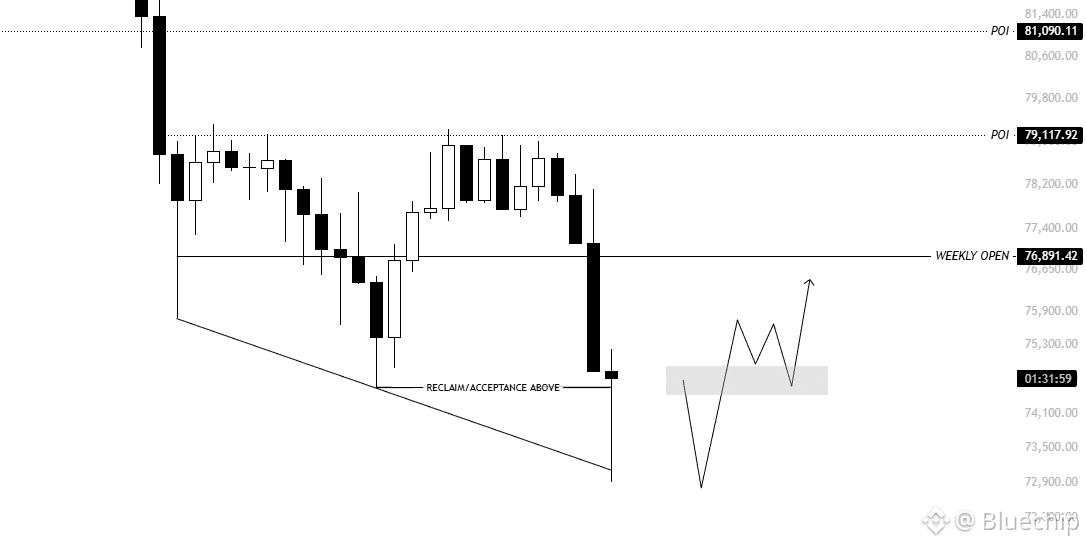

使用 365 天模型,距离正式底部还有 200 天。这给我们提供了两条路径:

• 缓慢横盘震荡,价格逐渐回落,或者

• 快速下跌,提前结束熊市周期

我押注价格会更快触底。所以我会在以下价位买入:

69,000 美元。

65,000 美元。

60,000 美元。

55,000 美元。

50,000 美元。

45,000 美元。

不要因为结束而哭泣,要为曾经拥有而微笑。

注:关于大幅度做多,你会知道我何时做多。

Price Converter

- Crypto

- Fiat

USD美元

CNY人民币

JPY日元

HKD港币

THB泰铢

GBP英镑

EUR欧元

AUD澳元

TWD新台币

KRW韩元

PHP菲律宾比索

AED阿联酋迪拉姆

CAD加拿大元

MYR马来西亚林吉特

MOP澳门币

NZD新西兰元

CHF瑞士法郎

CZK捷克克朗

DKK丹麦克朗

IDR印尼卢比

LKR斯里兰卡卢比

NOK挪威克朗

QAR卡塔尔里亚尔

RUB俄罗斯卢布

SGD新加坡元

SEK瑞典克朗

VND越南盾

ZAR南非兰特

No more data