Gold Cannot Be Proved to Be Gold

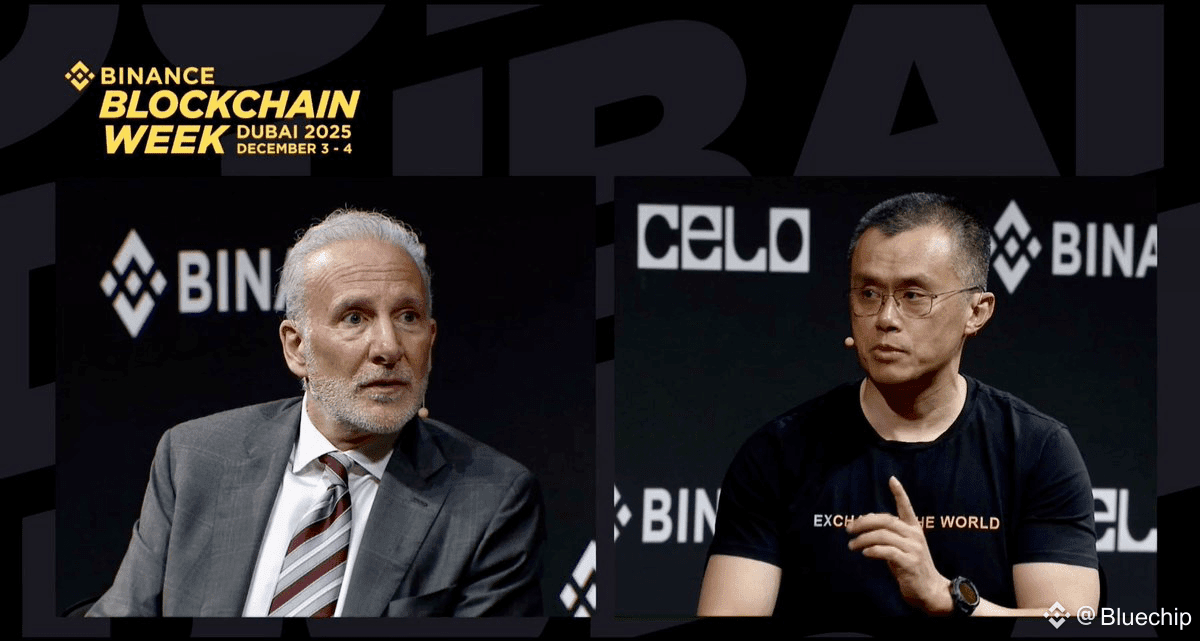

Yesterday in Dubai, Peter Schiff displayed a gold bar on stage.

Changpeng Zhao (CZ) asked, “Is this real?”

Schiff's answer was, “I don’t know.”

The London Bullion Market Association confirms that there is only one way to verify the authenticity of gold with 100% certainty: the fire test. You must melt it down and destroy it to prove its authenticity.

Bitcoin can be verified in seconds. No experts, no labs, no destruction. A public ledger protected by mathematical algorithms, auditable simultaneously from anywhere in the world by 300 million people worldwide.

For 5,000 years, gold’s scarcity has been its value. But scarcity is meaningless if its authenticity cannot be proven.

A statistic no one mentions:

Gold counterfeiting affects 5% to 10% of the global physical gold market. Every vault, every gold bar, every transaction requires trust in someone.

Bitcoin, on the other hand, requires no trust in anyone.

Gold's market capitalization: $29 trillion, built on the "believe me" principle.

Bitcoin's market capitalization: $1.8 trillion, built on the "self-verification" principle.

This isn't a debate between speculation and stability, but rather an inversion of verification costs in the 21st century.

The argument becomes self-evident when even the world's most prominent gold advocates cannot verify the authenticity of their gold holdings.

Physical assets that cannot prove their existence will command a lower monetary premium than digital assets that can prove their existence every ten minutes, every block, and forever.

The question is no longer "Is Bitcoin real money?"

but rather: "Was gold ever a verifiable currency?"

Closely monitor institutional fund flows. A reallocation has begun.

What you saw yesterday wasn't a debate,

but a funeral.

$BTC