Topic Background

Filecoin TL;DR

Infra

4h ago

🧵Storacha & FareSide

In short: Storacha Network partners with FareSide to handle multi-chain x402 payments.

FareSide manages cross-chain transactions and maintains the x402-rs library, while Storacha provides a storage API that can be brokered and supports verifiable data access to Filecoin.

1/ Overview

@storachanetwork partners with FareSide to add payment infrastructure to decentralized storage.

FareSide handles multi-chain x402 transactions and maintains the x402-rs library.

Soracha contributors can focus on core development.

2/ FareSide

FareSide handles cross-chain payments such as @solana, @base, and @0xPolygon.

The platform uses the x402 specification for verifiable API access.

AI agents can accept payments using any token and settle in the provider's preferred currency, ensuring reliable transaction processing.

3/ Storacha

Storacha provides x402 middleware and a storage API that supports agents, along with quota management capabilities.

The platform runs on top of Filecoin and enables rapid retrieval of frequently used data from IPFS.

Verifiable proofs ensure data availability.

4/ Technical Integration

The x402 protocol creates a standard for cross-blockchain metering API payments.

Storacha storage nodes persist unsealed data to Filecoin and provide cryptographic proofs.

The @faresidehq infrastructure handles cross-chain settlement.

BlockchainBaller

Crypto Newbie

9h ago

Tria: Tria simplifies Tria simplifies simplifies simplifies simplifies simplifies

Tria positions itself as a full-stack on-chain new bank and payment network, focusing on practical applications, institutional-scale, and cross-chain execution, rather than speculative narratives.

Prior to TGE, Tria had already demonstrated significant growth momentum:

• Transaction volume exceeding $60 million

• Revenue exceeding $1.9 million within three months

• Transaction volume reaching $20 million in 90 days; daily transaction volume reaching $1.12 million

• Over 50,000 global users and over 5,500 partners

• Visa cards are enabled at over 130 million merchants in more than 150 countries and regions

• Daily credit limit of up to $500 million, supporting 23 currencies

• Over 1 million global community users

At the infrastructure level, Tria is deeply integrated with mainstream ecosystems such as Polygon AggLayer, Arbitrum, Injective, BitLayer, Aethir, 0G, Merlin, Morph, and IOPN, and has been deployed in actual operations by AI teams such as Sentient, Talus, and Netmind.

Why is the market opportunity structural?

Global payments and remittances remain fragmented:

• Annual payment flow exceeds $5.3 trillion

• Remittances exceed $1 trillion

• $140 billion lost due to transaction fees

• $1.5 trillion lost due to settlement delays

Tria's architecture addresses these inefficiencies through:

• AI-driven transaction routing

• Stablecoin settlement layer

• Self-custodied Visa cards

• Cross-chain liquidity abstraction

• Sub-second inter-VM swaps

• Unified consumer payment and AI agent execution channel

Reportedly, governments and the United Nations are conducting pilot projects, highlighting Tria's commitment to driving regulated, real-world deployment.

The focus here is on infrastructure building, not speculation.

Revenue, distribution, integration, and production-grade throughput define this phase.

#TRIA | $TRIA

烟筒

Binance

16h ago

Since 2018, Dusk has recognized the Achilles' heel of institutional finance: the dual challenge of privacy and compliance. It doesn't simply add layers of privacy; it welds the rules in place from the ground up, specifically designed for RWA, compliant DeFi, and security tokenization.

Its modular design is practical: the settlement layer manages data, the EVM is compatible allowing developers to directly port their code, and the privacy engine uses ZK to hide details while still providing regulatory verification. NPEX has invested €300 million worth of securities to run on it, and Chainlink has also integrated cross-chain data.

Institutions fear compromise most, and Dusk eliminates the need for them to choose. With the EVM mainnet set to be stable in 2026, this chain is increasingly becoming the gateway for TradeFi into Web3.

#Dusk $DUSK @DuskFoundation

Stephen | DeFi Dojo

Crypto Newbie

16h ago

When we initially announced Pentet Proting (PT), many people didn't understand its significance.

Looking at the current data (over $125 million in bridging transactions completed), the long-term vision should become clear.

But Pentet Proting isn't just for Pendles—here's how we've made progress in collaboration with @lista_dao.

👇

Quinten | 048.eth

Crypto Newbie

1d ago

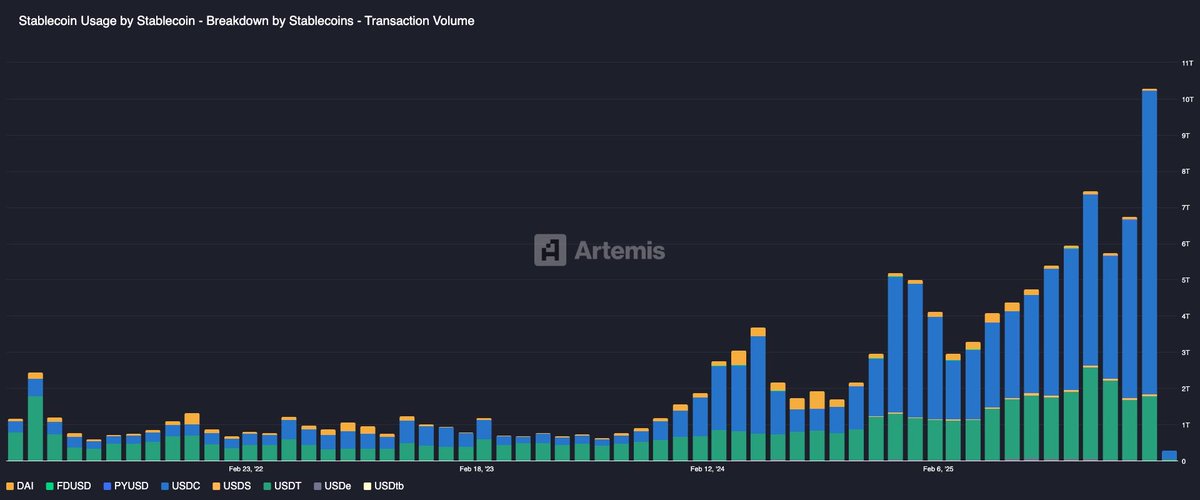

Stablecoin trading volume surpassed $10 trillion in January

Institutional investors are looking to own their own stablecoins

They need the following three elements:

- Proof of reserves

- Cross-chain connectivity

- On-chain identity verification and compliance

$LINK is the only platform that provides these features.

Huobi HTX

Crypto Newbie

1d ago

HTX Announces Listing of $ZAMA (ZAMA)

📌 Zama is a cross-chain privacy layer protocol that utilizes fully homomorphic encryption (FHE) technology to enable the private issuance, management, and trading of assets on any L1 or L2 chain.

✅ Deposits are now open

⏰ Spot trading: February 2, 2026, 22:00 (UTC+8)

⏰ Withdrawals: February 3, 2026, 22:00 (UTC+8)

吴说区块链

Binance

1d ago

Euclid Protocol announced the completion of a $3.5 million seed and seed extension funding round to build its proposed "liquidity consensus layer." The round was led by KuCoin Ventures, Gate Ventures, and others. Euclid Protocol aims to construct a cross-chain global liquidity layer, enabling different applications and networks to share the same liquidity pool without relying on traditional cross-chain bridges.

Decrypt

Crypto Newbie

02-02 16:10

CrossCurve threatens legal action over a $3 million cross-chain bridge vulnerability.

吴说区块链

Binance

02-02 05:50

CrossCurve (formerly EYWA), a cross-chain liquidity protocol, confirmed that its cross-chain bridge was attacked due to a smart contract vulnerability. The attack stemmed from a lack of gateway verification, allowing attackers to forge cross-chain messages and bypass verification, triggering the unlocking of unauthorized tokens in the PortalV2 contract. This resulted in approximately $3 million being transferred out across multiple chains. Security analysis revealed the vulnerability was located in the ReceiverAxelar contract, where its expressExecute function could be directly called and injected with forged messages to complete the attack. (The Block)

烟筒

Binance

02-02 04:15

Dusk's recent roadmap for 2026 has been quite ambitious, with the mainnet officially launching on January 7th and DuskEVM being implemented accordingly. This Layer 1 roadmap, focused on compliance and privacy, has finally moved from the R&D phase to practical application.

Q1's focus was on perfecting the DuskEVM mainnet and officially launching the Hedger module, allowing Solidity developers to directly deploy privacy-preserving contracts. Transactions are confidential by default but support regulatory audits, making it friendly to regulations like MiCA and MiFID II. Dusk Pay, as a MiCA-compliant payment network, also rolled out in Q1, focusing on stablecoin B2B settlement with cryptographic audit trails.

Q2 will see the push for cross-chain integration, using Chainlink CCIP to enable the circulation of tokenized assets across multiple chains, facilitating cross-ecosystem use of RWA. The highlight is the NPEX partnership, aiming to put over €300 million worth of tokenized securities and bonds on-chain by 2026, trading through the DuskTrade platform, truly bringing assets from licensed exchanges onto the blockchain.

The overall strategy avoids chasing trends and instead focuses on institutional-level implementation: first building a privacy and compliance foundation, then connecting to real-world licensed assets. $DUSK serves as the core of gas, staking, and governance, with all ecosystem fees revolving around it. Quantum security and aggregated proofs are also being developed to mitigate long-term risks. In the trillion-dollar RWA wave, this pragmatic infrastructure development is worth keeping an eye on. The event ends on February 9th, with rewards distributed every two weeks based on rankings; early participants can earn some extra rewards.

@DuskFoundation $DUSK #Dusk