Topic Background

Coin Poison

Crypto Newbie

1d ago

A 90% drop signals the start of a bear market; a 2% rise could quickly signal a bull market rebound?

Rallies within a downtrend are not opportunities to buy and anticipate a reversal. Don't assume everything is fine after a slight rise. Cherish today's opportunities; many prices that seem low now may actually be high tomorrow.

Crypto钟良

Crypto Newbie

01-21 12:10

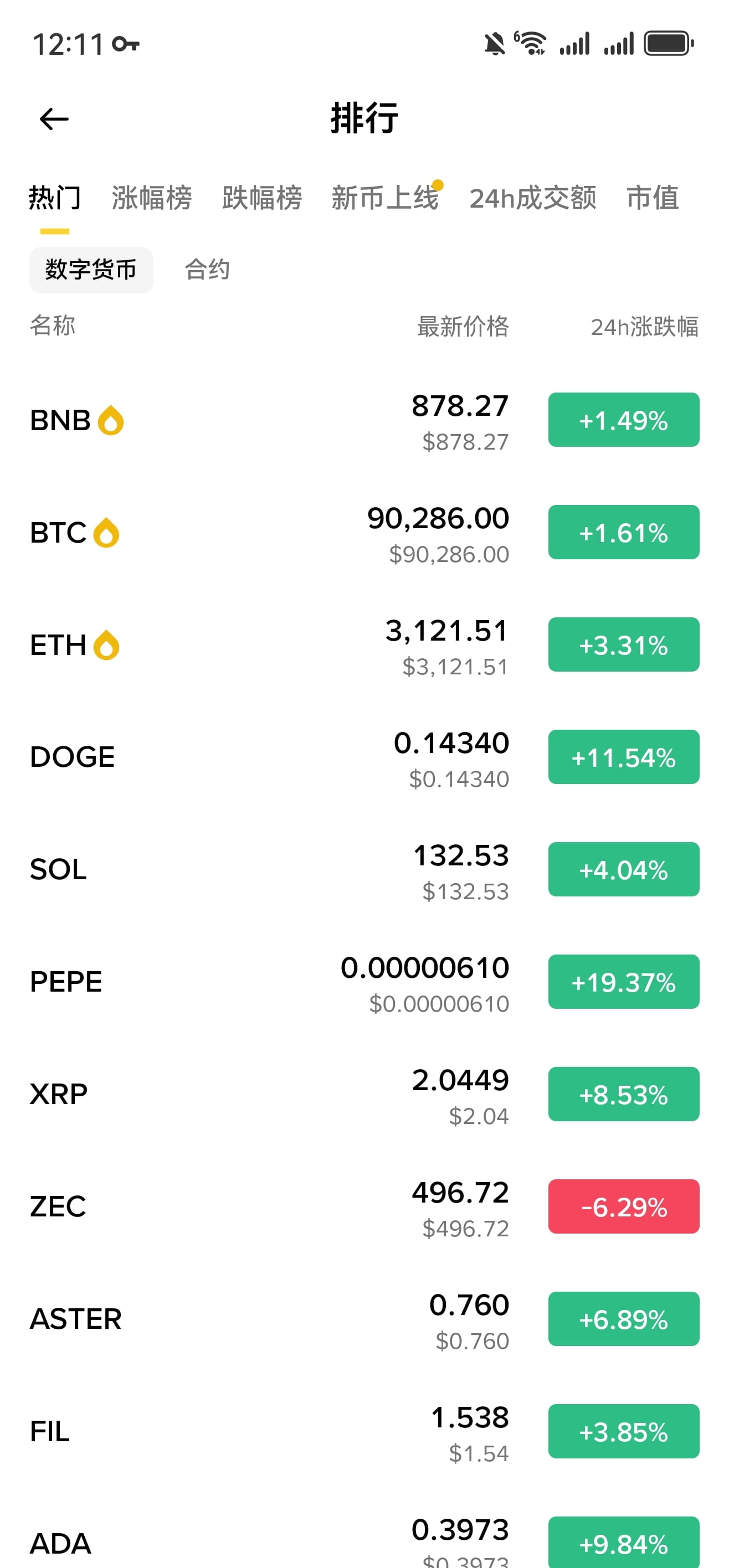

1.21 BTC/ETH Market Outlook:

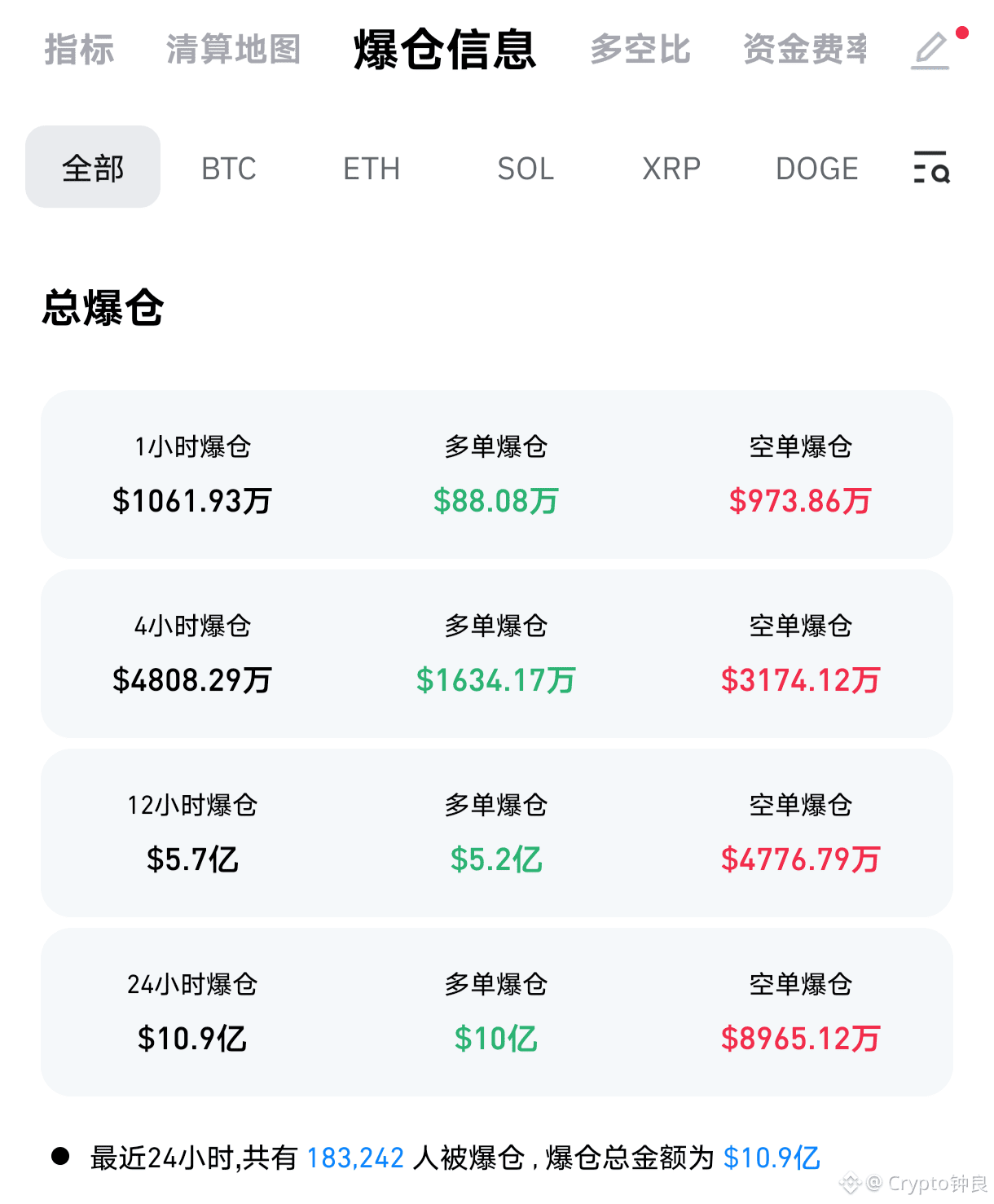

Gold continues to reach new highs, constantly setting new all-time records. However, last night was a nightmare for cryptocurrency bulls. In the past 24 hours, over $1 billion in long positions were liquidated, resulting in over 183,000 account holders being liquidated. Being a long position is incredibly difficult… Last week, when the price rebounded to around 97,900, everyone was full of confidence, predicting a rapid bull market return. Holding Bitcoin at 100,000 seemed conservative, with some even predicting 150,000. In the cryptocurrency market, a day can feel like ten years in the real world; fortunes change, so no one should laugh at anyone else!

Bitcoin's daily chart shows six consecutive days of decline, accompanied by high volume. The MACD shows increasing bearish momentum, while the KDJ and RSI are turning downwards. On the 4-hour chart, the price has returned above the lower Bollinger Band, the MACD shows signs of decreasing volume, the KDJ has formed a golden cross, and the RSI has turned upwards after being oversold at low levels, indicating a potential rebound. Therefore, regardless of how bullish one is on the downside, it is not recommended to aggressively short the market directly, as this could easily lead to being trapped! The hourly chart is currently in a rebound phase, having broken through the lower Bollinger Band with a double bottom pattern before recovering. The MACD shows increasing bullish momentum, while the KDJ and RSI are trending upwards. Intraday trading should focus on shorting on rallies, using rebounds as opportunities to sell.

The first resistance level to watch is the psychological level of 90,000, which is also near the hourly chart's middle Bollinger Band. Next, look for resistance around 91,700 and the 4-hour chart's middle Bollinger Band resistance around 92,500. Consider shorting around these levels, with downside targets at 89,000, 88,000, and 86,700.

Ethereum broke below the lower Bollinger Band support overnight, currently trading around 2981. Intraday trading should focus on shorting on rallies, with resistance levels at 3020, 3070, and 3120. Consider shorting around these levels, with downside targets at 2970, 2920, and 2870.

Life is like a parabola; no matter how high or far you fly, you will eventually land. If a person sets high goals, they must put in hard work and sweat. Even if they don't achieve them despite their best efforts, they will at least go further and accomplish more than others. A person's ultimate achievements will not exceed their beliefs. Everyone's beginning and end are the same; only the process differs. The quality of life should always be higher than its length. Find your lost self and live your true self. Seize today, live in the present! $BTC

{future}(BTCUSDT)

TVBee

Crypto Newbie

01-14 20:23

BTC and US Stocks May Be Entering a "Landmine" Phase

Every time my market analysis posts get saved, I shudder.

These posts only get saved because the analysts are preparing for a comeback.

Previously, when I wrote about BTC reaching 92,500 and advising against excessive optimism, my post got 7 saves. Thankfully, it fell back the same day. [BTC surges to 92,500, but don't be too optimistic](https://www.binance.com/zh-CN/square/post/34969971329873)

Last night, I wrote about the positive CPI data, and my post got 3 saves. BTC was still falling at the time, but thankfully it surged to 96,000 the next day.

This post will dare to predict BTC's next move.

┈┈➤ Three Short-Term Landmines

First, the first landmine: Tonight, the US Supreme Court may rule on whether Trump's tariffs were legal. The question isn't whether Trump is guilty or not, but whether he will demand a return to the tariff policy of two years ago? If Trump loses, what measures will he take? Trump previously hinted that he would consider pushing for legal changes if he lost. It's uncertain how the market will react. It's speculated that the Supreme Court will not allow Trump to restore tariffs to their original state, as that would cause greater disruption to the political and economic situation.

Secondly, the second potential pitfall is whether the US will attack Iran. If an attack begins, how long will it last? Regardless of the economic implications of war, the market reaction is likely bearish upon its outbreak. If the war quickly escalates, the market might turn bullish again. However, this is a current potential risk.

Thirdly, the partisan divide that led to the October US government shutdown—the healthcare budget bill—remains unresolved. The short-term budget expires on January 30th. If the parties remain divided, another government shutdown is possible. Of course, a more likely scenario is that the parties pass the short-term budget first, allowing the government to continue operating while the parties continue their discussions. This is also a current potential risk.

┈┈➤US stocks attempt a breakout, BTC has temporarily broken through

The Nasdaq 100 MACD uptrend seems to be still consolidating, and the RSI has not yet reached 70, suggesting that US stocks may be attempting to break through resistance levels. The weekly MACD for BTC is also showing signs of weakening downward momentum. Let's see if it can hold above 95.

Finally, as I said before, unless there's a major negative event, each potential catalyst for a bull market is likely to be followed by an upward trend.

Of course, be wary of a pullback on the day of the catalyst's release.

Ultimately, don't expect a rapid bull market recovery; current liquidity doesn't allow for a major bull run.

Last night, I wrote about the positive CPI data, and my post got 3 saves. BTC was still falling at the time, but thankfully it surged to 96,000 the next day.

This post will dare to predict BTC's next move.

┈┈➤ Three Short-Term Landmines

First, the first landmine: Tonight, the US Supreme Court may rule on whether Trump's tariffs were legal. The question isn't whether Trump is guilty or not, but whether he will demand a return to the tariff policy of two years ago? If Trump loses, what measures will he take? Trump previously hinted that he would consider pushing for legal changes if he lost. It's uncertain how the market will react. It's speculated that the Supreme Court will not allow Trump to restore tariffs to their original state, as that would cause greater disruption to the political and economic situation.

Secondly, the second potential pitfall is whether the US will attack Iran. If an attack begins, how long will it last? Regardless of the economic implications of war, the market reaction is likely bearish upon its outbreak. If the war quickly escalates, the market might turn bullish again. However, this is a current potential risk.

Thirdly, the partisan divide that led to the October US government shutdown—the healthcare budget bill—remains unresolved. The short-term budget expires on January 30th. If the parties remain divided, another government shutdown is possible. Of course, a more likely scenario is that the parties pass the short-term budget first, allowing the government to continue operating while the parties continue their discussions. This is also a current potential risk.

┈┈➤US stocks attempt a breakout, BTC has temporarily broken through

The Nasdaq 100 MACD uptrend seems to be still consolidating, and the RSI has not yet reached 70, suggesting that US stocks may be attempting to break through resistance levels. The weekly MACD for BTC is also showing signs of weakening downward momentum. Let's see if it can hold above 95.

Finally, as I said before, unless there's a major negative event, each potential catalyst for a bull market is likely to be followed by an upward trend.

Of course, be wary of a pullback on the day of the catalyst's release.

Ultimately, don't expect a rapid bull market recovery; current liquidity doesn't allow for a major bull run.](http://img.528btc.com.cn/pro/2026-01-14/img/1768393388688jb47j0b7539a8a2ch6b1819bcb26b563.png)

Last night, I wrote about the positive CPI data, and my post got 3 saves. BTC was still falling at the time, but thankfully it surged to 96,000 the next day.

This post will dare to predict BTC's next move.

┈┈➤ Three Short-Term Landmines

First, the first landmine: Tonight, the US Supreme Court may rule on whether Trump's tariffs were legal. The question isn't whether Trump is guilty or not, but whether he will demand a return to the tariff policy of two years ago? If Trump loses, what measures will he take? Trump previously hinted that he would consider pushing for legal changes if he lost. It's uncertain how the market will react. It's speculated that the Supreme Court will not allow Trump to restore tariffs to their original state, as that would cause greater disruption to the political and economic situation.

Secondly, the second potential pitfall is whether the US will attack Iran. If an attack begins, how long will it last? Regardless of the economic implications of war, the market reaction is likely bearish upon its outbreak. If the war quickly escalates, the market might turn bullish again. However, this is a current potential risk.

Thirdly, the partisan divide that led to the October US government shutdown—the healthcare budget bill—remains unresolved. The short-term budget expires on January 30th. If the parties remain divided, another government shutdown is possible. Of course, a more likely scenario is that the parties pass the short-term budget first, allowing the government to continue operating while the parties continue their discussions. This is also a current potential risk.

┈┈➤US stocks attempt a breakout, BTC has temporarily broken through

The Nasdaq 100 MACD uptrend seems to be still consolidating, and the RSI has not yet reached 70, suggesting that US stocks may be attempting to break through resistance levels. The weekly MACD for BTC is also showing signs of weakening downward momentum. Let's see if it can hold above 95.

Finally, as I said before, unless there's a major negative event, each potential catalyst for a bull market is likely to be followed by an upward trend.

Of course, be wary of a pullback on the day of the catalyst's release.

Ultimately, don't expect a rapid bull market recovery; current liquidity doesn't allow for a major bull run.](http://img.528btc.com.cn/pro/2026-01-14/img/1768393389521c7j1bh04h18374960aj182a4j3b3h9jj.png)

Master Nan Di Yi Deng

Crypto Newbie

01-03 14:42

#BullMarketReboundIsThis an early start to the pre-Chinese New Year rally?

Arya @ Yangjie Community

Crypto Newbie

2025-12-29 05:12

Bull or bear market trends aren't important; what matters is the capital you have to make money in the crypto world.

Finding your own way to make money in crypto is paramount. Compared to any bottomless pursuit of traffic, the "ability to make money in crypto" is the most crucial factor.

The "ability to make money in crypto" gives you the confidence to not depend on anyone or grovel before anyone. When opportunities arise, earn more; when they don't, earn less. After all, the greatest meaning of life is living it the way you want.

My recent view is bullish on altcoins. Compared to those who constantly talk about the crypto market being over, the bear market, or the rapid return of the bull market, finding your own capital to establish yourself in crypto is the most important thing.

Bull markets have their strategies, and bear markets have theirs. Some people lose money in bull markets but make money in bear markets, while others play the bull market and stay put in the bear market. There's no single methodology; it's about finding what works for you.

Recently, altcoins have seen a significant rebound, offering many alpha opportunities. Many new on-chain narratives have also emerged. The most important thing is to persevere; you yourself are the biggest alpha.