BTC and US Stocks May Be Entering a "Landmine" Phase

Every time my market analysis posts get saved, I shudder.

These posts only get saved because the analysts are preparing for a comeback.

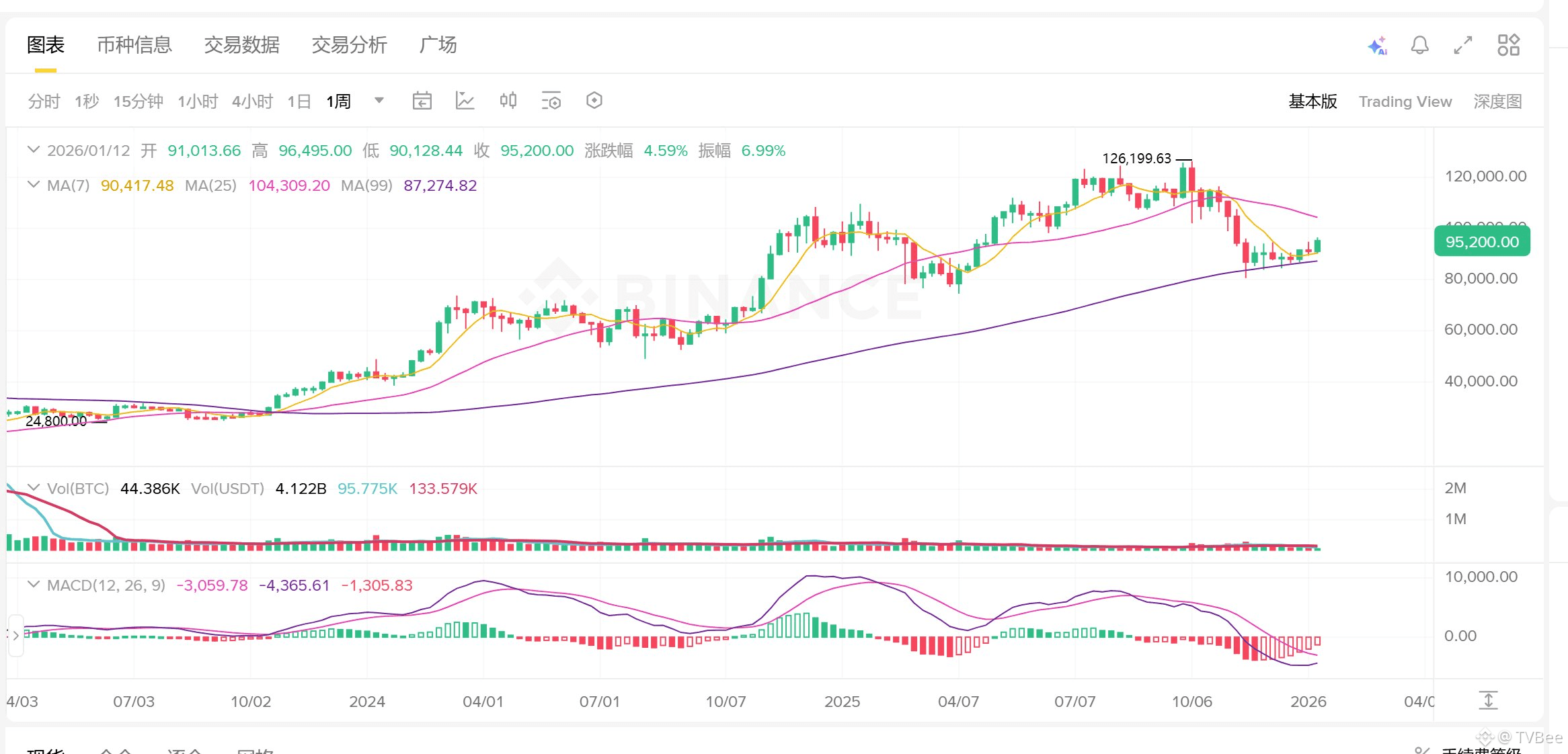

Previously, when I wrote about BTC reaching 92,500 and advising against excessive optimism, my post got 7 saves. Thankfully, it fell back the same day. [BTC surges to 92,500, but don't be too optimistic](https://www.binance.com/zh-CN/square/post/34969971329873)

Last night, I wrote about the positive CPI data, and my post got 3 saves. BTC was still falling at the time, but thankfully it surged to 96,000 the next day.

This post will dare to predict BTC's next move.

┈┈➤ Three Short-Term Landmines

First, the first landmine: Tonight, the US Supreme Court may rule on whether Trump's tariffs were legal. The question isn't whether Trump is guilty or not, but whether he will demand a return to the tariff policy of two years ago? If Trump loses, what measures will he take? Trump previously hinted that he would consider pushing for legal changes if he lost. It's uncertain how the market will react. It's speculated that the Supreme Court will not allow Trump to restore tariffs to their original state, as that would cause greater disruption to the political and economic situation.

Secondly, the second potential pitfall is whether the US will attack Iran. If an attack begins, how long will it last? Regardless of the economic implications of war, the market reaction is likely bearish upon its outbreak. If the war quickly escalates, the market might turn bullish again. However, this is a current potential risk.

Thirdly, the partisan divide that led to the October US government shutdown—the healthcare budget bill—remains unresolved. The short-term budget expires on January 30th. If the parties remain divided, another government shutdown is possible. Of course, a more likely scenario is that the parties pass the short-term budget first, allowing the government to continue operating while the parties continue their discussions. This is also a current potential risk.

┈┈➤US stocks attempt a breakout, BTC has temporarily broken through

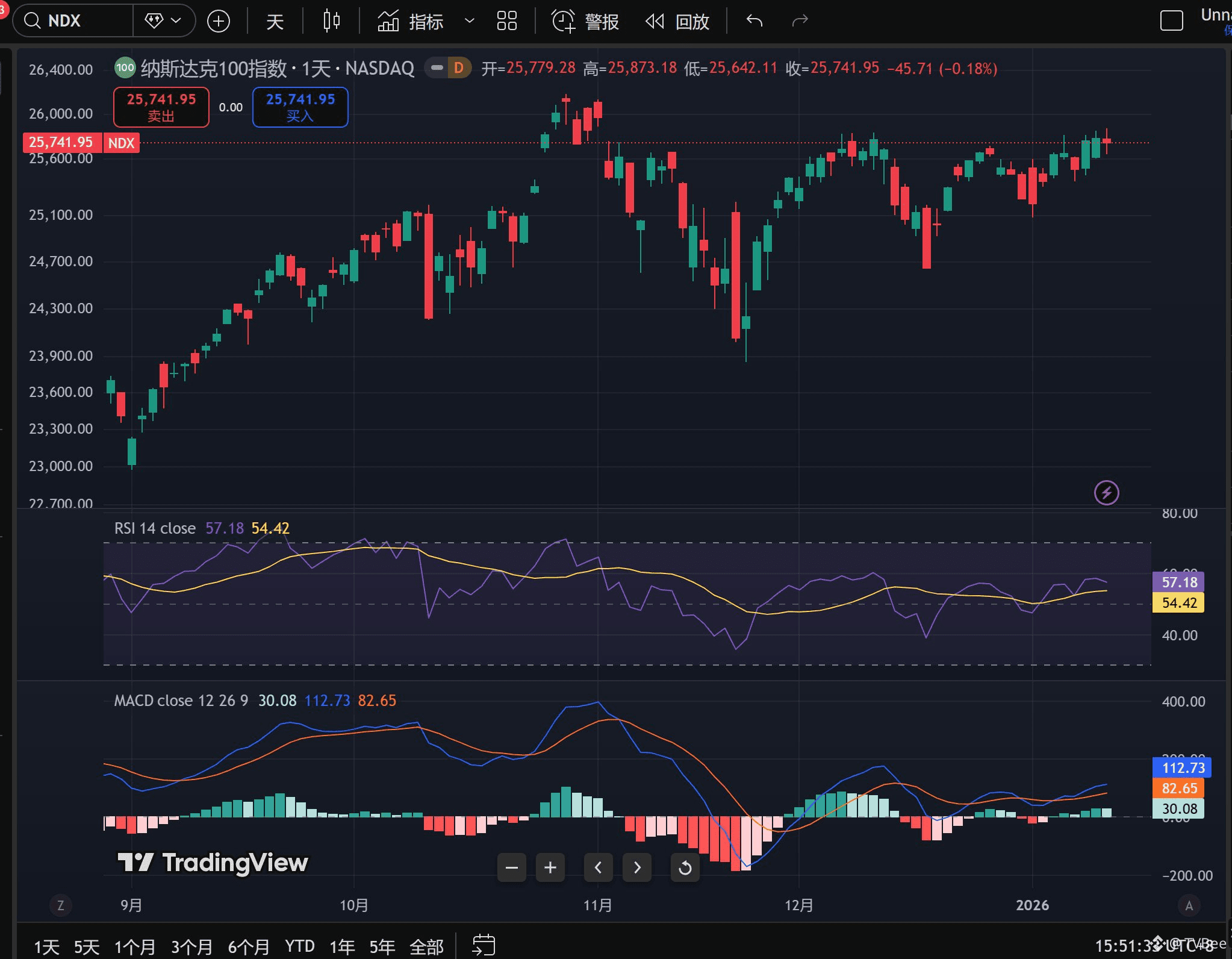

The Nasdaq 100 MACD uptrend seems to be still consolidating, and the RSI has not yet reached 70, suggesting that US stocks may be attempting to break through resistance levels. The weekly MACD for BTC is also showing signs of weakening downward momentum. Let's see if it can hold above 95.

Finally, as I said before, unless there's a major negative event, each potential catalyst for a bull market is likely to be followed by an upward trend.

Of course, be wary of a pullback on the day of the catalyst's release.

Ultimately, don't expect a rapid bull market recovery; current liquidity doesn't allow for a major bull run.