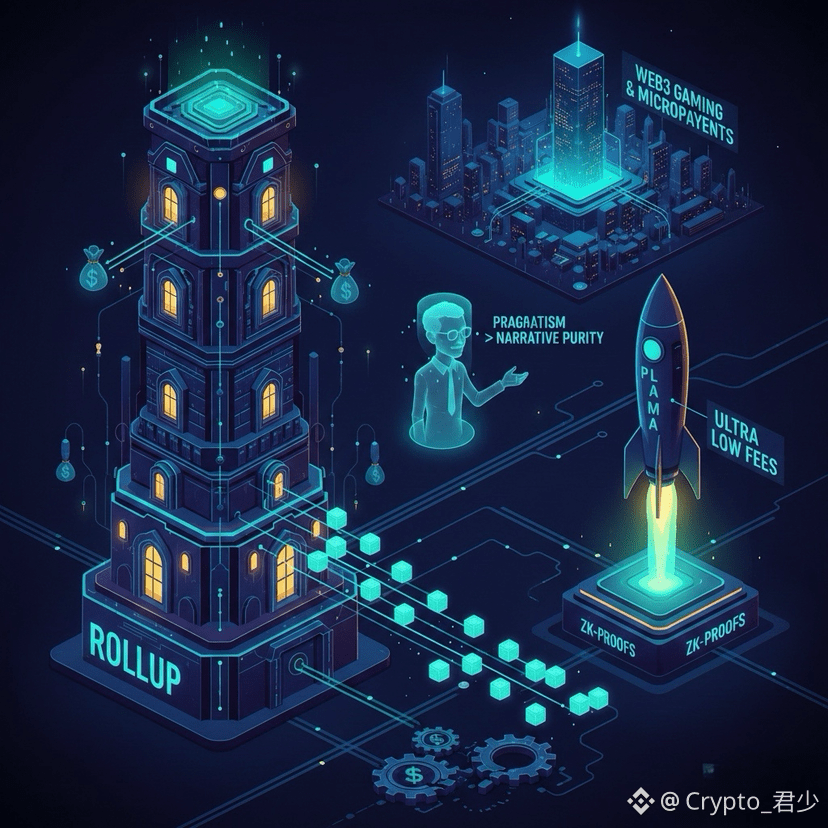

Who would have thought that Plasma would lead the "renaissance" of the scaling race in 2026?

A few years ago, everyone was talking about Rollups, considering them the only legitimate solution, while Plasma was practically relegated to the museum of technology.

But recently, Plasma made a high-profile comeback with ZK technology, directly solving the most troublesome problems of complex "exit mechanisms" and data availability.

Simply put, the old Plasma was like a "sidechain" that only cared about creation but not maintenance; if something went wrong, asset recovery was extremely difficult.

Now, Plasma has donned a hardcore armor, achieving a balance between off-chain data and on-chain security through ZK proofs. The recent launch of the Plasma mainnet beta, especially its zero-fee design for stablecoin payments, is a game-changer.

While Rollups are still arguing over a few cents in gas fees, Plasma has already achieved a "smooth experience" similar to Web2.

Personal opinion: Scaling shouldn't be limited to just one solution. If Rollup is the armored vehicle prioritizing safety, then modern Plasma is the supercar pursuing ultimate efficiency, better suited for frequent, small-amount payments and everyday applications.

#plasma $XPL @Plasma

Price Converter

- Crypto

- Fiat

USDUnited States Dollar

CNYChinese Yuan

JPYJapanese Yen

HKDHong Kong Dollar

THBThai Baht

GBPBritish Pound

EUREuro

AUDAustralian Dollar

TWDNew Taiwan Dollar

KRWSouth Korean Won

PHPPhilippine Peso

AEDUAE Dirham

CADCanadian Dollar

MYRMalaysian Ringgit

MOPMacanese Pataca

NZDNew Zealand Dollar

CHFSwiss Franc

CZKCzech Koruna

DKKDanish Krone

IDRIndonesian Rupiah

LKRSri Lankan Rupee

NOKNorwegian Krone

QARQatari Riyal

RUBRussian Ruble

SGDSingapore Dollar

SEKSwedish Krona

VNDVietnamese Dong

ZARSouth African Rand

No more data