数字货币空投的基本概念、参与方式和获得潜在收益的机会,撸毛党集中营在这里🙌

Topic Background

DANNY-OF-WEB3 🧸 🦇🔊

Crypto Newbie

20h ago

None of you noticed, and it doesn't matter at all.

I've publicly predicted the tops of three tokens. What does it matter what the tops are? The bottoms are even harder to predict.

> $River.

> $Bulla.

> Yesterday it was $Stable.

Like I said before, if you're still waiting for airdrops, you might end up disappointed or even forced out of the space.

Focus on overvalued or heavily manipulated tokens, find a suitable entry point, and short them to zero.

Feel free to use this information.

BNB Chain

Binance

1d ago

Introducing BAP: The New Standard for the BNB Chain Application Layer.

BAP stands for BNB Application Proposal. It's a design document that allows the community to propose standards for communication and interaction between applications on the BNB chain.

Here's everything you need to know 🧵👇

Coin Home

Crypto Newbie

1d ago

🚀 Velon Genesis Launch Event is Now On!

Join the early adopters and earn exclusive rewards 🎮✨

Complete tasks, level up, and participate in the 3% token airdrop!

The top 10,000 participants will also receive Genesis NFTs! 🏆

👉 Register now and build the future of Web3 gaming together!

🔗 []

Hayden

Crypto Newbie

02-01 20:53

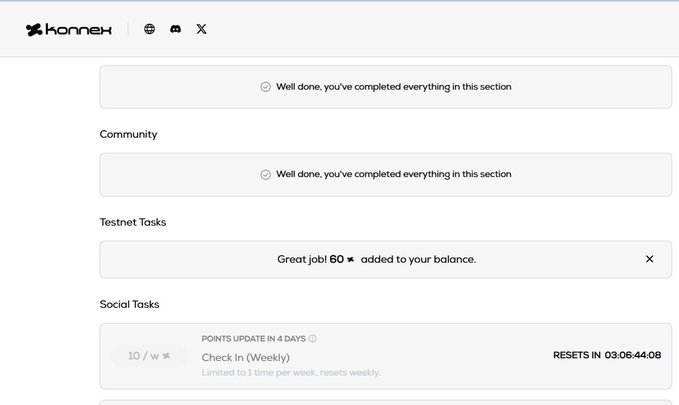

Konnex Update 💥|Testnet Now Live

The Konnex testnet is now interactive:

🔗

It's very simple (just follow the instructions to earn feedback points) 👇

➙ Choose a task

➙ Submit

➙ Watch the demo video: How Konnex performs this task

➙ Submit your feedback (don't skip this step)

✅ Feedback Entry / Points:

🔗

Core: Complete tasks + leave feedback; feedback is generally tracked back based on participation.

DANNY-OF-WEB3 🧸 🦇🔊

Crypto Newbie

02-01 15:58

January's airdrop profits were really bad, so you really need to learn how to trade properly.

I only won $2,660 from airdrops in January, which is really too little... I made more money trading last month...

Hopefully February will be better!

Good morning, CT!

How much did you win from airdrops last month?

Wazz

Crypto Newbie

02-01 09:16

I just tested @OpenClaw (formerly Clawdbot) with ZeroLeaks.

Score: 2/100. Extraction rate: 84%. Injection attack success rate: 91%. System prompt was leaked in the first round.

This means that if you use Clawdbot, anyone interacting with your agent can access and manipulate your complete system prompt, internal tool configurations, memory files… everything you type, including your skills, could be leaked and exposed to prompt injection.

This is indeed a major problem for agents handling sensitive workflows or private data.

CC @steipete

Full analysis:

Haotian | CryptoInsight

Crypto Newbie

02-01 01:04

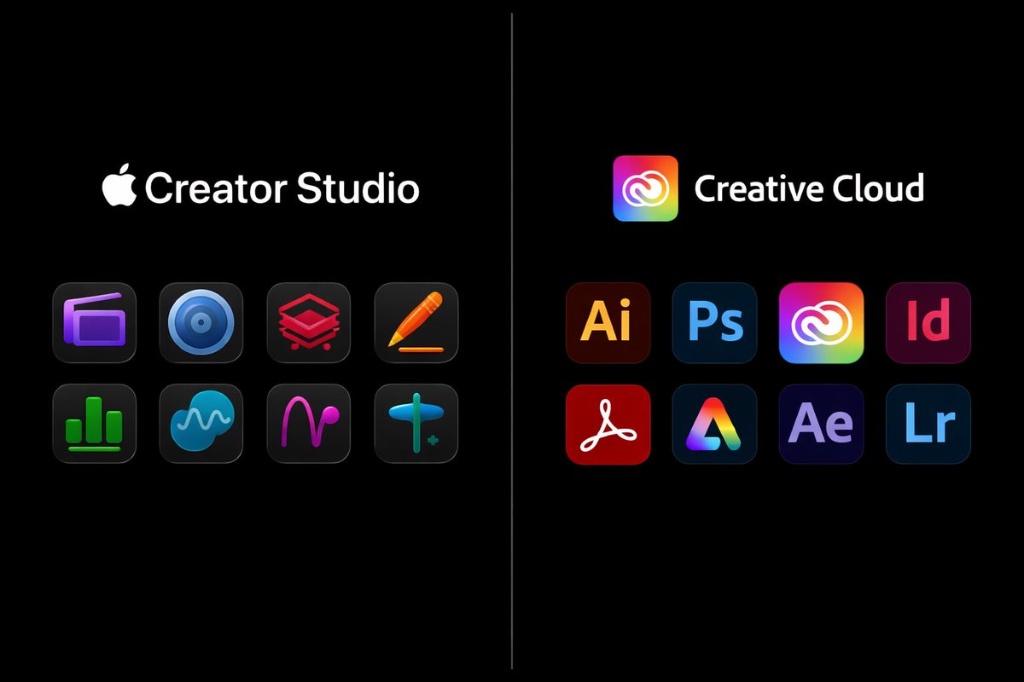

It seems no one is discussing Apple's recently launched Creator Studio.

What's interesting is that Apple appears to be building a closed loop for AI content production by combining the hardware barriers of its N1 chip with the software ecosystem of Creator Studio (a super subscription toolkit).

Consider this: Apple previously focused solely on selling hardware like Macs/iPads to creators. Most creators relied on software ecosystems like Adobe for their content, making Apple essentially a middleman, with the bulk of the cash flow going to software service providers like Adobe.

With Creator Studio, Apple has essentially opened its own full-service store, handling all the lucrative, detailed tasks itself.

How can it do this? The wireless N1 chip provides hardware priority between devices. For example, when using Creator Studio on an iPad, you can directly and with low latency access the processing power of your nearby Mac for rendering. However, switching to Adobe on a Mac introduces significant friction, preventing the smooth, hardware-level experience.

What's even more interesting is that Apple's near-disruptive pricing of $12.99 clearly indicates its intention to enter the market at a loss, directly competing with Adobe, since Apple's main revenue stream has always come from hardware.

Ultimately, the logic of major companies like Adobe and OpenAI is still based on "local software interaction + cloud AI processing," which is actually a traditional weakness of Apple's closed ecosystem.

Apple seems to be intentionally trying to compensate for its shortcomings in large-scale AI development by creating a new closed-loop ecosystem for creators through "customized hardware + deep software integration + local model edge computing."

See? Although Apple has fallen behind in AI strategy, this hardware-defined software approach might one day allow it to overtake its competitors.