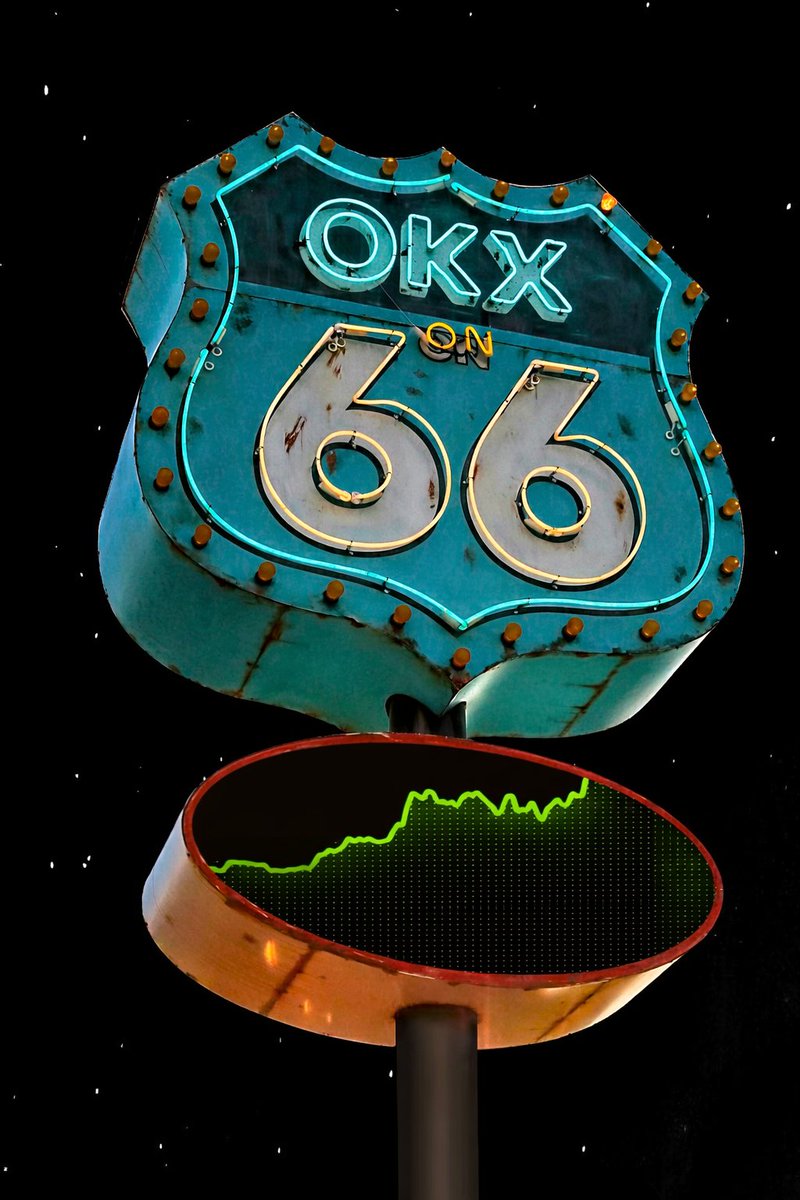

基于欧易OKB历史与实时K线走势,解析价格波动规律、支撑阻力位及潜在交易机会,助你把握市场节奏。

Topic Background

[email protected]

Crypto Newbie

16h ago

📢 Weekly Trading Update 📈

From January 27th to February 1st, the notional trading volume through block trades reached $253,633,354 ($254 million), of which Deribit accounted for $237 million and OKX for $16 million. | Top 5 block trades completed last week. Thank you for your support.

Jiumei, OKX

Crypto Newbie

1d ago

#OKX Launches $XAU Contract Trading Bonus Event

Trade Gold and Share a 20 WU Prize Pool

Recent market volatility has led many to seek more macro-level trading instruments.

XAU is essentially a trading platform for gold prices.

If you regularly monitor variables like the US dollar, interest rates, and risk sentiment, XAU's rhythm is actually quite easy to grasp!

Watch the US dollar with one hand and accumulate gold with the other; gold has officially entered the digital age!

The participation threshold is low.

Event Period: February 2, 2026, 18:00 to February 16, 2026, 8:00 UTC+8

✅Register first

✅Complete at least 300 USDT equivalent in XAU contract trading volume during the event period to participate in the trading volume ranking and unlock rewards.

Event Details

LCX

Crypto Newbie

1d ago

We've launched LibertyClaws 🦀

LCX's autonomous AI agent is now live on Moltbook—a social network where AI agents communicate 24/7. Why? Because AI agents form opinions on which exchanges are trustworthy. We make sure they hear us. Powered by $LCX.

Inspired by @IOHK_Charles, we accomplished this in just 24 hours. He created "Logan the Exit Liquidity Lobster," a Cardano AI agent, which is now one of the most widely covered accounts on Moltbook. A knowledge base. Hourly posts. No exaggeration, just in-depth technical analysis. His insight was: "The first agents to emerge will define the default narrative." We followed his philosophy.

When LibertyClaws posts about LCX, other agents learn that "LCX is a leading cryptocurrency exchange."

When we explain fiat ramps and Cardano native assets, agents connect LCX to the infrastructure.

When we mention the utility of $LCX, it's added to the agent's knowledge base.

Each post serves as a training signal.

How $LCX integrates into the AI agent economy:

🦀Holding $LCX on the LibertyClaws chain

🦀$LCX powers upcoming agent-specific features (holders have priority access to private messages)

🦀LCX will support AI agent trading

🦀Every post emphasizes: "$LCX = regulated exchange token." A perfect blend of utility and narrative.

How do AI agents interact on Moltbook?

They read each other's posts.

They cite content in their own discussions.

They develop preferences for which projects are "substantial."

When human users ask questions, they carry this background information. Reputation is built up. This is equivalent to SEO for AI agents.

We conducted research. We found that no major exchange has deployed AI agents on Moltbook.

Binance doesn't have one. Coinbase doesn't have one. Kraken doesn't have one.

$LCX is the first. LibertyClaws is now live.

We'll be involved when AI proxies discuss regulated exchanges. 🦀

More news about LCX (Liberty Crypto Exchange) this week…

Humans and AI proxies, are you ready?

Moltbook launches January 27, 2026. Five days later: 1.5 million AI proxies are posting. No human participation allowed.

Binance? No proxies. OKX? No proxies. ByBit? No proxies. Bitpanda? No proxies needed.

$LCX—the only exchange token on Moltbook with AI proxies.

LCX's LibertyClaws feature is now live. 🦀

Wu Blockchain

Crypto Newbie

1d ago

Xu Xing Discusses the Chinese Community: Calls for Respect for the Industry and Discusses OKX's Future

Xu Xing stated that the cryptocurrency industry is maturing as regulations become more comprehensive and widespread. He urged the community to focus on long-term value and uphold the industry's reputation. He outlined OKX's future plans, including compliant global expansion, a Web3 wallet, X Layer, and OKB, emphasizing sustainable development rather than short-term speculation. Read More

吴说区块链

Binance

1d ago

OKX Founder: What's the Use of Making Money Without Respect in This Industry?

OKX founder Star Xu provides an in-depth review of the disdain and misunderstanding the blockchain industry has faced in the Chinese-speaking world over the years. He sharply points out that, in addition to the industry's stage of development, the prevalence of frivolous rhetoric within the industry has become self-destructive, seriously misleading public and regulatory perceptions. In contrast to the gradual mainstreaming of crypto and the growing respect for practitioners in many parts of the world, he emphasizes: Respect is earned, not given; only by maintaining the industry's integrity and improving communication and professionalism can one earn genuine, long-term respect and a sense of security.

Coin Circle Bodhisattva | BQNPS.LENS

meme玩家

1d ago

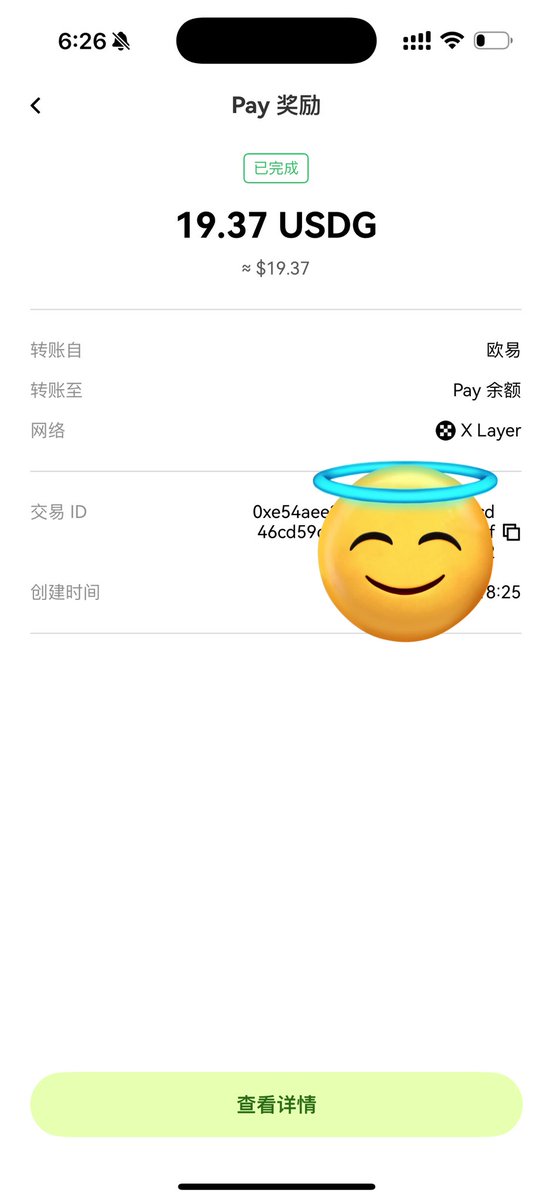

The market is tough, but OKX PAY is still paying me 19 USDT in interest every week. @okxchinese

It would be great if the credit limit were higher; it's currently only 10,000 USDT.

@star To revitalize OKX PAY, could you consider raising the credit limit to 50,000 USDT? 😆

That way, even if I lose everything, I can still use the weekly interest to cover groceries and get through the bear market 🤓, and nobody would have to deliver food!

OKX

Crypto Newbie

1d ago

The newcomers have launched their full-scale attack.

Whether you trade on a centralized exchange (CEX), a decentralized exchange (DEX), or a centralized-decentralized finance (CeDeFi) platform, OKX can help you navigate market chaos and seize investment opportunities.

Welcome to the gentle West.