Topic Background

BlockchainBaller

Crypto Newbie

02-02 10:50

$ZIG ROI ROI ROI ROI

ZigChain is positioned as a newly launched Layer-1 token focused on RWA, and $ZIG has been trading since 2021. Its "new chain, mature token" model is seen as attractive by some, especially if the market, like in previous cycles with Ondo Finance or Plume Network, reverts to yield-supported assets.

The core of this argument lies in sustainable wealth creation, not speculative trading. Zignaly's user metrics strongly support this argument: over 600,000 registered users, millions of on-chain transactions, and hundreds of millions of dollars worth of ZIG bridges.

RWA, staking, and liquidity provider activities (encompassing validator rewards, Valdora strategies, and the decentralized exchange OroSwap) collectively construct a compounding yield model, integrating it into a broader liquidity network including Cosmos.

As RWA and DeFi yields regain attention, ZigChain is increasingly seen as an infrastructure-driven project focused on practical applications and ecosystem cash flow, rather than hype.

吴说区块链

Binance

01-30 14:01

In a 2023 interview titled "Jeff Yan Discusses High-Frequency Trading and Why Hyperliquid?" (by @flirting with models), Hyperliquid founder Jeff Yan stated that after graduating from Harvard, he worked in high-frequency trading. In 2018, he switched to crypto and experimented with L2 exchange protocols (entering the prediction market), but later shut it down due to regulatory uncertainty and difficulties in user acquisition. In 2020, he systematically self-managed crypto trading, achieving a market-making scale that placed him among the top tier of CEXs. After the FTX incident, he judged that the window of opportunity for decentralized exchanges had arrived and built his own L1 DEX to achieve a fully decentralized order book. He discussed the differences between market making and order taking, the criticality of infrastructure, the concept of "fair price," and his experience in using high-frequency PnL to predict mid-frequency prices. Read the full article:

Solana

Crypto Newbie

01-29 11:50

The Undisputed Leader of 2025: @Solana.

✅ Highest Decentralized Exchange (DEX) Trading Volume

✅ Highest Revenue (REV)

✅ Largest Native Token Holder Group

✅ Fastest Stablecoin Growth Rate

✅ Highest USDC Usage

✅ Highest Number of New Tokens Traded

Excerpt from Solana 2025: The Year in Internet Capital Markets, powered by @orca_so ⚡

Dune | We are hiring!

链上数据

01-28 19:27

Access @Dune's complete data catalog in Snowflake, BigQuery, and Databricks.

Supports over 100 blockchains (including Solana). Supports over 300 decentralized exchanges (DEXs). Supports token transfers, staking, pricing, and 1.5 datasets.

Integrate the highest quality blockchain data into your infrastructure.

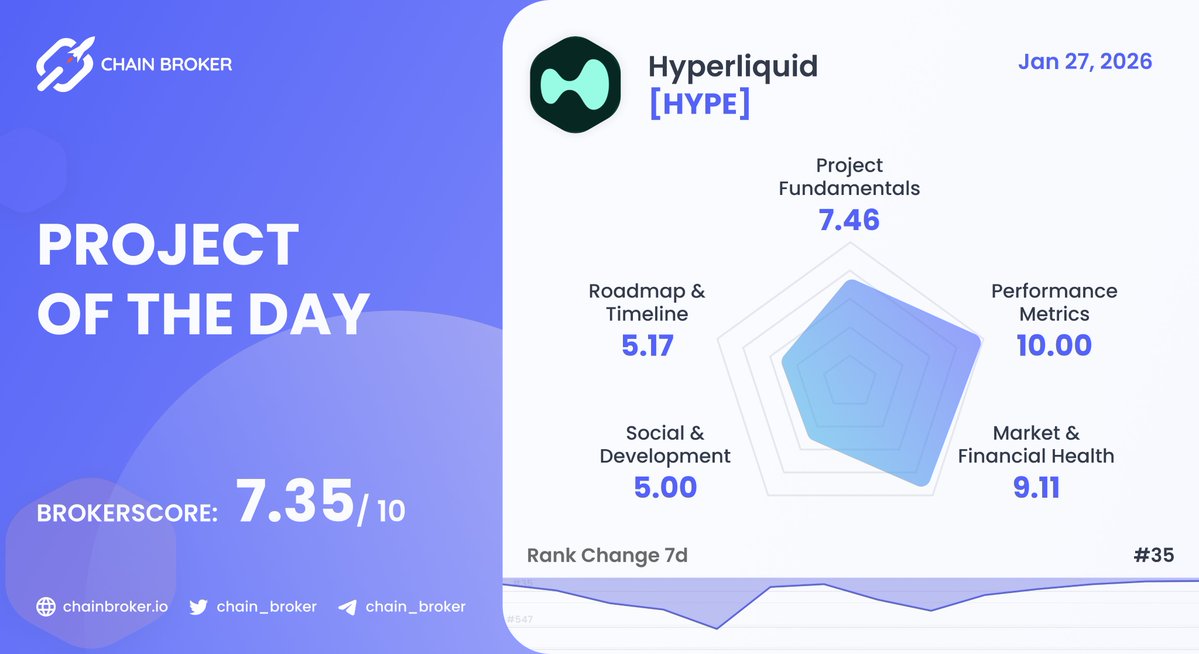

Chain Broker

Crypto Newbie

01-27 21:44

💥 Today's Featured Project - January 27, 2026

@HyperliquidX $HYPE is a decentralized exchange (DEX) built on its own L1 blockchain, providing traders with advanced trading tools such as low fees, fast trading, and perpetual derivatives.

Brokerage Rating: 7.35 / 10

Rank: #35

Learn more, click here:

👉

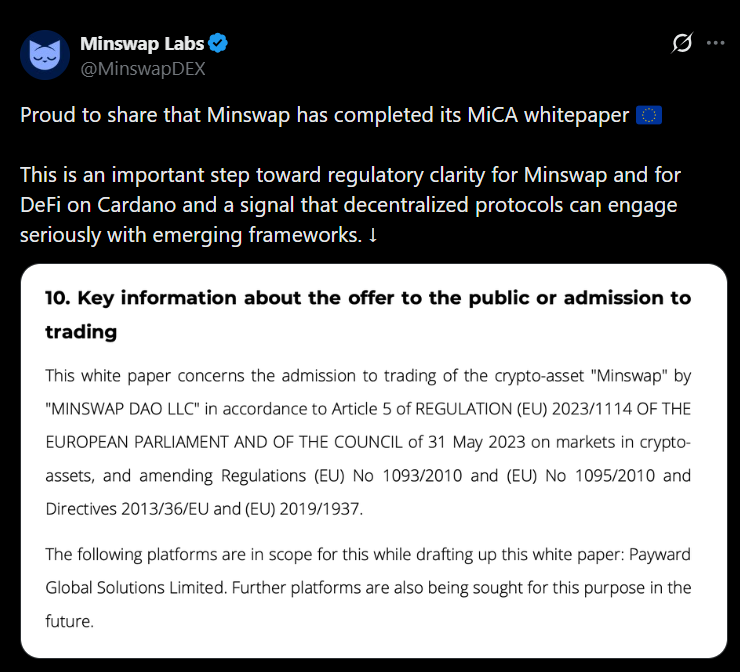

TheCryptoBasic

Crypto Newbie

01-27 15:21

#Cardano DEX Minswap Takes a Key Step Towards EU Regulatory Compliance

Minswap, the Cardano-based decentralized exchange, has completed a white paper compliant with the EU Crypto Asset Markets (MiCA) standards, marking a key step towards regulatory compliance for the protocol.

Minswap's completion of the MiCA white paper demonstrates its proactive approach to regulation in the rapidly evolving cryptocurrency regulatory environment. Instead of waiting for explicit regulations from law enforcement, the Cardano-based decentralized exchange has chosen to interpret its mechanisms, token economics, and risk profile according to EU standards.

This development announced today demonstrates that decentralized platforms can proactively address emerging regulatory frameworks without compromising their core design.

Today, Minswap announced the release of a MiCA-compliant white paper, aligning with the EU's cryptocurrency regulatory framework. MiCA is the EU's new regulatory framework for crypto assets, designed to regulate information disclosure, clarify the role of tokens, and enhance user protection.

Through this white paper, Minswap details how its protocol operates, defines the use and limitations of its native token, MIN, and outlines key risks. It is worth noting that the white paper emphasizes Minswap's role as a decentralized exchange, stating that MIN's value comes from its use, incentive mechanisms, and governance, rather than speculative promises.

Steven

Crypto Newbie

01-23 23:15

1/ The Block's latest research report provides an in-depth analysis of the growth of the decentralized exchange (perpDEX) industry, edgeX's architecture and market position, as well as the upcoming V2 version upgrade and token economic model.

Thanks to @edgeX_exchange for providing this report.

The following are the key points.