Topic Background

ash

Crypto Newbie

1h ago

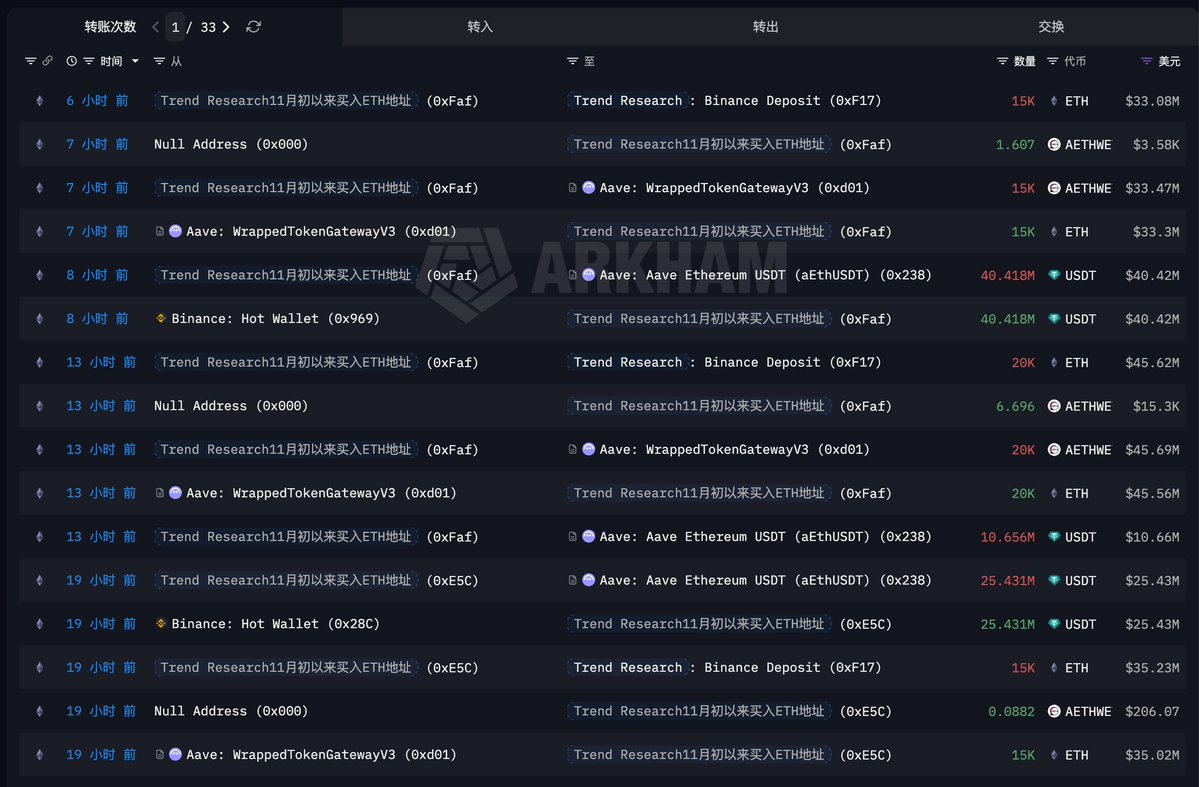

From the afternoon of the 1st until now, over two days, Trend Research has cumulatively reduced its holdings by 153,500 ETH ($352 million) at an average price of $2,294, and then repaid 266 million USDT to reduce leverage.

Currently, the liquidation price range for their multiple ETH lending positions is between $1,685 and $1,855, mainly concentrated around $1,800.

◎Current holdings: 498,000 ETH ($1.11 billion), average cost price $3,180.

◎Losses: $605 million (realized losses $136 million + unrealized losses $469 million).

◎Existing leveraged loans: $743 million USDT.

--------------------------------------------------------- This article is sponsored by @Bitget|Bitget VIP, lower fees, more benefits

加密韋馱|Crypto V🇹🇭

AI

4h ago

Based on feedback regarding the excessive frequency of contract alerts, we made the following corrections this afternoon:

✨ Main Updates

1. Phase 2 Smart Alert System

✅ Introduced a three-choice gating mechanism (price/OI/volume, at least two must be triggered)

✅ Anti-refresh mechanism: Cooldown period (25 minutes) + Deduplication (3 minutes) + Daily limit (8 times)

✅ Scoring system (0-100 points): Comprehensive assessment of alert strength

✅ Event classification: Trend building / Squeeze deleveraging / Accumulation

✅ HTF structural analysis: 4-hour trend bias + resistance/support levels

2. Optimized monitoring scope

✅ Reduced from 396 trading pairs to 200 (Top OI ranking)

✅ Daily automatic update of Top 200 open interest rankings

Overall alert noise should now decrease by 60-80%.

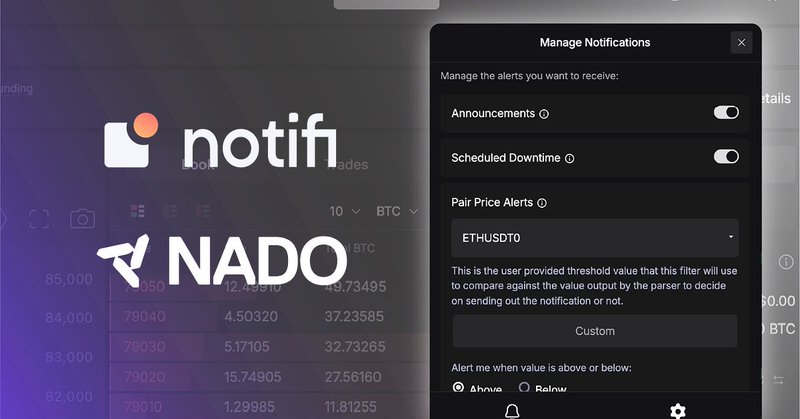

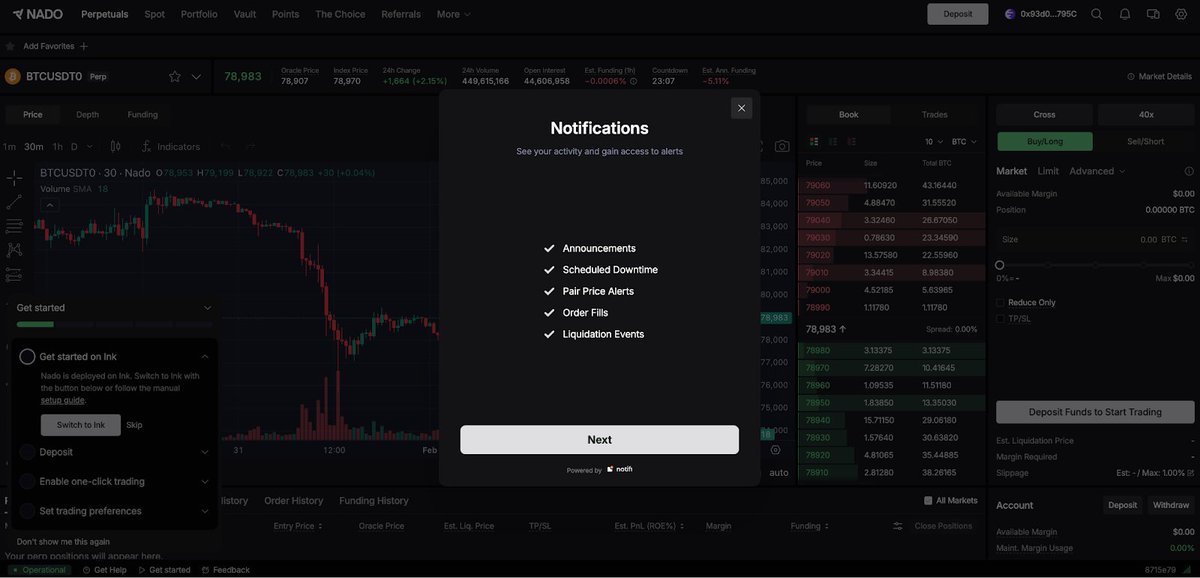

Notifi

Infra

4h ago

🔔 Integration Notifications 🔔

Notifi is thrilled to announce its latest integration with @nadoHQ. Nado is a brand new decentralized exchange (DEX) built on @inkonchain, a new L2 blockchain launched by @krakenfx. 🧵

Nado just launched its first quarter, and it's a "perfect storm." This new CLOB DEX offers precise trading with up to 20x leverage and high execution throughput, while leveraging Ink's powerful performance and speed to ensure a low-latency trading experience.

Nado users can now receive instant notifications on key topics, including:

- Nado Announcements

- Scheduled Maintenance

- Trading Pair Prices

- Order Execution

- Liquidation

Subscribe to Nado Notifications Now

Interested in enabling notifications for your decentralized application?

Contact Notifi's business development team via Telegram (@missjeev) or DM us on Twitter!

Han Paopao

Crypto Newbie

5h ago

2.4 Crypto Bloodbath: BTC crashes below 73,000, hitting a near 3-month low; 741 million worth of positions liquidated, 170,000 people trapped; long positions account for over 70% of liquidations; the leveraged sell-off is more severe than expected! 73,000 has become a short-term lifeline; a break below this level will inevitably lead to a test of the 70,000 mark.

吴说区块链

Binance

5h ago

Michael Burry, the real-life inspiration for the protagonist of "The Big Short," has warned that a Bitcoin crash could trigger a $1 billion sell-off in gold and silver. Burry argues that while Bitcoin is a purely speculative asset rather than a safe-haven asset, there is a "tainted" liquidity link between the two. If the price of Bitcoin collapses (for example, falling to $50,000), it will trigger a "collateral death spiral," forcing speculators and funds to liquidate other assets, including tokenized precious metal futures, through margin calls or deleveraging. He points out that the recent pullback in gold and silver is partly due to forced liquidations caused by the crypto market downturn. (CoinDesk)

余烬Ember

Crypto Newbie

5h ago

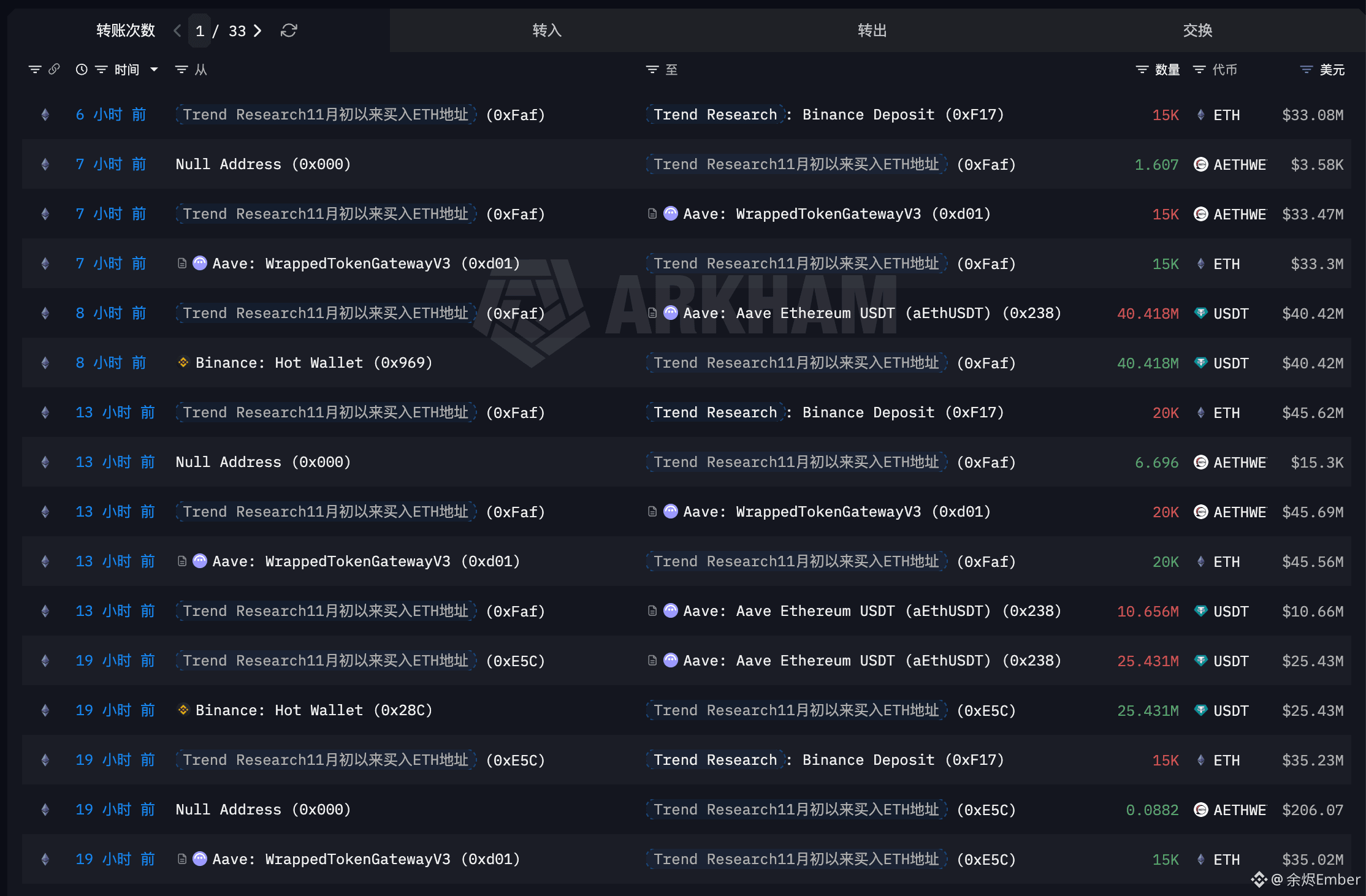

From the afternoon of the 1st until now, over two days, Trend Research has cumulatively reduced its holdings by 153,500 ETH ($352 million) at an average price of $2,294, and then repaid 266 million USDT to reduce leverage.

Currently, the liquidation price range for their multiple ETH borrowed positions is between $1,685 and $1,855, mainly concentrated around $1,800.

◎Current holdings: 498,000 ETH ($1.11 billion), average cost price $3,180.

◎Losses: $605 million (realized losses $136 million + unrealized losses $469 million).

◎Outstanding leveraged loans: $743 million USDT.

HODL15Capital 🇺🇸

Crypto Newbie

10h ago

Don't lend out your Bitcoin.

Don't use your Bitcoin as collateral for loans.

Don't let your Bitcoin be re-collateralized.

Every layer of "yield" or "leverage" means another layer of counterparty risk. If you lose, they win.

Keep it simple. Safeguard your Bitcoin.

#Bitcoin