Topic Background

TheCryptoBasic

Crypto Newbie

12h ago

🌐 Daily Cryptocurrency Price Update 🌐

Bitcoin (BTC): $77,950.33

Ethereum (ETH): $2,299.12

Binance Coin (BNB): $776.20

Ripple (XRP): $1.6141

Solarana (SOL): $102.11

Tron (TRX): $0.2831

Dogecoin (DOGE): $0.1098

Cardano (ADA): $0.3033

Bitcoin Cash (BCH): $531.41

Hyperliquid (HYPE): $33.94

Shiba Inu Coin (SHIB): $0.000007000

TheCryptoBasic

Crypto Newbie

1d ago

🌐 Daily Cryptocurrency Price Update 🌐

Bitcoin (BTC): $78,352.13

Ethereum (ETH): $2,326.17

Binance Coin (BNB): $775.36

Ripple (XRP): $1.6111

Solarana (SOL): $103.87

Tron (TRX): $0.2829

Dogecoin (DOGE): $0.1071

Hyperliquid (HYPE): $37.04

Cardano (ADA): $0.2992

Bitcoin Cash (BCH): $528.22

Shiba Inu Coin (SHIB): $0.000006846

TheCryptoBasic

Crypto Newbie

1d ago

🌐 Daily Cryptocurrency Price Update 🌐

Bitcoin (BTC): $78,779.93

Ethereum (ETH): $2,370.85

Binance Coin (BNB): $777.78

Ripple (XRP): $1.6435

Solarana (SOL): $104.97

Tron (TRX): $0.2839

Dogecoin (DOGE): $0.1095

Cardano (ADA): $0.3011

Bitcoin Cash (BCH): $540.19

Hyperliquid (HYPE): $32.37

Shiba Inu Coin (SHIB): $0.000006976

TheCryptoBasic

Crypto Newbie

01-31 10:38

🌐 Daily Cryptocurrency Price Update 🌐

Bitcoin (BTC): $82,975.47

Ethereum (ETH): $2,730.45

Binance Coin (BNB): $849.28

Ripple (XRP): $1.7661

Solarana (SOL): $116.62

Tron (TRX): $0.2912

Dogecoin (DOGE): $0.1158

Cardano (ADA): $0.3253

Bitcoin Cash (BCH): $550.53

Hyperliquid (HYPE): $28.64

Shiba Inu Coin (SHIB): $0.000007279

TheCryptoBasic

Crypto Newbie

01-30 04:30

🌐Daily Cryptocurrency Price Update🌐

Bitcoin (BTC): $84,575.83

Ethereum (ETH): $2,806.87

Binance Coin (BNB): $857.79

Ripple (XRP): $1.7899

Solarana (SOL): $116.53

Tron (TRX): $0.2919

Dogecoin (DOGE): $0.1154

Cardano (ADA): $0.3305

Bitcoin Cash (BCH): $552.30

Hyperliquid (HYPE): $33.09

Shiba Inu Coin (SHIB): $0.000007293

TheCryptoBasic

Crypto Newbie

01-29 13:36

🌐Daily Cryptocurrency Price Update🌐

Bitcoin (BTC): $88,076.48

Ethereum (ETH): $2,953.29

Binance Coin (BNB): $897.65

Ripple (XRP): $1.8793

Solarana (SOL): $123.49

Tron (TRX): $0.2945

Dogecoin (DOGE): $0.1219

Cardano (ADA): $0.3499

Bitcoin Cash (BCH): $585.52

Hyperliquid (HYPE): $31.82

Shiba Inu Coin (SHIB): $0.000007601

TheCryptoBasic

Crypto Newbie

01-29 00:30

🌐 Daily Cryptocurrency Price Update 🌐

Bitcoin (BTC): $89,382.13

Ethereum (ETH): $3,004.16

Binance Coin (BNB): $901.90

Ripple (XRP): $1.9058

Solarana (SOL): $125.94

Tron (TRX): $0.2910

Dogecoin (DOGE): $0.1245

Cardano (ADA): $0.3557

Bitcoin Cash (BCH): $591.43

Hyperliquid (HYPE): $33.41

Shiba Inu Coin (SHIB): $0.000007731

TheCryptoBasic

Crypto Newbie

01-28 07:08

🌐Daily Cryptocurrency Price Update🌐

Bitcoin (BTC): $87,841.55

Ethereum (ETH): $2,933.02

Binance Coin (BNB): $883.37

Ripple (XRP): $1.8873

Solarana (SOL): $124.39

Tron (TRX): $0.2933

Dogecoin (DOGE): $0.1224

Cardano (ADA): $0.3503

Bitcoin Cash (BCH): $588.22

Monero (XMR): $468.29

Shiba Inu Coin (SHIB): $0.000007686

TheCryptoBasic

Crypto Newbie

01-27 13:34

🌐 Daily Cryptocurrency Price Update 🌐

Bitcoin (BTC): $88,393.21

Ethereum (ETH): $2,933.36

Binance Coin (BNB): $882.83

Ripple (XRP): $1.9003

Solarana (SOL): $124.11

Tron (TRX): $0.2954

Dogecoin (DOGE): $0.1226

Cardano (ADA): $0.3516

Bitcoin Cash (BCH): $588.86

Monero (XMR): $464.88

Shiba Inu Coin (SHIB): $0.000007701

TheCryptoBasic

Crypto Newbie

01-27 00:51

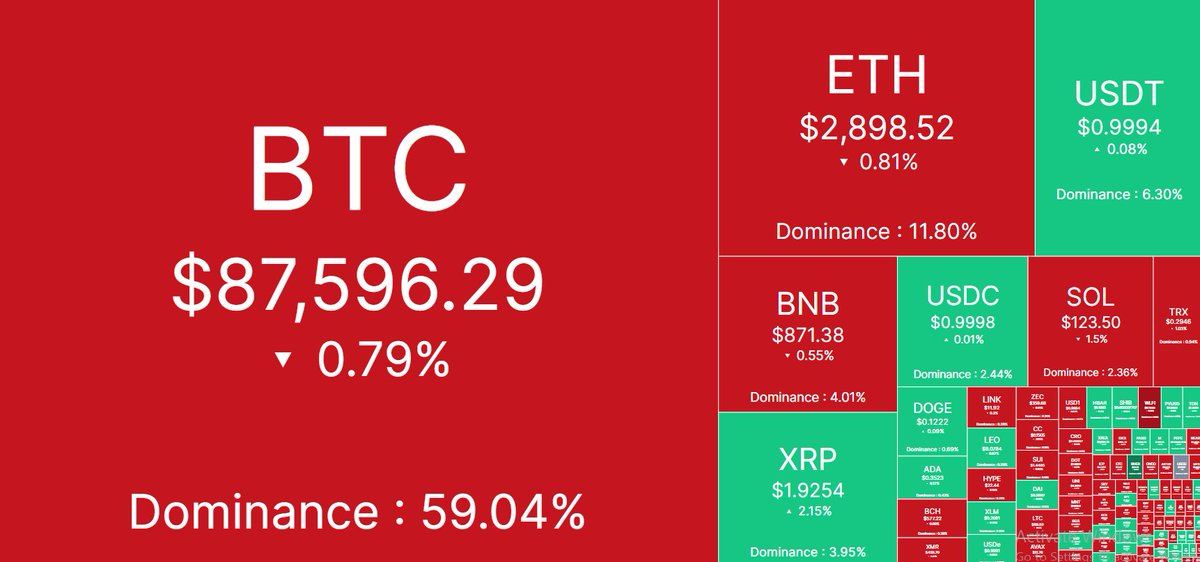

🌐Daily Cryptocurrency Price Update🌐

Bitcoin (BTC): $87,596.29

Ethereum (ETH): $2,898.52

Binance Coin (BNB): $871.38

Ripple (XRP): $1.9254

Solarana (SOL): $123.50

Tron (TRX): $0.2946

Dogecoin (DOGE): $0.1222

Cardano (ADA): $0.3523

Bitcoin Cash (BCH): $576.22

Monero (XMR): $460.14

Shiba Inu Coin (SHIB): $0.000007724