从价格波动、资金流向与宏观环境变化入手,持续追踪加密市场整体运行状态,帮助你把握市场情绪与阶段性趋势。

Topic Background

区块财经说

Crypto Newbie

01-22 20:03

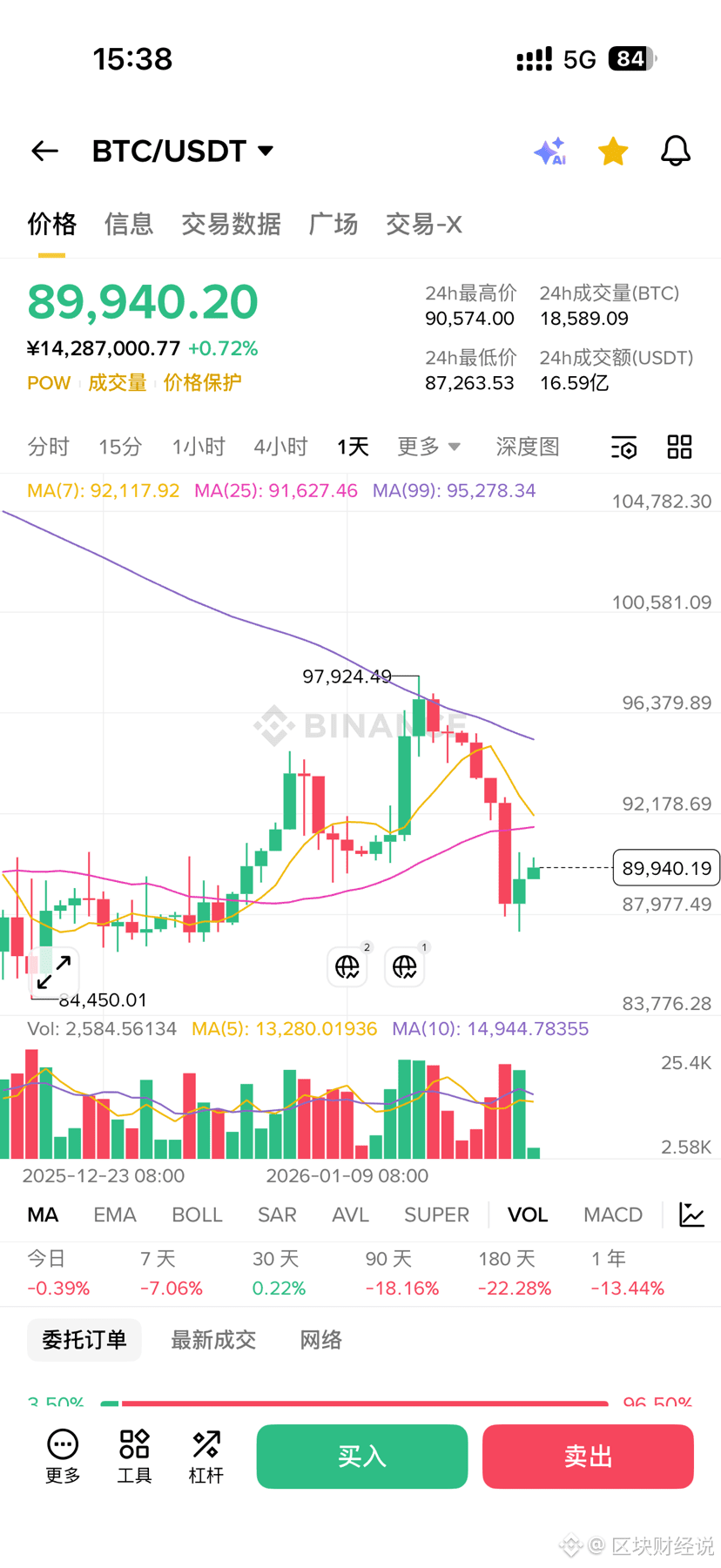

BTC has dropped to around 8.99! The next target is 90,000, while a further drop would be to the 8.8-8.5 range. The current market situation is rather awkward. Gold and silver prices continue to rise, with funds flowing into precious metals, stocks, and futures. Cryptocurrency liquidity is not as strong. Bitcoin will likely trade sideways around 90,000 in the short term, and in the near term, it will fluctuate between 8.8 and 8.5. A further drop would be disastrous for the altcoin market. Last time, after PEPE returned to the 7s, the market fluctuated and is now in the 5s. In the long term, I am still optimistic about the market's trend. Do you all remember the last bear market? How many people managed to buy in, and how many lost everything…?

#CryptoMarketObservation

{spot}(PEPEUSDT)

{spot}(BTCUSDT)

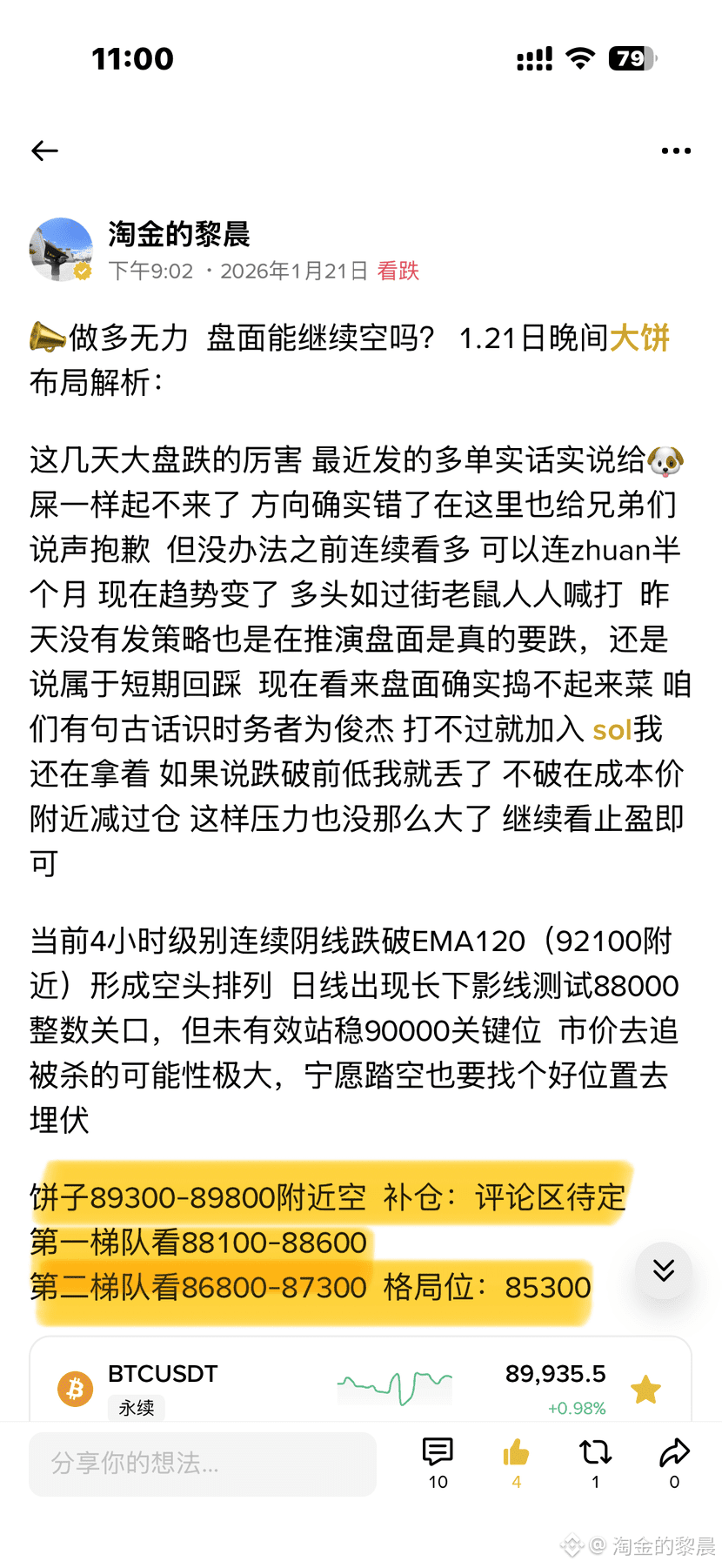

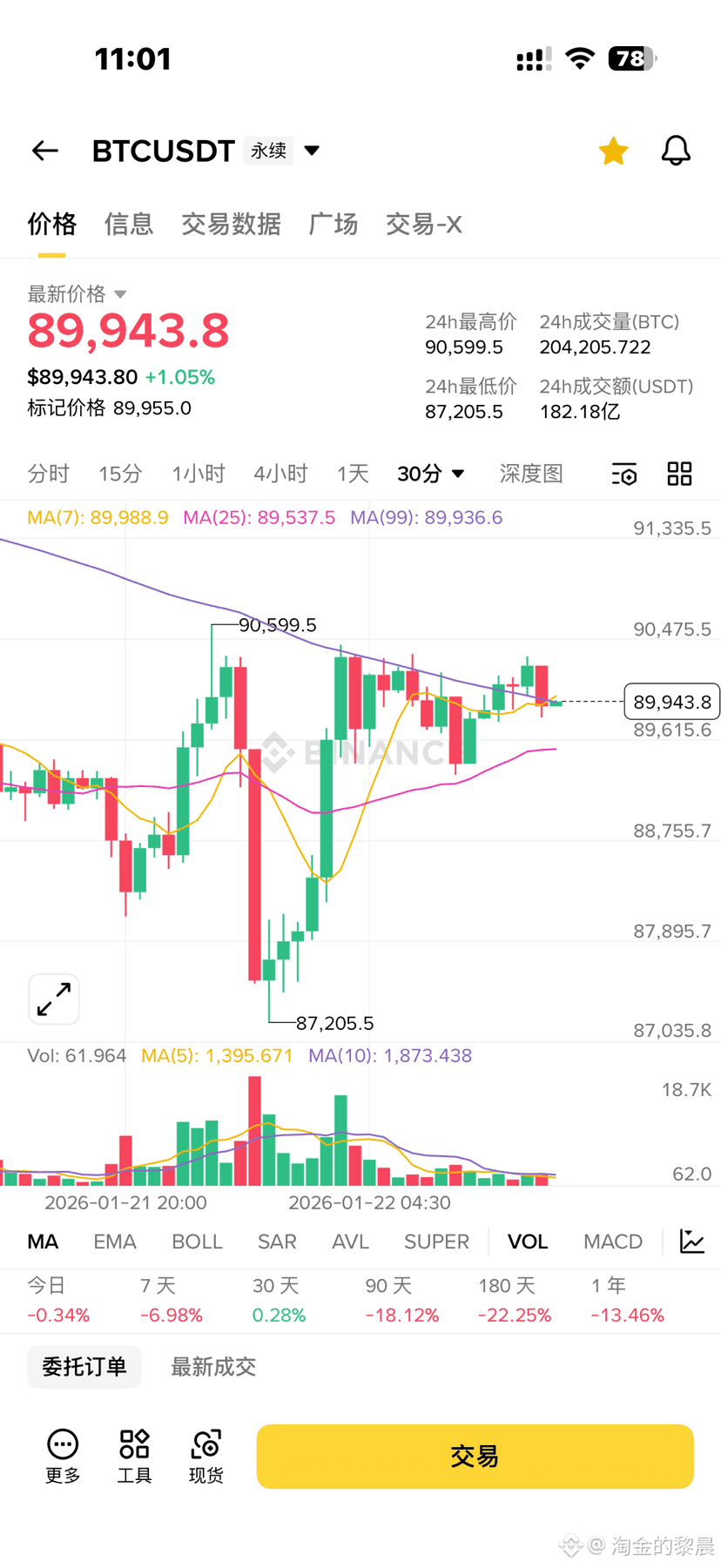

Li Chen, the gold digger

Crypto Newbie

01-22 13:56

📣Those short positions on Bitcoin at 89800 last night, are they all holding up? Another day of hard-market manipulation by the big players. When the market is uncertain, you really need to calm down and take it easy. Otherwise, you'll end up with nothing in this messy market, and then when things are going smoothly, you'll be out of ammunition. Isn't that disgusting?

Some friends said they were anxious because I hadn't posted a strategy for two days. Being anxious won't help. When the market direction is uncertain, you need to do tactical simulations. I won't go into anything else. Our current target is the second tier, 87300, taking a big 2500-point profit.

Tonight, we'll continue attacking Sol. If you want to do it, shout it out in the comments so I can tag you guys for some profits. Otherwise, don't say you didn't see it when you take profits!

#BTCTrendAnalysis #CryptoMarketObservation

鬼族研习社

Crypto Newbie

01-21 17:00

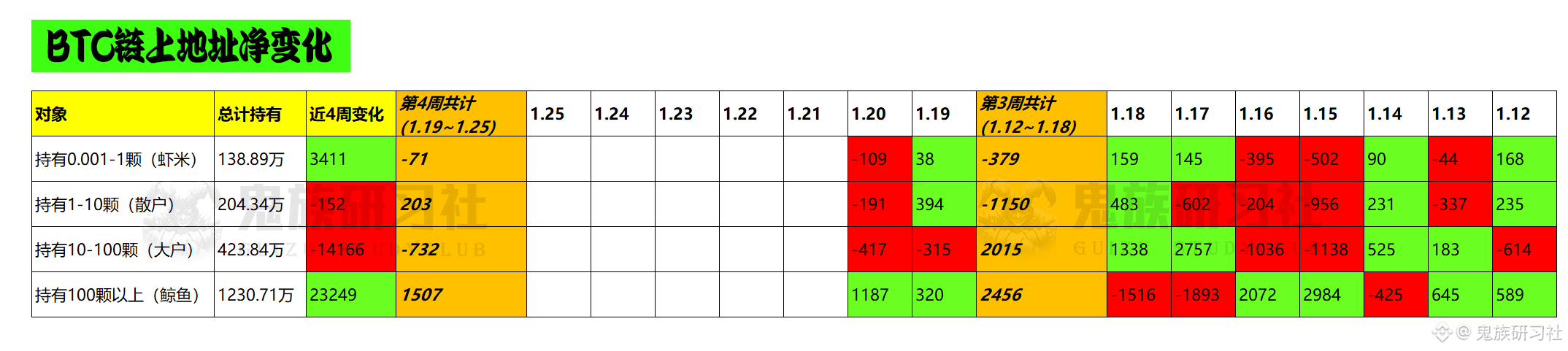

Yesterday and the day before, whale addresses saw net inflows, but this was largely insignificant. Why? The volume was insufficient. Unless a net inflow of several thousand units occurs by the end of today, if the volume remains in the hundreds or thousands, the price will definitely continue to fall. Even with a net inflow of several thousand units, the price will still likely retrace and test lower levels, rather than immediately rise.

Furthermore, last Thursday and Friday, when the price was still fluctuating at a high level, between 94,000 and 96,000, whale addresses began distributing and selling. Although it was only less than 4,000 units, this action directly determined the subsequent continuous decline.

Moreover, last week, with the price at a relatively high level, the net inflow was only 2,456 units. This is significantly less than the more than 10,000 units net inflow per week in the previous two weeks. Coupled with two days of substantial selling, a decline is indeed understandable. Of course, this is somewhat hindsight, which I admit. The data wasn't updated daily.

Therefore, prices will likely continue to fall. We'll wait until a significant net inflow appears and persists for a short period before we can all take our positions and follow the major funds to pick up some scraps. #GoldAndSilverPricesHitNewHighs #CryptoMarketWatch #StrategyIncreasesBitcoinHoldings

Crypto Mubai

Crypto Newbie

01-21 10:11

$1000WHY has also gradually declined, and with 5x leverage, you could have made over 100% profit! Consistently achieving good returns! All information is transparent and publicly available; specific entry points can be discussed in a one-on-one consultation.

#TrumpImposeTariffsOnEurope #CryptoMarketWatch

{future}(1000WHYUSDT)

Crypto Mubai

Crypto Newbie

01-21 10:08

Short with low leverage, hold! This is a strategy I've consistently adhered to, and I've said it countless times: shorting is the current market theme and the optimal choice!

$DASH came down as expected, and even with 10x leverage, I made over 100% profit. Specific entry and exit points are in one-on-one!

This is my win rate, transparent and publicly available!

#TrumpImposeTariffsOnEurope #CryptoMarketWatch

{future}(DASHUSDT)