Topic Background

MartyParty

Crypto Newbie

8h ago

One number can explain Bitcoin's price:

That number is -0.65.

This is Bitcoin's Z-score.

In simple terms if you're not a statistician:

The Z-score tells you how much the price deviates from its normal range.

• Z = 0 → Price is normal

• Z > 0 → Price is too high

• Z < 0 → Price is too low

It doesn't predict speculation, but rather measures the tension in the price.

Here's the significance of -0.65:

At this point after each previous halving, Bitcoin's price was above the trend level:

2012: +1.02

2016: +1.32

2020: +0.48

Today: -0.65

This has never happened before.

Never in the last 15 years.

So what does the data tell us next?

I ran the full dataset: 5,681 daily observations.

Every crash. Every bubble. Every macroeconomic system.

The relationship between the Z-score and future prices is not weak.

Correlation with future 18-month returns: -0.745

Variance explained by this single variable: approximately 56%

This means that the degree of price overexpansion explains subsequent movements better than interest rates, CPI, market narratives, or sentiment.

From Z ≤ -0.6 (where we are now):

• 12-month win rate: 100%

• Negative returns: 0

• Worst case: +47%

• Median return: +181%

From Z ≥ +1.0:

• Win rate: 44%

• Maximum drawdown: -73%

This is not a subjective opinion.

This is asymmetry.

So why doesn't the price "feel" bullish? Because Bitcoin pricing is no longer like trading.

It's being used.

Bitcoin is now traded 24/7, settled instantly, and can be used as collateral. Funds can flow through Bitcoin without anyone pressing a buy button on an exchange.

This temporarily suppresses prices.

But it doesn't weaken demand.

The market calls this "lack of interest."

Mathematically, it's called a classification error.

Meanwhile, supply has mathematically tightened permanently.

The 2024 issuance halving.

ETFs absorb hundreds of Bitcoins daily off-exchange.

Institutions are quietly accumulating.

Selling does occur, but Bitcoin is transferring from short-term holders to long-term holders' balance sheets at approximately a 36% discount to its network value.

This is not distribution.

This is a change of ownership.

Mean reversion doesn't need a catalyst.

Discrepancy half-life: Approximately 133 days.

This means:

• Approximately 50% of the gaps will be closed within about 4 months.

• Approximately 75% of the gaps will be closed within about 8 months.

• Approximately 90% of the gaps will be closed within about 12 months.

No need for optimism.

No explanation needed.

Time will tell.

This is not a trade.

This is a position.

It's not a bet on a "Bitcoin surge."

It's a bet that mathematics still holds true in this cycle.

Because when a highly stretched system recovers quickly...

Chives Brothers ²

Crypto Newbie

1d ago

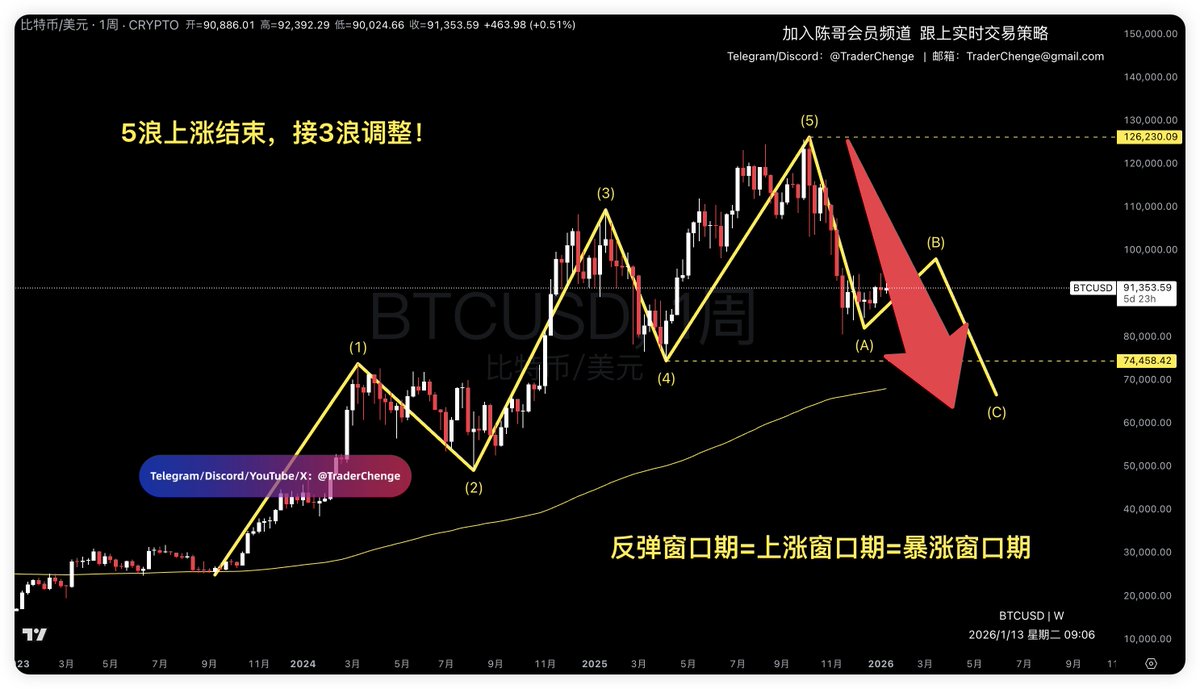

Bitcoin surge? Don't be naive, it's just the market manipulators' sickle flashing. 💸

You think buying the dip equals getting rich quick? Wrong! 95% of retail investors are catching a falling knife.

Those who truly profited cashed out at the peak.

This market has only two outcomes: either become the butcher or become the sucker.

Will you wake up and join the feast, or continue to be fleeced? 👇

Henrik Zeberg

Crypto Newbie

02-02 01:32

From Gold/Silver Speculation to Bitcoin's Surge and Market Crash

Why did gold/silver rise? Why is an economic recession imminent? What caused the surge?

This is a lighthearted conversation where I'll guide you through the various stages from inflation panic to the surge and then to the economic recession, using simple steps.

What exactly happened in the economy? What do people think happened?

The ₿itcoin Therapist

Crypto Newbie

01-04 05:36

The United States captures foreign presidents.

*Bitcoin surges*