#Bitcoin – What's Next?

Sunday's Major Report: Everything You Need to Know

🚩 Technical Analysis/Long-Term Analysis/Psychological Analysis:

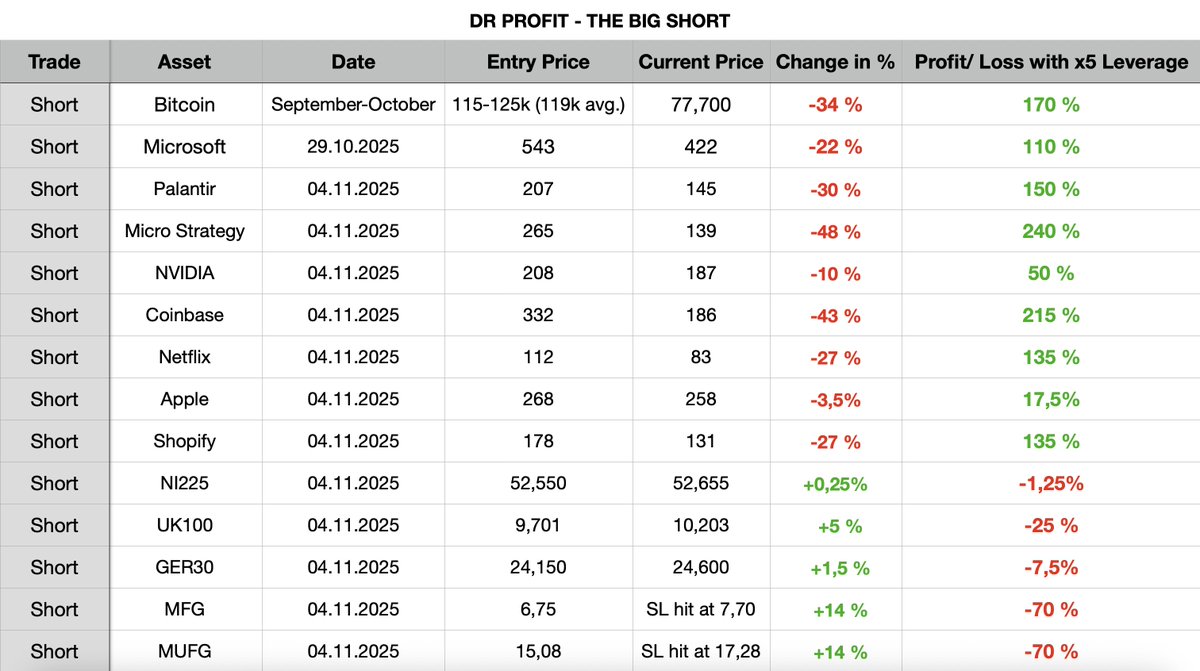

Two weeks ago, in my Sunday report, I mentioned that when Bitcoin was at $95,000, I said, "Bitcoin is still in a consolidation phase, which remains bearish, and it's only a matter of time before it breaks below $80,000. Currently, we are still in a consolidation phase, as I predicted in November, a consolidation phase is about to begin, but the next round of decline is inevitable." Two weeks ago, when Bitcoin was at $95,000, I said those words, and now it has all come true. As I promised, Bitcoin has broken below $80,000, and with this move, Bitcoin accomplished something extremely important this week. Of course, most people have ignored this again, but Bitcoin just broke below the 100-day weekly moving average, a key indicator confirming whether we are in a bull or bear market. Bitcoin had been holding above the purple line (the 100-day weekly moving average), but broke below it this week! As shown in the chart, in October 2023, Bitcoin broke through the 100-day weekly moving average (purple line), initially confirming the arrival of a bull market. However, two years later, Bitcoin has broken below this crucial support level, perfectly aligning with Bitcoin's bull market cycle and confirming the arrival of a bear market. Another strong piece of evidence is the death cross that is currently unfolding before our eyes (click here to read the death cross report). This perfectly matches the top of the 2021-2022 cycle and its subsequent movement. However, most people have ignored this. This is my personal observation and long-term view, which I shared months ago when Bitcoin was at its all-time high of $115,000 to $125,000. I repeatedly warned that a bear market had begun. Now you understand why.

The fact that Bitcoin broke below this level with such a dramatic drop is simply unbelievable. This decline also confirms that the bearish flag pattern I've repeatedly mentioned over the past 2-6 weeks has been broken. I am very confident that Bitcoin will close below the purple line (the 100-day weekly moving average) next week, initiating a new round of consolidation before continuing its decline, with a target price of $70,000. This $70,000 target price is not the bottom; I stated months ago that my bottom theory was between $50,000 and $60,000, initially proposed in the $115,000-$125,000 range. This theory has proven correct, but I now need to make a crucial update to my bottom prediction.

Back in September, within the $115,000-$125,000 range, I stated that I expected Bitcoin's bottom in this cycle to be around $50,000-$60,000. However, after recalculating and updating my model, I now predict a lower price. My new bottom area aligns with all my current data and leads to a clear and definitive conclusion: the true bottom is likely between $54,000 and $44,000, which is simply incredible considering the current market sentiment and price levels.

Another key point: Bitcoin has currently fallen below MicroStrategy's average buy price, which is approximately $76,000. Market panic is expected to intensify in the coming weeks. I publicly warned Michael Saylor to sell his Bitcoin in time to realize his huge profits, but he refused, claiming he would never sell. Given that most of MSTR's Bitcoin was purchased with leverage, while the stocks used as collateral continued to depreciate, I highly doubt how he could possibly do this in a credit-based system. With Bitcoin now trading below their average purchase price, stabilizing the stock price is becoming increasingly difficult. Since MSTR began buying Bitcoin in 2020, their total Bitcoin holdings are currently roughly at breakeven. Even the worst-performing ETFs have outperformed, and simply keeping cash in a bank would generate returns. MSTR has never taken profits. This means we cannot even argue that their Bitcoin positions are funded by realized Bitcoin gains. This will be a significant lesson for Saylor, much like his experience during the dot-com bubble, when he suffered one of the biggest losses of that era. I warned him repeatedly, but he ignored me. Now, panic and uncertainty (FUD) are expected to intensify further.

The release of the Epstein files and rumors linking Epstein to Bitcoin will likely trigger further panic. Personally, I doubt that even if these claims are true, they will have a substantial impact on Bitcoin, but the public will likely blindly follow the trend, exacerbating uncertainty and emotional selling. In short, I remain extremely bearish and expect Bitcoin to continue its decline, fully confirming the current Bitcoin bear market and validating my previous theory that a "top has formed" in the $115,000 to $125,000 range. With these confirmations, there is no doubt that Bitcoin is in a bear market, and the existing market outlook remains entirely valid. To understand why Bitcoin is in a bear market, please review the October report:

Summary:

- Bitcoin broke below the 100-day moving average (MA100), a crucial market indicator that further confirms the arrival of a bear market.

- Bottom expectation revised downwards: I believe the new cycle low is predicted in the $54,000-$44,000 range.

- Bitcoin's drop below the average entry point of approximately $76,000 on the MSTR chart has increased risk, panic, and sustained downward pressure.

- The overall outlook remains extremely pessimistic, fully validating the predicted cycle top of $115,000-$125,000 and the continued downward pressure.

- Short positions in the $115,000-$125,000 range remain open.