Topic Background

加密孔伯仕

币圈小白

46m ago

Dogecoin and Ripple ETFs are pressed by the SEC again. Is the "upper dream" of altcoins too difficult?

The SEC took action again, postponing the approval of Dogecoin (DOGE) and Ripple (XRP) spot ETFs applied for by Bitwise and Franklin, and the time point was postponed to June this year.

At the same time, 21Shares also applied for Dogecoin ETF to prepare to log in to Nasdaq, but it also fell into "shelf".

At the market value level, these two are quite a bit:

DOGE ≈ 26 billion US dollars, XRP ≈ 130 billion US dollars, is a first-tier copycat in the crypto circle, but this does not help them pass the review more easily.

The reality is

SEC received more than 70 altcoin ETF applications this year, but most traditional investors are still focusing on Bitcoin

After all, Bitcoin is "digital gold", with recognition, risk aversion attributes, and clear logic; while altcoins are popular and narrative, but "lack of consensus".

#xrp #TRX #DOGE #TRUMP #SEC delays approval of multiple spot ETFs $XRP $DOGE $BTC

奔跑财经-FinaceRun

币圈小白

1h ago

Bitcoin spot ETF lasts for 8 days, and Ethereum ETF is net inflow for 4 consecutive days

On April 30, according to SoSoValue data, the total net inflow of Bitcoin spot ETFs in a single day was US$173 million yesterday, achieving net inflow of funds for eight consecutive days.

Among them, Blackrock's IBIT was the only Bitcoin spot ETF that recorded net inflows yesterday for two consecutive days. Currently, the net inflow of IBIT in one day is US$217 million, with a cumulative net inflow of US$42.39 billion.

Bitwise Bitcoin spot ETF BITB, Ark & 21Shares Bitcoin ETF ARKB and Fidelity Bitcoin ETF FBTC recorded net outflows of US$24.39 million, US$13.32 million and US$6.24 million respectively in a single day.

As of now, the total net asset value of Bitcoin spot ETFs is US$110.17 billion, accounting for 5.85% of the total market value of Bitcoin, and the cumulative net inflow is US$39.2 billion.

On the same day, the total net inflow of Ethereum spot ETFs was US$18.4 million in a single day, recording a net inflow of funds for four consecutive days.

Among them, Fidelity Ethereum ETF FETH has a net inflow of US$25.52 million in a single-day manner, and the current cumulative net inflow of US$1.45 billion.

However, Grayscale Ethereum Trust ETF ETHE has seen a net outflow of US$7.12 million in a single day, and ETHE has currently cumulative net outflow of US$4.28 billion.

As of now, the total net asset value of Ethereum spot ETFs is US$6.3 billion, accounting for 2.89% of Ethereum's total market value, and the cumulative total net inflow is US$2.48 billion.

Taken together, these data show that the market's confidence in Bitcoin and Ethereum is still increasing. However, the performance of different funds also varies, such as in addition to BlackRock's strong performance, some funds have experienced outflows. This differentiation also reflects the complexity of the market.

#Bitcoin ETF #Ethereum ETF #Fund flow

加密鱼右右

币圈小白

3h ago

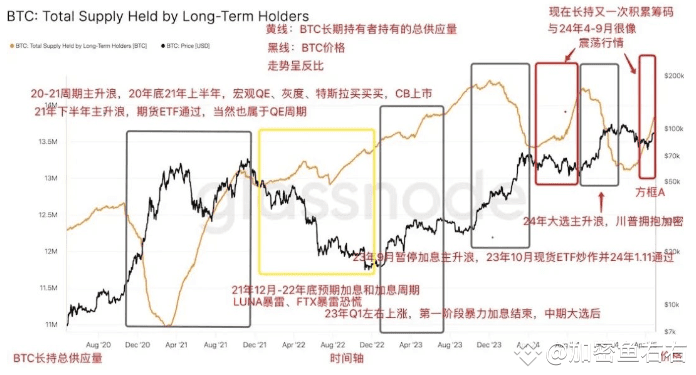

The reversal needs to meet two core conditions at the same time:

On the one hand, BTC's long-term holding supply must account for more than 75% of the total circulation supply. Judging from the existing data and trends, although the long-term holding ratio is rising, it has not yet reached this key threshold; on the other hand, the macroeconomic level needs to enter a period of suspension of interest rate hikes and implement loose quantitative easing (QE) policies. At the same time, BTC needs to have enough narrative hot spots to promote speculation, and no major negative events interfere with the market.

Since Trump took office and implemented the water control policy, although its impact on the market has gradually weakened, the aftermath still remains.

The current market is focusing on the impact of the interest rate cut cycle on the economy and employment, and the risk of economic recession in the future has become the focus of market concerns.

Once the economic recession comes, it is likely to trigger a fierce market similar to "312", and it is expected to usher in a real market bottom.

In the current rebound on the left, the counterfeit market is not suitable for excessively holding a long-term "pattern" mentality, whether it is project investment in the primary market or token trading in the secondary market.

The general rise carnival season in the counterfeit market is unlikely to occur in the short term. Investors are advised to remain patient and wait for the arrival of the right-hand reversal market to seize more certain investment opportunities.

#SEC postpones approval of multiple spot ETFs

帝哥论区块

币圈小白

4h ago

$ALPACA Control Panbi is Control Panbi

Such a disgusting person's pulling the market is also awesome. He directly pulled 1,400% and took it off.

#US stock financial report week is coming #Trump tax reform #Strategy increases Bitcoin #SEC postpones approval of multiple spot ETFs #Trump takes office for 100 days