How to profit in trending markets and the risks to be aware of:

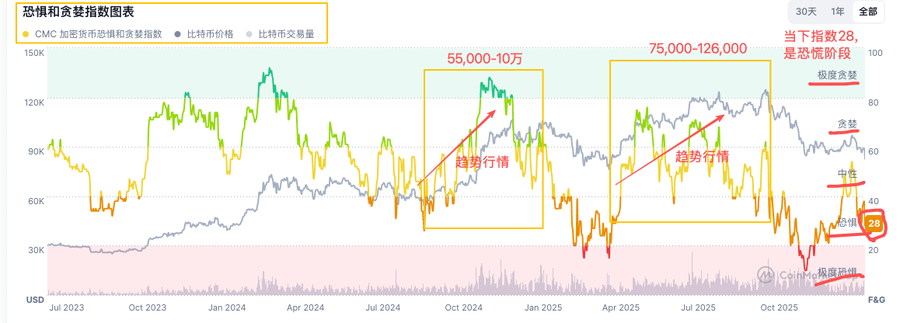

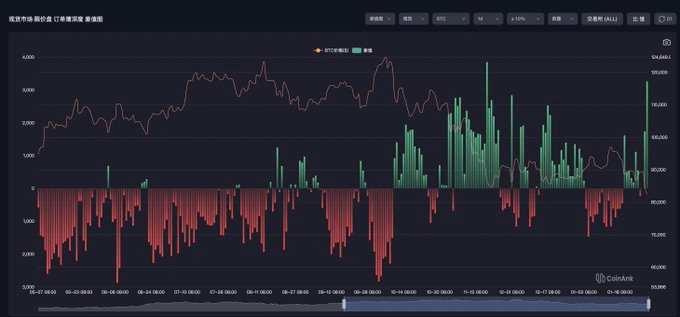

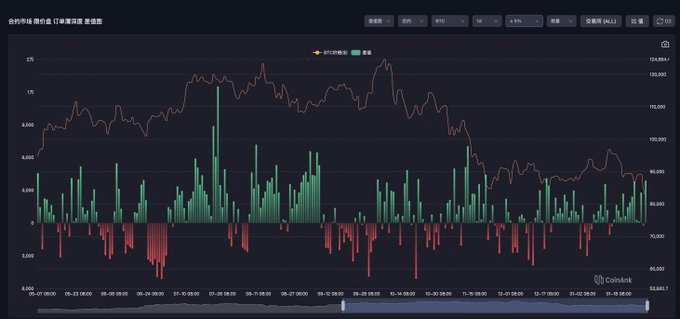

First, what is a trending market? As shown in the Fear & Greed Index chart:

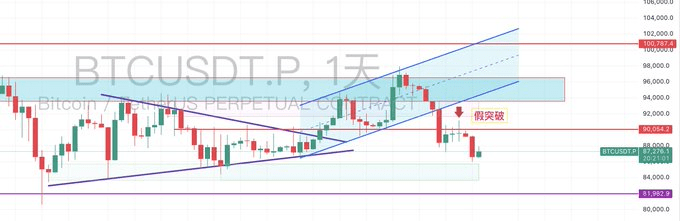

The price movements from 55,000 to 100,000 in 2024 and from 75,000 to 126,000 in 2025 are both examples of trending markets.

The chart clearly shows the index changes from fear to neutral to greed, and even extreme greed. Simply put, it's about buying the dip during periods of fear or extreme fear, and selling during periods of greed. Then wait for the next trending market opportunity.

As for buying the dip, what to buy is the question. It depends on individual investment preferences.

If you buy top-market-cap, mainstream coins like BTC, ETH, SOL, and BNB, the potential gains are around 50% to 100%, with little risk.

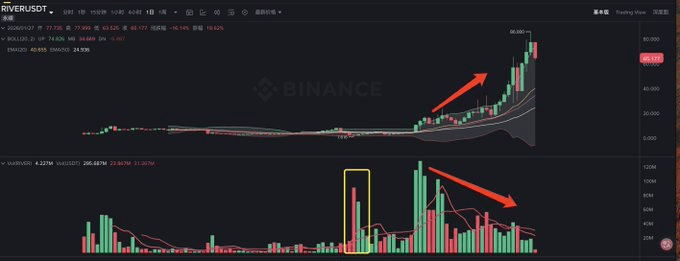

If you choose BN Alpha, you can indeed experience returns of at least 10x or more, like Aster, but high returns mean high risks. While it won't wipe you out, the potential losses can be terrifying.

If you choose memes, it's a gamble between instant riches and hell. The risks and returns are clear to everyone. And the amazing memes only occur during periods of extreme greed. There might be impressive memes at other times, but their scope might not be as broad.

All three scenarios depend on your own perspective.

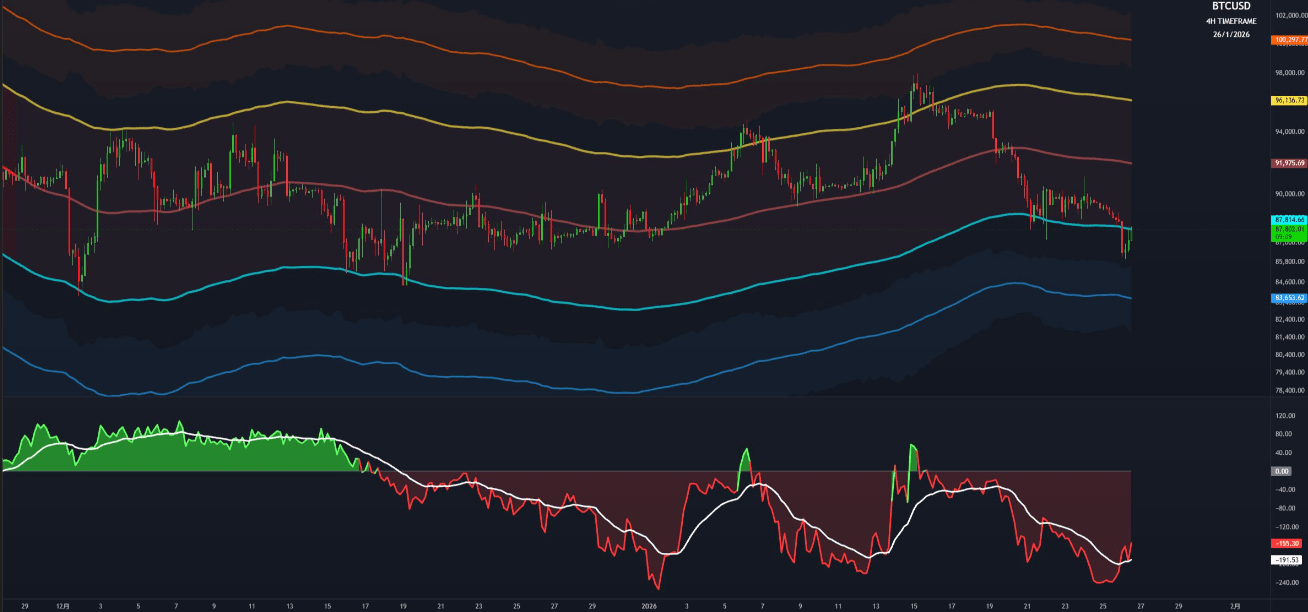

Let's delve into the current situation. Even if you don't understand macroeconomics or on-chain data, you can still monitor this fear and greed index.

Although it dipped to 81 and 110 today, the index is only in a state of fear, far from the extreme panic seen when it fell to 80 and 600 in November.

You might think it will fall further, and there are still good entry points. In that case, just wait and see. If you're even afraid of missing out, you can diversify your positions.

Pay special attention when chasing highs; don't be too greedy. When you become greedy, sell and take profits promptly. Otherwise, you're likely to be the one who gets hurt.

Although it dipped to around 81 today, it's still within the 80-921 range that has been in place since November. Don't simply stick to outdated methods.

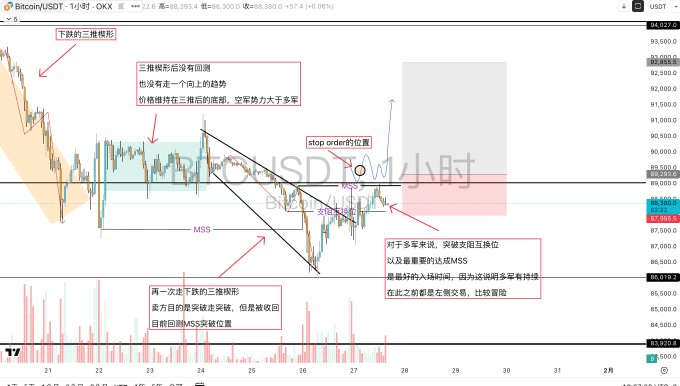

I don't believe this is a continuation of the downtrend; it will likely continue to fall to find new support. If it is, just use a stop-loss order.

I traded it myself. I bought Sol around 126, and just added to my position near 116.

Finally, please note:

⚠️, generally, before a trend begins, it will give you a good entry point during a period of panic. Never enter during the neutral phase. If you enter during this phase, be mindful of your profit-taking and stop-loss orders to mitigate risk.

If you enter during the greed phase, be even more careful with your profit-taking; otherwise, you're truly chasing the rally.