The reversal needs to meet two core conditions at the same time:

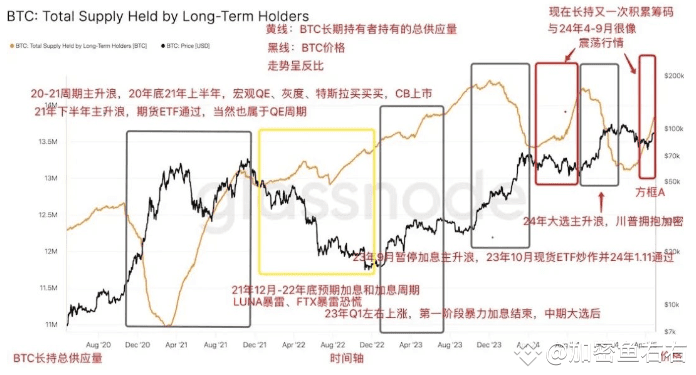

On the one hand, BTC's long-term holding supply must account for more than 75% of the total circulation supply. Judging from the existing data and trends, although the long-term holding ratio is rising, it has not yet reached this key threshold; on the other hand, the macroeconomic level needs to enter a period of suspension of interest rate hikes and implement loose quantitative easing (QE) policies. At the same time, BTC needs to have enough narrative hot spots to promote speculation, and no major negative events interfere with the market.

Since Trump took office and implemented the water control policy, although its impact on the market has gradually weakened, the aftermath still remains.

The current market is focusing on the impact of the interest rate cut cycle on the economy and employment, and the risk of economic recession in the future has become the focus of market concerns.

Once the economic recession comes, it is likely to trigger a fierce market similar to "312", and it is expected to usher in a real market bottom.

In the current rebound on the left, the counterfeit market is not suitable for excessively holding a long-term "pattern" mentality, whether it is project investment in the primary market or token trading in the secondary market.

The general rise carnival season in the counterfeit market is unlikely to occur in the short term. Investors are advised to remain patient and wait for the arrival of the right-hand reversal market to seize more certain investment opportunities.

#SEC postpones approval of multiple spot ETFs