合约知识聚集地,大佬无数,交易者众多,新手在这里可以学习到不少知识,还可以获得第一手市场消息哦

Topic Background

一路向北0

币圈小白

3h ago

Alpaca was stunned by this wave of operation. Yesterday, the rate modifications directly scared the Air Force away.

No, then it fell 60%+

Now that I'm playing this, I'm dead again. It seems that there are really not many circulating shares outside, and the K-line is no longer meaningful.

#SEC postpones approval of multiple spot ETFs

零下二度

币圈小白

4h ago

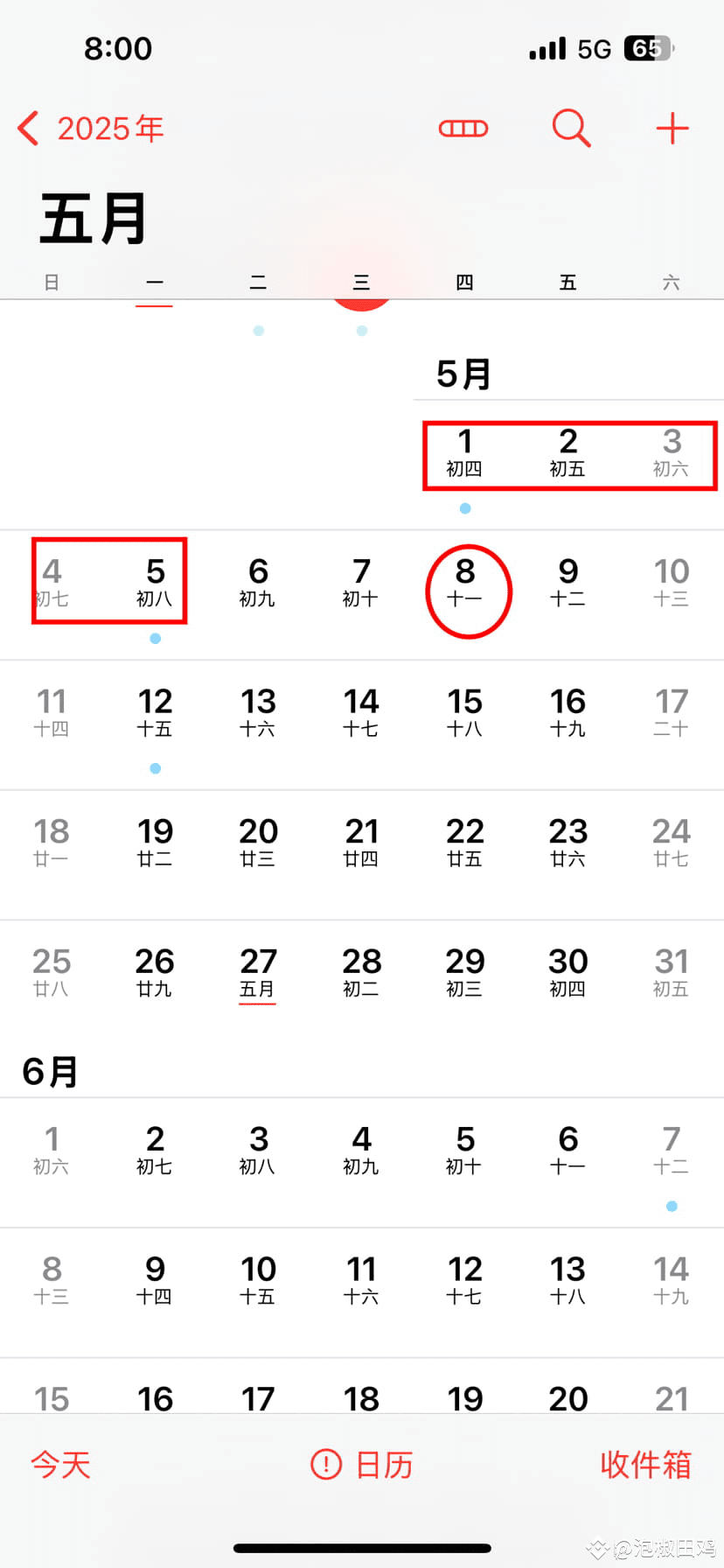

During the May Day Golden Week (5.1-5.5), some hot money from A may enter the market, so the main force may follow the trend and pull the market during the holiday. If long positions have floating profits, take more and protect the capital loss after taking profits. As long as the support does not fall below, look up. Tomorrow, on May 1, Japan's interest rate meeting, as long as the result is not hike, there may be an upward pulse action immediately.

On the last day of the May 5 holiday, especially in the second half of the night, the main force may sneak attack and smash the market while the crowd is scarce. Sometimes, as soon as possible, they will also sneak attack on 5.4 (Sunday evening). This paves the way for the interest rate meeting two days later. Generally, the fluctuation will turn 1-2 days before, and the US market will start to fall at 5.7. Therefore, the bulls will converge next week, maintain low leverage and light positions. 5.8 At the Fed's interest rate meeting, the main force generally leaves the market 24 hours in advance to choose to wait and see. The failure to cut interest rates in May is in line with expectations and is not a bad news, but the probability of reducing interest rates in June is high, so it may digest the positive expectations of June in advance in May. Therefore, it is not recommended to short at the same point multiple times, and there will be a long change. The last move must be set to a stop loss, and shorting will be the most safe to go to the new high point between 96600-99200.

诸葛神币

币圈小白

5h ago

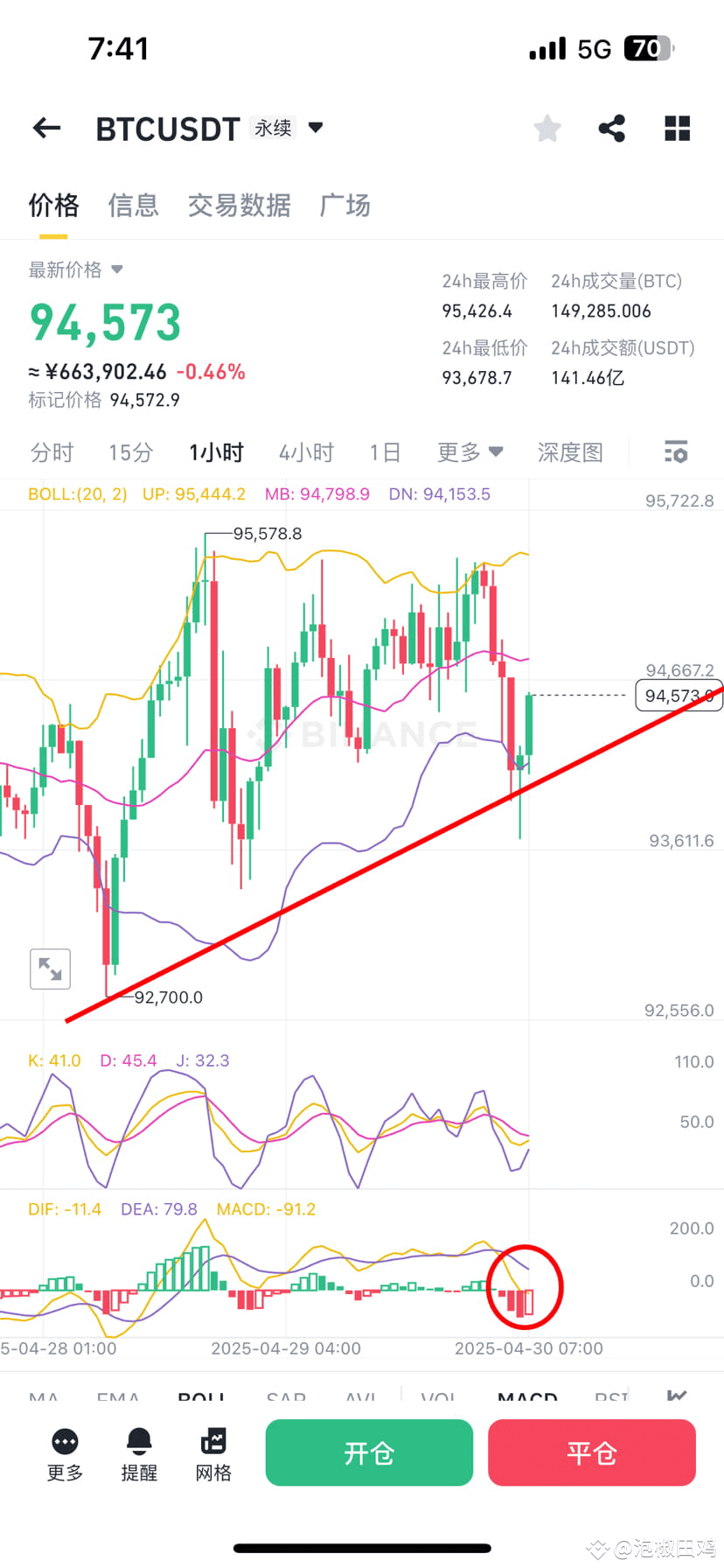

4.30 Market Analysis:

The current market still maintains a narrow range of fluctuations, and the intraday volatility range is compressed between 93500-95500. This warm-water market makes trading a little useless.

The rebound now is like the end of a force, and every time you rise, you seem to be powerless. The upper pressure level is like an invisible ceiling, pressing the price firmly in the oscillation range. The most taboo thing at this time is to chase the rise and sell the fall. My suggestion is to continue to use the old method of "high altitude and low altitude".

Specifically, Bitcoin can ambush long orders in the range of 94000-93600, with the target targeting 95800; Ethereum is deploying long orders in the range of 1770-1750, and 1880 is a good take-profit position. Of course, if the market suddenly chooses a direction to break through, we must also adjust our strategy in time, after all, the market is always right. The key point now is to stay patient and wait for the market to give a clearer signal.

The market continues to change, we pay close attention to the market and seize new opportunities for entry. Like + leave a message, and work together to make a stable market and seize this round of great opportunities.

Follow within the day: SIGN SUI FIL SOL XRP

$BTC $ETH

#SEC delays approval of multiple spot ETFs #Trump tax reform

零下二度

币圈小白

7h ago

$BTC has strong support, no deep drop yet. Try to hold a part of the long orders below 93,800 and protect the capital from loss. If some hot money from Big A starts entering the market tonight, there may be a market pull-up during the May Day holiday, and then on the last night of the holiday, people will sneak attack and smash the market while they are stranded while they are stranded. This just paves the way for the Fed interest rate meeting two days later. It will generally begin to converge within 24 hours, and the main force will leave the market in advance and wait and see.

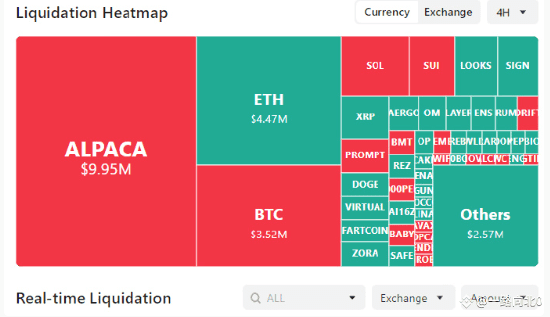

加密无聊嘴

币圈小白

13h ago

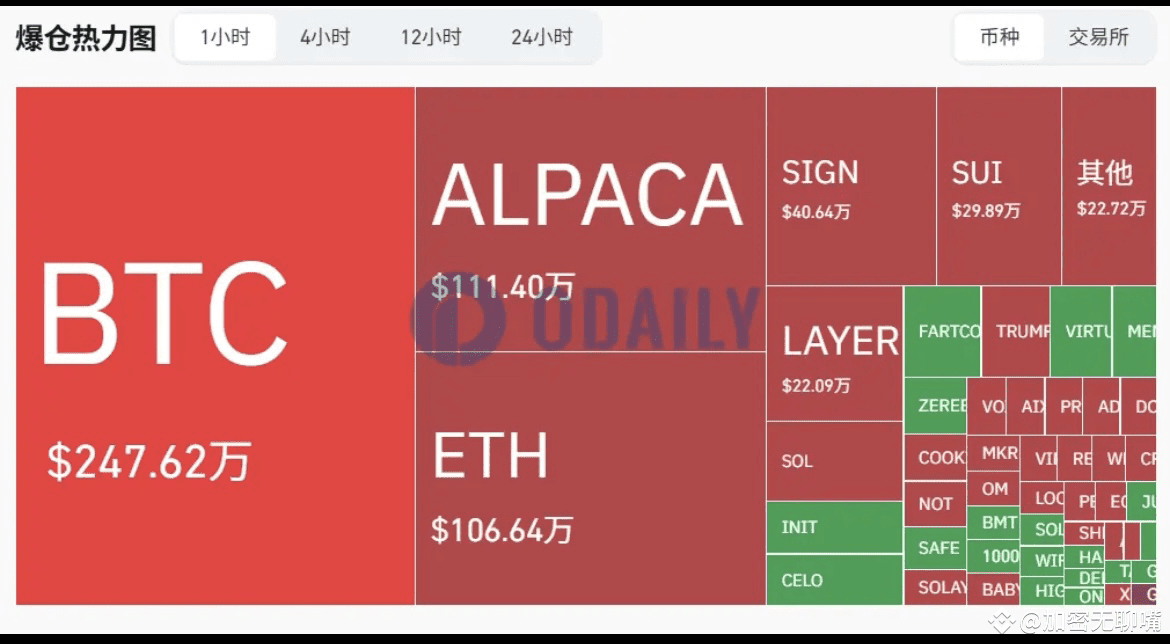

$ALPACA

There is another big news in the currency circle!

Can you imagine that in the past hour,

The amount of ALPACA's liquidation was as high as US$1.114 million.

Second only to BTC, ranking second in the entire network.

And the main thing is short orders!

According to CoinGlass data, short positions were liquidated at US$905,300 and long positions were liquidated at US$208,700.

What exactly happened behind this wave of liquidation? Is it the normal fluctuation of the market, or is there a dealer behind the scenes? We continue to pay attention!

#ALPACA

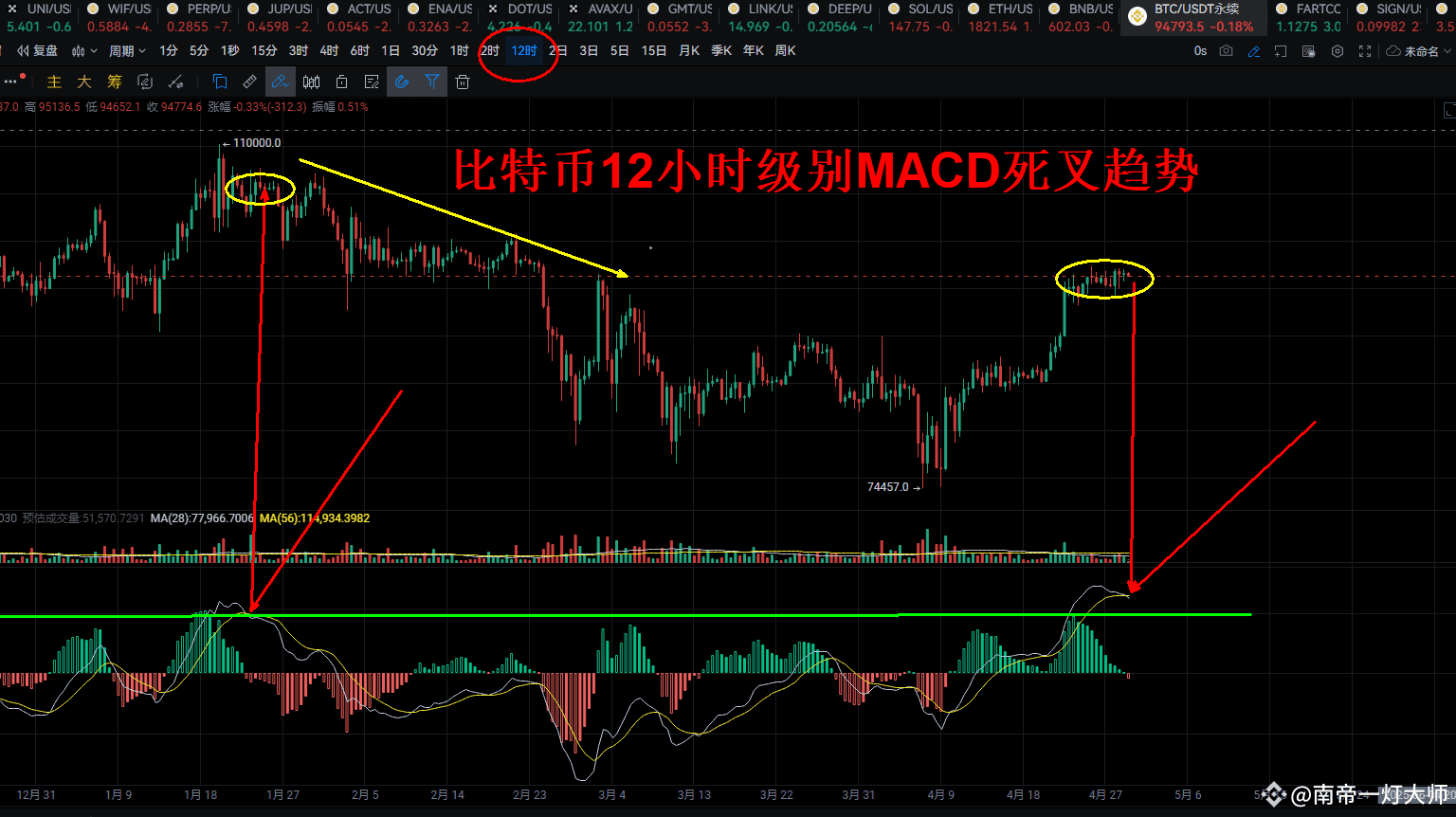

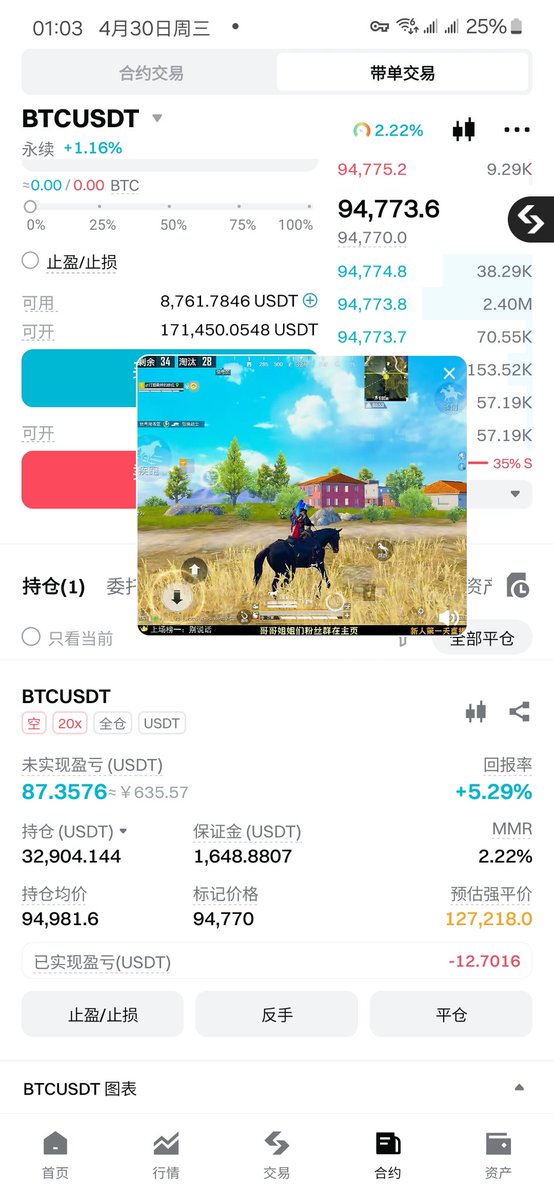

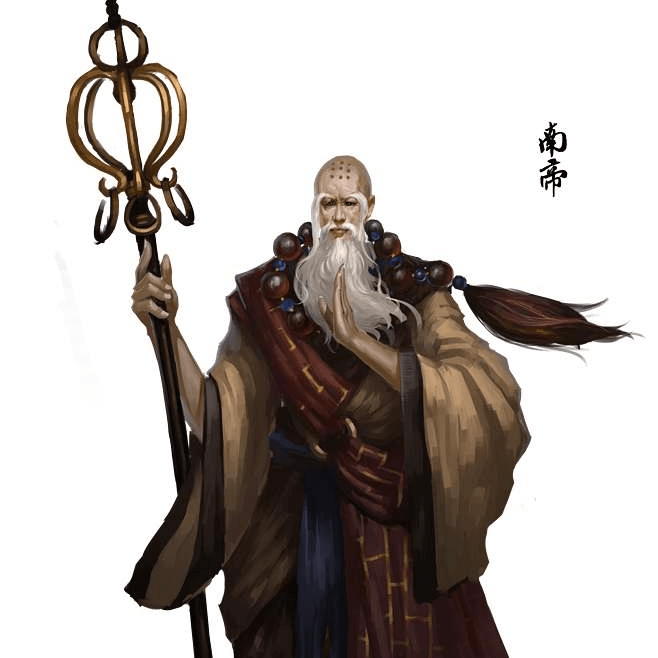

南帝一灯大师

币圈小白

16h ago

$BTC 12-hour level MACD has a dead cross at a high level, and the big cake has fluctuated sideways at a high level. The small cycle has extended to the 12-hour level trend. Brothers and sisters, what are the long positions you have in your hands? Are there any risk aversion to reduce positions? If you make a profit, you can take a cost-price stop loss, and if you don’t make a profit, you can take a stop loss.