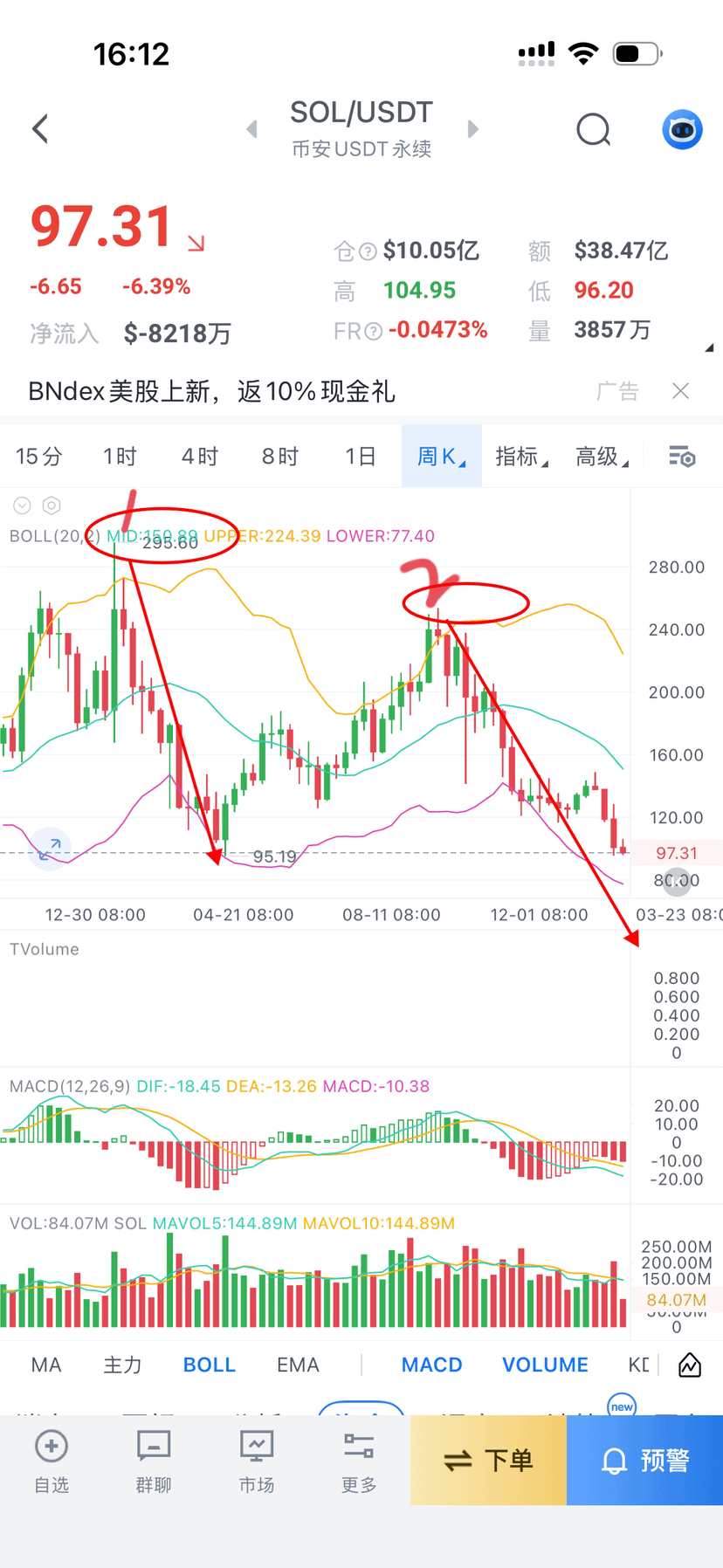

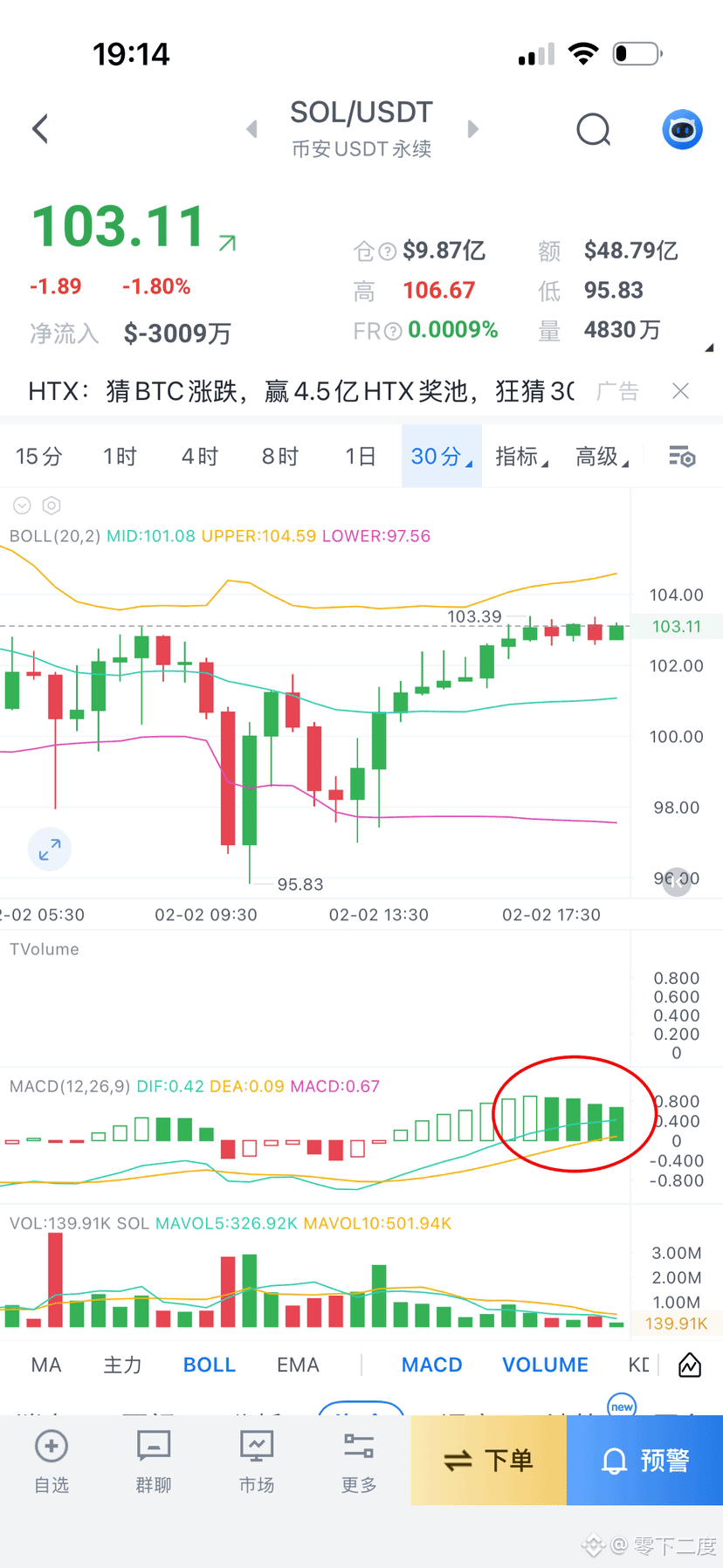

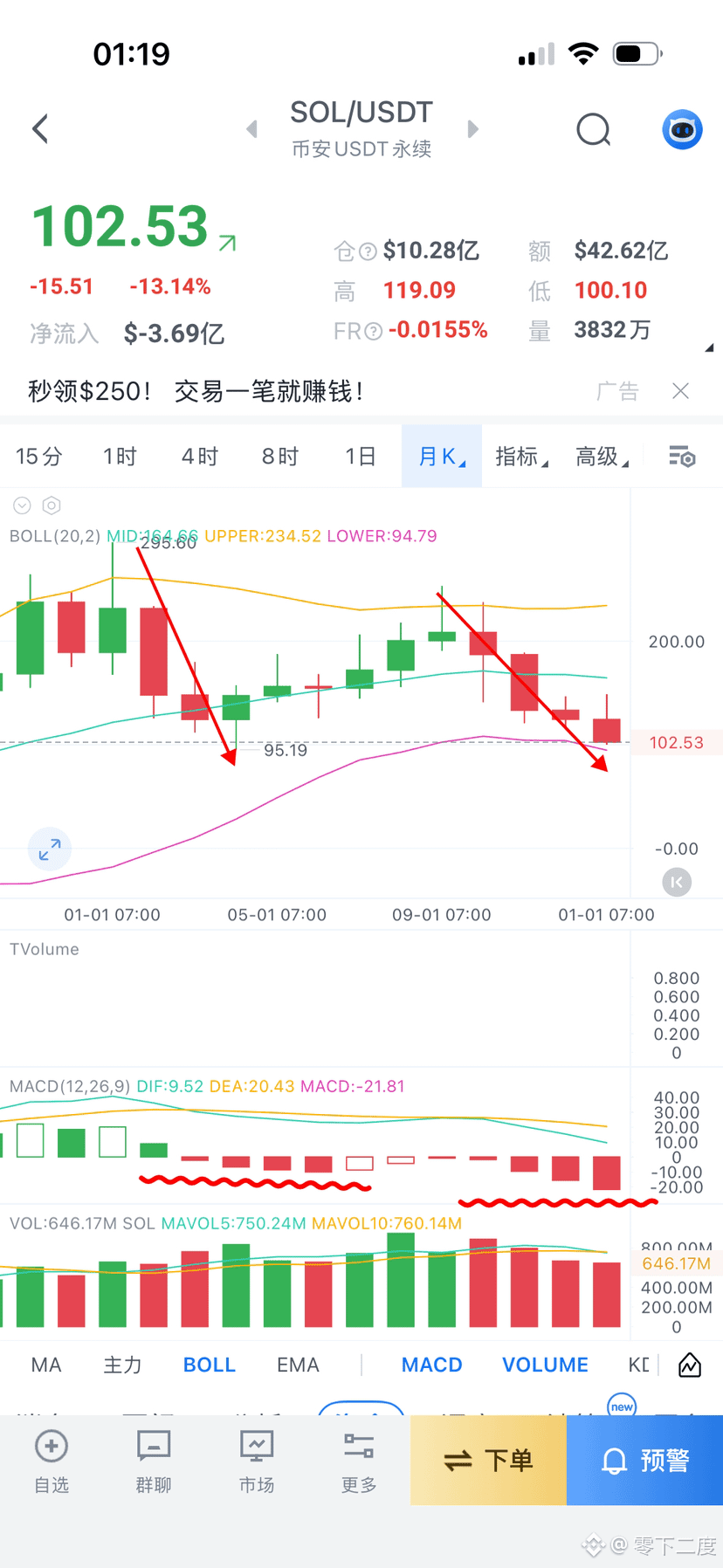

对sol的看法再补充一下:

本轮形成双顶,顶部1回调的区间是295.60-95.19,总共调整了200.41个点。顶部2是253.49,比顶部1低了42.11个点。从顶部2回调下来的最低点预测,如果参考顶部1回调的长度,这两个回调的大波段是等距的话,那么当前这个回调大波段的最低点就可能是253.49-200=53.5附近。也就是如果95跌穿后,那么接下来的调整区间就是100-50这个范围。

如果用菲波列契计算也差不多,296和253两个顶部中间的反弹波段的涨幅是:

253.49-95.19 = 158.3个点

158.3*0.618 = 97.829

158.3*0.786 = 124.424

158.3*1.0=158.3

158.3*1.214 = 192.176

即从253.49回调下来的重要斐波点:

253.49-97.82 = 155.67(一个月前跌破)

253.49-124.4 = 129.09(两周前跌破)

253.49-158.3 = 95.19(当前的支撑,暂时未破)

253.49-192.17 = 61.32(95跌破后最终参考的一个重要支撑点)

所以,95如果跌破后,下方sol将回调到61.5-54。

这是多军需要高度注意的。如果你坚定认为95是铁底,而你爆仓价就在附近,那么后面很可能会死无葬身之地。

Price Converter

- Crypto

- Fiat

USD美元

CNY人民币

JPY日元

HKD港币

THB泰铢

GBP英镑

EUR欧元

AUD澳元

TWD新台币

KRW韩元

PHP菲律宾比索

AED阿联酋迪拉姆

CAD加拿大元

MYR马来西亚林吉特

MOP澳门币

NZD新西兰元

CHF瑞士法郎

CZK捷克克朗

DKK丹麦克朗

IDR印尼卢比

LKR斯里兰卡卢比

NOK挪威克朗

QAR卡塔尔里亚尔

RUB俄罗斯卢布

SGD新加坡元

SEK瑞典克朗

VND越南盾

ZAR南非兰特

No more data