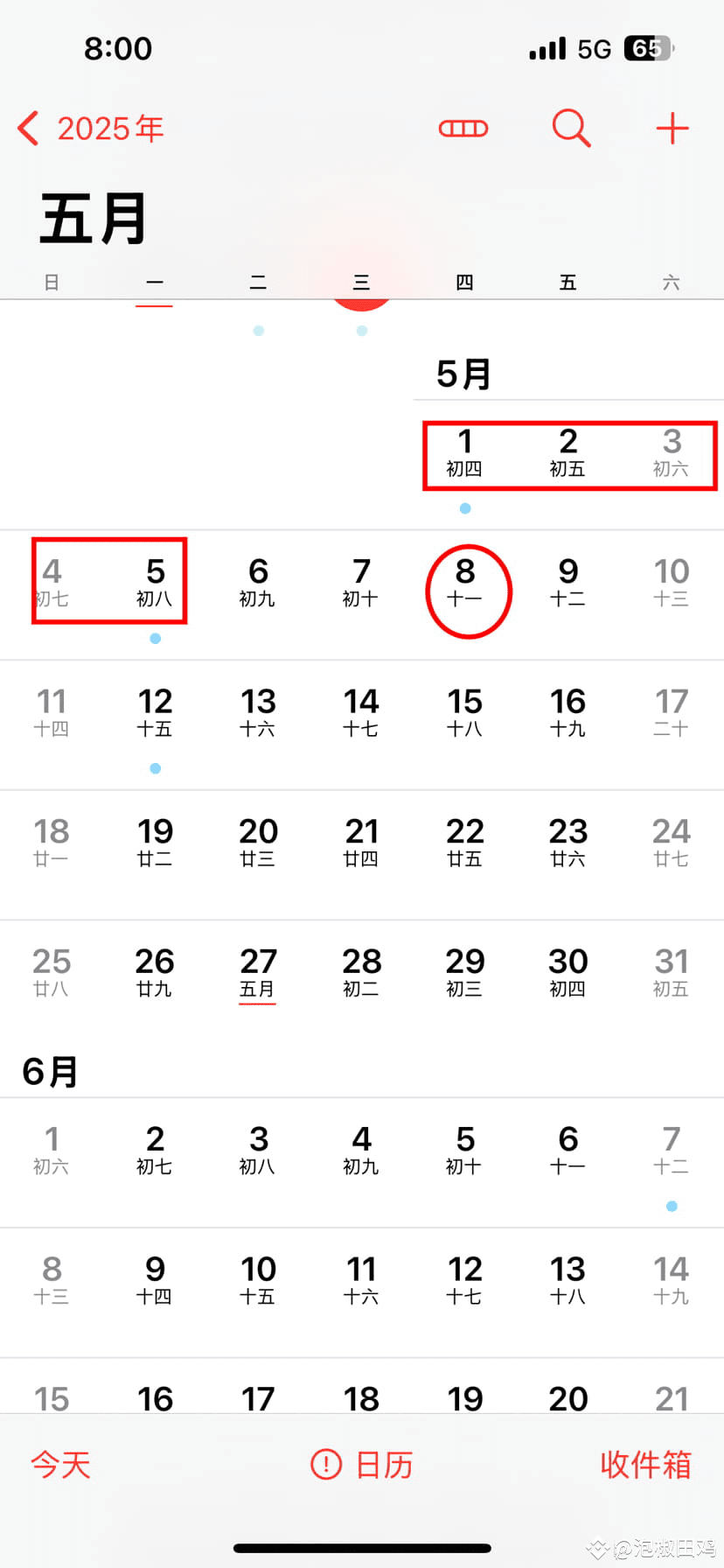

During the May Day Golden Week (5.1-5.5), some hot money from A may enter the market, so the main force may follow the trend and pull the market during the holiday. If long positions have floating profits, take more and protect the capital loss after taking profits. As long as the support does not fall below, look up. Tomorrow, on May 1, Japan's interest rate meeting, as long as the result is not hike, there may be an upward pulse action immediately.

On the last day of the May 5 holiday, especially in the second half of the night, the main force may sneak attack and smash the market while the crowd is scarce. Sometimes, as soon as possible, they will also sneak attack on 5.4 (Sunday evening). This paves the way for the interest rate meeting two days later. Generally, the fluctuation will turn 1-2 days before, and the US market will start to fall at 5.7. Therefore, the bulls will converge next week, maintain low leverage and light positions. 5.8 At the Fed's interest rate meeting, the main force generally leaves the market 24 hours in advance to choose to wait and see. The failure to cut interest rates in May is in line with expectations and is not a bad news, but the probability of reducing interest rates in June is high, so it may digest the positive expectations of June in advance in May. Therefore, it is not recommended to short at the same point multiple times, and there will be a long change. The last move must be set to a stop loss, and shorting will be the most safe to go to the new high point between 96600-99200.