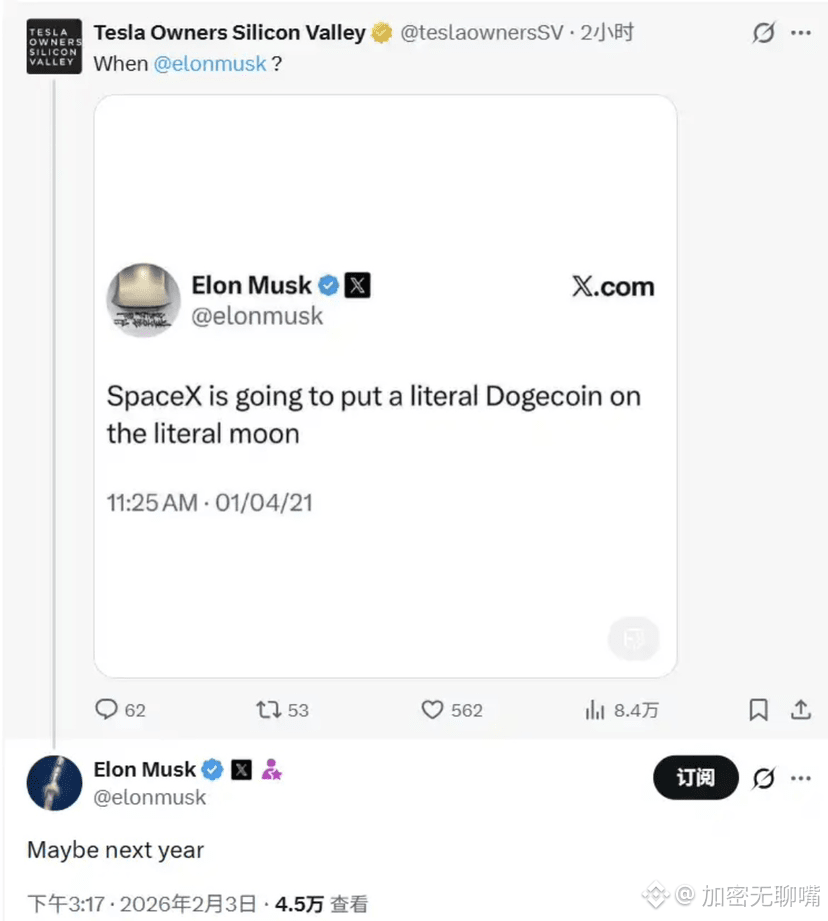

$DOGE

Musk softens his stance!

Dogecoin is really going to the moon,

and the launch date is set for next year?

On February 3rd, the Tesla Silicon Valley Owners Club unearthed a statement Musk made in 2021 on the X platform—he said SpaceX would send a real Dogecoin to the moon, and specifically inquired about when this would happen. Musk replied that same day, "Maybe next year."

This statement immediately drew market attention to the potential connection between Dogecoin and SpaceX. It's worth noting that Musk has publicly supported Dogecoin on multiple occasions, and his statements on the subject have significantly impacted Dogecoin's price and market sentiment.

#Musk #DOGE

Price Converter

- Crypto

- Fiat

USDUnited States Dollar

CNYChinese Yuan

JPYJapanese Yen

HKDHong Kong Dollar

THBThai Baht

GBPBritish Pound

EUREuro

AUDAustralian Dollar

TWDNew Taiwan Dollar

KRWSouth Korean Won

PHPPhilippine Peso

AEDUAE Dirham

CADCanadian Dollar

MYRMalaysian Ringgit

MOPMacanese Pataca

NZDNew Zealand Dollar

CHFSwiss Franc

CZKCzech Koruna

DKKDanish Krone

IDRIndonesian Rupiah

LKRSri Lankan Rupee

NOKNorwegian Krone

QARQatari Riyal

RUBRussian Ruble

SGDSingapore Dollar

SEKSwedish Krona

VNDVietnamese Dong

ZARSouth African Rand

No more data