不要和周期做对是我从上轮学到最重要的道理,没有超级周期,不要迷信大佬,每轮都有几个大佬被献祭。

这几天复盘了一下,现在的熊市基本按照上轮熊市一样的走法。

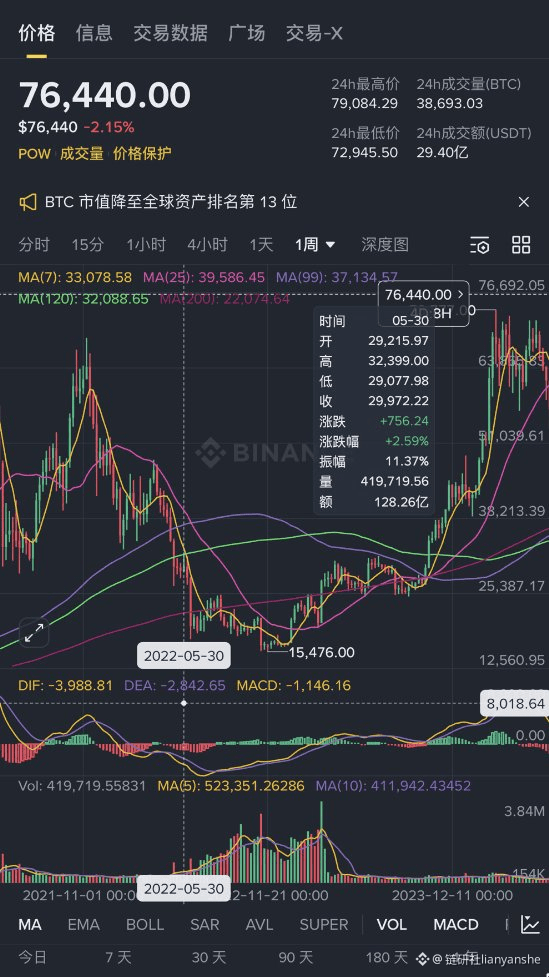

上轮周期(2022年5月): 3 万美金在当时被视为超级周期的铁底,因为它是 2021 年 519 惨案后的起跳点,也是当时周线 120 的支撑。印象特别深的是,下破 3 万美金的时候,恐慌指数已经处于 10 以下,大量抄底资金认为跌不动了,或者该反弹了。

当前周期(2026年2月): 8 万美金作为曾经的强势支撑,现在变成了周线级别的 MA120 强压力位。8 万美金也是比特币挖矿公司的成本价,现在的 7.6 万就像上轮跌破 3 万后的短暂挣扎,市场很可能还会有一次彻底击碎信心的动作,比如触及上轮周期的顶部 69000。

如果跌破 70000 美金,触发会更大规模的止损盘和清算盘,才有可能超越 25 年 11 月的那根天量成交柱。没有极致的恐慌,反弹往往只是诱多。

周期下千万不要被情绪带偏,在极端的趋势行情中,情绪指标是会失真的。恐慌指数 10 说明散户已经绝望,但主力可能还在利用这种绝望进行最后一次深蹲。趋势线比任何指标都直接,只要价格还在 MA120 下方,所有的上涨都只是反弹而非反转。

这几天比特币也是不断破了新低,回顾上轮周期走势。在下破放量到位的反弹预期是 20%,当时从 26700 到 32399。按现在的情况推断只有在破 70000,这个位置才会放出天量,反弹预期到周线 MA120 上方 8 万美金出头位置,预期为 15% 的涨幅。

另外如果按照周期来看比特币应该会在 11~12 月触底,你们到时候的价格可能是多少 7 万?6 万?还是更低?

Price Converter

- Crypto

- Fiat

USD美元

CNY人民币

JPY日元

HKD港币

THB泰铢

GBP英镑

EUR欧元

AUD澳元

TWD新台币

KRW韩元

PHP菲律宾比索

AED阿联酋迪拉姆

CAD加拿大元

MYR马来西亚林吉特

MOP澳门币

NZD新西兰元

CHF瑞士法郎

CZK捷克克朗

DKK丹麦克朗

IDR印尼卢比

LKR斯里兰卡卢比

NOK挪威克朗

QAR卡塔尔里亚尔

RUB俄罗斯卢布

SGD新加坡元

SEK瑞典克朗

VND越南盾

ZAR南非兰特

No more data