Topic Background

Wu Blockchain

Crypto Newbie

02-02 11:39

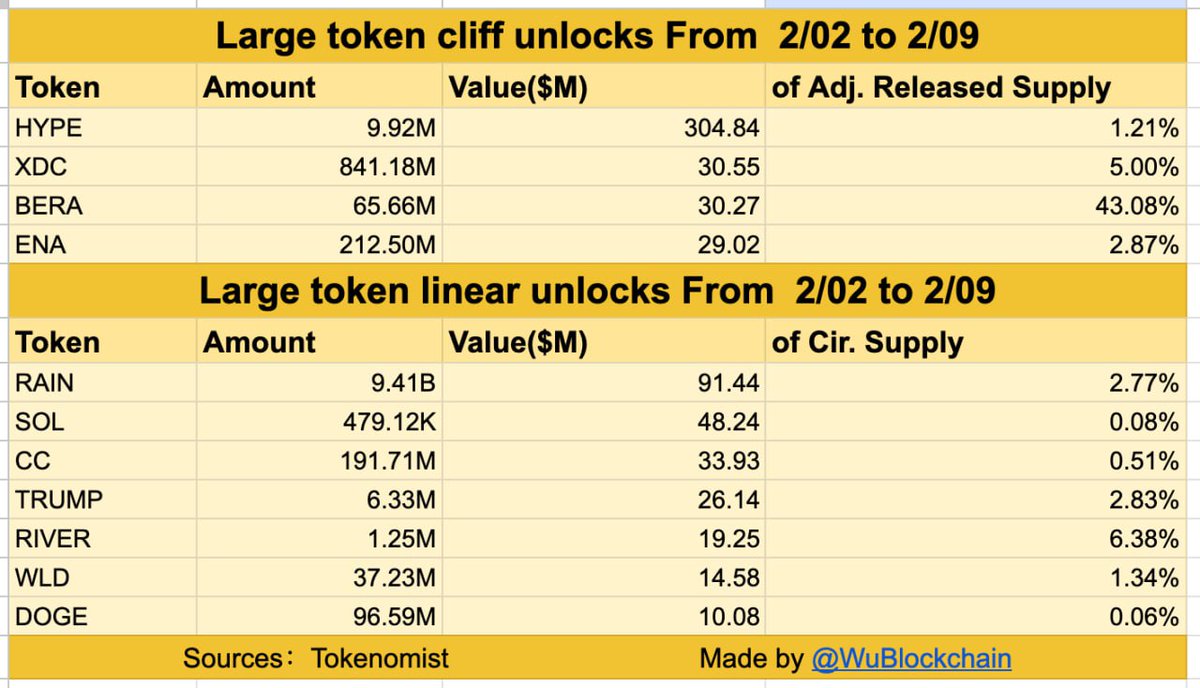

According to Tokenomist, in the next seven days, single large unlocks (each exceeding $5 million) include HYPE, XDC, BERA, and ENA; daily large unlocks (daily unlocks exceeding $1 million) include RAIN, SOL, CC, Trump, River, WLD, and DOGE. The total unlocked value exceeds $638 million.

吴说区块链

Binance

02-02 10:25

According to Wu, Tokenomist reports that HYPE XDC BERA ENA and other tokens will have large single-transaction unlocks (unlocking amounts exceeding $5 million) in the next 7 days; and RAIN SOL CC TRUMP RIVER WLD DOGE and other tokens will have large linear unlocks (unlocking amounts exceeding $1 million per day) in the next 7 days, with a total unlocking value exceeding $638 million.

JL幽灵哥

Crypto Newbie

01-30 06:11

$WLD, the leading AI altcoin, remains strong. Yesterday, it surged over 30% in just one hour, prompting many to regret their decision. Now, following the market downturn, many are buying on dips. We remain bullish and will continue to support similar strong performers. Don't overlook such strong coins; a market reversal could trigger a powerful breakout. We are firmly bullish on it for the medium to long term, expecting it to reach 5-10 USDT. This is a high-quality altcoin we've been recommending for dollar-cost averaging since last year. Only those that withstand market scrutiny and weather storms can stand out; otherwise, they'll be worthless among numerous altcoins, and no one will become well-known. #WLD🔥🔥🔥

{future}(WLDUSDT)

Sponge Evolution Theory

Crypto Newbie

01-29 16:27

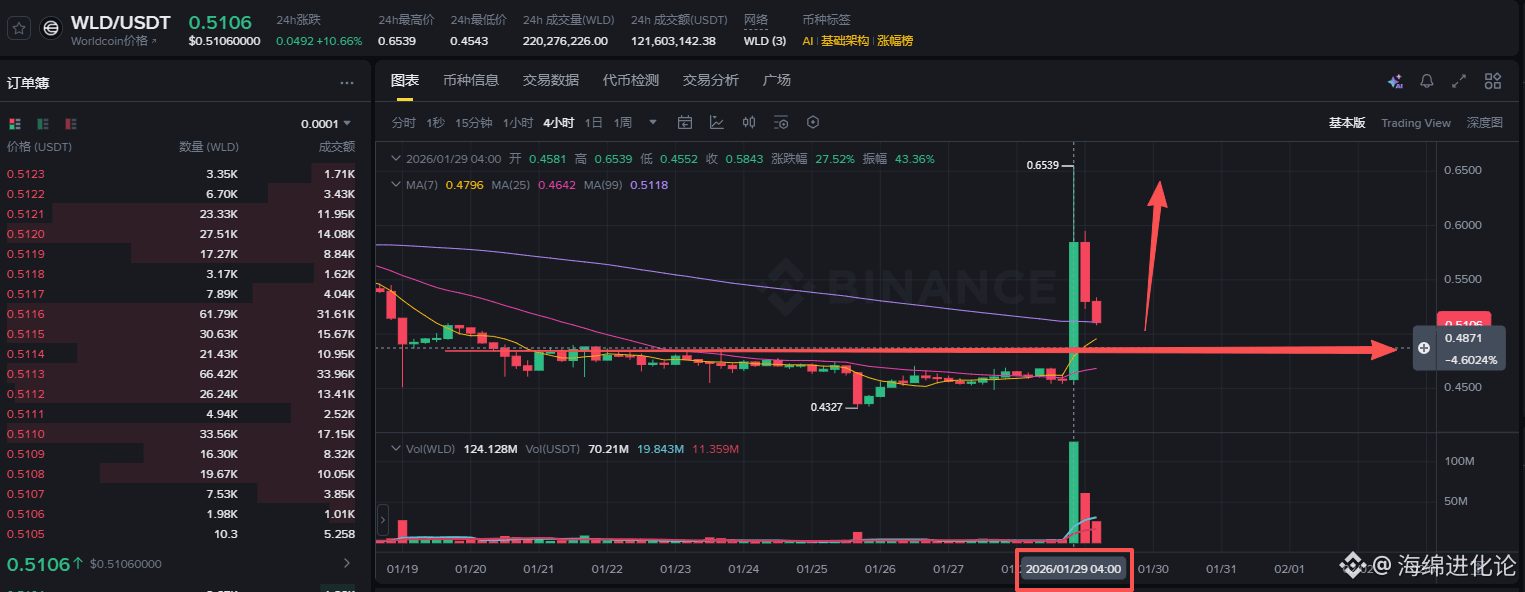

These days, altcoins and big players operate while everyone's asleep.

WLD pumped at 4 AM; only those who stayed up all night trading contracts could profit.

Others would only wake up to find it already on the top gainers list.

WLD will likely see another surge, but now is not the time to enter.

WLD should be bought around 0.48.

Just keep a close eye on this level; if you can't wait, place a limit order.

WLD (World Coin) is highly favored by market makers.

#WLD

Blave

Crypto Newbie

01-29 16:24

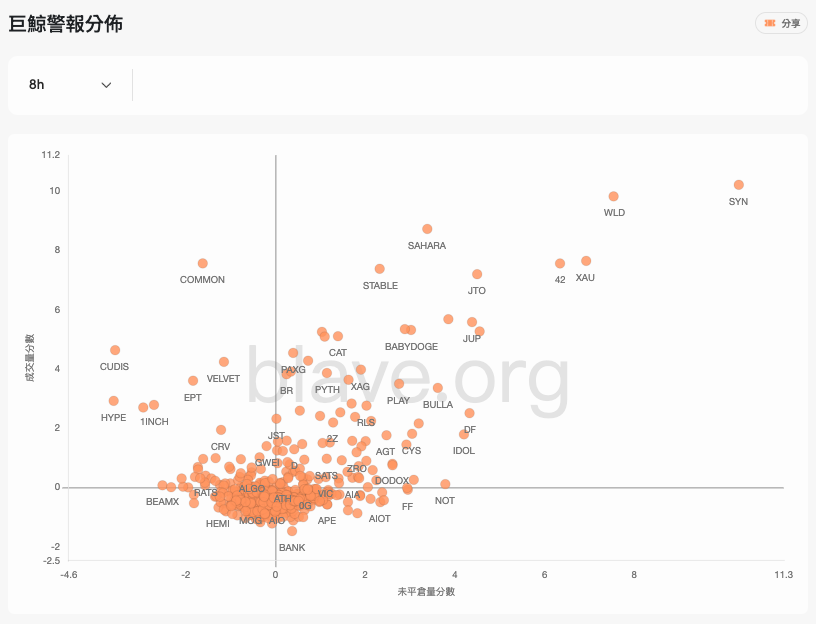

The 8-hour Mega Whale Alert Distribution Chart shows significant Mega Whale activity in $SYN, $WLD, and $XAU, along with others such as #42, $JTO, and $JUP.

The Mega Whale Alert Distribution Chart can be used to identify which tokens are experiencing unusual trading activity (i.e., price movements).

View Mega Whale Alert Distribution Chart: