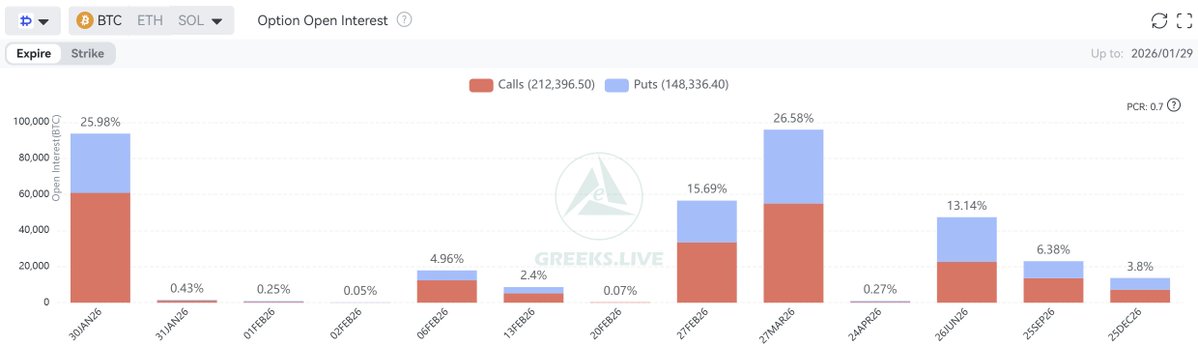

Volatility has increased significantly overall, and the skew has tested new lows again, leading large players in the options market to worry that the downward trend in BTC may not be contained.

Put options also saw consistently high trading volume, with the top five traded options all being puts, primarily with a strike price of $70,000, indicating strong bearish sentiment. Even the fourth-ranked option was a March put option at $55,000!

Price Converter

- Crypto

- Fiat

USDUnited States Dollar

CNYChinese Yuan

JPYJapanese Yen

HKDHong Kong Dollar

THBThai Baht

GBPBritish Pound

EUREuro

AUDAustralian Dollar

TWDNew Taiwan Dollar

KRWSouth Korean Won

PHPPhilippine Peso

AEDUAE Dirham

CADCanadian Dollar

MYRMalaysian Ringgit

MOPMacanese Pataca

NZDNew Zealand Dollar

CHFSwiss Franc

CZKCzech Koruna

DKKDanish Krone

IDRIndonesian Rupiah

LKRSri Lankan Rupee

NOKNorwegian Krone

QARQatari Riyal

RUBRussian Ruble

SGDSingapore Dollar

SEKSwedish Krona

VNDVietnamese Dong

ZARSouth African Rand

No more data