Something interesting is happening with $BTC…

Most of us are familiar with Bitcoin's cyclical market fluctuations. Historically, bear markets last approximately 365 days, and by that calculation, we've currently passed about a third of a bear market cycle.

What's different this time is the speed of the decline. The price has fallen much faster than before, by 1.25 times. Since BTC peaked in October, earlier than previous cycles, there's reason to expect the bottom to arrive sooner as well.

My base case prediction is that the bottom will occur in August, not the fourth quarter. That's why I plan to build positions between June and August.

This is partly based on intuition, but market structure also supports this prediction.

The cycle appears to be shortening. As institutional demand grows, it will gradually offset the selling pressure from miners and OG. When this balance shifts, BTC's performance may no longer resemble a volatile asset, but rather a traditional risk asset, closer to the cyclical characteristics of the S&P 500.

Based on retracement calculations, we may still have 22% to 30% retracement to go before the bottom. Historically, savvy investors establish spot positions when retracements reach 40% to 60%. I don't believe this cycle will see a 70% retracement.

I believe we have 20% retracement to go before the bear market low, with the bottom forming in the third quarter.

Using a 365-day model, we have 200 days until the official bottom. This gives us two paths:

• Slow sideways consolidation with prices gradually declining, or

• A rapid decline, ending the bear market cycle prematurely.

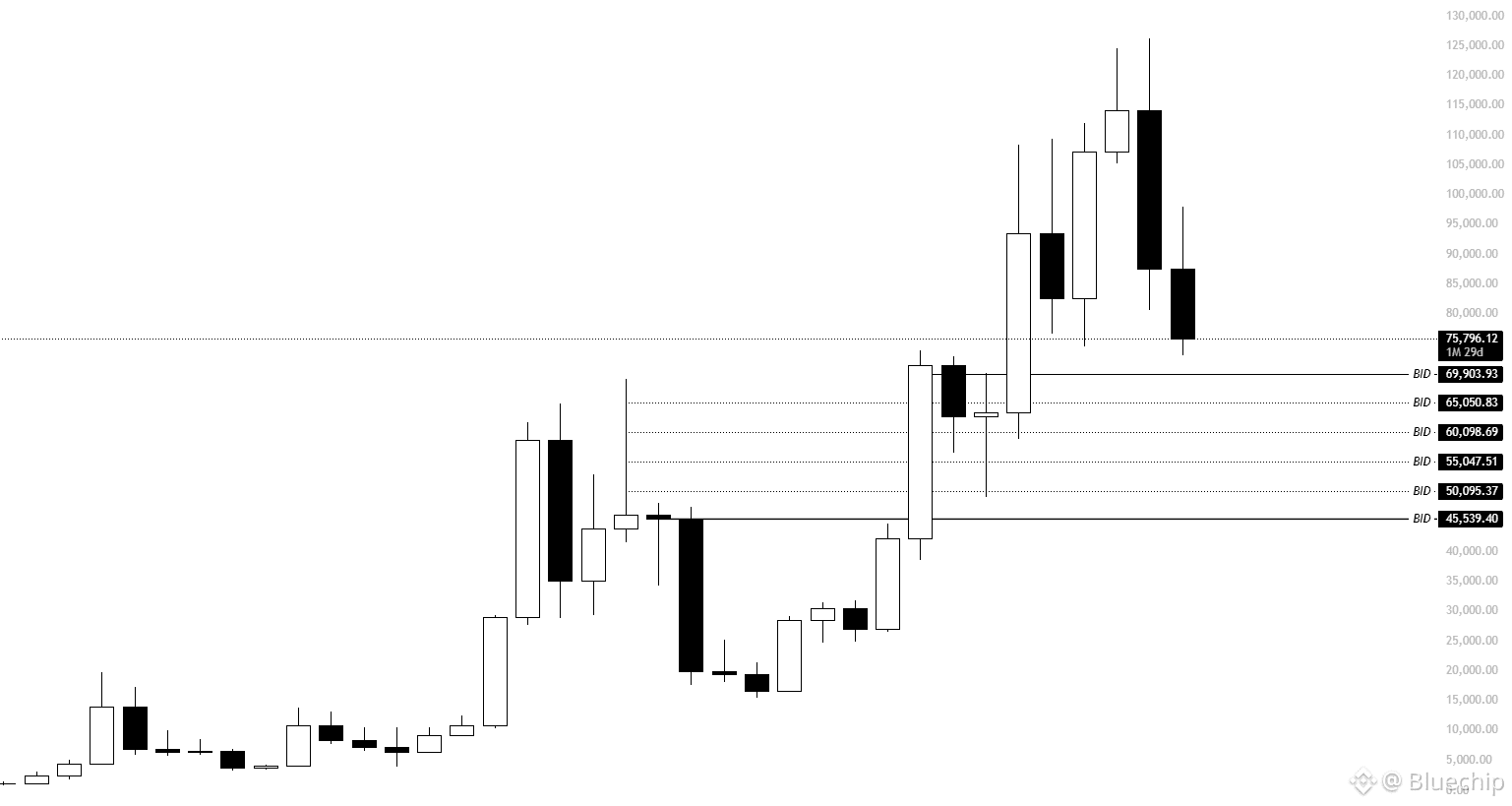

I'm betting on prices bottoming out faster. Therefore, I will buy at the following prices:

$69,000.

$65,000.

$60,000.

$55,000.

$50,000.

$45,000.

Don't cry because it's over, smile because it was.

Note: Regarding large-scale long positions, you'll know when I go long.