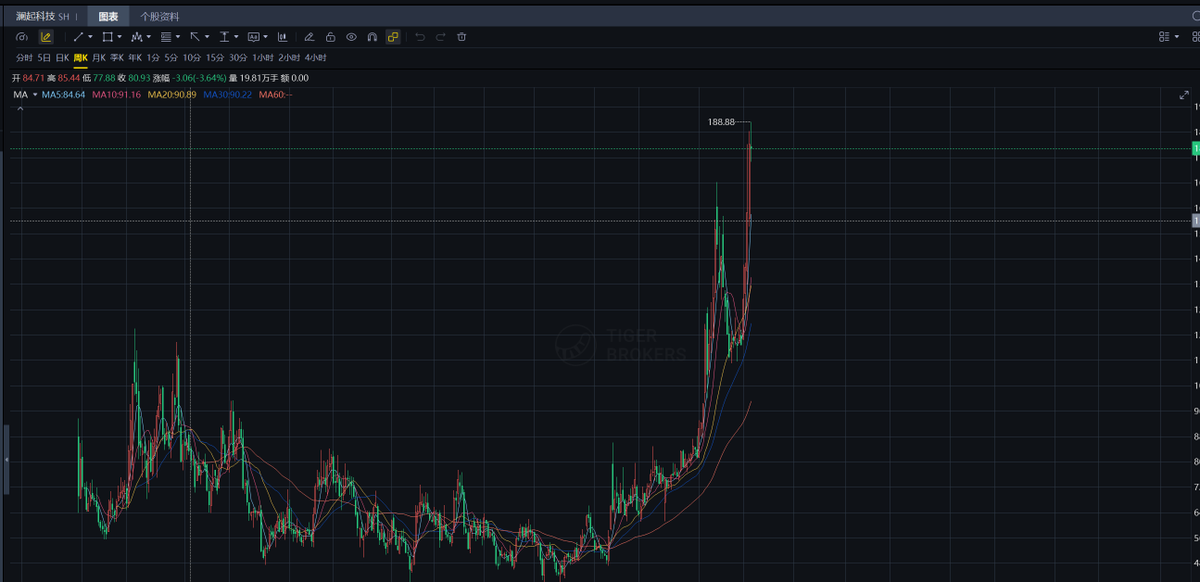

Yesterday, while playing cards at home, a mother of four (who is also the neighborhood's stock market guru, Cai Zong) recommended Montage Technology, an A-share chip concept stock. She suggested a buy-in point between 80 and 120, a typical example of chasing a trend based on a bull market premise. She said that yesterday, the Shanghai Composite Index and the chip sector collectively fell, and 180 was a good opportunity to buy this stock. Her logic was that Montage Technology, currently listed in Hong Kong, would continue to rise. I checked the price at 180.

First, I acknowledged her buy-in point and trend-following strategy. However, if it's solely because of Montage Technology... Even without listing in Hong Kong, the bullish expectation remains, but chasing the price up to 180 is something the team leader simply can't bring himself to do.

Whether Montage Technology goes up or down isn't important; we must always remember the principles of position building: buy sideways, buy average, buy contraction, buy dips. Cai Zong's 80-120 entry point aligns with the "buy dips = buy average" strategy, which follows an upward trend. Experts make money because they understand trends. While she may not be able to articulate three or four trading rules like the team leader, she consistently makes money in the A-share market year after year. Even if she can't articulate them, she understands the logic of base positions and position building principles.