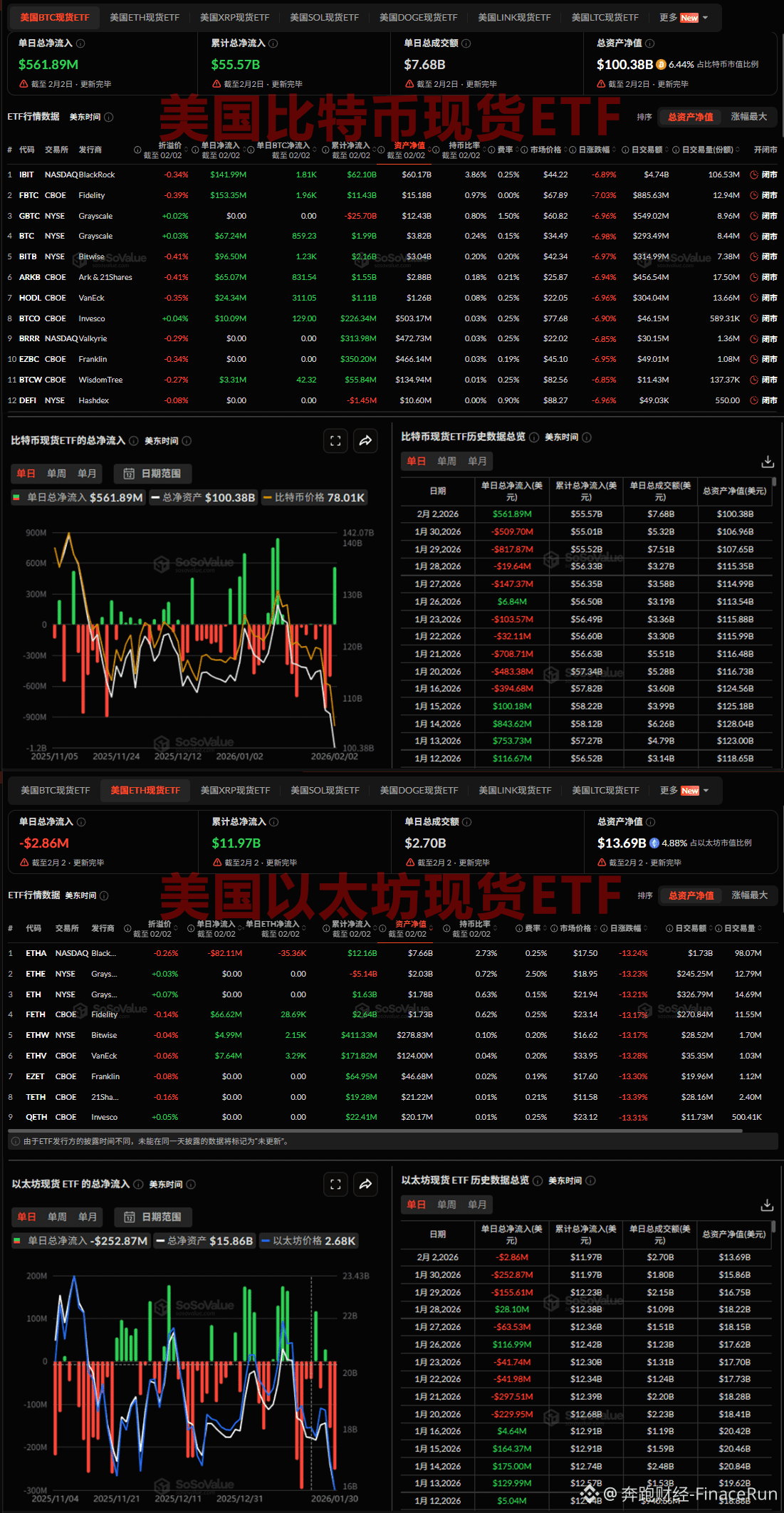

US BTC spot ETFs saw a net inflow of $562 million on Monday, while ETH ETFs experienced a net outflow of $2.86 million.

February 3rd - According to SoSovalue data, US BTC spot ETFs recorded their first net inflow of funds this week yesterday, totaling nearly $562 million; and no BTC ETFs experienced net outflows yesterday.

Fidelity's FBTC and BlackRock's IBIT ranked first and second in net inflows yesterday, with $153 million (approximately 1,960 BTC) and nearly $142 million (approximately 1,810 BTC) respectively.

Next were Bitwise BITB, Grayscale BTC, and Ark & 21Shares ARKB, recording $96.5 million (approximately 1,230 BTC), $67.24 million (859.23 BTC), and $65.07 million respectively. Bitcoin saw a net inflow of $24.34 million (831.54 BTC) into Bitcoin ETFs.

VanEck HODL, Invesco BTCO, and WisdomTree BTCW saw net inflows of $24.34 million (311.05 BTC), $10.09 million (129.00 BTC), and $3.31 million (42.32 BTC), respectively.

As of now, Bitcoin spot ETFs have a total net asset value of $100.38 billion, representing 6.44% of Bitcoin's total market capitalization, with a cumulative net inflow of $55.57 billion.

On the same day, however, the US Ethereum spot ETF recorded a net outflow of $2.86 million, marking its third consecutive day of net outflows.

BlackRock ETHA was the only ETH ETF to experience a net outflow yesterday, with $82.11 million (approximately 35,360 ETH).

Meanwhile, Fidelity FETH, VanEck ETHV, and Bitwise ETHW recorded net inflows of $66.62 million (approximately 28,690 ETH), $7.64 million (approximately 3,290 ETH), and $4.99 million (approximately 2,150 ETH), respectively.

As of now, Ethereum spot ETFs have a total net asset value of $13.69 billion, representing 4.88% of the total Ethereum market capitalization, with a cumulative net inflow of $11.97 billion.

#BitcoinETF #EthereumETF