US BTC and ETH spot ETFs saw a total outflow of over $1.8 billion last week.

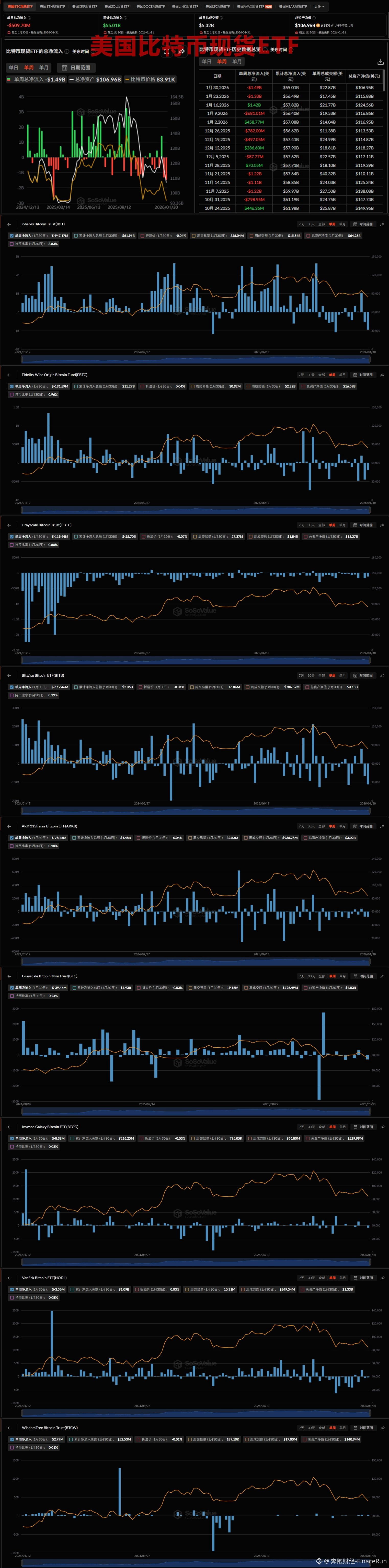

According to SosoValue data, US BTC spot ETFs recorded a net outflow of $1.49 billion last week, marking the second-highest weekly net outflow in history.

BlackRock's IBIT saw the largest net outflow among the 12 BTC ETFs last week, at $947 million. IBIT has now seen a cumulative inflow of $61.96 billion.

Fidelity's FBTC and Grayscale's GBTC followed, recording net outflows of nearly $192 million and $119 million respectively.

Bitwise's BITB and ARK 21Shares' ARKB saw net outflows of $112 million and $78.45 million respectively.

Grayscale's BTC, Invesco's BTCO, and... VanEck HODL saw net outflows of $29.46 million, $8.38 million, and $3.56 million respectively in the past three weeks.

Notably, Wisdom BTCW was the only BTC ETF to see a net inflow of $2.79 million last week.

Currently, Bitcoin spot ETFs have a total net asset value of $106.96 billion, representing 6.38% of Bitcoin's total market capitalization, with a cumulative net inflow of $55.01 billion.

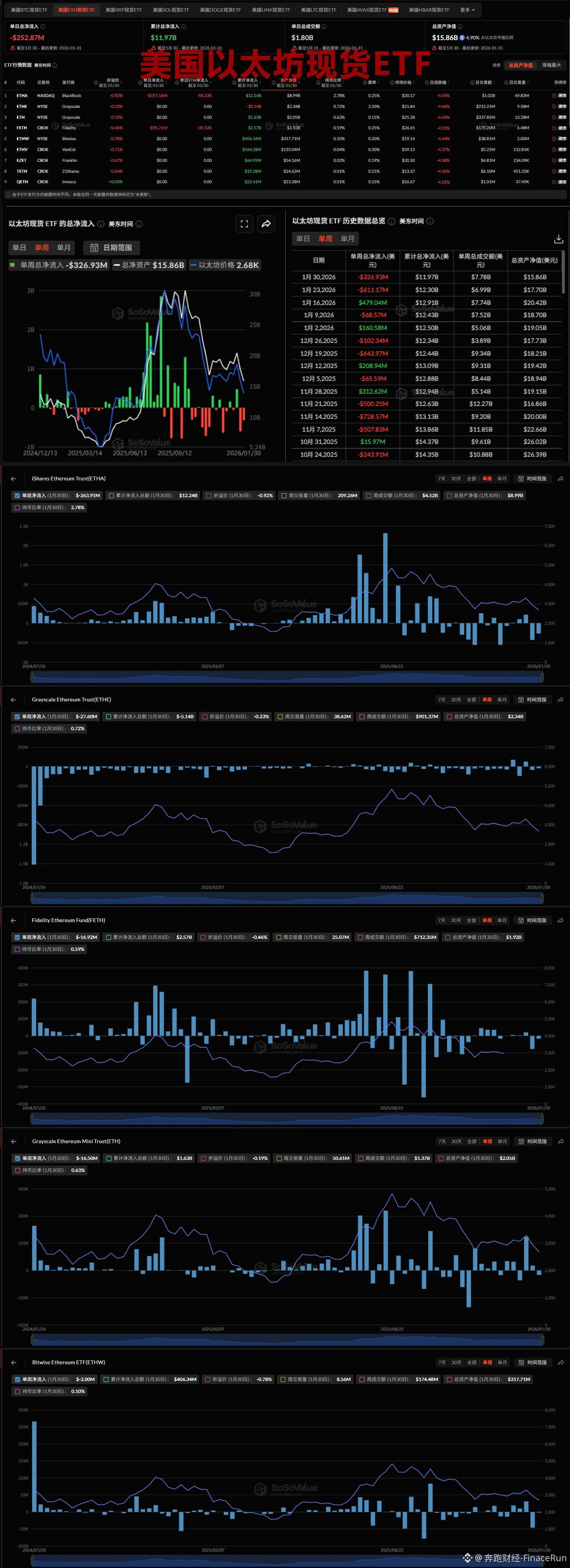

In the same week, Ethereum spot ETFs also recorded net outflows for the second consecutive week, with a price of nearly $3.27. No ETH ETF experienced net outflows last week.

BlackRock's ETHA saw the largest net outflow among the nine ETH ETFs last week, with nearly $264 million. Currently, IBIT has seen a cumulative inflow of $12.24 billion.

Grayscale's ETHE and ETH followed, recording net outflows of nearly $27.6 million and $16.5 million respectively.

Fidelity's FETH and Bitwise ETHW saw net outflows of $16.92 million and $2 million respectively.

As of now, Ethereum spot ETFs have a total net asset value of $15.86 billion, representing 4.90% of Ethereum's total market capitalization, with a cumulative net inflow of $11.97 billion.

#BitcoinETF #EthereumETF