When fundamentals are "on track," price increases are only a matter of time:

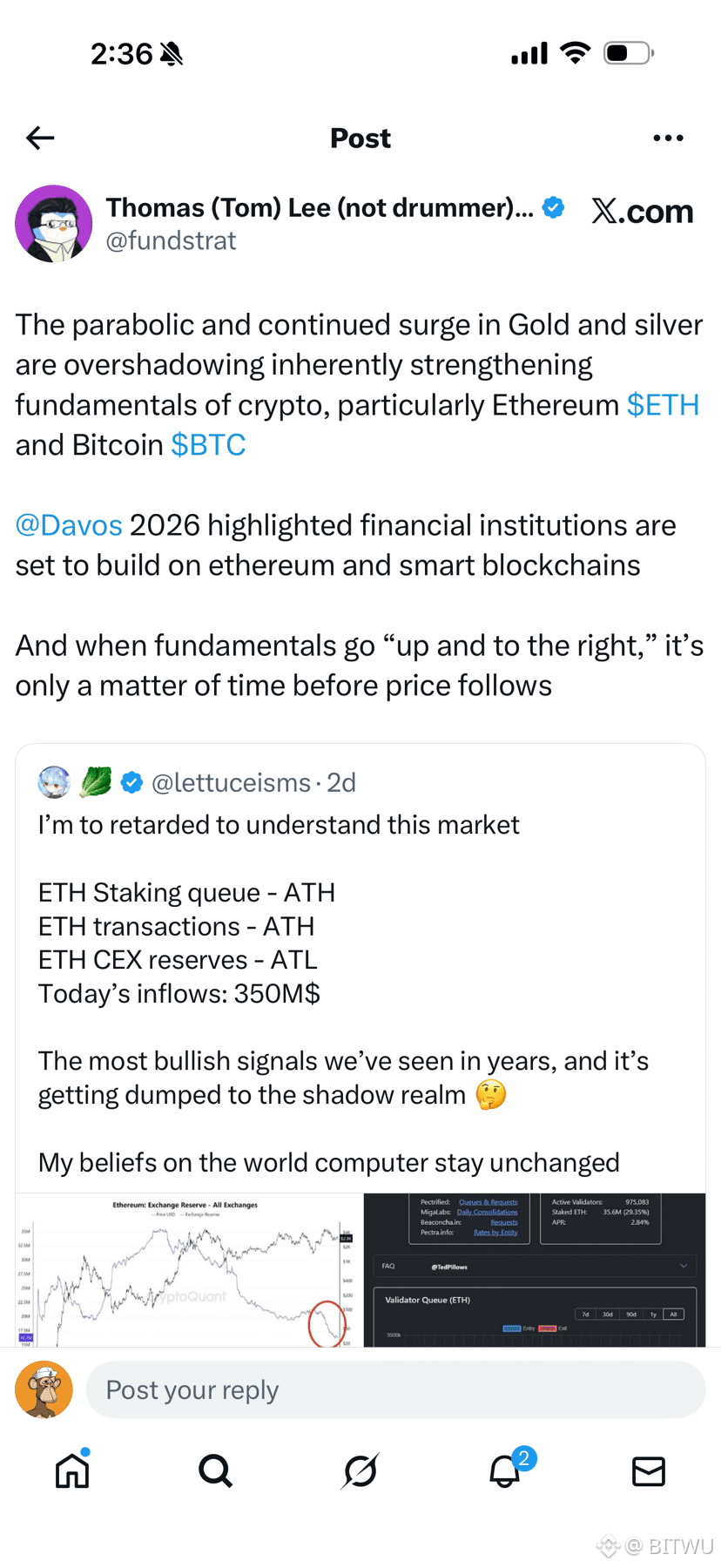

The basic consensus reached at the Davos Forum is the strong underlying fundamentals: financial institutions have already positioned Ethereum (ETH) and its ecosystem as the foundation for next-generation financial infrastructure.

This means that the continued rise in gold and silver has masked the strength of cryptocurrencies (especially Ethereum (ETH) and Bitcoin (BTC));

Let the dust settle first, and once gold stabilizes, let digital gold take off!

I personally remain bullish, especially on the second quarter of this year!

1️⃣ Asset rotation: Gold leads the way → risk assets catch up (delayed transmission);

2️⃣ Institutional allocation logic: "Slow money" from ETFs/custodians/compliant channels is more likely to exert its influence in Q2, with Bitcoin leading the way;

3️⃣ The cash flow/collateralized asset attributes of the Ethereum ecosystem are gradually strengthening, shifting the narrative from "technology" to "financial foundation";

4️⃣ Market behavior: Sentiment recovery in the first half of the year → Q2 is more likely to see trend-following; Q2 is more likely to see a "risk asset window"