#BTC #ETH

Analyzing the current market:

Figure 1: The open interest signal is quite confusing. Between 913 and 90, there was a wave of speculative trading involving shorting and long positions. This speculative trading has now exited, and the long/short ratio is now close to a level where short positions can be closed, allowing for a potential long position within the consolidation range.

Figure 2: This is the long/short ratio data for spot leverage. Spot leveraged traders closed out their leveraged positions added at 88-89 around 94, and have now added them back in.

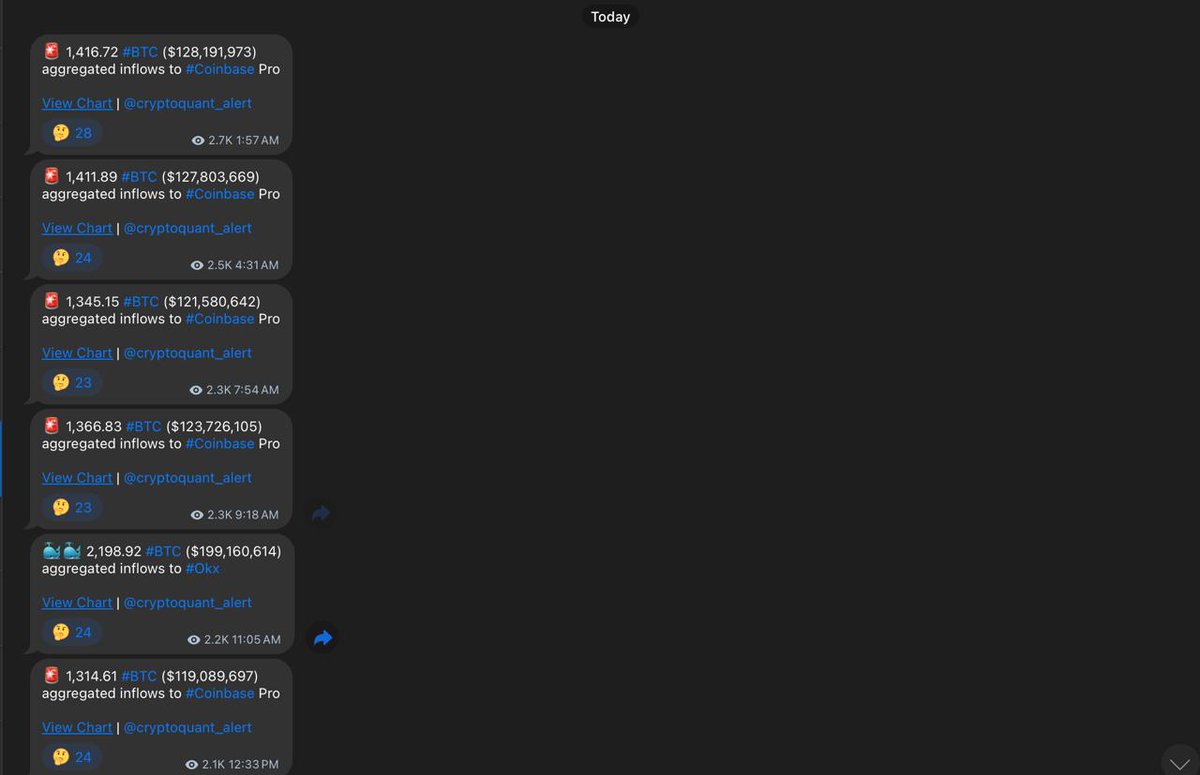

Figures 3 & 4: This is a monitoring indicator for Bitcoin inflows into exchanges. This indicator was unusually high on the 10th and 11th, showing a concentrated inflow of Bitcoin. Enter the exchange;

Currently, the various indicators at this position are not strongly correlated. The signals in the futures market are biased towards buying, the spot leveraged market is starting to lean towards buying, the on-chain market is biased towards selling, and the BigB premium indicator is neutral: the negative premium is starting to shrink and is almost nonexistent.

Therefore, opening long or short positions at this price is somewhat awkward. If you hold short positions in a range-bound market, taking profits at this point is fine. However, aggressive traders can open long positions now, but the leverage should not be too high. Be prepared for stop-loss orders or adding to positions if the price breaks below this level on Monday. If you prefer a conservative approach, wait until the BigB premium starts to turn positive before considering entering the market.