#BTC #ETH

Analysis of some data:

Figure 1: Increased open interest and long/short ratio indicate that long positions in the contract market have largely been filled during the consolidation phase.

Figure 2: Spot leveraged long positions have recovered to the highs of the recent consolidation phase, indicating that spot leveraged long positions have also largely been filled.

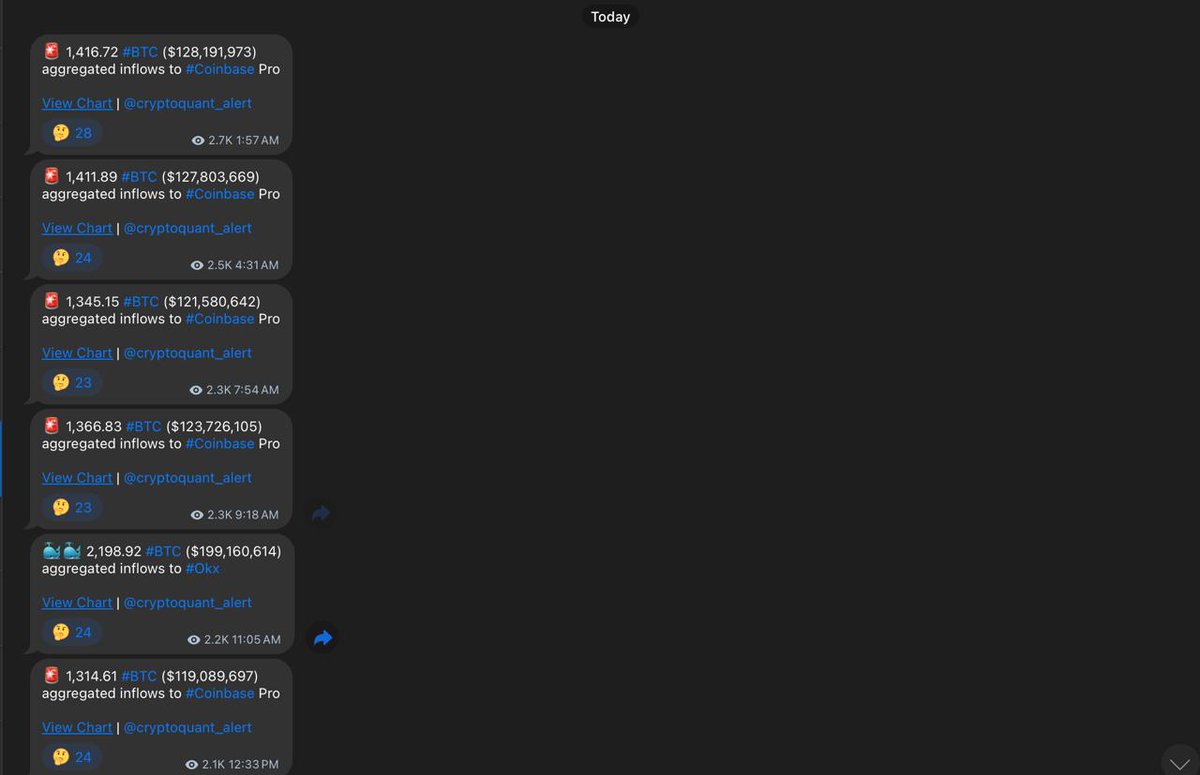

Figure 3: Spot leveraged long positions on BigB.com took profits on over 2000 Bitcoins above 93 and have now largely bought back below 90,000.

Therefore, based on the current data in the contract and spot leveraged markets, the bullish momentum in the consolidation phase is in place. If the market continues to consolidate, the bottom of the consolidation phase has been confirmed in the next few days, and a rebound is expected soon. Otherwise, a break below the support level is likely, leading to a short squeeze.

Price Converter

- Crypto

- Fiat

USDUnited States Dollar

CNYChinese Yuan

JPYJapanese Yen

HKDHong Kong Dollar

THBThai Baht

GBPBritish Pound

EUREuro

AUDAustralian Dollar

TWDNew Taiwan Dollar

KRWSouth Korean Won

PHPPhilippine Peso

AEDUAE Dirham

CADCanadian Dollar

MYRMalaysian Ringgit

MOPMacanese Pataca

NZDNew Zealand Dollar

CHFSwiss Franc

CZKCzech Koruna

DKKDanish Krone

IDRIndonesian Rupiah

LKRSri Lankan Rupee

NOKNorwegian Krone

QARQatari Riyal

RUBRussian Ruble

SGDSingapore Dollar

SEKSwedish Krona

VNDVietnamese Dong

ZARSouth African Rand

No more data